Why I don’t have a need for a cobranded hotel card

I’ve been involved in the world of points and miles for over a decade, and not once have I applied for a cobranded hotel credit card. Although this might come as a surprise to most people, my travel habits just haven’t required me to need one. Although I travel around 100,000 aeronautical miles a year, …

I’ve been involved in the world of points and miles for over a decade, and not once have I applied for a cobranded hotel credit card. Although this might come as a surprise to most people, my travel habits just haven’t required me to need one.

Although I travel around 100,000 aeronautical miles a year, I don’t stick to a single hotel brand and have been very open with the brands I choose to stay at. When I book a hotel, I focus on price, location and the uniqueness of the property. This makes me open to all brands, but I tend to end up at ones without a loyalty program.

Here are my top reasons why I haven’t needed a cobranded hotel credit card, and how I’ve managed to make it work with the current credit cards in my wallet.

I’m not loyal to 1 brand

When most people think of hotel brands, they tend to focus on the three major ones: Marriott, Hilton and Hyatt. These brands have several types of hotels in their portfolios, from budget to extended-stay to high-end properties.

When booking properties for domestic or international trips, I consider various factors, including price, ratings, location and amenities.

Occasionally, I’ll end up at a Marriott property since it has the largest hotel portfolio. But 75% of the time, Marriott hotels are not in my location of choice (or at the right price point).

A big reason why I don’t see a need for a cobranded hotel credit card is that the majority of the properties I stay at have no loyalty ecosystem. These properties include Four Seasons, Mandarin Oriental, Rosewood, Aman and One&Only.

Quite frankly, I travel specifically to certain destinations because the brands mentioned above tend to have unique and luxurious properties. These properties provide a level of service, amenities, personalization and quality that is hard to beat, even when staying at top-tier properties with brands that offer cobranded credit cards.

For example, Four Seasons has some of the comfiest mattresses in the industry, so much so that it even sells them. I travel with my family often, and whenever these brands see a small child on the reservation, they almost always provide amenities and special gifts.

Because the hotel brand I stay at varies, it’s more beneficial for me to use my Chase Sapphire Reserve® (see rates and fees) to earn 3 points per dollar spent on purchases coded as travel, including hotels. I’ll later redeem those points for airfare by transferring to one of Chase’s 11 airline partners.

Best of all, the Sapphire Reserve offers a flexible $300 annual travel credit to apply to anything that codes as travel, according to Chase, so this credit can automatically be applied to any hotel purchase. In the past, I’ve called hotels after my $300 credit has reset and asked the property to charge my Sapphire Reserve $300, instantly using my credit.

Related: Chase Sapphire Reserve credit card review: Luxury perks and valuable rewards

I worry about program devaluations

This may come as a surprise, but I currently hold Platinum Elite status in the Marriott Bonvoy program. I earn it organically through paid stays and maximizing Marriott promotions for double elite night credits or bonus nights after eligible stays.

Marriott consistently runs a double-night promotion from February to April every year, where each paid night earns you a bonus elite night credit. In order to earn Marriott Bonvoy® Platinum Elite status, you need to stay 50 nights within a calendar year. During the double-night promotion, I stay about 15 to 20 nights, which earns me between 30 to 40 nights right off the bat.

But like airline frequent flyer programs, hotel loyalty programs are subject to devaluations. Earlier this year, TPG calculated a drop in value for Marriott Bonvoy points toward stays across various properties worldwide.

By opening a cobranded hotel credit card, I am investing in the program for the long run. I am tying myself to the hotel program by staying almost exclusively with that brand and using the brand’s card for purchases that will give me bonus points.

The points earned on a cobranded hotel credit card are also valued quite low. For example, based on TPG’s May 2025 valuations, Marriott Bonvoy points are worth 0.7 cents each. On the flip side, transferable points from programs like Chase Ultimate Rewards and American Express Membership Rewards are worth 2.05 and 2 cents apiece, respectively.

When I first started collecting points and miles a decade ago, Marriott had a fixed award chart that made it easy to maximize redemptions. The Ritz-Carlton, Dubai International Financial Centre, for instance, cost me just 200,000 Bonvoy points for four nights over New Year’s in 2019, thanks, in part, to the fifth night being free. The same property this year during New Year’s Eve will run more than 400,000 points, a staggering 200% increase in cost.

In my experience, hotel program devaluations are far worse than airline program devaluations.

Related: Marriott Bonvoy has significantly increased some award costs

Dynamic pricing

Currently, Marriott and Hilton offer dynamic pricing for redemptions, while Hyatt has a set award chart with off-peak, standard and peak rates.

