Double the platinum, double the perks: Why having both Amex Platinum cards is worth it

Editor’s note: This is a recurring post, regularly updated with new information and offers. The Platinum Card® from American Express and The Business Platinum Card® from American Express have established themselves as two of the top cards to have if you’re interested in luxury travel benefits. With an overlapping rewards structure and similar benefits, it’s …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

The Platinum Card® from American Express and The Business Platinum Card® from American Express have established themselves as two of the top cards to have if you’re interested in luxury travel benefits.

With an overlapping rewards structure and similar benefits, it’s natural to wonder which of the two is the best for you. Or, if you already have one of the cards, you might be wondering if it’s worth getting the other as well.

Well, it could actually work out in your favor to make room for both cards in your wallet — even with the $695 annual fees on each (see rates and fees for the Platinum and the Business Platinum).

Each card has benefits that complement the other, and travelers will have no problem offsetting the steep annual fees, making them a great combination for getting the most out of trips.

Here’s why you may want both in your wallet.

2 welcome bonuses

Both cards come with substantial welcome offers.

Right now, new Business Platinum Card members can earn 150,000 bonus points after spending $20,000 in the first three months of card membership. Plus, they’ll earn a $500 statement credit after spending $2,500 on qualifying flights booked directly with airlines or through American Express Travel (spending can come from multiple airlines) within the first three months. This offer ends June 30.

New Amex Platinum Card members can earn 80,000 bonus points after spending $8,000 in the first six months of card membership. However, you may be targeted for a higher offer via the CardMatch tool (subject to change at any time, and not everyone will be targeted for the same offers).

If you apply for both cards and earn the full welcome bonuses, you’ll get at least 230,000 Membership Rewards points plus the $500 statement credit. Based on TPG’s April 2025 valuations, that’s worth up to $5,100 — more than triple the combined cost of the annual fees.

Related: Is the Amex Business Platinum worth the annual fee?

Statement credits

Both cards have credits to help cardmembers get value year after year. (Enrollment is required for select benefits; terms apply.)

Overlapping credits

Typically, one of the easiest perks to take advantage of with the Platinum cards is the annual airline fee statement credit you’ll receive. Each card offers up to $200 each calendar year (enrollment required) that can be used to cover incidental purchases with one airline, such as seat upgrades, lounge passes and inflight drinks. If you have both cards, you could use one credit for Delta Air Lines purchases and the other for United Airlines, for example.

Both cards also offer:

- Up to $199 in annual Clear Plus statement credits (subject to auto-renewal)

- Up to $120 in credits for your Global Entry application every four years or up to $85 in credits for your TSA PreCheck application every 4 1/2 years

You could use one card to cover your own Clear Plus and Global Entry membership and then the other to cover a loved one’s membership.

Unique credits

For the rest of the credits, the personal card offers mainly travel- and lifestyle-related credits, while the business one focuses on getting value out of business expenses.

For example, the Amex Platinum offers an up to $200 annual hotel credit for prepaid American Express Fine Hotels + Resorts or The Hotel Collection bookings made through Amex Travel.

Meanwhile, the Business Platinum offers up to $200 in annual statement credits for Hilton purchases (up to a total of $50 per quarter). You can use this credit to cover room charges and incidental purchases like room service and minibar items.

So, you can get up to $400 in value from hotel stays by holding both cards.

In total, the personal card offers over $1,500 in value if you fully use all the statement credits. The Business Platinum doesn’t lack in value, either, offering over $1,700 in value if fully utilized for a total of over $3,200 in annual statement credits across the two cards.

Even if you only use half of the credits, you can fully cover the combined annual fees of both cards.

Maximizing earning rates and redemptions

Perhaps one of the biggest benefits of having both the personal and business versions of the Amex Platinum is the earnings rate.

You should use your Amex Platinum for personal expenses and most airfare. That’s because the personal card earns 5 points per dollar spent on airfare booked directly with the airline as well as through Amex Travel (on up to $500,000 spent on airfare per calendar year, then 1 point thereafter) whereas the business version only offers it for Amex Travel bookings.

