The Estée Lauder Companies reveals ‘Beauty Reimagined’ strategic vision amid -6% net sales decline in Q2

The Estée Lauder Companies has revealed ‘Beauty Reimagined’, a comprehensive strategy designed to restore sustainable sales growth and enhance profitability.

The Estée Lauder Companies (ELC) has revealed ‘Beauty Reimagined’, a comprehensive strategy designed to restore sustainable sales growth and enhance profitability. The strategy was unveiled today (4 February) together with the company’s FY2025 second-quarter results for the period ended 31 December 2024.

ELC reported a -6% decline in net sales to US$4 billion for FY2025 Q2. Organic net sales also decreased -6%, reflecting ongoing challenges across key markets. However, gross margin expanded to 76.1%, primarily driven by net benefits from the company’s Profit Recovery and Growth Plan (PRGP).

The ‘Beauty Reimagined’ strategy encompasses several key actions which focus on accelerating ‘best-in-class consumer coverage’, creating transformative innovation, boosting consumer-facing investments, fuelling sustainable growth and streamlining work processes.

ELC will be strengthening its presence in high-growth channels, markets and price tiers, ensuring greater participation in prestige beauty’s key opportunities.

A renewed focus on transformative innovation will help ELC accelerate fast-to-market, trend-driven product development across price segments, aligning with evolving consumer demands, said the company. At the same time, ELC said it is increasing consumer-facing investments, boosting advertising spend, optimising marketing and eliminating low-return activities to enhance customer acquisition.

To support sustainable growth, ELC is expanding its PRGP, addressing volume deleverage through strategic procurement, supply chain efficiencies and selective outsourcing. These measures aim to fund consumer-facing investments and restore double-digit adjusted operating margins over the coming years.

The company is also streamlining operations, simplifying structures and fostering a leaner, more agile organisation. This approach enhances execution, empowers smaller brands, drives scale for larger brands, and accelerates decision-making to position ELC for long-term success.

“Today, we are excited to launch Beauty Reimagined, a bold strategic vision to restore sustainable sales growth and achieve a solid double-digit adjusted operating margin over the next few years as we aim to become the best consumer-centric prestige beauty company,” said ELC President and Chief Executive Officer Stéphane de La Faverie.

“While we recognise there is much work to do, we are confident that Beauty Reimagined is the way to realise our ambition. We are significantly transforming our operating model to be leaner, faster and more agile, while taking decisive actions to expand consumer coverage, step-change innovation, and increase consumer-facing investments to better capture growth and drive profitability.

“Together with our talented employees, fundamental values and incredible brands, Beauty Reimagined positions us to lead the prestige beauty industry once again.”

