Franchise fatigue: Is esports’ big league model hitting a wall?

TL;DR Franchising has created stagnation, with no promotion or relegation and few chances for new teams to rise. Prize pools have dropped or stayed flat in most franchised leagues, while open or state-funded events like Riyadh Masters offered significantly more. Open circuits are gaining traction, offering more excitement and flexibility for fans and new teams. … Continued The post Franchise fatigue: Is esports’ big league model hitting a wall? appeared first on Esports Insider.

TL;DR

- Franchising has created stagnation, with no promotion or relegation and few chances for new teams to rise.

- Prize pools have dropped or stayed flat in most franchised leagues, while open or state-funded events like Riyadh Masters offered significantly more.

- Open circuits are gaining traction, offering more excitement and flexibility for fans and new teams.

- Some regions are adapting better than others: North America has seen the steepest decline, while Asia’s mobile-focused leagues remain strong.

- Teams are cutting costs and diversifying, focusing on fewer games, content creation, and community engagement.

- The franchising model isn’t dead, but it is being reshaped into something leaner, more flexible, and closer to the spirit of esports.

What happens when a structure designed to bring consistency and professionalism to esports starts to show its limits? That’s the conversation taking place across competitive gaming.

The franchised league model was supposed to bridge grassroots chaos and organized growth. It brought formal team slots, long-term partnerships, and a more corporate approach to monetization. But today, its limitations are becoming harder to ignore.

Esports Insider examines what many now call “franchise fatigue” in esports. We explore whether this model is still viable or contributes to declining viewership, tightening budgets, and rising frustration among teams and fans.

The current state of things

LCS’s viewership slump

The League of Legends Championship Series (LCS) used to be the pride of Western esports, but all that changed in 2023. The summer split finals attracted just over 223,000 peak viewers, marking the league’s lowest point.

Average viewership across the split struggled to hold attention. Riot Games responded by downsizing the league from 10 to eight teams for the following season.

Two well-known organizations, Evil Geniuses and Golden Guardians, left the league. Riot explained the move as a necessary correction to match current economics. Behind that decision was the stark reality that fan interest had eroded, and some teams could no longer justify the cost of staying in. The league may still function, but the excitement that once defined it feels increasingly distant.

Overwatch League’s financial woes

When the Overwatch League kicked off in 2018, it followed a traditional sports model, with city-based teams, major sponsors, and buy-in costs that ran well into the millions. For a while, it looked like the future of esports. By 2023, things had changed. Fewer people were tuning in each year, and the season’s playoffs pulled in less than 160,000 viewers.

Behind the scenes, Activision Blizzard gave team owners a choice of taking a large payout and leaving the league. Most took the cash and left. By the end of 2023, the Overwatch League was pulling in nearly half the audience it had just a year earlier. Many blamed Blizzard’s handling of the competitive scene by moving streams to YouTube, which hurt visibility, and there were growing frustrations around teams not seeing the returns they were promised.

Many referred to the fatigue as “Esports Winter.” Unfortunately, two years later, debates have suggested that Overwatch esports is dead.

Why is the franchise league model faltering?

The warning signs of franchise fatigue have become impossible to ignore. Teams are downsizing, exiting, or consolidating. Sponsorship income is shrinking. Tournament organizers and publishers are revisiting league structures. For many, the model has become too expensive and too inflexible.

One core issue is the buy-in cost. Teams paid enormous sums to secure permanent slots in leagues like the Call of Duty League, the LCS, and the Overwatch League. Those costs made sense during rapid growth and venture capital investment. But the expected returns never materialized. Most teams are operating at a loss without media rights deals or consistent fan monetization.

“Franchising improves the floor of the game but severely limits the ceiling,” as one Reddit user summarized. Over the long term, limiting the ceiling can translate to slower growth or decline, as we now see.

At the same time, the structure of franchised leagues has created competitive stagnation. There is no promotion or relegation. The same organizations compete season after season. Underperforming teams cannot be replaced. Aspiring teams have no path to the top unless they acquire a vacant spot, usually at a steep price. For viewers, the format has become stale.

The good news is that fixes are starting to take shape. Riot Games is testing new financial models in its leagues, including in-game content revenue sharing. Some are experimenting with salary caps, and third-party tournament organizers are being brought back.

The one thing everyone can agree on is the need to find a more sustainable way forward that allows for stability without shutting out competition or innovation.

How is this playing out in terms of viewership and prize pools?

