17 Ways to Cut Your Expenses and Have More Money for Travel

No matter how cheap we want to be, travel requires some money. There’s no way to avoid that, so in order to save for our trips, we need to cut our expenses. Here are some simple and creative ways to cut your expenses, make money, and get on the road sooner! The post 17 Ways to Cut Your Expenses and Have More Money for Travel appeared first on Nomadic Matt's Travel Site.

Get out a sheet of paper and write down all your set expenses: rent/mortgage, car payments, cable/streaming bill, cell phone, insurance, school payments, etc. Tally them up.

Then write down all your discretionary spending. This is what you spend on food, movie nights, drinks, shopping, that daily coffee from Starbucks, your daily midday snack, and other similar things. If you don’t know what you spend money on, go track your expenses for a two-week period, see what you spend, and come back.

Add that all up. What did you get? Probably a large sum of money.

And I bet there will be many expenses you didn’t realize were there. Financial experts call these “phantom expenses” — we never know they are there because the expenses are so small. People bleed money without realizing it. A dollar here and a dollar there…it adds up. Even a daily bottle of water or candy bar can make a substantial difference over the course of a year.

What does this have to do with travel?

Well, one of the main reasons why we think we can’t travel the world is money. “I can’t afford it,” people say to me, “I have too many expenses.”

Most of us certainly have expenses we can’t cut (though remember when you travel the world long-term, many of those expenses disappear), but if we cut our phantom expenses, reduce our set costs, and find other ways to save we can build our travel fund much more quickly.

Cutting your daily expenses, being more frugal, and downgrading to a simpler way of living will allow you to save money for your trip around the world without having to find extra sources of income. Of course, the lower your income, the longer it will take to save enough to travel. But longer does not mean never. A little bit every day adds up to a lot over a long period of time.

Here are some simple and creative ways to cut your expenses, make money, and get on the road sooner:

1. Track your spending

As mentioned in the introduction, most people don’t have a budget so the first thing you need to do to save money is to know where you’re spending it. In an age where you tap an app and a car arrives, it’s easy to not think about how much we spend. You can use a spreadsheet or one of these websites. You’ll probably be surprised at where your money goes once you start paying attention. Start tracking your expenses — and keep doing so — so you can keep cutting out the low-hanging fruit and find where you’re spending money.

2. Set up a separate bank account

Financial experts have long recommended this for a variety of things. When you set up a separate bank account and have money automatically deposited into that account each pay cycle, you don’t have the urge to spend it. “Out of sight, out of mind”, right?

This works for travel. No matter how much you put away there, putting that money in a separate bank account means it’s away from your spending and you won’t overspend. Think of this like a piggy bank. Don’t raid it. It’s your travel fund. Let it sit there and grow.

Just make sure that the account is a high-yield online savings account. I’ve done this since the time when I was preparing to go away on my first trip and I netted hundreds of dollars in extra money thanks to interest (and a bit more while I was traveling too as the money was sitting there while it was being spent down). Interest rates are very high these days and you can earn around 4% on your savings account! Take advantage of that! Here are the current best rates:

Not from the US? Check out these websites for information:

3. Get a new credit card

A travel credit card can give you free money, free rooms, and free flights. After accruing miles and rewards points with your card on everyday purchases, you can redeem them for free travel on your trip. Travel credit cards are a big weapon in a budget traveler’s arsenal. You’ll even earn huge sign-up bonuses when you get a new card.

For more credit card suggestions, check out this list of the best travel credit cards.

And, for more information on travel credit cards in general, here is my comprehensive guide on how to pick a good travel credit card.

4. Cut the coffee

Love your Starbucks? Well, Starbucks loves your money. Coffee is the little thing that quietly drains your bank account without you ever noticing. That daily coffee can cost you $90 per month ($3 for a regular coffee, more if you want some fancy Frappuccino). At $1,080 per year, that’s a lot of money.

