Should I pay with a rewards credit card even if it incurs fees?

Editor’s note: This is a recurring post, regularly updated with new information and offers. These days, you can pay for almost anything with a credit card. However, some merchants charge an extra fee for that privilege — which is perfectly legal. That surcharge might be charged by your wedding venue, your landlord, the local corner …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

These days, you can pay for almost anything with a credit card. However, some merchants charge an extra fee for that privilege — which is perfectly legal. That surcharge might be charged by your wedding venue, your landlord, the local corner store or even your utility company.

So, let’s say you can use your rewards credit card for a purchase — is it still worth it if you are charged a transaction fee?

Typically, these fees are between 1-4%, but more commonly, you’ll see a 3% fee. That means, for every dollar you spend, you could be paying an extra 3 cents to swipe the charge. If the rewards you earn per dollar charged are only worth 2 cents each, then, no, you likely shouldn’t pay with your credit card.

It’s typically only worth paying a fee if the value you’re earning on a rewards credit card is more than the fee paid. But that math can get a little more involved on some cards.

Let’s break it down to see when it is — and is not — worth it to pay a fee to use your credit card.

Related: Credit vs. debit cards: Which is the smarter choice?

Earning rewards that are worth more than the surcharge

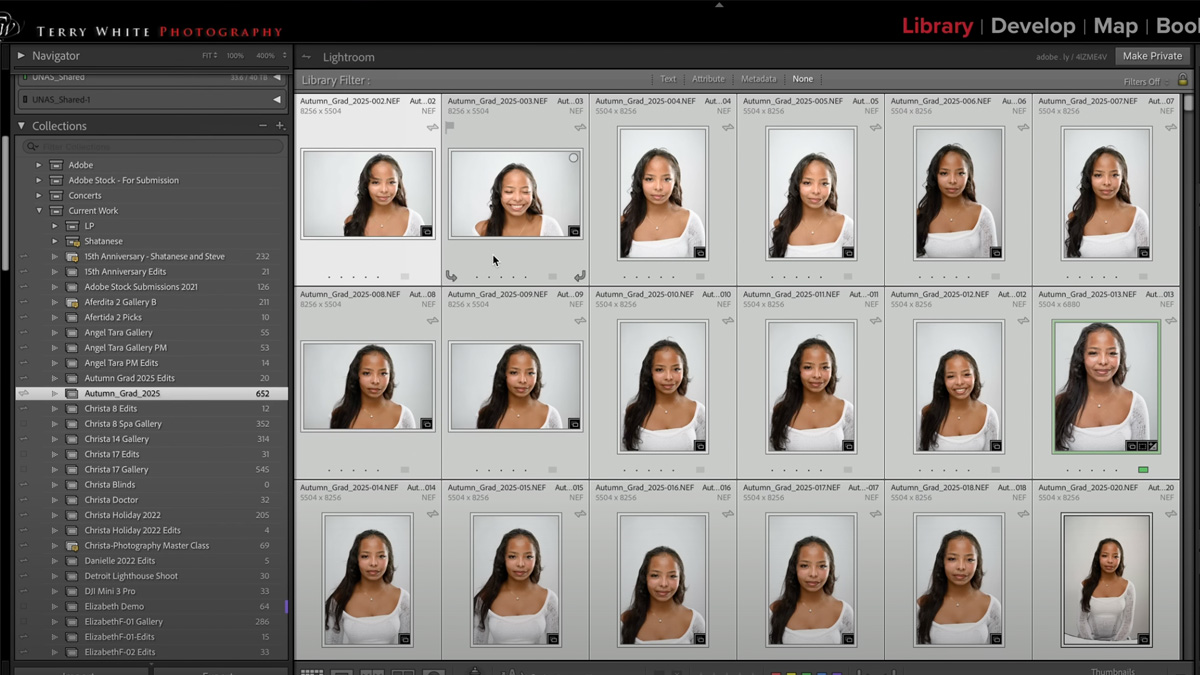

All points are not created equal. Before you swipe your card, you’ll want to find out the average value of rewards you’ll earn. TPG updates our points and miles valuations every month since these currencies vary and have different values depending on how you redeem them.

