Marriott Bonvoy Bountiful vs. Marriott Bonvoy Boundless: Which should you get?

Editor’s note: This is a recurring post, regularly updated with new information and offers. There are currently six Marriott credit cards available to new applicants and several cards that no longer accept new applications. Chase offers three of the Marriott credit cards you can currently apply for, while American Express offers the other three. These …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

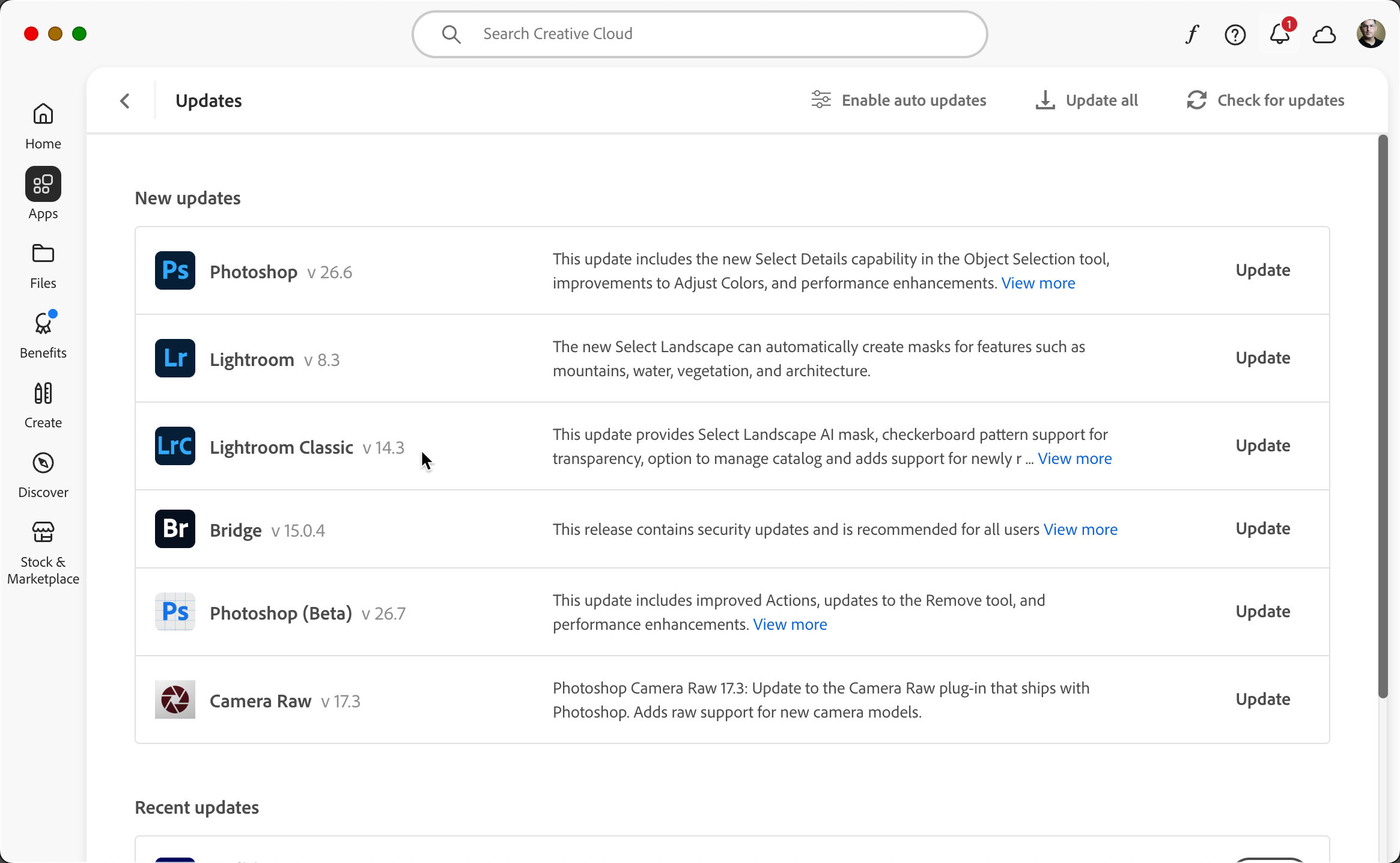

There are currently six Marriott credit cards available to new applicants and several cards that no longer accept new applications. Chase offers three of the Marriott credit cards you can currently apply for, while American Express offers the other three.