So, what’s more important: your daily cup of Joe or spending more time on the beaches of Thailand or exploring the jungles of Borneo? Give up the coffee, or switch from the cappuccino to a standard brew. Move to tea, or brew your own cup. Folger’s might not taste as delicious as a venti triple mocha latte with whipped cream, but it’s a lot cheaper (and, let’s be honest, healthier).

Sure, giving up your cup of coffee seems like a “duh” thing. And, yes, there is utility in the time saved from buying one. Under normal circumstances, this would be “small thinking” financial advice that isn’t worth the time or effort.

But, right now, you have a travel goal to reach and every penny counts.

5. Learn to cook

Dinner out is usually someone’s biggest discretionary expense—and it’s also one of the easiest to eliminate. Instead of buying $20 lunches and $30 dinners, brown-bag it to work and cook dinner at night. When I saved for my first trip, I was spending $70 per week on groceries. I cooked once for dinner and ate the leftovers the next day for lunch. Sure, cooking can be intimidating since not all of us are Julia Child in the kitchen. However, I found cooking to be an invaluable skill, not only because it saved me money before my trip but because it’s also one of the easiest ways to cut down expenses when you travel.

The more I cooked, the more I loved cooking. And the more I saved. (I also got a lot healthier because I knew what was in my meals, which was an added bonus.)

Of course, grocery prices have gone up since the mid-2000s and you’re likely spending a lot more than $70 on groceries (I currently spend around $125 per week). But cooking is still cheaper than eating out or getting your food delivered via an app.

Here are some sites to check out to get the ball rolling:

6. Lose the car

Between insurance, repairs, loan payments, and filling your tank with gas, cars are crazy expensive to own. Get rid of your car if you can. Learn to love the bus, take the subway, bike, or walk. It may take longer to get to work using public transportation, but you can use that time to plan your trip, read, write, or do other productive tasks.

I understand that this tip may not be feasible for everyone, especially those in smaller towns that don’t have an extensive public transportation system, but an alternative is to sell your car and buy a cheaper used one, which you will only need until you leave for your trip. Buying a throwaway car will allow you to pocket the money from your more expensive car and put it toward your travels.

Additionally, with the proliferation of Uber, Lyft, and other ride-sharing services, it’s never been easier, even in small towns, to find transportation. Do the math on it but it may be cheaper to get Lyfts around town than to own a car. (Plus, if you need a car for long distances, you can easily rent one.)

7. Save on Gas

Gas adds up! Luckily, there are plenty of ways to save on gas! First, use the app GasBuddy to find cheap gas near you. Second, sign up for all the major gas station loyalty programs. By default, they save you around 5 cents per gallon.

Shell’s Fuel Rewards is the best because you attach it to a dining program leading to savings up to 50 cents a gallon. Moreover, use GasBuddy’s credit card, which can be tied to any gas station loyalty program for an additional savings of 25 cents per gallon. Most supermarkets also have loyalty programs that offer gas savings.

If you sign up for Costco, they have huge savings on gas, too.

8. Cut your streaming

Cutting the cord was supposed to save us money, but with so many subscription services out there, it feels to me that we are paying more than we did with regular cable. I mean, how many streaming services do we really need!?

Rather than subscribe to all of them at once, try rotating which ones you are using. I watch everything I want to watch over the course of a few months on one service, cancel it, sign up for a new service, and repeat. By doing this, you are never paying for more than one service at a time while still being able to binge watch what you want.

9. Sign up for travel newsletters

No one likes to clutter up their inbox, but by signing up for mailing lists from airlines and travel companies, you’ll be able to get updates about all the last-minute sales or special deals happening. I would have missed out on a round-trip ticket to Japan for $700 USD (normally $1,500) if it wasn’t for the American Airlines mailing list.

Additionally, consider signing up for a website like Going.com. They hunt down deals and send them directly to your inbox — for free! They also offer a premium service that offers more (and better) deals but at the very least join their free newsletter. Chances are you’ll find some awesome deals!