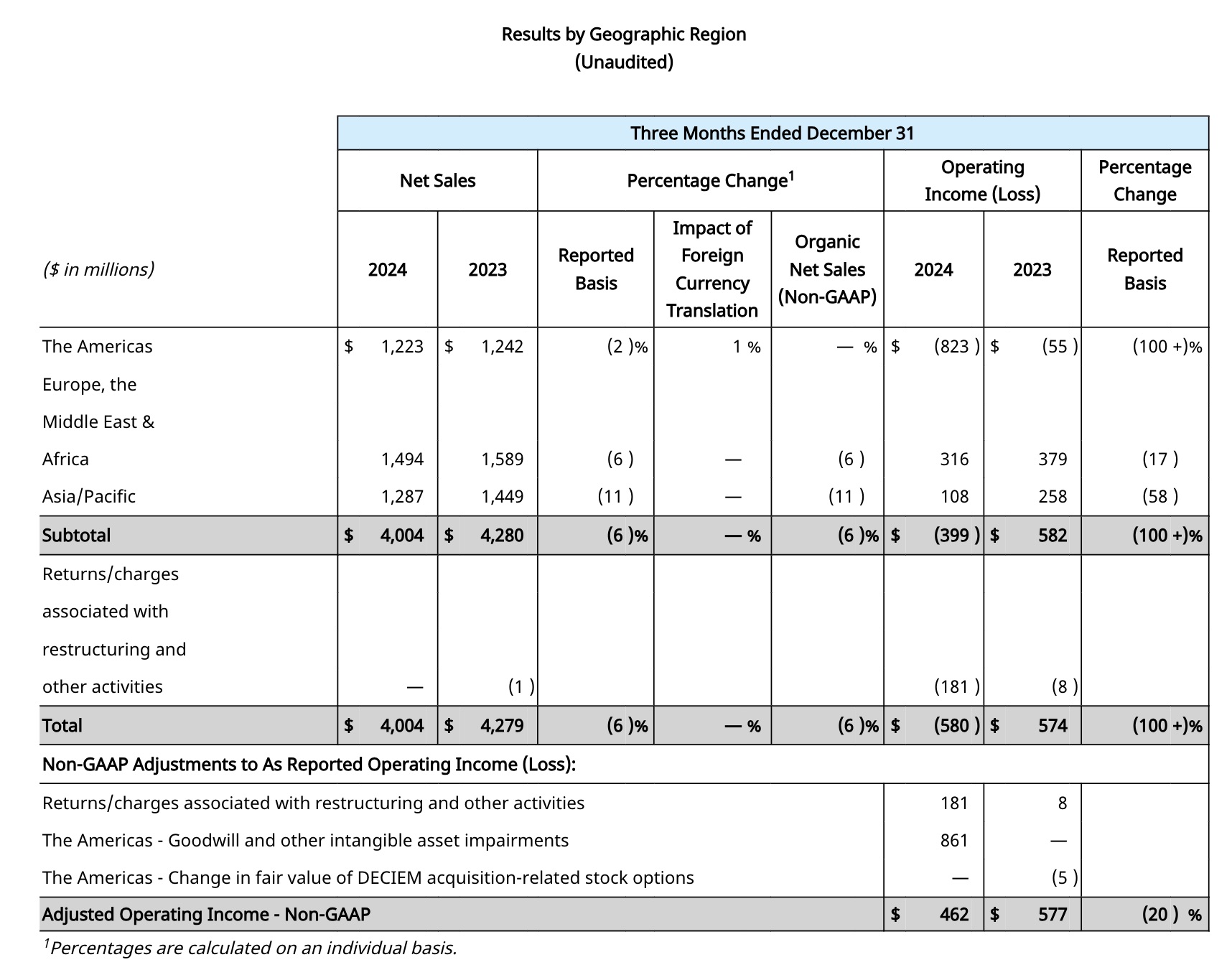

Regional performance

By region in Q2, net sales decreased -11% in Asia Pacific due to declines in Mainland China, Korea and Hong Kong SAR. The net sales decline in Korea also reflects the strategic exit of Dr.Jart+ from travel retail in November 2024. The decrease in Mainland China was attributed to softened consumer sentiment affecting the overall prestige beauty segment.

Net sales in EMEA decreased -6%, primarily driven by double-digit declines in travel retail. The challenging retail environment, coupled with subdued sentiment from Chinese consumers, weighed heavily on performance. However, while certain markets across the region delivered stable results, overall net sales remained flat.

Net sales in the Americas remained flat, as the decline in North America offset gains from new brand launches on Amazon’s US Premium Beauty Store. Retail softness for certain brands led to lower replenishment orders, contributing to the region’s muted performance.

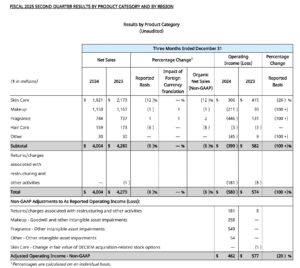

Performance by category

In the second quarter, ELC reported a mixed performance across its core product categories. Skincare saw a steep -12% decline, primarily due to ongoing challenges in China and Asia Pacific which drove declines from Estée Lauder and La Mer.

Makeup net sales decreased -1%, impacted by a weaker performance from Tom Ford, reflecting a challenging beauty retail environment, particularly in Asia Pacific. Additionally, MAC and Smashbox posted lower net sales, with weakness in the eye and face subcategories, respectively.

These declines were partially offset by high-single-digit growth from Clinique, which delivered gains across all geographic regions. The brand benefitted from its launch in Amazon’s US Premium Beauty Store and continued momentum from its Almost Lipstick in Black Honey.

Fragrance net sales increased +2% driven by strong performance from its Luxury Brands portfolio. This was led by Le Labo, which posted double-digit growth across all geographic regions. Le Labo benefitted from targeted expansion of consumer reach and continued demand for hero products, including its Classic Collection. However, this growth was partially offset by a decline from Estée Lauder.

Haircare net sales fell -8%, largely due to continued softness in Aveda’s salon channel and the timing of shipments. Despite the sales decline, haircare’s operating loss remained flat, reflecting disciplined expense management and lower cost of sales, which helped to offset the weaker top-line performance.

Continued weakness in Asia weighs in ELC outlook

ELC has projected a double-digit decline in global travel retail sales for its fiscal 2025 third quarter, citing continued weakness in Asia travel retail and additional pressure from policy changes at key Korean retailers. The decline also reflects an unfavourable year-on-year comparison due to last year’s resumption of replenishment orders.

Outside of travel retail, ELC expects moderation in its overall net sales decline, as retail trends continue to show incremental improvement from the first to the second quarter. The company’s increased investment in consumer-facing activities is anticipated to drive significant improvement in retail sales.

De La Faverie commented: “While we are not satisfied with our third-quarter outlook, it primarily reflects weak retail sales trends in our Asia travel retail business, which deteriorated in our second quarter driven by Korea. While our retail sales trends in Hainan were still negative in the second quarter, they improved sequentially, fuelled by our retail activations.

“For the third quarter, we expect overall soft retail trends to persist in Asia travel retail, significantly pressuring our organic net sales despite the improvement we made with in-trade inventory levels in the first half of fiscal 2025, which we intend to maintain around current levels.

“In order to reignite our retail sales growth, we are strategically increasing consumer-facing investments around the world in the third quarter. We expect the benefits of the PRGP to both fund these investments and modestly offset the meaningful operating deleverage from the sales decline.”

More details to follow after the ELC earnings call.