Although Hyatt recently shifted hotels within categories for many properties, it is still a top favorite among TPG staffers and points enthusiasts because of the published award chart. You can redeem a night for as little as 3,500 points (off-peak) or splurge on a Category 8 property for anywhere between 35,000 and 45,000 points a night. The only downside is that its global footprint is not as large as other hotel brands.

Hilton and Marriott are an entirely different story. Due to the sheer number of points required for stays with those brands, saving up points for aspirational stays can take quite some time.

I have almost 800,000 Bonvoy points from several years of hotel stays across Marriott brands. Every time I’ve thought of redeeming them, there was either a change in hotel categories or better-priced cash rates that were hard to pass up.

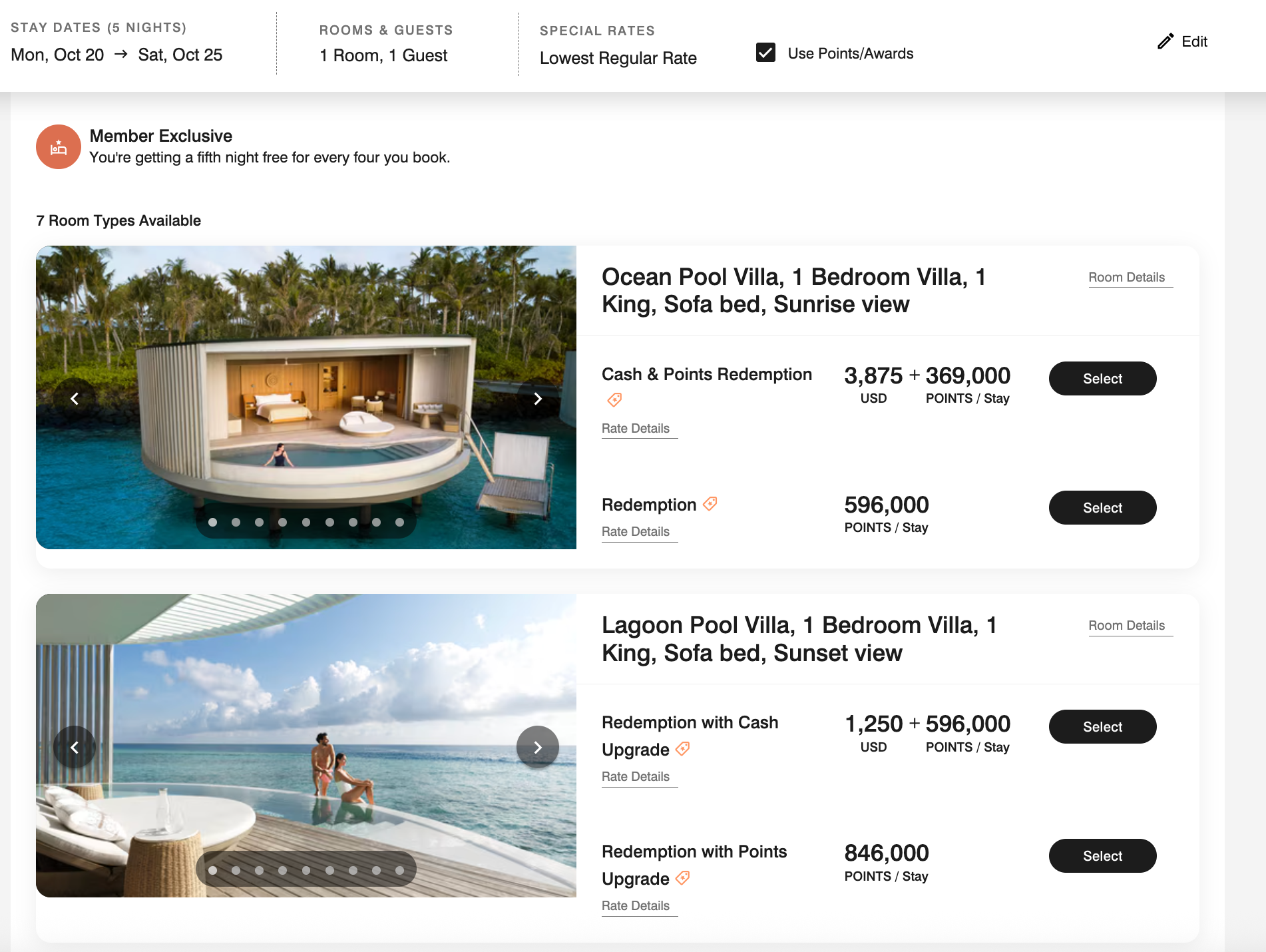

For example, I’ve been eyeing The Ritz-Carlton Maldives, Fari Islands for some time now. A five-night stay in an ocean pool villa would cost 596,000 points, while a similar stay in a lagoon pool villa would set you back 846,000 points. Both options still require a cash copay of over $2,000 for seaplane transfers and some taxes.

