5 reasons I love my World of Hyatt Credit Card and plan to keep it for the long term

It seems every hotel brand has a credit card (or six, in the case of Marriott). So, it can be difficult to choose which one to get. Out of the 33 credit cards currently in my wallet, a quarter of them are from hotel brands. And one of my top choices is the World of …

It seems every hotel brand has a credit card (or six, in the case of Marriott). So, it can be difficult to choose which one to get.

Out of the 33 credit cards currently in my wallet, a quarter of them are from hotel brands. And one of my top choices is the World of Hyatt Credit Card, which is the personal credit card from Chase and my favorite hotel loyalty program, World of Hyatt.

Here are five reasons I got the card — and plan to keep it for the long term.

Annual fee that pays for itself

The World of Hyatt card‘s $95 annual fee is average for a mid-tier cobranded hotel card. And it’s offset by more than just one benefit — making it a no-brainer to keep in your wallet year after year.

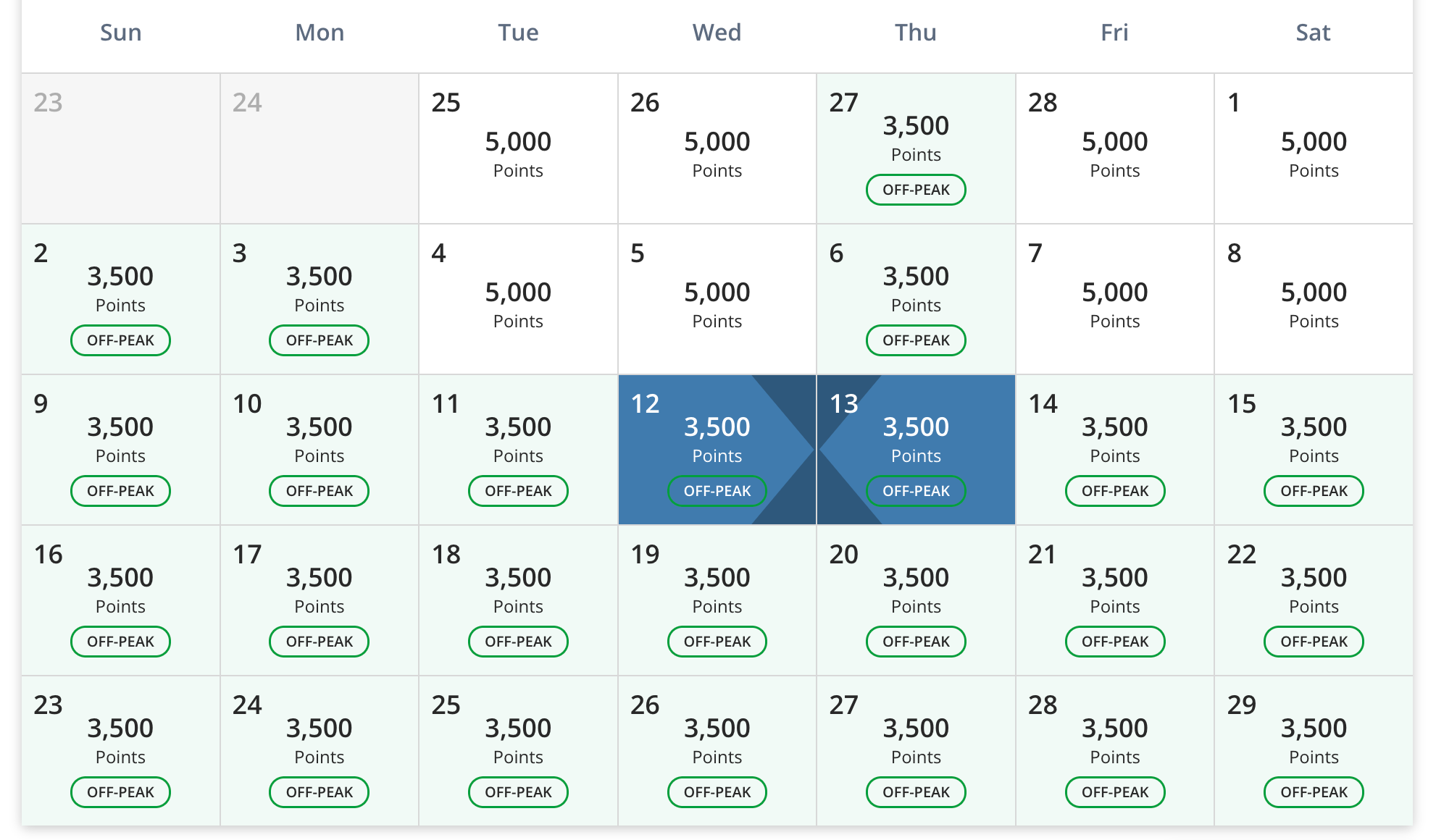

This card offers an annual free night certificate at a Category 1-4 property, valid for peak, standard and off-peak dates. That means you can redeem it for a night costing between 3,500 and 18,000 points, with a preference for the higher end to get maximum value out of the certificate.

