CNBC: ‘Nvidia Drops 17 Percent as China’s Cheaper AI Model DeepSeek Sparks Global Tech Sell-Off’

Jenni Reid and Alex Harring, reporting for CNBC: Nvidia and other U.S. technology firms plunged on Monday, part of a global sell-off as Chinese startup DeepSeek sparked concerns over competitiveness in artificial intelligence and America’s leadership in the sector. Nvidia, the chip designer who has been a major beneficiary of the AI hype, last slid 17.3%. With that, the megacap tech stock was on track to notch its worst day since March 2020. To make a long story short, it’s been broadly assumed that leading-edge model training and inference requires the highest of high-end hardware — which hardware, especially for training, pretty much exclusively comes from Nvidia. The assumption was that any company trying to compete in this fiercely competitive field — a field with massive implications for industry, culture, and national security — must get in line to buy (or rent) enormous amounts of computational power exclusively available on the very best systems from Nvidia. That hardware isn’t available (at least legally) to Chinese companies, because of the Biden administration’s export bans. DeepSeek engineers found and implemented multiple massive efficiency improvements that allowed the company to train its latest models at far lower prices using far-less-capable hardware, and perform inference under heretofore unprecedented memory constraints. DeepSeek’s achievements render obsolete several prior planks of conventional wisdom regarding the state of AI. My link a few sentences prior in this paragraph is to a WSJ report from 14 days ago that now feels like it dates from at least 14 months ago. The most shocking result has been a 17 percent hit to Nvidia’s stock price today, knocking somewhere around $350 billion off their market cap. Google is down about 4 percent, and Microsoft down 2 percent — but Meta is up 1 percent and Apple is up a little over 3 percent. I think the market is reacting pretty sensibly: Nvidia has taken an unprecedented beating. $350 billion is more than the combined market caps of Verizon and AT&T (each worth roughly $170 billion). But Nvidia has been — and even with these breakthroughs from DeepSeek, remains — in an unprecedented position. Nvidia’s high-flying valuation reflects its unprecedented position as the essential hardware company for AI. Nvidia’s position, post-R1, remains essential — just not as essential as everyone thought. Hence the haircut. But Nvidia remains the third-most-valuable company in the world — it took a massive plunge today but in no way collapsed. TSMC and Broadcom both took big hits today too (-13% and -17%, respectively). Being a “chip company” doesn’t look as sweet today as it did last week. If OpenAI were publicly traded, I suspect it might have collapsed — the sell-off it would have faced today might have triggered emergency measures that halted trading. Microsoft has been distancing itself from OpenAI, but is still intertwined with them like no other company. (Recall that Apple walked away from a big investment in OpenAI just four months ago.) A -2% hit feels about right. The broadest implication of DeepSeek’s achievements is that really good AI is going to be even cheaper and more openly available than expected — sooner than expected. That’s bad news for Google, whose entire enterprise value is based around their having an unassailable and sustainable lead in these areas. Google doesn’t have to worry about a competitor coming along to rival them in search. They have to worry that the entire field of “search” is on the cusp of being commoditized. Thus the -4% hit. Meta, the thinking goes, benefits as generative AI becomes cheaper. That’s why Meta’s own AI efforts are sorta-kinda open source. Meta has nothing to do with DeepSeek, but DeepSeek’s achievements seem perfectly aligned with Meta’s own interests in AI. Apple benefits, indirectly, in at least two ways from DeepSeek’s breakthroughs. First, a vast increase in the inference capabilities of RAM-constrained hardware strongly suggests that Apple’s consumer devices will soon be able to perform far more AI functionality locally. Apple Silicon’s shared memory architecture is perfect for this — and still un-replicated by anyone else in the industry. Second, Apple’s decades-long standoffish relationship with Nvidia suddenly looks like less of a problem. ★

Jenni Reid and Alex Harring, reporting for CNBC:

