China Trading Desk: Outbound travel to surge by up to +30% during Chinese New Year

While representing a sharp increase over 204, outbound travel remains far below pre-pandemic 2019 levels.

CHINA. Data-driven marketing agency China Trading Desk forecasts between 2.2 million and 2.6 million Chinese travellers will head overseas across this China New Year holiday period, which began yesterday (28 January, New Year’s Eve).

That represents a year-on-year increase of as much as +30% off a low 2024 base, according to the Singapore-based agency’s CEO Subramania Bhatt.

However, outbound travel remains far below pre-pandemic 2019 levels, which saw some 6.3 million overseas travellers.

It’s not just the passenger traffic that will be down on 2019 but also spending levels, Bhatt said.

“Chinese are being more selective about their travel this year. They’re looking for value and experiences rather than seeking out location-specific purchases,” he observed.

“We’re not going to see the heyday of Chinese visiting luxury stores and spending big on handbags due to price differentials.”

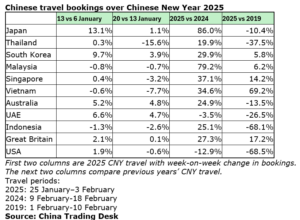

For this year’s annual getaway, Chinese travellers are staying closer to home with Japan, Thailand and South Korea shaping as the top hotspots. Nearly 75% are booking last-minute trips to get better deals.

While China Trading Desk research shows Chinese traveller bookings data well up on 2024, the agency noted a drop in recent weekly cancellations to Thailand since news of Chinese actor Wang Xing’s kidnapping in the Kingdom earlier this month.

While Thailand has been the most-affected destination by the event (Wang has subsequently been freed), other southeast Asian countries are experiencing related damage. That’s primarily because many Chinese travellers plan multiple destination trips, involving Thailand and countries such as Vietnam, Singapore, Malaysia and Indonesia.

Additional insights about domestic travel in China:

- Domestic tourism is set to reach a record 9 billion trips, with family travellers making up 49% of the total, a +75% increase from last year for families with children.

- Bookings to Hong Kong increased by +73. This has led to a drop in flight and hotel prices by -10-20% compared to last year.

- Long-haul destinations such as the UK, Spain, Italy, France and Iceland are gaining popularity, with growth rates of +56%, +74%, +50%, +49% and 1+08% respectively.

- Domestic key trends: family trips (both extended and immediate), along with cultural heritage and winter tourism, are the top trends. Parent-child trips will account for over 80% of travel. Cultural tours featuring intangible heritage experiences are highly popular, with some destinations seeing a fourfold increase. Harbin and other winter destinations remain in the top five, with bookings up +32%.

- Talking points:

- Platforms such as Xiaohongshu and Douyin dominate as planning tools, indicating a growing reliance on peer recommendations, user-generated content, and short-form videos for travel decisions. Younger demographics, particularly Gen Z, are leading this shift, showcasing the importance of leveraging digital ecosystems for engagement

- A notable 74% of travellers booked trips less than a month in advance, reflecting increased demand for agility among travel providers and dynamic last-minute offerings.

Scan the QR codes via WeChat to visit our platforms. Stories related to the China travel retail sector at home and abroad are featured in this unrivalled dual service. For native content opportunities please contact Zhang Yimei (China) at Yimei@MoodieDavittReport.com or Irene Revilla (international) at Irene@MoodieDavittReport.com. For editorial please reach out to Martin Moodie at Martin@MoodieDavittReport.com