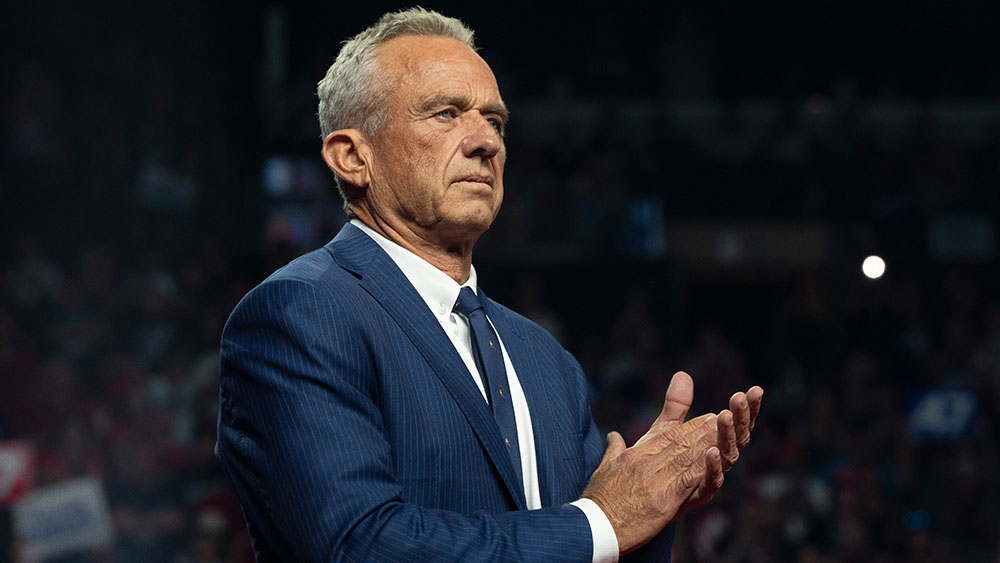

“The biggest transformation in our history” – Estée Lauder Companies leader Stéphane de La Faverie spells out a reimagined future