10. Replace your light bulbs

Electricity costs money and, since every penny counts, using energy-efficient light bulbs will cut down on your utility bills. Moreover, due to energy efficiency initiatives in certain states, many electric companies will give you a rebate if you buy LED bulbs. Be sure to check out which rebates your local energy company offers no matter where you live in the world. Going green can save you green! Check your local government or utility company’s website for information.

For US readers, check out EnergyStar or the DSIRE database. For Canadian readers, check out this page run by the government. For everyone else, check your local government or utility company’s website for information!

11. Buy second-hand

Why pay full price when you can pay half? Use websites like Amazon (discounted books and electronics), wholesale websites, Facebook Marketplace, and Craigslist. Towns big and small usually have thrift stores like Goodwill where you can pick up clothing and odds and ends.

Sure, you don’t want to buy everything used, but you can definitely buy most things used! (Plus, it’s good for the environment since you’re giving stuff an added use life rather than having it end up in a landfill!)

12. Cut coupons

The Entertainment Book, grocery coupons, Groupon, and loyalty cards all reduce the price you pay at the register. Clipping coupons might make you feel like an 80-year-old grandmother, but the goal here is to be frugal and save money, and coupons definitely help with that.

Many grocery stores also offer electronic coupons based on your shopping habits. Sign up at your local grocery store for their loyalty program and you can lower your weekly grocery bill with discounts either sent via email or added directly to your loyalty card.

Also, use Rakuten, which is an app and web browser extension that gives you cash back on purchases that range from 1–20%. You can also get American Express Membership Rewards points instead of cash back if you want. I use this service for all my shopping, including all my hotel bookings since many travel companies are on the service. You can also tie a specific credit card to your Rakuten account and get cash back in physical stores, too. They offer many deals and I always check this website before making any purchase.

When you combine Rakuten with coupon codes you find on the web, you have a very powerful combo to save money.

13. Sell your stuff

Before I started long-term travel, I looked around my apartment and saw just a lot of stuff I had no need for anymore: TVs, couches, tables, stereo equipment. Instead of keeping it in storage (which costs money), I decided to just get rid of everything. I sold it all and used the money to travel. After all, I’m not going to need my couch while eating pasta in Rome! Sites like Craigslist, Amazon, and Gumtree are excellent places to sell your unneeded consumer goods.

Personally, I love the app OfferUp. It’s easy to use and people are less flaky than on Craigslist (and they don’t try to haggle you down as much). Definitely check it out.

If you’ve got a ton of stuff, consider having a yard sale. That’s the fastest way to clear out your house and make a few bucks in the process.

As you downsize your life, sell your clothes and extra stuff for cash. Sites like The Real Real, Poshmark, and Facebook Marketplace all provide an opportunity to get rid of your unwanted stuff and make some decent money.

14. Stop drinking alcohol

Alcohol is expensive. Cutting down the amount you drink is going to have a big impact on your budget. While this might not apply to everyone, those of you who are carefree might go out with your friends on the weekend. Drink before you go out to the bar or simply don’t drink at all. Cutting down the amount of alcohol you consume is considered low-hanging fruit — an easy way to save money.

15. Stop snacking

A snack here and there not only adds calories to your waistline but also empties your wallet — another example of phantom expenses. We don’t think much of them because they cost so little, but they add up over time and eat into our savings. Eat fuller meals during lunch and dinner and avoid snacks.

If you do want to snack, bring snacks from home and plan your snacks in advance. That way, you can buy cheaper (and healthier snacks) and avoid buying chips, chocolate bars, and other expensive junk.

16. Earn extra money on the side

The rise of the gig economy has made it easier to earn extra money on the side. TaskRabbit lets you do tasks that people don’t have time for—from cleaning to moving, doing research, or helping with errands. Websites like Fiverr and Upwork allow you to be people’s assistants, editors, designers, or a host of other professional roles, while Yoodlize allows you to rent out your unused stuff for money. These sites can provide an easy way to earn money on the side. Be sure to check them out as a way to earn extra money for your upcoming trip.

Additionally, you can become an Uber or Lyft driver, teach a skill on the side, or rent out a room on Airbnb. In the age of the “side hustle,” there are lots of ways to utilize your proven skills for extra cash. Get creative!

