United Explorer Card Review: Rich Benefits & 80K Bonus Miles

Chase and United offer a suite of co-branded credit cards, which have been completely overhauled. In this post, I want to take a close look at The New United Explorer Card. This is a great card for someone who flies United occasionally, and values benefits that will make their travel experience better.

Link: Apply now for The New United℠ Explorer Card

Chase and United offer a suite of co-branded credit cards, which have been completely overhauled. In this post, I want to take a close look at The New United℠ Explorer Card. This is a great card for someone who flies United occasionally, and values benefits that will make their travel experience better.

United Airlines Explorer Card Basics For March 2025

The United Explorer Card is probably Chase’s most popular co-branded United Airlines credit card. This is a consumer card that offers perks that can be valuable when flying United, especially if you don’t have elite status. Let’s look at what you need to know about this card, from the welcome bonus, to the return on spending, to the perks.

Welcome Bonus Of 80,000 MileagePlus Miles

For applications through May 7, 2025, the United Explorer Card is offering a limited time welcome bonus of 80,000 bonus MileagePlus miles after spending $3,000 within the first three months. I value United miles at ~1.1 cents each, so to me, the bonus miles are worth $880. This is an excellent bonus, among the best we’ve seen on this card.

Card Eligibility & Restrictions

The welcome bonus on the United Explorer Card isn’t available to those who currently have the card, or those who have received a new cardmember bonus on the card in the past 24 months. However, you are eligible for this card if you have (or have had) another United Airlines credit card.

In addition to that, there are general restrictions when applying for Chase cards, including the 5/24 rule (though that’s not consistently enforced anymore).

$150 Annual Fee, Waived The First Year

The United Explorer Card has a $0 introductory annual fee for the first year, then $150. This is a great way to try the card before paying an annual fee.

You can add authorized users to the card at no extra cost.

Earn 2x Miles On Restaurants, Hotels, And United Flights

The United Explorer Card offers bonus categories that some might find useful. Here’s the rewards structure of the card:

- Earn 2x miles on United purchases

- Earn 2x miles at restaurants

- Earn 2x miles at hotels

- Earn 1x miles on all other purchases

For an airline credit card, those are some well-rounded bonus categories. However, I’d argue there are still better cards for everyday spending.

Earn MileagePlus PQPs Toward Status

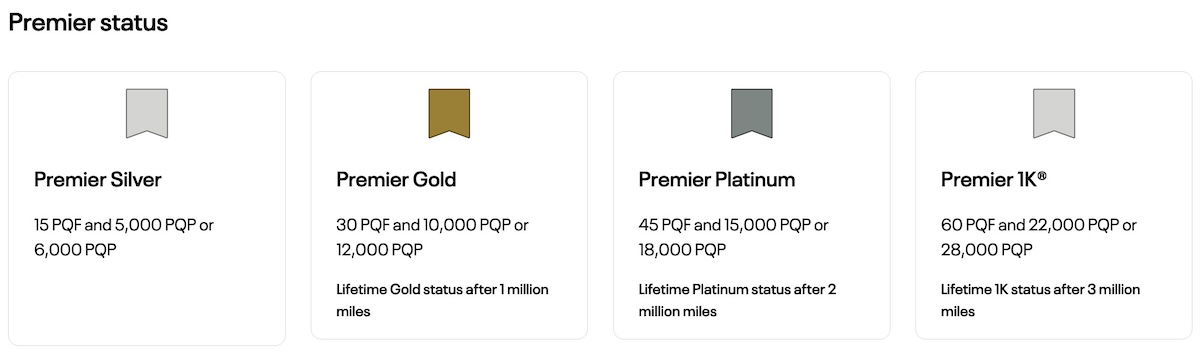

Spending money on the United Explorer Card can help you earn MileagePlus status, though not in as lucrative way as the more premium versions of the card. The card offers one Premier Qualifying Point (PQP) for every $20 spent on purchases, up to a maximum of 1,000 PQPs per year.

As a reminder, below are the MileagePlus elite requirements for 2025. As you can see, spending on the card won’t put that much of a dent into earning status, given the cap of 1,000 PQPs.