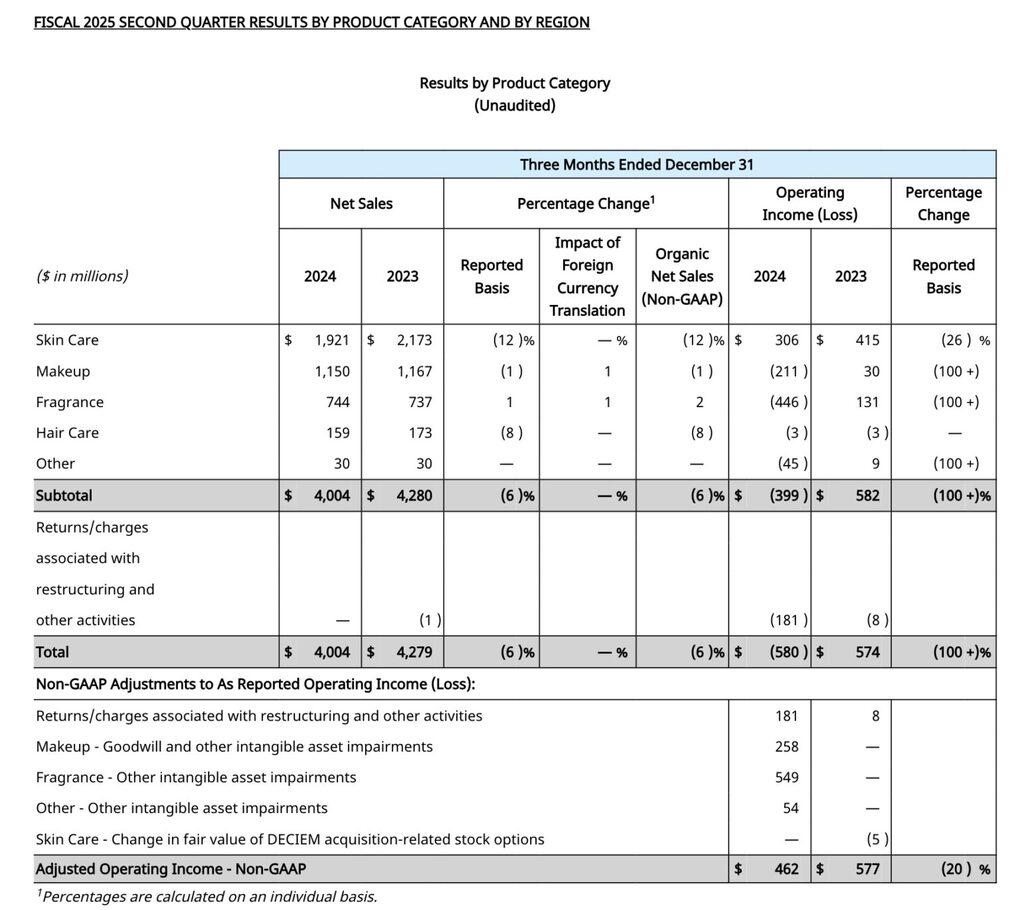

The American beauty group is integrating its travel retail operations within the Asia Pacific region, rather than Europe, the Middle East & Africa, amid a comprehensive strategic reengineering called Beauty Reimagined. We report from yesterday’s revealing earnings call.

“Our focus is clear: restore sustainable sales growth and achieve a solid double-digit adjusted operating margin over the next few years as we aim to become the best consumer-centric prestige beauty company.”

The Estée Lauder Companies’ (ELC) newly appointed President and CEO Stéphane de La Faverie wasn’t holding back yesterday in his first earnings call since assuming the role on 1 January.

De La Faverie began by expounding the company’s new strategic vision, dubbed Beauty Reimagined, announced earlier in the day amid the company’s Q2 results.

Having begun his comments by laying bare with admirable candour what he perceives as ELC’s shortcomings over recent years, (see bullet points below), de La Faverie said: “Our bold new strategic vision of Beauty Reimagined is designed to address these factors to restore sustainable sales growth and deliver a solid double-digit adjusted operating margin over the next few years.

“We are reimagining our operating model to be leaner, faster and more agile through the biggest transformation in our history to best serve consumers globally.”

Outlining the drivers of the company’s “challenged” performance over the last few years, de la Faverie highlighted the following:

- Subdued consumer sentiment in China greatly pressured the prestige beauty industry and the ELC business. Given the group’s strategically strong share in prestige beauty with the Chinese consumer, it was disproportionally impacted.

- The increasing complexity of the organisation, coupled with a narrow focus on too few markets and channels to drive growth, prevented ELC from tapping into the prevailing strength of prestige beauty around the world. This was especially true in North America.

- “Simply said, we lost our agility,” he said. “We did not capitalise on the higher growth opportunities quickly enough in channels, markets, media and prestige price tiers nor fuel new consumer acquisition aggressively enough.”

- The company also failed to deliver sufficient levels of on-trend innovation in its time to market, often putting it behind trend. This happened as prestige beauty became nimbler, driven both by incumbents and new entrants as ELC learned with its own indie brand, The Ordinary, along with faster-moving consumers magnifying such issues.

- Compounding matters, lower sales in higher-margin areas of the group’s business coincided with ELC’s overall expense base becoming too large as the company invested in capabilities ahead of growth that didn’t materialise.

[Main article continues below the following panel]

Travel retail changesIn a key change to group structure, The Estée Lauder Companies (ELC) is integrating its travel retail operations within the Asia Pacific region, rather than Europe, the Middle East & Africa as before. “This allows us to have much further and greater alignment between the local market and travel retail on the activities that we are going to run,” explained ELC President and CEO Stéphane de La Faverie on yesterday’s earnings call. Travel retail came in for plenty of attention during the call, particularly in how the North Asian business (specifically South Korea and Hainan) continue to drag the business. “While we are not satisfied with our third-quarter outlook, it primarily reflects weak retail sales trend in our Asia travel retail business, which deteriorated in the second quarter driven by Korea,” de La Faverie commented. “While our retail sales trends in Hainan were still negative in the second quarter, they improved sequentially, fuelled by our retail activations. “For the third quarter, we expect overall soft retail trends to persist in Asia travel retail, significantly pressuring our organic net sales despite the improvement we made with our in-trade inventory levels in the first half of fiscal 2025, which we intend to maintain across current levels.”