I redeemed my free night certificate at the Andaz Mexico City Condesa (a Category 4 property) last year, and at the Hyatt House Manchester (Category 2) the year before. Given cash rates for these properties start at $250 and $170, respectively, I got my annual fee’s worth — and then some.

You can also combine your points and free night certificate on the same stay; I usually use my certificate for the first night and then add nights booked with points.

Valuable hotel points

According to TPG’s February 2025 valuations, World of Hyatt points are among the most valuable hotel points, worth at least double the value of Hilton Honors, IHG One Rewards and Marriott Bonvoy points.

Part of the reason is that World of Hyatt is the only one of these four major loyalty programs that still sticks to an award chart (for the most part). Standard room redemptions at most Hyatt-affiliated properties cost between 3,500 and 45,000 points.

While some people aim for luxury hotel stays at brands like Park Hyatt, I prefer to squeeze the most nights out of my Hyatt points by using them at high-value Category 1 and 2 properties. For example, I recently stayed at the excellent Alila Bangsar Kuala Lumpur for only 5,000 points a night (the property increases to 8,000 points a night March 25).

It’s important to do the math to decide whether using points or cash to book a hotel stay is better. When I use cash, I earn 4 points per dollar spent with Hyatt — including on meals and spa services — which is equivalent to an almost 7% return on my spending, according to our February 2025 valuations.

Top up with Chase and Bilt points

I direct most of my general travel and dining spending to my Chase Sapphire Reserve®, which earns 3 points per dollar spent. And since Hyatt is one of Chase’s 14 transfer partners, I can transfer my points at a 1:1 ratio to top up my account.

You can also transfer Bilt Rewards Points to Hyatt at a 1:1 ratio.

Transfers are typically instant, but over the past six months, I have had two instances of Chase points taking three to seven days to appear in my Hyatt account.

Automatic elite status

It’s safe to say I’ve boarded the Hyatt status train. This card gives me my ticket, granting me complimentary Discoverist status just for having it in my wallet.

While this entry-level status doesn’t give me many perks, the notable ones include:

- A 10% points bonus on Hyatt stays

- Upgrades to preferred rooms (subject to availability)

- 2 p.m. late checkout (subject to availability)

Fast track to higher status

My aim last year was to get to mid-tier Explorist status, which requires 30 nights in a year. I reached this status tier thanks to the five elite night status credits this card grants me and staying 25 nights at Hyatt hotels.

While not a perk specific to the card, I appreciate the program’s Milestone Rewards, which granted me 2,000 bonus points when I reached 20 nights, and a free night certificate and two club access awards when I reached 30 nights.

This year, I aim to reach top-tier Globalist status, which requires 60 nights. Thanks to this card’s five elite nights, some recent stays and upcoming ones, I’m on track to get halfway there by the middle of the year.

This card will give me a boost in the second half of the year, granting me two elite night credits for every $5,000 spent on it. By year’s end, I plan to put my almost $10,000 property tax bill on this card, plus another $5,000 or so in general spending, totaling $15,000.

This is the sweet spot to aim for, as it will not only give me six elite night credits toward my 60-night target but also an additional free night certificate to redeem at a Category 1-4 property.

Bottom line

If you ask TPG veterans and experts on points and miles which hotel program they’re most loyal to, the most common answer is Hyatt. So, if you want to aim for top-tier hotel status and enjoy some Milestone Rewards along the way, the World of Hyatt card is a great choice.

Given the high-value redemptions and free night certificate, it’s also a no-brainer for those looking to minimize the cash cost of hotel stays.

If you don’t particularly care about status but have a card that earns Chase Ultimate Rewards points, the Hyatt card is a great choice, too. Its annual fee easily pays for itself each year.

To learn more, read our full review of the World of Hyatt Credit Card.

Apply here: World of Hyatt Credit Card

Related: My top 3 picks for the best cobranded hotel credit card