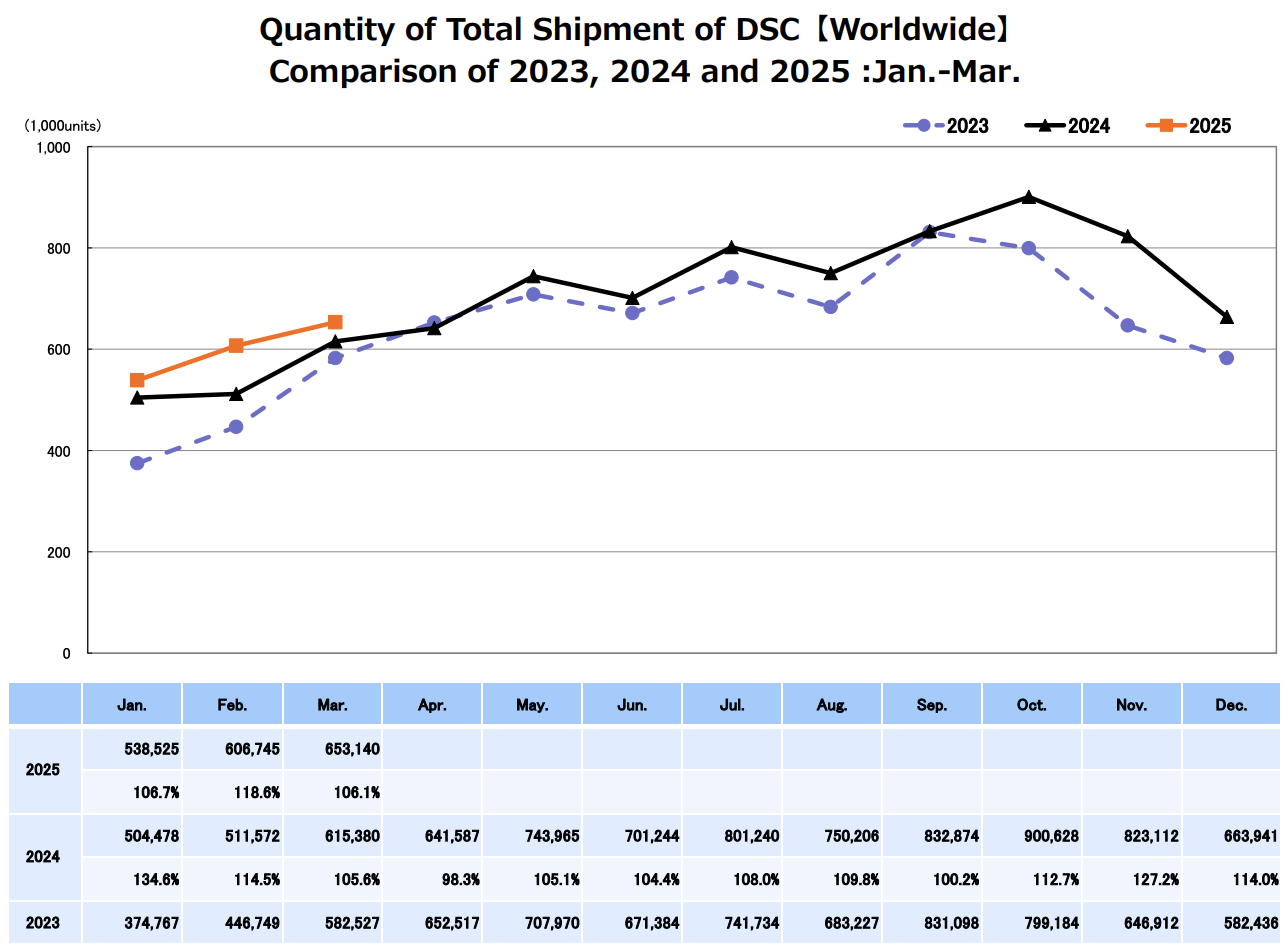

Prize pools are often used as a shorthand for a scene’s health. In franchised leagues, these numbers have either stayed flat or declined. In 2023, the Call of Duty League Championship had a prize pool of 2.38 million dollars, significantly down from the previous year. The Overwatch League reduced its prize money significantly in its final season. While popular, even the League of Legends World Championship has kept its prize pool relatively steady.

Dota 2’s traditional championship, The International, dropped in prize money. However, events like Riyadh Masters, funded by new sources such as state-backed initiatives, offered a prize pool of $15 million. That tournament alone nearly doubled the payout of most franchised events.