These cards share some similarities but differ in key areas. If you’re thinking about applying for a Marriott credit card, you may be considering the Marriott Bonvoy Bountiful® Credit Card or the [applyLink pid=”6389″ overridetext=”Marriott Bonvoy Boundless® Credit Card”] (see [termsConditions pid=”6388″ overridetext=”rates and fees”]). Both are offered by Chase and earn points and rewards with Marriott’s loyalty program, Marriott Bonvoy.

Which should you choose? Let’s look at the similarities and differences between the Bountiful and Boundless cards to help you decide which option is better.

The information for the Marriott Bonvoy Bountiful Credit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Marriott Bonvoy Bountiful vs. Marriott Bonvoy Boundless comparison

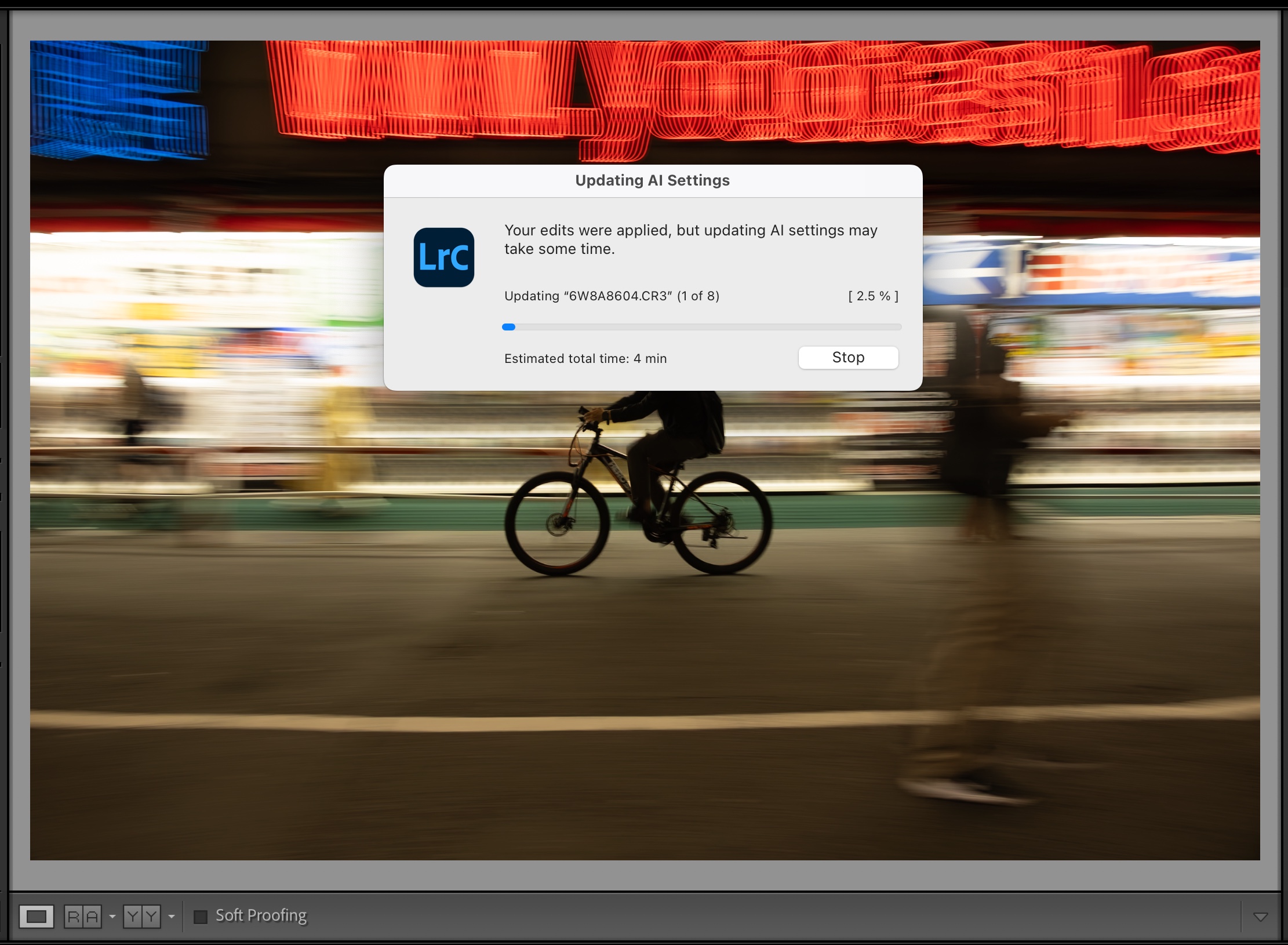

| Card | Bonvoy Bountiful | Bonvoy Boundless |

| Annual fee | $250 | $95 |

| Welcome bonus | Earn 85,000 bonus points after spending $4,000 on purchases in the first three months from account opening. | Earn five free nights (each night valued at up to 50,000 points) after spending $5,000 on purchases in the first three months from account opening. Certain hotels have resort fees. |

| Welcome bonus value* | $595 | Up to $1,750 |

| Rewards structure |

|

|

| Other benefits |

|

|

| Travel protections |

|

|

*Point value is an estimated value calculated by TPG’s June 2025 valuations and not the card issuer.

Bonvoy Bountiful vs. Bonvoy Boundless welcome offer

New Bonvoy Bountiful cardholders can earn 85,000 bonus points after spending $4,000 on purchases within the first three months. Based on TPG’s June 2025 valuations, this bonus is worth $595.

Meanwhile, new [applyLink pid=”6389″ overridetext=”Bonvoy Boundless”] cardholders can earn five free nights (each night valued at up to 50,000 points) after spending $5,000 on purchases in the first three months from account opening. Certain hotels have resort fees. Based on TPG’s June 2025 valuations, this bonus is worth up to $1,750.