Earn $100 In United TravelBank Cash For Spending

Spending on the United Explorer Card can unlock additional rewards. If you spend $10,000 on the card in a calendar year, then you receive $100 in United TravelBank cash. This is basically good as cash for buying flights on United or United Express, so I’d view that as being nearly the equivalent of an incremental 1% return on spending in the right increment, which is pretty good.

Earn 10,000 Mile Award Discount For Spending

In addition to being able to earn $100 in United TravelBank cash, the card also offers a further incentive for spending. If you spend $20,000 on the card in a calendar year, then you receive a 10,000 mile award discount, valid toward a future itinerary. This only applies to award flights on United and United Express, but that creates an incentive to reach the $20,000 spending threshold.

No Foreign Transaction Fees

The United Airlines Explorer Card has no foreign transaction fees, so this is a good card for purchases abroad. Visa has excellent global acceptance, and you may earn bonus miles for purchases abroad, including at restaurants and hotels.

United Explorer Card Perks & Benefits

The United Explorer Card offers an excellent welcome bonus and an annual fee that’s waived for the first year, but the card also has all kinds of fantastic perks that can help more than justify the annual fee. That includes up to hundreds of dollars worth of credits, though admittedly it’ll take some work to maximize them. In no particular order, let’s look at what you can expect…

A Free First Checked Bag

The United Explorer Card primary cardmember and one companion traveling on the same reservation receive a standard free first checked bag. You must pay for your ticket with your United Airlines credit card to qualify for this benefit.

United charges $40 for a first checked bag, so this is a value of up to $160 on a roundtrip ticket.

Two United Club Passes Annually

You receive two United Club passes annually for having the United Explorer Card. This includes the year you open your card, and any subsequent years. These will automatically be deposited into your MileagePlus account within four weeks.

A United Club pass ordinarily costs $59, so that’s a value of up to $118. This is an awesome perk for the occasional traveler since it can make your travels on United more pleasant.

25% Back On United Inflight Purchases

If you have the United Explorer Card, you’ll receive 25% back on purchases of food, beverages, and Wi-Fi, onboard United and United Express flights. This comes in the form of an account statement credit. You have to pay with your United Explorer Card, and your statement credit should post within 24 hours.

Up To $120 In Instacart Credits Annually

The United Explorer Card offers a $10 Instacart credit monthly, up to $120 total each calendar year. This applies for purchases made through Instacart with your United Explorer Card, and currently the benefit is valid through December 31, 2027.

If you use Instacart anyway, then this could be worth close to face value. For others, the small increments of the credits will make it hard to get much value.

Up To $100 In United Hotels Credits Annually

United Hotels is United’s hotel booking platform. The United Explorer Card offers up to $100 back on United Hotels purchases each anniversary year. Specifically, you can get a $50 statement credit on both your first and second prepaid hotel stays purchased through United Hotels with your United Explorer Card.

This could prove valuable for some, though keep in mind there’s typically an opportunity cost to booking through a hotel portal (in terms of earning loyalty points, there being lower rates elsewhere, etc.).

Up To $100 In JSX Flight Credits Annually

The United Explorer Card offers up to $100 back on JSX flight purchases per anniversary year. This comes in the form of a statement credit, and you must use your United Explorer Card to make the purchase. JSX is a hop-on jet service, which United owns a stake in. If you fly JSX with any frequency, then this is a great perk

Up To $60 In Credits On Rideshare Purchases Annually

The United Explorer Card offers up to $5 back per month on rideshare purchases, in the form of a statement credit, when paying with your card. This allows you to earn up to $60 in statement credits every calendar year, and an annual opt-in is required.

On the one hand, these statement credits are easy enough to use. The catch is that there are probably better cards for rideshare spending in terms of maximizing rewards.

Global Entry, TSA PreCheck, Or NEXUS Credit

The United Explorer Card offers a Global Entry, TSA PreCheck, or NEXUS credit every four years. Simply charge the enrollment fee to the card and it will automatically be reimbursed.

Nowadays, quite a few credit cards offer these fee credits, so you can always use this benefit for a friend or family member. Simply use your credit card to pay, and you’ll automatically receive the statement credit.

Priority Boarding

For having the United Explorer Card, you and your companions receive priority boarding on United and United Express flights. You can board before general boarding, after customers with Premier Access, and those requiring special assistance. This would be in Group 2.