VALORANT, although partially structured around team partnerships, has taken a different approach. Riot introduced a system where teams could earn revenue from special cosmetic bundles. This allowed the publisher to offer a higher prize pool at VALORANT Champions and reward teams more directly through community spending.

The trend is clear. Where publishers and organizers have found creative ways to involve the community or diversify funding, engagement, and financial results have followed. In contrast, the outlook has dimmed where franchised leagues remain dependent on central funding and sponsor dollars.

What would the scene look like if things continued on this trajectory?

If current patterns hold, we can expect more teams to exit expensive franchised systems. Leagues will likely shrink, restructure, or dissolve entirely. The remaining participants may see reduced costs but also reduced exposure. More leagues will move toward digital revenue models, and some will return to hybrid formats that blend franchise-style stability with open circuit access.

The more agile organizations will survive by diversifying. Content creation, merchandise, and direct-to-fan engagement will become central to team operations. Competitive success alone will not be enough to stay afloat.

Publishers may also become more selective about which games receive formal league structures. The era of franchising every new title may be behind us. Instead, open tournament ecosystems or limited partnership models may become more common.

Could this be a positive?

The shakeup could push the industry toward structures that better reflect the esports culture. That means more open formats, community-led events, and more freedom for teams to build their brands outside restrictive league systems.

If revenue-sharing models tied to in-game content prove successful, they could create a fairer, more predictable path for teams. Instead of relying on sponsorships that come and go, teams could earn a share of the attention they help generate.

The end of the old franchising model does not mean the end of professional leagues. It may be a shift toward formats that feel more natural and sustainable within the esports world.

How will teams and the esports scene adapt, and how will it look different?

Many already are. Several organizations have reduced player salaries and staff counts. Some have merged or partnered with others. Teams that once tried to compete in every major title are now focused on fewer games with more substantial community alignment.

Franchised leagues that remain active are making changes, too. Riot has introduced financial guardrails and is planning more international play to re-energize interest. The Call of Duty League has shown signs of loosening its structure. Even formerly rigid leagues are beginning to look at third-party partnerships and community tournaments to fill in the gaps.

One common theme is a shift away from expensive, top-down planning and toward flexible, revenue-linked systems that reward performance, fan support, and creativity.

What works in Manila doesn’t always work in Miami

Regional differences remain. In North America, franchised leagues have been hit hardest. The player base is smaller, the sponsorship market has cooled, and many teams are now backed by investors with shorter time horizons.

Europe has fared better. The LEC remains stable, and organizations like Karmine Corp have added fresh energy. Still, even there, leagues are introducing financial controls to prevent overspending and maintain balance.

In Asia, franchised systems are holding up in some cases. Mobile Legends: Bang Bang and Honor of Kings continue to draw massive numbers in Southeast Asia and China. These regions benefit from large local audiences and closer cultural alignment with the games being played.

Conclusion

The warning signs of franchise fatigue are the shrinking esports leagues, quiet exits, financial pressure, and changing audience behavior. However, rather than seeing this as a failure, the industry could view it as a necessary reset.

Publishers, teams, and fans are learning that what works in traditional sports does not always translate directly to esports. The next chapter will likely include leaner, more adaptable leagues that blend structure with openness. In-game monetization, hybrid models, and eliminating franchise entry fees are steps in the right direction.

So, is franchising in esports over? Not entirely. But the version we knew is being replaced by something more measured. The long-term success of competitive gaming may depend on learning from this period and building systems that match the spirit and speed of the games we all care about.

FAQs

They are similar to US sports leagues with teams occupying permanent places in a league without promotion or relegation.

Many major games have franchised leagues, including League of Legends, VALORANT, Overwatch, Call of Duty, and Apex Legends. In almost all cases, the game developers/publishers control and operate the league.

References

- https://digiday.com/marketing/the-digiday-guide-to-esports-winter/ (Digiday)

- https://www.reddit.com/r/esports/comments/1avch4e/did_franchising_ruin_esports/ (Reddit)

- https://www.riotgames.com/en/news/building-the-future-of-sport-at-riot-games (Riot Games)

The post Franchise fatigue: Is esports’ big league model hitting a wall? appeared first on Esports Insider.

/f871ef26-7798-46a2-9db3-fe949a2f050b--2016-0719_okra-couscous-salad_james-ransom-417.jpg?#)

.jpg)

.jpg)