Then, you should use your Business Platinum for business expenses and to earn:

- 1.5 points per dollar spent on purchases of $5,000 or more (on up to the first $2 million every calendar year, then 1 point per dollar thereafter)

- 5 points per dollar spent on flights booked through Amex Travel (once you’ve hit your spending cap on the personal card)

Then, the points you earn on both cards can be combined and transferred to one of Amex’s 21 airline and hotel partners, sometimes with a transfer bonus.

If you have the business card, you can also get 35% of your points back (up to 1 million points per calendar year) when booking flights with Pay with Points. (Applies to first- or business-class tickets on any airline or an economy ticket on one airline of your choice.)

Related: How to maximize your earning with the Amex Business Platinum

Authorized users

Holding both versions of the Platinum cards can help you add more than three authorized users.

The Amex Platinum Card allows you to add up to three authorized users for $195 each (see rates and fees). However, if you want to add more authorized users, the Business Platinum Card will allow you to add up to 99 authorized users. Just note that it does cost a steep $350 per authorized user (see rates and fees).

For example, you could add your family members as authorized users to the personal card and your employees as authorized users to the business card. They would all enjoy:

- Unrivaled lounge access for their travels

- Their own Global Entry/TSA PreCheck application fee credit

- Elite hotel and rental car status for themselves

(Enrollment is required; terms apply.)

Related: Should you get your own Amex Platinum or be an authorized user on someone else’s account?

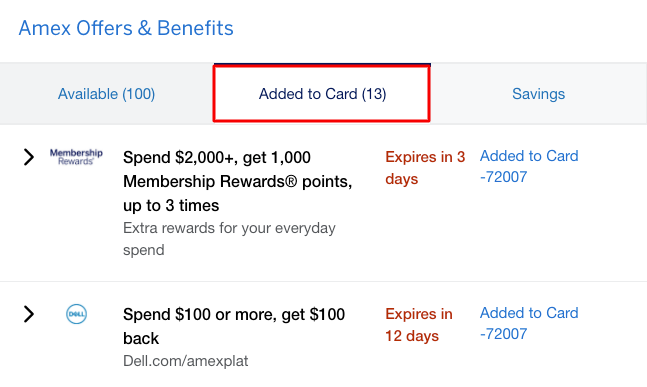

Amex Offers

All American Express cards, including the Platinum and Business Platinum cards, come with access to Amex Offers. These allow you to earn a statement credit or bonus points when shopping with a participating merchant like Amazon, Nike or Sephora.

Oftentimes, both cards have the same or very similar offers. However, many of these offers have limits on the number of bonus points or savings you can earn, so by having both cards, you can double-dip on the rewards with your favorite merchants.

While Amex Offers can be great deals on their own, you can do even better when you stack them with online shopping portals to earn extra cash back or bonus points on your purchase. And you can also stack them on top of a statement credit that your card offers.

So, if you find an Amex Offer for Dell, you can click through a shopping portal and use your Business Platinum to stack your statement credit, Amex Offer and shopping portal rewards.

(Enrollment is required for select benefits; terms apply.)

Related: Your ultimate guide to saving money with Amex Offers

Separating expenses

Another reason to hold both cards is to separate expenses, which involves putting personal expenses on a personal card and business expenses on a business card. This is a good practice and can be especially helpful come tax season and help streamline your expenses.

Business expenses tend to be larger than personal expenses. So, if you have any expenses over $5,000, it’s beneficial to put them on the Business Platinum, as you’ll earn 50% more points (compared to putting them on the personal card).

Related: Can you use a business credit card for personal expenses?

Bottom line

The personal and business Platinum cards can complement each other nicely, as both offer valuable cardmember perks. Despite the steep annual fees of both cards, the annual credits and earning potential can easily provide more value than the combined annual fee of both cards.

This card combination is not right for everyone. However, for small-business owners who have a large budget and want to take advantage of generous credits and luxurious travel opportunities, it could be a worthwhile addition to your wallet.

To learn more, read our full reviews of the Amex Platinum and the Amex Business Platinum.

Apply here: Amex Platinum

Apply here: Amex Business Platinum

For rates and fees of the Amex Platinum Card, click here.

For rates and fees of the Amex Business Platinum Card, click here.

/33901f8b-dab8-4ac5-8d01-7bf897aa6a96--2015-0122_chocolate-dump-it-cake_james-ransom_008.jpg?#)