In order to reignite retail sales growth, ELC is strategically increasing consumer-facing investments around the world in Q3, de La Faverie observed. “We expect the benefits of the PRGP [Profit Recovery and Growth Plan] to both fund these investments and modestly offset the meaningful operating deleverage from the sales decline.” He commented: “We expect our business to continue to be challenged by subdued consumer sentiment in China and Korea, pressuring Asia travel retail. “We expect a strong double-digit sales decline in our global travel retail business in the second half of the fiscal year. This reflects shipments based on our expectation of persistent industry retail softness and incremental pressure from the change in selling policies at several Korean retailers [i.e. the move away from bulk reseller trading]. Additionally, recall that we resumed replenishment orders in the third quarter last year, making for a difficult comparison. “However, we are encouraged that for the second quarter, our retail trends, while still negative, improved sequentially in both Mainland China and globally, excluding travel retail. We anticipate our retail sales trends, excluding travel retail, to significantly improve in the third quarter as we increase consumer-facing investments. “Given that context… we expect organic net sales for our third quarter to decrease -10% to -8% compared to last year… primarily driven by a strong double-digit decline in our global travel retail business.” A double-digit decline in the South Korean market, which contributed to an -11% year-on-year fall in Asia Pacific net sales was partly attributed to the November 2024 exit of Dr.Jart from travel retail as well as the impacts of recent political and social unrest in the Republic. These declines were partially offset by double-digit organic net sales growth in Japan where both domestic and travelling consumers continue to fuel growth across nearly all channels of distribution. |

Beauty Reimagined will find voice across five key areas, de La Faverie explained.

1. Accelerate best-in-class consumer coverage

“We are going to put the consumer at the heart of our business. To do so, we plan to rapidly expand our portfolio presence in consumer-preferred, high-growth channels, markets, media and price tiers to fully participate in the growth opportunities of prestige beauty,” de La Faverie said.

“We have numerous areas in which to capitalise: geographically, in the US, the UK and emerging markets; and by channel from travel retail in Western markets to online platforms, specialty-multi globally and pharmacies in Europe. By doing so, we expect to better diversify our growth drivers.”

2. Create transformative innovation

De La Faverie said the company will deliver “fast-to-market, on-trend innovation with an eye towards in-demand subcategories, benefits and occasions”. Examples include dynamic subcategories in skincare such as body, makeup-like multi-benefit lip products, and fragrance-like lifestyle for home for ELC brands to either enter or expand.

“We will innovate across price tiers from entry prestige to luxury, making sure to bring products to market at attractive price points for new consumer acquisition.”

3. Boost consumer-facing investments to accelerate new consumer acquisition

ELC plans to achieve this goal by increasing visible advertising spending, optimising marketing programmes and eliminating unproductive A&P expenditure.

The plan includes greater investment in selling to support free-standing store acceleration for ELC’s luxury and artisanal fragrance brands.

