A guide to credit card security codes: What they are and why they matter

Whether shopping online or over the phone, you must provide your credit card information to process the transaction. Apart from entering a card number and an expiration date, you probably will have to enter a security code — a feature on every credit card meant to help verify the card is in your possession. These …

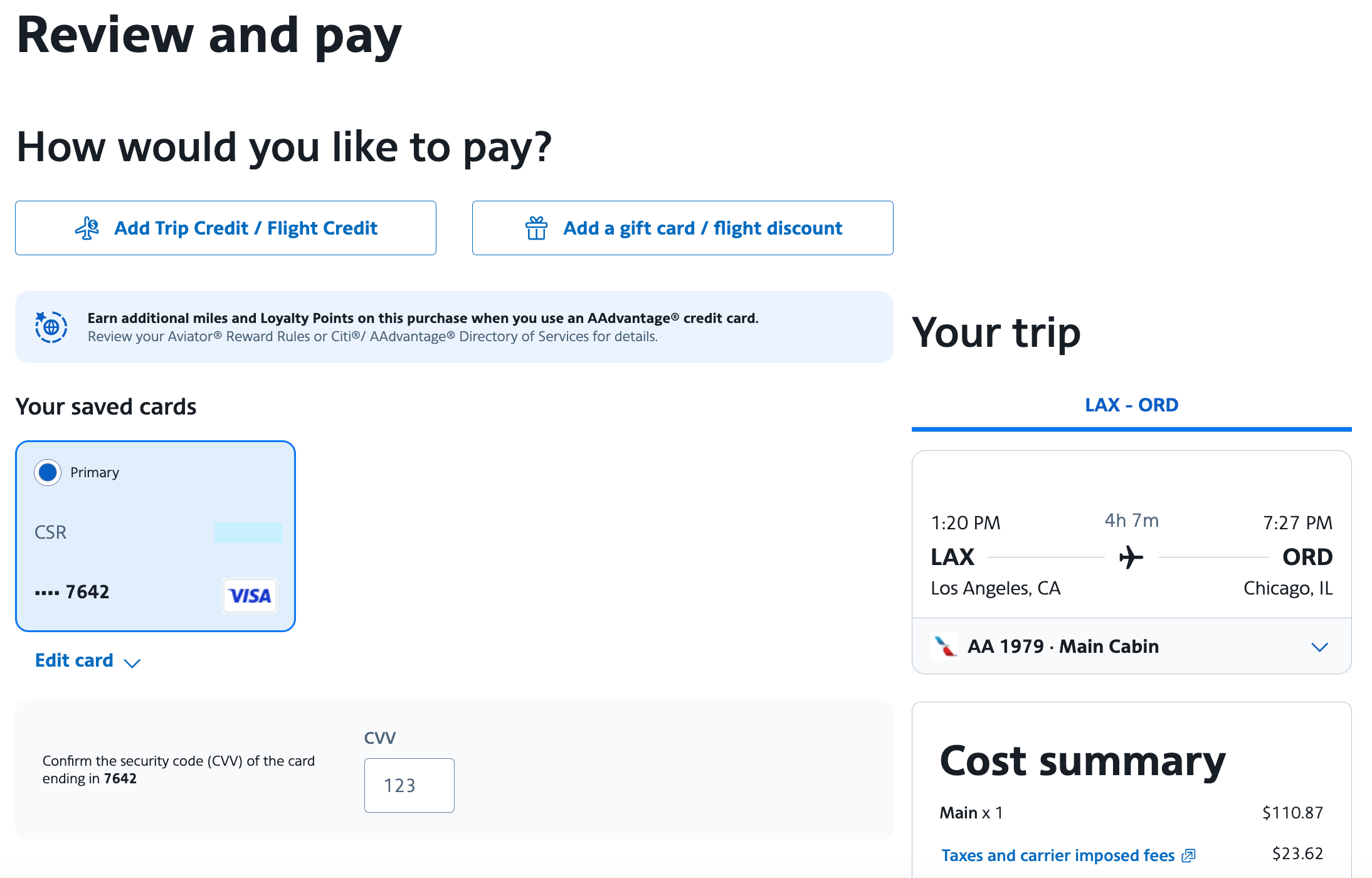

Whether shopping online or over the phone, you must provide your credit card information to process the transaction. Apart from entering a card number and an expiration date, you probably will have to enter a security code — a feature on every credit card meant to help verify the card is in your possession.

