How to maximize Amex Gold credits when traveling abroad

The American Express® Gold Card is one of our top picks when it comes to earning bonus points on dining and groceries. However, offsetting its high $325 annual fee (see rates and fees) by maximizing up to $424 in annual statement credits takes a fair bit of effort — especially when you’re abroad. I’ve spent …

The American Express® Gold Card is one of our top picks when it comes to earning bonus points on dining and groceries. However, offsetting its high $325 annual fee (see rates and fees) by maximizing up to $424 in annual statement credits takes a fair bit of effort — especially when you’re abroad.

I’ve spent the past three months traveling through South America and have figured out some ways to get value from the card’s credits. So, whether you’re abroad temporarily or long term, here are my tips on how to get the most out of the Amex Gold’s four statement credits.

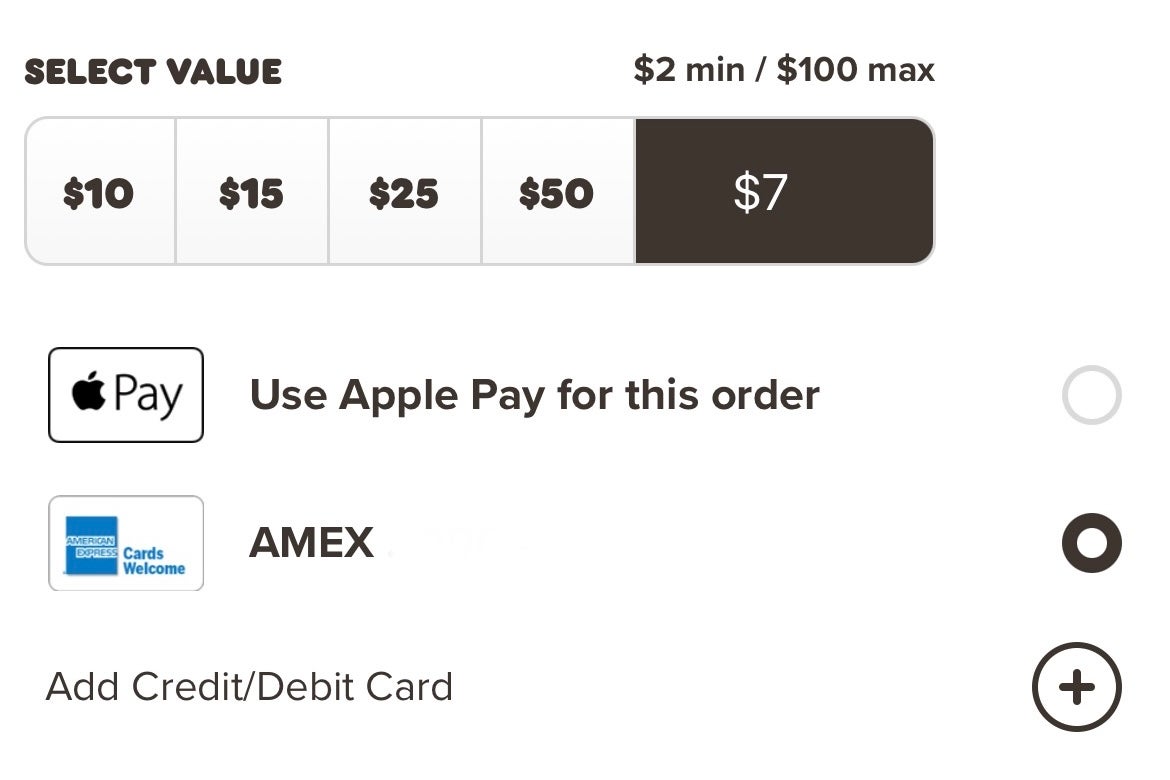

Reload your Dunkin’ balance

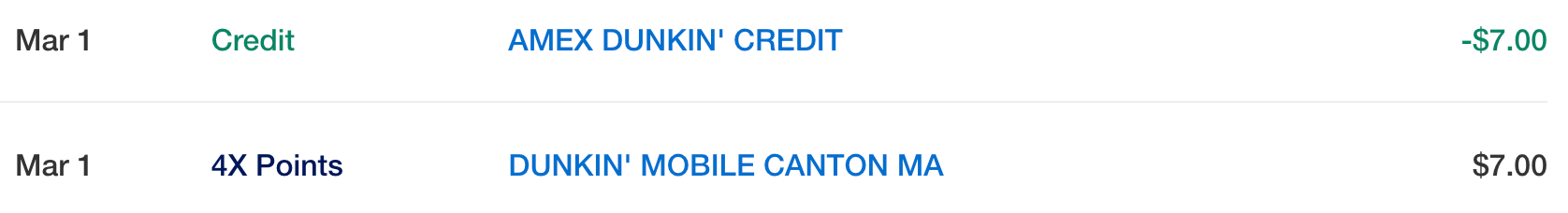

This is an easy one. While I’m abroad, I can’t use the credit since it’s only valid in the U.S., but I can still reload my balance for future use. Download the Dunkin’ mobile app, go to the “Scan / Pay” tab and use your Amex Gold to reload your balance with $7 every month (enrollment required).