Let’s say you’re dining out and your local restaurant gives you a 3% discount for paying your bill in cash versus paying with a credit card. The only way it’ll make sense to use your credit card is if you receive more than 3% in value from the points earned.

For example, the Citi Strata Premier℠ Card (see rates and fees) earns 3 ThankYou points per dollar spent at restaurants. As of June 2025, TPG values Citi points at 1.8 cents per point. That equals a 5.4% return at restaurants, which means this card offers better value in this scenario.

But, let’s say you typically use your Citi Double Cash® Card (see rates and fees) for all of your purchases, with a simple earn rate of 2% back on every purchase (1% when you buy, 1% when you pay). Paying a 3% premium for dinner is tricky here.

If you hold a premium Citi card like the Strata Premier, you can transfer your Double Cash rewards to Citi’s transfer partners to get TPG’s target value of 1.8 cents per ThankYou point. Otherwise, you’ll get minimal value from your purchase, making a cash payment a better value in this scenario.

This is just one example of many scenarios where you’ll need to do some quick math to determine whether using your credit card will give you a return on spending that surpasses the surcharge.

Other examples may include purchasing produce at a farmer’s market, paying for rent or making a purchase at a small mom-and-pop shop.

Related: The best rewards credit cards for each bonus category

Earning a welcome bonus

Some welcome bonuses are easier to obtain than others due to lower minimum spending requirements. However, some highly desirable credit cards with welcome bonuses require a large amount of spending.

Consider credit cards with welcome bonuses of 100,000 points or more, for example. Sometimes, the only way to meet the minimum spending requirement is to put every dollar you spend on your new credit card. For example, let’s say the card you’re applying for requires $6,000 in spending over three months to earn its welcome offer.

Let’s also say that the only way you can meet the minimum spending amount is by using your card to pay your rent of $2,000 each month. That’s $6,000 total over the course of the three months in which you’re working on this welcome bonus.

If your landlord doesn’t accept credit cards directly, many third-party apps let you pay your rent online, but they all come with a fee. One of these apps, Plastiq, charges a 2.9% fee. This means you’d pay $174 in surcharges over those three months.

Calculate the value of the welcome bonus against the fee you’re incurring for paying your rent through one of these services. TPG’s monthly valuations can help you figure out how much your welcome bonus can be worth. Compare that value against the cost of the fees you’ll pay, and see if the added cost is worth it.

Many times, the value of a welcome bonus will greatly exceed the cost of any fees associated with paying rent with a credit card. TPG credit card writer Olivia Mittak often uses her rent to help her meet high spending requirements for travel cards. Just make sure the fees are worth it for your specific scenario.

Related: Should you use the Bilt Mastercard? Why it could be a game changer for renters

Earning extra benefits

Many credit cards offer increased benefits after spending a certain amount of money on the card each year, such as bonus points, award night certificates and/or opportunities to unlock elite status.

Depending on the benefit you’ll receive — and how you actually value that particular benefit — you might find value in paying transaction fees when necessary. The World of Hyatt Credit Card (see rates and fees) provides some good examples.

For every $5,000 spent on the card, you’ll earn two qualifying nights toward World of Hyatt elite status.

Let’s say you pay $2,000 each month for rent, and you decide to put two rent payments toward the $5,000 spending requirement to earn two extra qualifying nights. Considering Plastiq’s 2.9% fee, you’ll be paying an extra $116 over those two months.

Whether that fee is worth it to you is dependent on how you value those extra qualifying elite nights. If you’re a Hyatt loyalist and you stay with the chain at least a few times each year, those extra fees can definitely be worth it if it means gaining higher elite status.

However, if those two extra qualifying nights won’t put you anywhere within reach of the next Hyatt status tier, or if you don’t frequently stay at Hyatt properties, the extra fee isn’t worth it.

Related: The best hotel credit cards

Bottom line

Paying an extra fee to earn additional points or miles or to gain additional benefits may or may not be worth it. It all comes down to the number of points or miles earned, extra benefits you may receive and the value you get out of all of that.

Before you go ahead and pay for transaction fees on every credit card swipe you make, do the math on a course of action. Make sure that you’re getting more value than the surcharges you’re paying or ensure you’re making tangible progress toward unlocking a higher-value goal on your cards.

Related: Credit card economics: A look at the fees that you rarely see