Winner: Bonvoy Boundless. The current offer beats the Bountiful by a long shot.

Related: Are you eligible for a new Marriott Bonvoy card? This chart tells you yes or no

Bonvoy Bountiful vs. Bonvoy Boundless benefits

Both cards share many similar benefits.

- Elite night credits received each year: You’ll start each year with 15 elite night credits by holding either of these cards. Elite night credits are what you need to earn elite status with Marriott Bonvoy. For reference, you’ll need 50 elite nights per year to reach Platinum Elite status, where benefits like free breakfast and suite upgrades kick in.

- Fifth-night-free benefit: When redeeming points for hotel stays with Marriott Bonvoy, you’ll get a fifth night free. So, booking a four-night stay with points gets you a fifth night free. Note that this benefit only applies to points redemptions and does not apply when paying cash or using free night awards.

- Credit card issuer and application rules: As both cards are issued by Chase, both are subject to Chase’s credit card application rules and restrictions. The most famous of these is the 5/24 rule, meaning you’ll likely be denied if you have opened five or more cards in the last 24 months across all issuers. Another rule is that you likely won’t be approved for more than two credit cards from Chase within 30 days.

- Access to Chase Offers

- Travel protections: Both cards offer baggage delay insurance, lost luggage reimbursement and trip delay reimbursement.

- Purchase protection: Both cards offer purchase protection on items you paid for with your card, available up to 120 days from the purchase date but subject to limits on the number of claims and per-claim value limits.