Because the purchase codes as “Dunkin’ Mobile,” it earns the 4 points per dollar Amex Gold awards at restaurants worldwide on the first $50,000 spent each calendar year (1 point per dollar thereafter).

I have done this each month since the statement credit was added in July 2024 and the credit has been backdated to the same day every time.

Buy a Goldbelly (or Wine.com) gift card

The Amex Gold gives cardmembers up to $120 per calendar year in statement credits — up to $10 per month — for dining purchases from select merchants (enrollment required).

Out of the five eligible dining statement credit merchants, my top recommendation is to buy a Goldbelly e-gift card. Goldbelly “delivers food and food gifts from iconic restaurants and food makers across the United States” — albeit at a premium price.

I have purchased a $10 e-gift card from Goldbelly twice and the credit has posted within three and nine days, respectively. You can then combine multiple gift cards when placing an order, either for yourself when you’re back in the U.S. or as a gift for a loved one. These items offer free shipping.

Buying an e-gift card from Wine.com also triggers the credit, which TPG credit cards writer Chris Nelson received within three days. However, there are two drawbacks:

- The minimum gift card purchase is $25

- You can only use up to two gift cards per purchase

So, this is a good method if you want to buy a $30 bottle of wine every two months. You’d pay $50 total for two gift cards and Amex would give you $20 in statement credits. Effectively, the Amex credits cover the $19.99 shipping fee, meaning you’re buying a $30 bottle of wine for $30 — with “free” shipping, courtesy of Amex.

As for the other three listed merchants, we tested buying e-gift cards from Grubhub and The Cheesecake Factory — and neither triggered the credit. And Five Guys only offers gift cards in person at one of their locations.