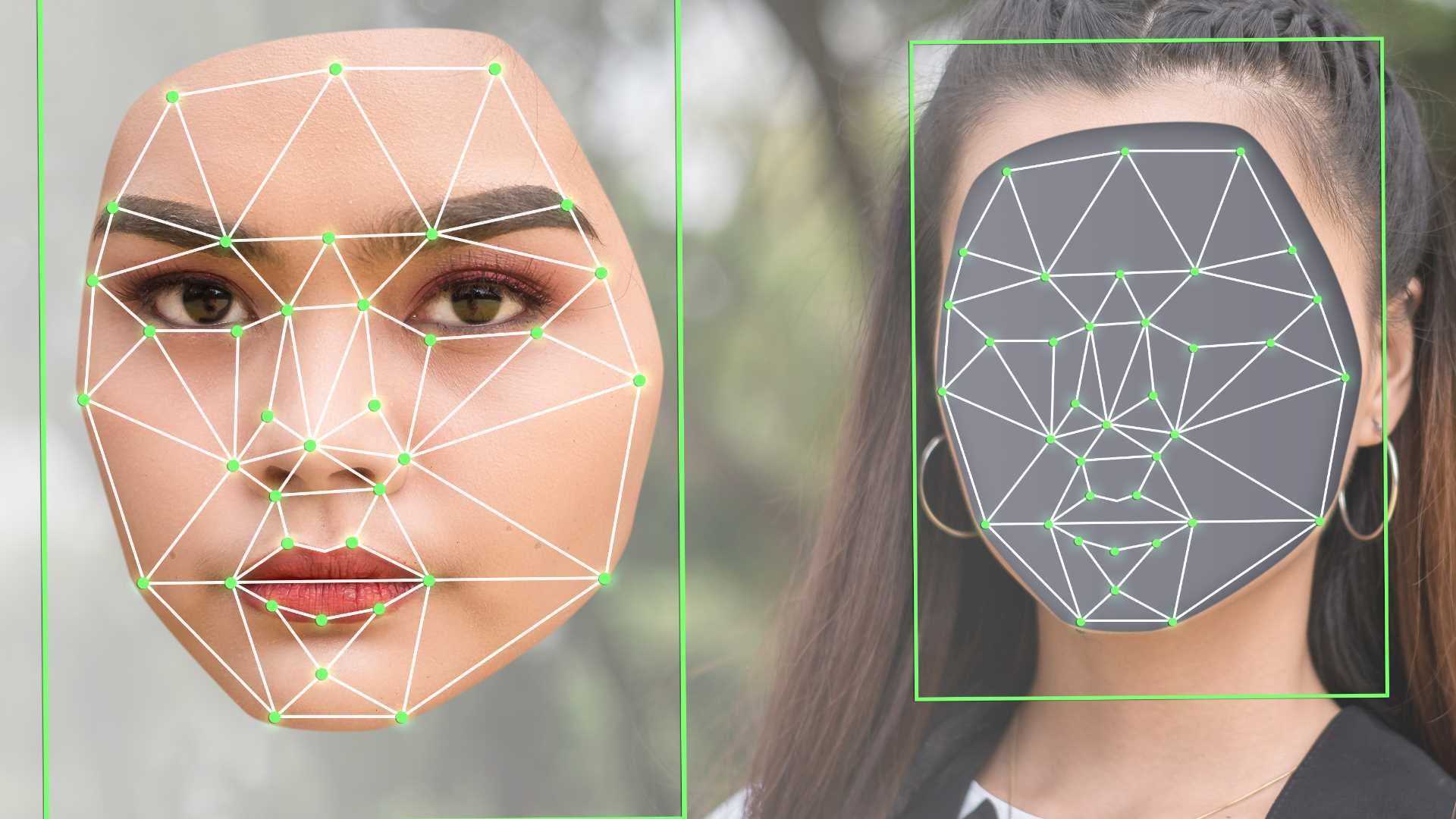

On the record with Stéphane de La FaverieOn the company’s strengths: Brand desirability, consumer experience, innovation, quality and end-to-end execution. On AI: In support of our strengths and for certain other areas of our business, we are hardwiring AI through the organisation. We are in an exciting moment in time for the company with AI as we have been working with the best-in-class technology partners. Their resources, technology and investments, combined with our use cases and proprietary data, are enabling us to deploy AI in a cost-effective manner to drive efficiencies with high-quality and differentiated output. As one example, we are leveraging AI to forecast our demand and plan for our material and production needs, which has resulted in our weighted average forecast accuracy reaching new heights. We are ready to dramatically scale the integration of AI into our workflows from product development to marketing, supply chain, back office and beyond to accelerate processes and improve decision-making. On innovation: As we look to step change our innovation, we are committed to tripling the percentage of our innovation that is launched in less than a year. On M&A: We are laser-focused with Beauty Reimagined to really reignite growth and rebuild profitability. When it comes to M&A… obviously every time there’s an opportunity, we have a great team that is looking at what is available, but it has to be looked with the lens of is it complementary to the portfolio? Is it going to add anything? And at the same time, we need also to manage and balance our overall balance sheet in the near-term. |

4. Fuel sustainable growth through an expanded Profit Recovery and Growth Plan

De La Faverie spoke of creating “bold efficiencies”, saying ELC had already made significant progress with its Profit Recovery and Growth Plan (PRGP), having delivered over 60% of its fiscal 2025 objective in the first half of the financial year.

This has primarily been driven by addressing “elevated excess and obsolescence”, realising strategic pricing through fewer discounts, lowering professional service expenses and restructuring the workforce, he observed.

“However, greater expense reduction is necessary,” de La Faverie warned. The company has experienced further volume decline since the PRGP’s inception, driven by moderated industry growth projection and geopolitical uncertainty as well as company-specific issues.

As a result, “several thousand additional positions” will be reduced, he said (the end total will be 5,800 to 7,000 positions globally, including those approved to date).

“We must redesign our expense structure for an evolving mix of business to better align with prestige beauty growth drivers and given the significant changes in the travel retail industry,” de La Faverie added.

5. Reimagine the way the company works

De La Faverie said the group is removing complexity and simplifying the organisation. “In doing so, we will provide for greater focus on execution excellence for the consumer.

“Moreover, we are unburdening our smaller brands so they can be more successful in a large organisation, while driving greater benefits of scale for our larger brands.”