Bonvoy Bountiful cardholders receive:

- Automatic Gold Elite status

- An annual free night award worth up to 50,000 points after spending at least $15,000 on purchases in a calendar year. (Certain hotels have resort fees.)

- 1,000 bonus points per stay at participating eligible Marriott Bonvoy properties

Meanwhile, [applyLink pid=”6389″ overridetext=”Bonvoy Boundless”] cardholders receive:

- Automatic Silver Elite status

- An annual free night award worth up to 35,000 points with no spending requirement. (Certain hotels have resort fees.)

Winner: Bonvoy Boundless. It offers an annual free night award every anniversary year that you don’t have to spend anything to receive and has a more affordable annual fee.

Related: Marriott elite status: What it is and how to earn it

Earning points on the Bonvoy Bountiful vs. Bonvoy Boundless

With the Bonvoy Bountiful, cardholders earn:

- 6 points per dollar spent on Marriott purchases

- 4 points per dollar spent on the first $15,000 per calendar year in combined purchases at grocery stores and on dining, including takeout and eligible delivery services (then 2 points per dollar)

- 2 points per dollar spent on all other eligible purchases

These earning rates represent a 4.2%, 2.8% and 1.4% return on spending, respectively, based on TPG’s June 2025 valuations.

With the [applyLink pid=”6389″ overridetext=”Bonvoy Boundless”], cardholders earn:

- 6 points per dollar spent on Marriott purchases

- 3 points per dollar spent on the first $6,000 spent in combined purchases per calendar year on gas stations, grocery stores and dining (then 2 points per dollar)

- 2 points per dollar spent on all other eligible purchases

These earning rates represent a 4.2%, 2.1% or 1.4% return on spending, respectively.

Winner: Bonvoy Bountiful, as it earns more in dining and grocery store spending and comes with a higher spending cap.

Related: The best rewards credit cards for each bonus category

Redeeming and transferring points on the Bonvoy Bountiful vs. Bonvoy Boundless

Both cards earn Marriott Bonvoy points that can be redeemed for Marriott stays. TPG’s June 2025 valuations place these points at 0.7 cents apiece. Unfortunately, the program has been devalued this year.

While the most obvious use of these points is for hotel stays with Marriott, there are other uses (though some are not very valuable), including transferring points to more than 35 airline partners to redeem them for flights.

In most cases, transferring Bonvoy points to airline partners does not offer good value, as the transfer ratio is not favorable.

TPG credit cards writer Chris Nelson likes to redeem his Marriott Bonvoy points on luxury properties in Eastern Europe. He routinely stays at The Ritz-Carlton Budapest for just 35,000 Bonvoy points per night.

Winner: Tie as both cards have the same redemption and transfer options.

Related: The award traveler’s guide to Marriott Bonvoy

Should I get the Bonvoy Bountiful or the Bonvoy Boundless?

Both cards earn the same on Marriott purchases, but the Bonvoy Boundless stands out with its annual free night — no spending required. Unless you need elevated elite status or higher earnings on groceries and dining, the Boundless offers better overall value.

Related: How to use a Marriott Bonvoy 35,000-point certificate

How to switch from the Bonvoy Bountiful to the Bonvoy Boundless

You can switch between the Bonvoy Boundless and Bonvoy Bountiful through a product change, which lets you keep your account open without a new credit check. Call the number on the back of your card and request the change. Note that product changes don’t qualify for new welcome bonuses.

Related: 4 considerations before making a product change

Bottom line

The Bonvoy Bountiful and Bonvoy Boundless both earn valuable Marriott points, but they cater to different priorities.

If maximizing everyday spending and securing Gold status is your goal, the Bountiful may be worth the higher fee.

However, for most travelers, the Boundless offers significantly better long-term value — especially with its annual free night certificate that doesn’t require any spending.

To learn more, read our full Bonvoy Bountiful review and Bonvoy Boundless review.

Learn more: Marriott Bonvoy Bountiful review

Apply here: [applyLink pid=”6389″ overridetext=”Marriott Bonvoy Boundless”]