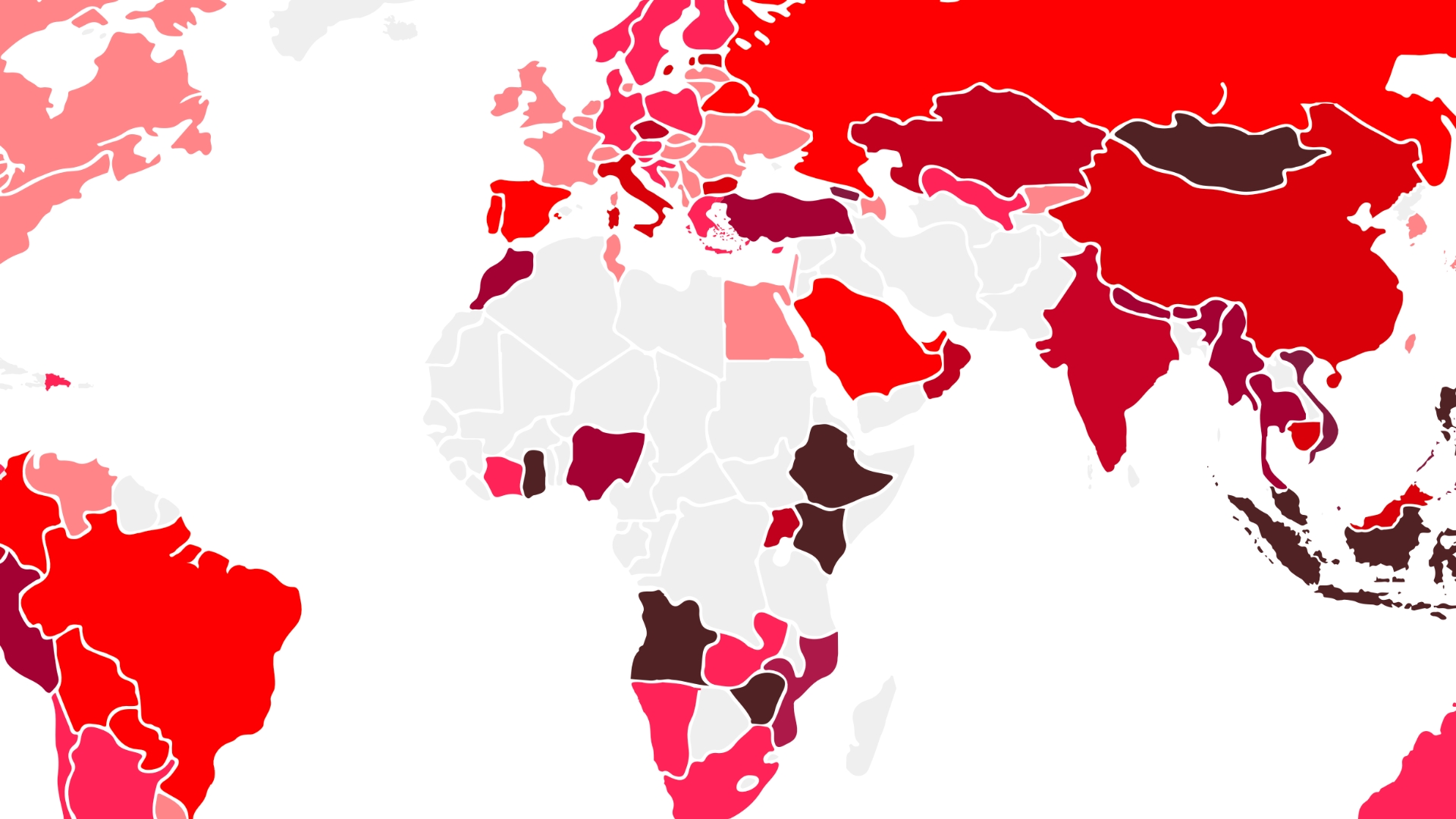

Nvidia and other U.S. technology firms plunged on Monday, part of a global sell-off as Chinese startup DeepSeek sparked concerns over competitiveness in artificial intelligence and America’s leadership in the sector.

Nvidia, the chip designer who has been a major beneficiary of the AI hype, last slid 17.3%. With that, the megacap tech stock was on track to notch its worst day since March 2020.

To make a long story short, it’s been broadly assumed that leading-edge model training and inference requires the highest of high-end hardware — which hardware, especially for training, pretty much exclusively comes from Nvidia. The assumption was that any company trying to compete in this fiercely competitive field — a field with massive implications for industry, culture, and national security — must get in line to buy (or rent) enormous amounts of computational power exclusively available on the very best systems from Nvidia. That hardware isn’t available (at least legally) to Chinese companies, because of the Biden administration’s export bans. DeepSeek engineers found and implemented multiple massive efficiency improvements that allowed the company to train its latest models at far lower prices using far-less-capable hardware, and perform inference under heretofore unprecedented memory constraints. DeepSeek’s achievements render obsolete several prior planks of conventional wisdom regarding the state of AI. My link a few sentences prior in this paragraph is to a WSJ report from 14 days ago that now feels like it dates from at least 14 months ago.

The most shocking result has been a 17 percent hit to Nvidia’s stock price today, knocking somewhere around $350 billion off their market cap. Google is down about 4 percent, and Microsoft down 2 percent — but Meta is up 1 percent and Apple is up a little over 3 percent. I think the market is reacting pretty sensibly:

Nvidia has taken an unprecedented beating. $350 billion is more than the combined market caps of Verizon and AT&T (each worth roughly $170 billion). But Nvidia has been — and even with these breakthroughs from DeepSeek, remains — in an unprecedented position. Nvidia’s high-flying valuation reflects its unprecedented position as the essential hardware company for AI. Nvidia’s position, post-R1, remains essential — just not as essential as everyone thought. Hence the haircut. But Nvidia remains the third-most-valuable company in the world — it took a massive plunge today but in no way collapsed.

TSMC and Broadcom both took big hits today too (-13% and -17%, respectively). Being a “chip company” doesn’t look as sweet today as it did last week.

If OpenAI were publicly traded, I suspect it might have collapsed — the sell-off it would have faced today might have triggered emergency measures that halted trading.

Microsoft has been distancing itself from OpenAI, but is still intertwined with them like no other company. (Recall that Apple walked away from a big investment in OpenAI just four months ago.) A -2% hit feels about right.

The broadest implication of DeepSeek’s achievements is that really good AI is going to be even cheaper and more openly available than expected — sooner than expected. That’s bad news for Google, whose entire enterprise value is based around their having an unassailable and sustainable lead in these areas. Google doesn’t have to worry about a competitor coming along to rival them in search. They have to worry that the entire field of “search” is on the cusp of being commoditized. Thus the -4% hit.

Meta, the thinking goes, benefits as generative AI becomes cheaper. That’s why Meta’s own AI efforts are sorta-kinda open source. Meta has nothing to do with DeepSeek, but DeepSeek’s achievements seem perfectly aligned with Meta’s own interests in AI.

Apple benefits, indirectly, in at least two ways from DeepSeek’s breakthroughs. First, a vast increase in the inference capabilities of RAM-constrained hardware strongly suggests that Apple’s consumer devices will soon be able to perform far more AI functionality locally. Apple Silicon’s shared memory architecture is perfect for this — and still un-replicated by anyone else in the industry. Second, Apple’s decades-long standoffish relationship with Nvidia suddenly looks like less of a problem.