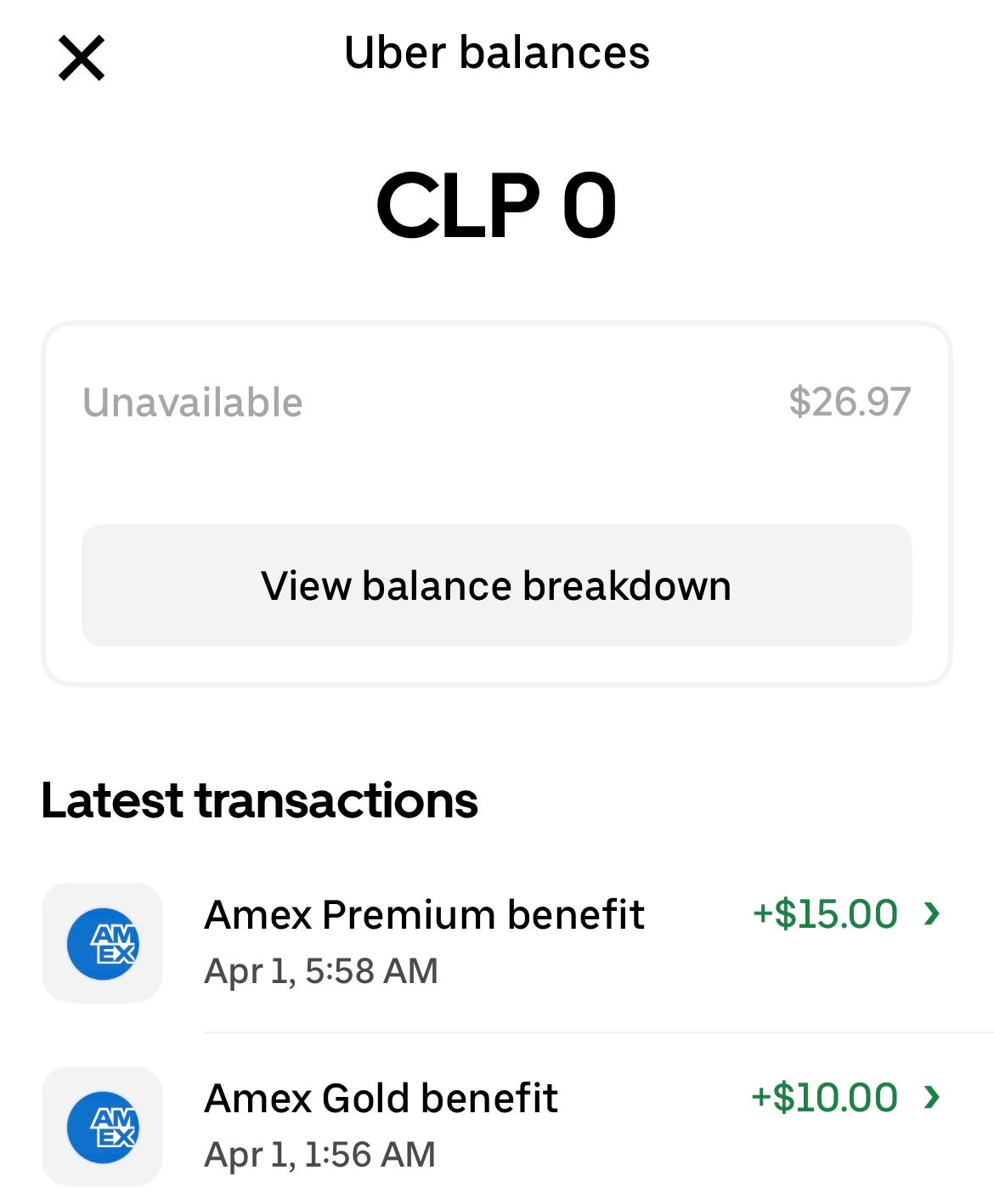

Order Uber Eats for a loved one

This has been the trickiest credit to maximize.

The best workaround I’ve found has been to pay for a loved one’s Uber ride or Uber Eats order back in the U.S. It does require a good amount of real-time coordination with that person to organize the logistics of the ride or order, though.

You’ll receive up to $120 in Uber Cash annually, which comes in the form of a $10 monthly credit.

Note that you can use any Amex card as your payment method in order to use your Uber Cash — just make sure your Amex Gold is added to your Uber account first.

Purchase a restaurant gift card

If you’re in the U.S. at least once every six months, this statement credit is fairly easy to use in person (enrollment required). It’s split into two parts: an up to $50 credit from January to June and another up to $50 credit from July to December.

I make it a point to visit a Resy-affiliated restaurant — one that accepts reservations through Resy — twice a year and pay with my Amex Gold. You don’t need to make a reservation for the credit to trigger — you just need to pay with your Gold card.

Also, keep an eye on your account to make sure the credit posts. In my experience, the first time I used this credit — I waited the full eight weeks and had to chat with an Amex agent online to get the credit applied manually. However, the second time I used this benefit, the credit posted the same day.

If you can’t be in the U.S. every six months, try purchasing a gift card from a Resy-affiliated restaurant online or calling the restaurant directly. You’ll likely earn 4 points per dollar spent on this purchase since it should be considered a restaurant purchase.

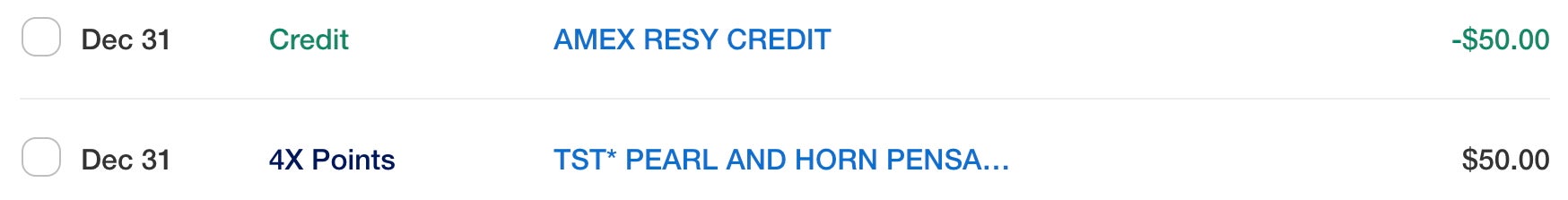

TPG newsletter and partnerships editor Emily Thompson got in at the nick of time on Dec. 31 by buying a gift card at a Pensacola, Florida restaurant to receive her credit for the second half of the year.

Note that each restaurant codes purchases differently, so your gift card purchase isn’t guaranteed to trigger the credit. Make sure you choose a restaurant where you’d be happy to spend up to $50 either way.

Bottom line

It’s important to squeeze as much value as possible out of your cards — especially ones with a hefty annual fee like the Amex Gold. That’s true whether you’re based in the U.S. or traveling internationally.

If you are an Amex Gold cardmember, my recommendation is to:

- Buy a $10 Goldbelly gift card every month

- Reload your Dunkin’ app balance with $7 every month

- Cover a $10-plus Uber ride or Uber Eats order for a loved one (in the U.S.) each month

- Purchase a $50 gift card to your favorite Resy-affiliated restaurant every six months

Also, be sure to check out our monthly and quarterly, biannual and annual credit checklists to make sure you’re maximizing all your card benefits.

Related: Is the Amex Gold worth the annual fee?

For rates and fees of the Amex Gold Card, click here.