How to maximize the Amex Business Platinum’s $200 Hilton statement credit

Editor’s note: This is a recurring post, regularly updated with new information and offers. The Business Platinum Card® from American Express is a favorite at TPG, thanks to its impressive range of statement credits and perks, such as access to Centurion Lounges. In December 2024, the Amex Business Platinum introduced up to $200 in Hilton …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

The Business Platinum Card® from American Express is a favorite at TPG, thanks to its impressive range of statement credits and perks, such as access to Centurion Lounges.

In December 2024, the Amex Business Platinum introduced up to $200 in Hilton statement credits per calendar year.

Let’s dive into this benefit and how it compares to similar statement credits offered by some other American Express cards.

$200 Hilton credit

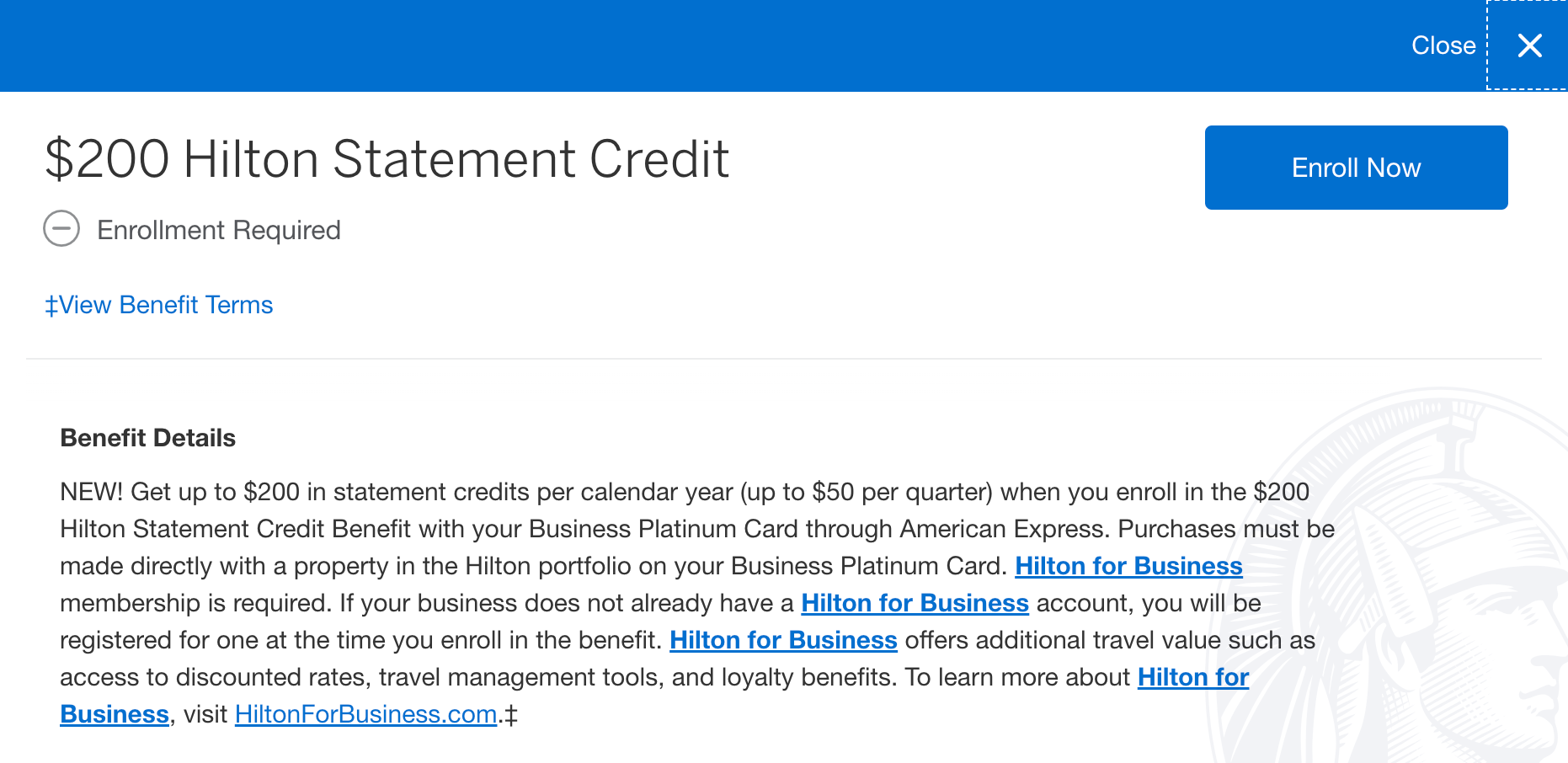

Amex Business Platinum Card members now receive up to $200 in statement credits for Hilton purchases every calendar year. Rather than receiving the credits all at once, they’re divided throughout the year so that members earn up to $50 per quarter (enrollment required; terms apply).

Purchases made directly with a Hilton portfolio property are eligible to receive the statement credit. These can include eligible room rates, as well as incidental purchases charged to the room, such as dining purchases, room service and spa treatments.

To receive the statement credit, you must also have a Hilton for Business membership. If you don’t currently participate in the program, you will be registered upon enrolling in this benefit.

The new statement credit has the Business Platinum joining the Hilton Honors American Express Surpass® Card and the Hilton Honors American Express Business Card in offering a quarterly Hilton credit.

The Hilton Surpass card offers up to $50 statement credits each quarter for purchases made directly with a property in the Hilton portfolio and charged to this card (up to $200 in statement credits annually). Terms apply.

Meanwhile, the Hilton Business card offers up to $60 statement credits per quarter (up to $240 back annually) on purchases made directly with a property in the Hilton portfolio charged to the Hilton Business card. Terms apply.

It’s important to note that the benefit on the Hilton Surpass and the Hilton Business only requires enrollment with American Express, whereas the new statement credit on the Amex Business Platinum Card requires enrollment with Hilton for Business in addition to enrollment with American Express.

If the new statement credit on the Amex Business Platinum works similarly to the Hilton Surpass and the Hilton Business, then data points suggest the following purchases also trigger the statement credit, even when not staying at a hotel:

- Gift store purchases at a Hilton property

- Dining purchases at a restaurant in a Hilton property

- Hilton online gift card purchases

Check out our guide to maximizing Hilton statement credits to learn the best ways to use the new benefit on the Amex Business Platinum.

Bottom line

The addition of the Hilton statement credit to the Amex Business Platinum‘s lineup of perks is a great value proposition, as it gives cardmembers more value above and beyond the card’s $695 annual fee (see rates and fees).

If you’re a current cardmember, log in to your account to enroll in the benefit and sign up for Hilton for Business. For those who’ve had this card on their radar, it’s now even more travel-friendly, so we say it’s a good time to apply.

To learn more about the card, read our full review of the Amex Business Platinum.

Apply here: The Business Platinum Card from American Express

For rates and fees of the Amex Business Platinum, click here.

.jpg)

.jpg)