Trump tariffs will only lead to inflation, retaliation and loss of trust

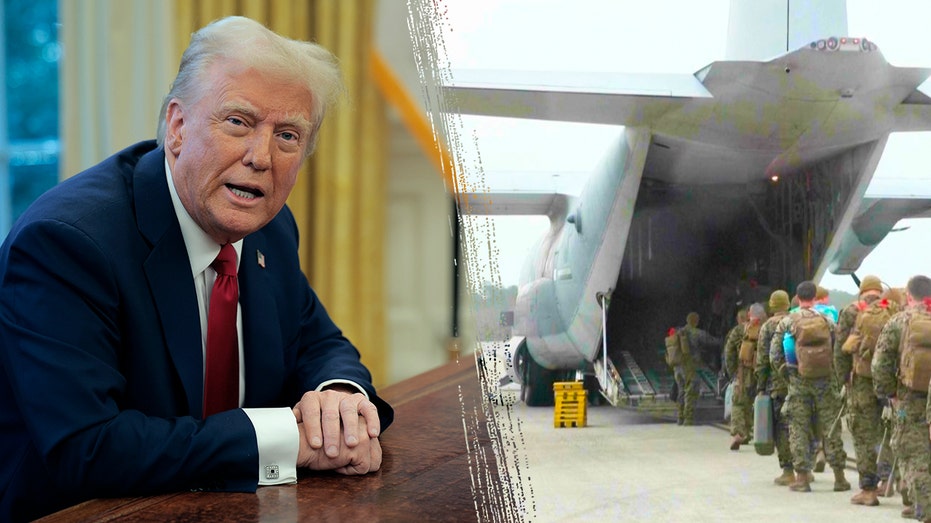

President Trump's recent efforts to impose tariffs on imports from Canada and Mexico and China has sparked concerns over the potential economic impact and potential retaliation from other countries.

In the 2002 blockbuster movie “My Big Fat Greek Wedding,” Portokalos family patriarch Gus uses Windex to combat every health issue from pimples to poison ivy. It is a comedic representation of how old-world beliefs are still intertwined in daily lives.

In the first two weeks of President Trump’s second term, we are seeing that tariffs, like Windex, are being used as a solution to any economic and social problem, ranging from propping up industrial production to combating the fentanyl crisis. But unfortunately, threats of tariffs and their actual imposition do have dire consequences in real life.

It is important to start with a nod to Trump’s noble goals. He wants to solve the immigration crisis. He wants to prevent drug overdoses. He wants to revive American manufacturing. But in his mind, all these somehow require tariffs that will ultimately hurt American businesses and consumers.

In his latest move, Trump decided to impose a 25 percent tariff on Canadian and Mexican Imports (10 percent tariffs for energy imports) and an additional 10 percent tariff on Chinese imports. He cites illegal immigration, drug trafficking and trade deficits as his major motivation for the move. Currently the Canadian and Mexican tariffs are delayed by one month, but the Chinese tariffs are still a go.

As expected, the countries that are subject to these tariffs have already started looking at retaliatory tariffs in response. In fact, Canada was making a list of products that could hit red states the hardest before the pause. China, in addition to retaliatory tariffs, announced an antitrust investigation into Google. It will not be surprising if President Trump responds with even higher tariffs, like a game of chicken.

A slew of studies will come, quantifying the potential impacts of these tariffs on the U.S. economy down the line. The Budget Lab at Yale University already did some number crunching and found that because of this latest round of tariffs, combined with potential retaliation, U.S. inflation could increase by an additional 0.76 percent, which is equivalent to a loss of average real income of $1,245 in 2024 dollars.

The president recognizes the potential price increase, but he is ignoring the No. 1 reason why he was elected in the first place: American’s disdain for rising prices.

If the inflation is not an issue for the president, then it is important to ask how trying to decimate the economies of two key allies will help his agenda? If the goal is to have strong borders, that can be done better by the countries that have enough economic resources.

By weakening both countries with constant threats, trying to change unilaterally an agreement that he personally dubbed as “the largest, most significant, modern, and balanced trade agreement in history” is just increasing the narrative around the U.S. not being a trusted partner. If this continues, there will come a time when countries will start talking about how to decouple from the U.S. economy.

Given that roughly three quarters of world purchasing power and over 95 percent of the world’s consumers are outside America's borders, and other rising economies are waiting to get a bigger share, that cannot be a good move.

Trump has a historic chance to achieve many of his goals and create a lasting legacy. With his tax and regulatory agenda, he can boost the competitiveness of the U.S. businesses immensely. However, it will be prudent to remember that the uncertainty he is creating for the U.S. and global economies can quickly turn the political tides.

As seen by the markets’ reaction to the tariff announcement on Friday, greater uncertainty can threaten financial stability by increasing risks and ultimately delay consumption and investment decisions. This should be the time for President Trump to refine his “Art of the Deal” and show the world that the U.S. is and will be a reliable partner.

Pinar Çebi Wilber, Ph.D., is chief economist and executive vice president of the American Council for Capital Formation.