Here is a full list of sharing economy websites you can use to earn some extra cash on the site.

17. Buy a reusable water bottle

Single-use water bottles are not only harmful to the environment, they are also harmful to your wallet. One or two water bottles a day at $1 USD per bottle will add up to at least $30 USD a month. That’s $360 USD a year! You can spend a week in France with that much money!

Instead of plastic, buy a reusable water bottle and fill it with tap water. You’ll want one for your trip anyway, so buy one now and get in the habit of using it. I like Lifestraw as it also has a water filter.

The most important thing you can do though is to track your expenses as everyone’s situation is different. For me, the biggest “Wow! I can’t believe I’m spending money on this” were Lyft and e-scooters. Hundreds of dollars a month were being wasted on those two things with me realizing it.

Track your spending so you can keep cutting what is discretionary spending. The more you do that, the more you’ll save money, the quicker you’ll be able to get on the road!

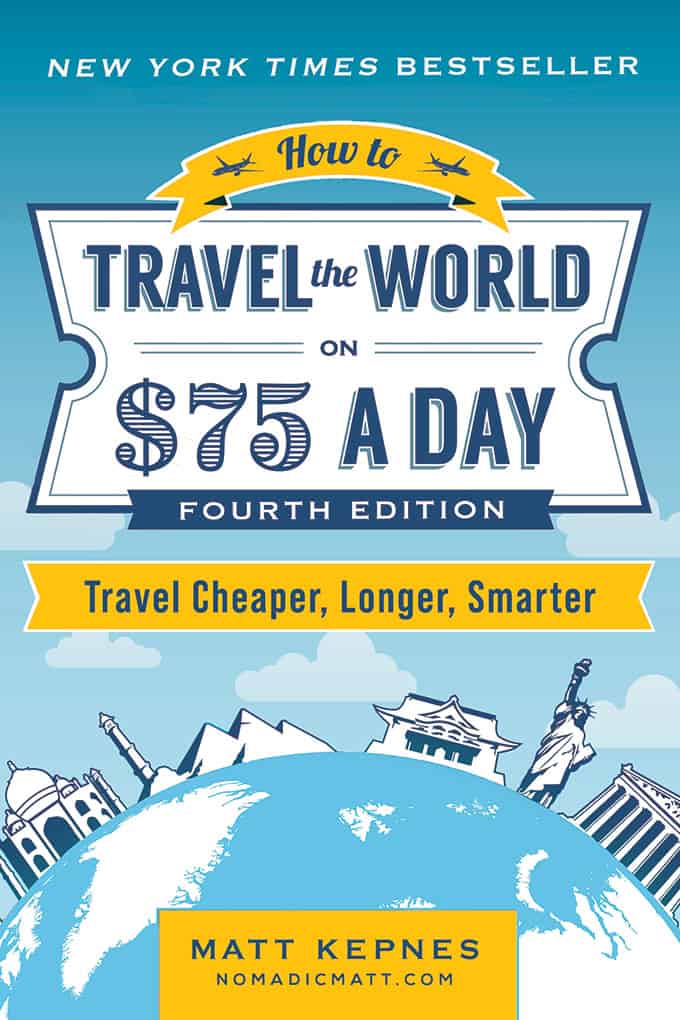

How to Travel the World on $75 a Day

My New York Times best-selling book to travel will teach you how to master the art of travel so that you’ll get off save money, always find deals, and have a deeper travel experience. It’s your A to Z planning guide that the BBC called the “bible for budget travelers.”

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for budget travelers)

- World Nomads (best for mid-range travelers)

- InsureMyTrip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need a Rental Car?

Discover Cars is a budget-friendly international car rental website. No matter where you’re headed, they’ll be able to find the best — and cheapest — rental for your trip!

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.

The post 17 Ways to Cut Your Expenses and Have More Money for Travel appeared first on Nomadic Matt's Travel Site.

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg)

.2%20(1).jpg)