Premier Upgrades On Award Tickets

MileagePlus elite members receive complimentary upgrades on domestic and short-haul international flights (in most markets) when paying cash for their tickets. If you have the Explorer Card, you also receive Premier upgrades on award tickets when traveling on United or United Express. Travel companions and authorized users aren’t eligible for this benefit.

Expanded Award Availability

For having the United Explorer Card, you receive access to more award availability. This includes both extra saver and standard level award availability. It can be useful because MileagePlus miles are often best used for travel on United metal.

Primary Rental Car CDW

The United Explorer Card offers a primary collision damage waiver benefit. Just decline the rental company’s collision insurance and charge the entire rental cost to your card. This is a really valuable benefit that comes in handy when renting cars.

Trip Delay & Lost Luggage Protection

The United Explorer Card offers a variety of protection benefits when traveling, assuming you pay for purchases with your card. These features include the following:

- Trip cancellation & trip interruption insurance — be reimbursed up to $1,500 per person and $6,000 per trip when your trip is canceled or cut short due to sickness, severe weather, etc.

- Trip delay reimbursement — if your flight is delayed by more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket

- Lost luggage reimbursement — be reimbursed up to $3,000 per passenger if you or your immediate family member check or carry on luggage that is damaged or lost by an airline

- Baggage delay insurance — be reimbursed up to $100 per day for three days for essential purchases when your bag is delayed by over six hours

Make sure you check your cardmember agreement for all of the details, since there are terms & conditions.

Is The United Explorer Card Worth It?

While I generally wouldn’t recommend using the United Explorer Card for your everyday spending (since there are better cards for earning United miles), this is one of the better airline credit cards when it comes to having great perks and a fair annual fee. On the surface, I consider this to be the mid-tier airline credit card with the strongest perks.

In particular, I think this card is worth considering if you only fly United occasionally, since the perks are largely geared toward people without elite status. Meanwhile if you’re an elite-level flyer with United, I think one of the more premium cards is probably a better bet, especially since those cards can help you earn elite status at a faster pace.

United Explorer Card Vs. United Quest Card

The New United Quest℠ Card has a $350 annual fee, so it’s a more premium version of the United Explorer Card. If you ask me, this card is very much the sweet spot for more frequent United flyers, who have elite status.

For one, the annual fee is quite easy to justify, thanks to the card offering $200 in United TravelBank cash annually, plus a 10,000 mile discount on an award redemption annually, all with no spending requirement. That would recoup most of the card’s annual fee. Beyond that, the card offers some strong incremental perks, including larger credits with rideshares, JSX, and Instacart.

Furthermore, this card is better if you want to earn status through spending, as you earn one PQP for every $20 spent, up to a maximum of 18,000 PQPs per year. If you’re a frequent United flyer but don’t quite want the most premium version of the card, I think this is the product to go for.

Read a full review of the United Quest Card.

United Explorer Card Vs. United Club Card

In addition to the United Explorer Card, there’s also The New United Club℠ Card, which is United Airlines’ most premium personal credit card. The United Club Card has a $695 annual fee.

If you ask me, this is the card for frequent United flyers, and there are two reasons to consider this card. For one, the card offers United Club access, which is valuable if you fly with the airline often. The second reason is that this is the best personal card for earning MileagePlus elite status through spending. The card offers one PQP for every $15 spent, up to a maximum of 28,000 PQPs per year. In other words, you could earn Premier 1K status exclusively through credit card spending.

Read a full review of the United Club Card.

Best Ways To Earn United Miles With Credit Cards

While the United Explorer Card has great perks, I wouldn’t generally use it for my everyday spending. That’s true whether you want to earn United miles for your spending or not. United MileagePlus is a Chase Ultimate Rewards transfer partner, so you can convert Ultimate Rewards points into United miles at a 1:1 ratio.

There are so many great Ultimate Rewards cards that earn points at a potentially faster rate than you’d earn directly through United, so that’s something worth considering.

Bottom Line

The United Explorer Card is one of the most benefits-rich airline credit cards out there. For a reasonable $150 annual fee (which is even waived for the first year) you get two United Club passes annually, savings on inflight purchases, a Known Traveler Program credit, a first checked bag free, (potentially) hundreds of dollars worth of credits, and much more.

If you want to learn more about the United Explorer Card or apply, follow this link.