These three- or four-digit numbers provide an additional layer of security. Here is what you need to know about credit card security codes and how to find them by issuer.

What is a credit card security code?

A credit card security code is a group of digits that’s unique to your card. When you provide your security code to a retailer, along with your credit card number and expiration date, the information is instantly sent to the card issuer for authentication. Once that is accepted, your transaction will go through. This entire process takes only a few seconds.

Credit card security codes also go by a few other names:

- CVV: card verification value

- CVV2: card verification value 2 (Visa)

- CVC: card verification code (Mastercard)

- CVC2: card verification code 2 (Mastercard)

- CVD: card verification data (Discover)

- CID: card identification (Discover and American Express)

- CSC: card security code (American Express)

The credit card security code is a safeguard against potential fraud and theft. If someone were able to get a hold of your credit card number via skimming or other means, they’d be out of luck, as most websites require a security code to make a purchase. Essentially, the code is designed to indicate the card is in your possession at the time of purchase.

Related: 5 ways to protect yourself from credit card skimmers

Where to find the security code by issuer

The length and location of each credit card security code depend on your issuer. Here is a snapshot:

| Issuer | Security Code Length | Where to Find the Code | Common Names for Security Codes |

| Visa | Three numbers | Back of the card | CVV2 |

| Mastercard | Three numbers | Back of the card | CVC and CVC2 |

| American Express | Four numbers | Front of the card | CID number and CSC |

| Discover | Three numbers | Back of the card | CVD and CID number |

The security code is three digits long for Visa, Mastercard and Discover cards. These issuers have the security code on the back of your card, to the right of the signature panel. Before the code, you might see part or all of your credit card account number.

For American Express cards, the security code is four digits in length. It appears on the front of your card, usually to the upper right of your card account number.

Related: How to identify and prevent credit card fraud

Why security codes are important

Beyond protection against theft, card security codes provide another function: data breach security. With so many breaches and hacks occurring in recent years, this is a particularly sensitive matter.

While companies may save your credit card number, industry regulations prevent them from storing your CVV code, which means would-be hackers cannot seize that data. That is also why even if you request that a company save your payment information for future purchases, you’ll need to enter your security code at checkout each time.

Nowadays, internet browsers on our computers and phones can also store credit card information, but when you do go to autofill your information for a purchase, they, too, will ask for the CVV code for verification.

How to protect your security code

Protecting your credit card security code is similar to protecting any other financial or personal information. A bank or other financial institution will almost never ask you for your CVV code by email or over the phone. Sensitive financial information should be ideally sent through secure channels only. That means you shouldn’t click on links or reply to emails that directly ask you to verify your account number and CVV code, as these are likely phishing scams.

Similarly, a retailer may require you to provide a credit card security code when making a purchase. When shopping online, enter your security code on websites you trust by looking out for “https” in the address bar or the security lock symbol.

The best way to spot credit card fraud is to monitor your card account frequently for unfamiliar charges. It’s best to check throughout the month so you can catch any unfamiliar charges quickly. At a bare minimum, you should review the charges on your billing statement every month before paying your balance.

Bottom line

Even though credit cards have plenty of security protection, including security codes, it’s important to be mindful of where you’re purchasing items and to check your statements periodically. Security codes are a safeguard for consumers, and it’s helpful to know what and where they are if you need to share them.

![How to find and catch the Sea Leviathan in Fisch [2ND SEA] – Tips & Tricks](https://www.destructoid.com/wp-content/uploads/2025/03/how-to-find-and-catch-the-sea-leviathan-in-fisch.png)