The cash rate for the same stay in an ocean pool villa would be $11,675, giving us about 1.95 cents a point in value, almost three times what Marriott points are worth based on TPG’s May 2025 valuations. A lagoon pool villa will set you back $13,206, giving you about 1.56 cents per point in value, according to TPG’s May 2025 valuations. Although these are good deals, it could take a while for Marriott cardholders to amass that many points.

If I had a Marriott Bonvoy Brilliant® American Express® Card and was trying to collect points solely through hotel spending, I’d have to accrue $28,380 worth of expenses at Marriott properties to make the redemption in the Maldives come to life. I came to that cost based on earning 6 points per dollar spent on Marriott purchases and earning an additional 15 points per dollar spent at most properties thanks to having Platinum Elite status.

This would give me enough points for the redemption I’m looking for, but that’s quite a bit of spending (well above what the room would cost cash-wise). Not to mention, you could be hit with another devaluation.

Related: Stay at these amazing Ritz-Carltons across the world

I prefer earning transferable rewards

Given how common hotel program devaluations are, I prefer earning transferable rewards versus points with a specific brand through a cobranded hotel card.

My go-to travel credit card is my Sapphire Reserve because it earns 3 points per dollar spent on purchases that code as travel, including hotels. According to TPG’s May 2025 valuations, Chase Ultimate Rewards points are worth 2.05 cents apiece.

Chase Ultimate Rewards points transfer to 11 airline and three hotel programs, giving me flexibility when using my points. I don’t have to worry about Chase points being devalued, and rarely does an issuer sever ties with a transfer partner.

By earning transferable points, I can easily transfer my points to airlines to experience products like Qatar Airways Qsuite, Etihad first-class Apartments (via Air Canada Aeroplan) or All Nippon Airways’ The Suite.

Recently, Chris Nelson, a credit cards writer at TPG, presented a compelling case as to why he never pays for his hotel stays using a cobranded credit card, and I agree with him.

Thanks to my Platinum Elite status, I earn 15 points per dollar spent at most Marriott properties, giving me a 10.5% return on purchases. While that may seem like a lot, keep in mind that according to TPG’s May 2025 valuations, Marriott Bonvoy points are worth 0.7 cents apiece, which is about a third of the value of Chase Ultimate Rewards points.

I have other ways to enjoy elitelike perks

The biggest benefit of a cobranded hotel credit card is the ability to have instant elite status or a pathway to earning it.

For example, the Hilton Honors American Express Aspire Card gives cardmembers Hilton Diamond status, providing room upgrades, on-site food-and-beverage credits and access to hotel executive lounges.

The information for the Hilton Honors American Express Aspire card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Some would argue that instant top-tier elite status makes a card worth it, but I would argue that the number of elite members with hotel programs makes the most desirable perks like room upgrades tough to come by.

I can use elitelike perks without having a cobranded hotel credit card, thanks to programs such as American Express Fine Hotels + Resorts and The Edit by Chase Travel℠. When booking eligible properties, these programs provide breakfast for up to two guests, room upgrades, property credit, early check-in, late checkout and welcome amenities.

Another way I earn elitelike perks is by using specialty travel agencies. These travel agencies are part of unique programs with top brands that offer similar or better perks than Amex Fine Hotels + Resorts and The Edit and predate those programs.

If a travel agency is a Four Seasons Preferred Partner, a Rosewood Elite partner, an Aman partner or affiliated with another similar partner program, then you can expect unique rates, offers and elitelike perks when booking through it.

On a recent trip to Tokyo, I was upgraded to a suite at the Four Seasons Hotel Tokyo at Otemachi, given a property credit of $200 and provided with both early check-in and late checkout. In my experience, these programs are a lot more consistent at providing perks than hotel elite status.

Related: Four Seasons Hotel Tokyo at Otemachi: An ultramodern hotel in a historic neighborhood

Bottom line

It has been nearly a decade since I began using points and miles, and I am still without a cobranded hotel credit card. My desire to earn transferable points and to have flexibility with the brands I choose to stay at, plus the high points costs for free nights, have kept me from needing one.

Overall, my travel style and increasing interest in seeking out brands without loyalty programs (think: Four Seasons, Mandarin Oriental and Rosewood, among others) are the main drivers for me not getting a hotel credit card. Points-wise, I benefit more from earning transferable points, as I tend to use them to book premium cabin airfare.

Despite not having a hotel credit card, I still earn status with Marriott through paid stays and achieve elitelike benefits through status or booking through special programs with travel agents. Unless there are major negative changes that come to my transferable rewards credit card, I will continue to be without a hotel credit card.

Related: Best travel rewards credit cards