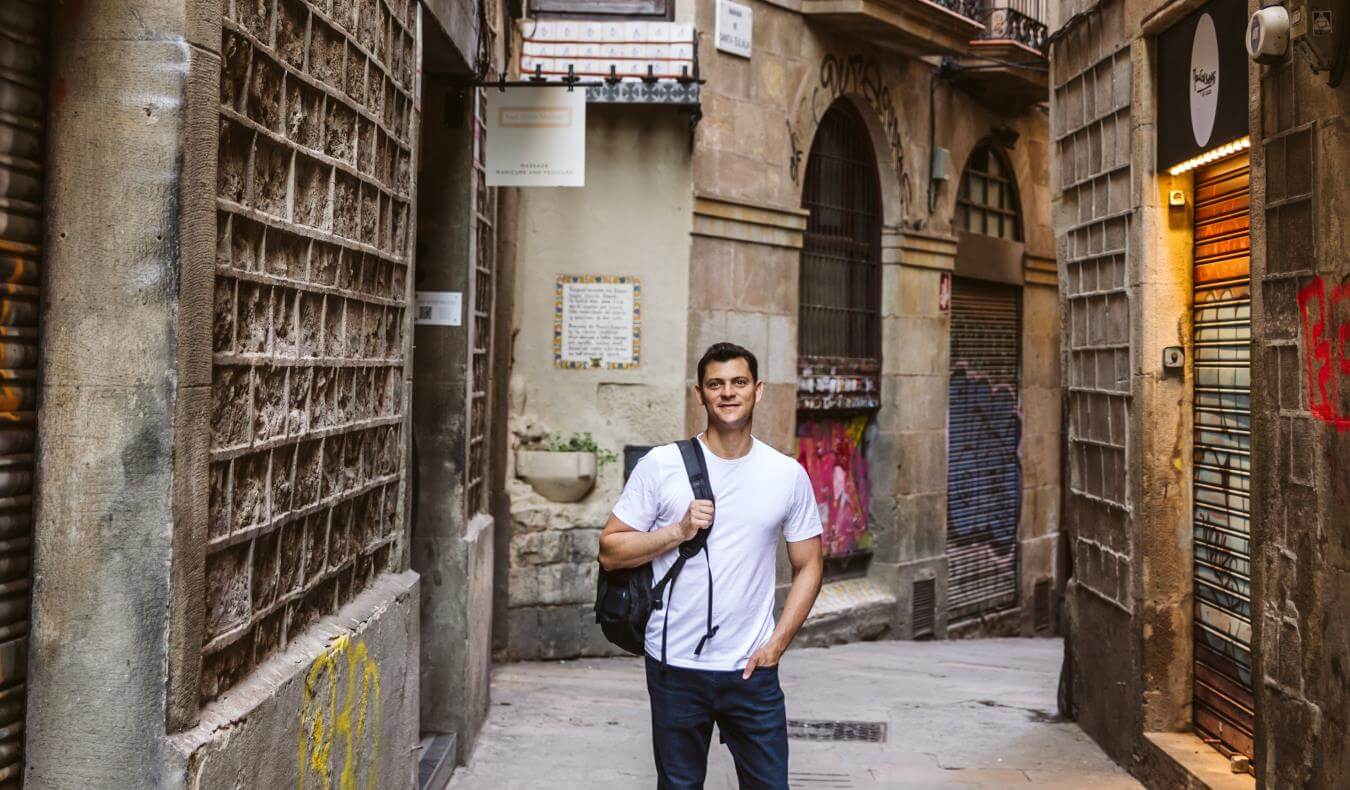

Nearly 200,000 fewer Europeans flew to the US in March, new data shows

Europeans are joining the increasingly global cohort of travelers opting not to take trips to the U.S. Roughly 178,000 fewer Western Europeans arrived in the U.S. by air in March compared to last year, new data from the U.S. International Trade Administration shows. That represents a 17.4% drop to 846,577 travelers. Visitors to the U.S. …

Europeans are joining the increasingly global cohort of travelers opting not to take trips to the U.S.

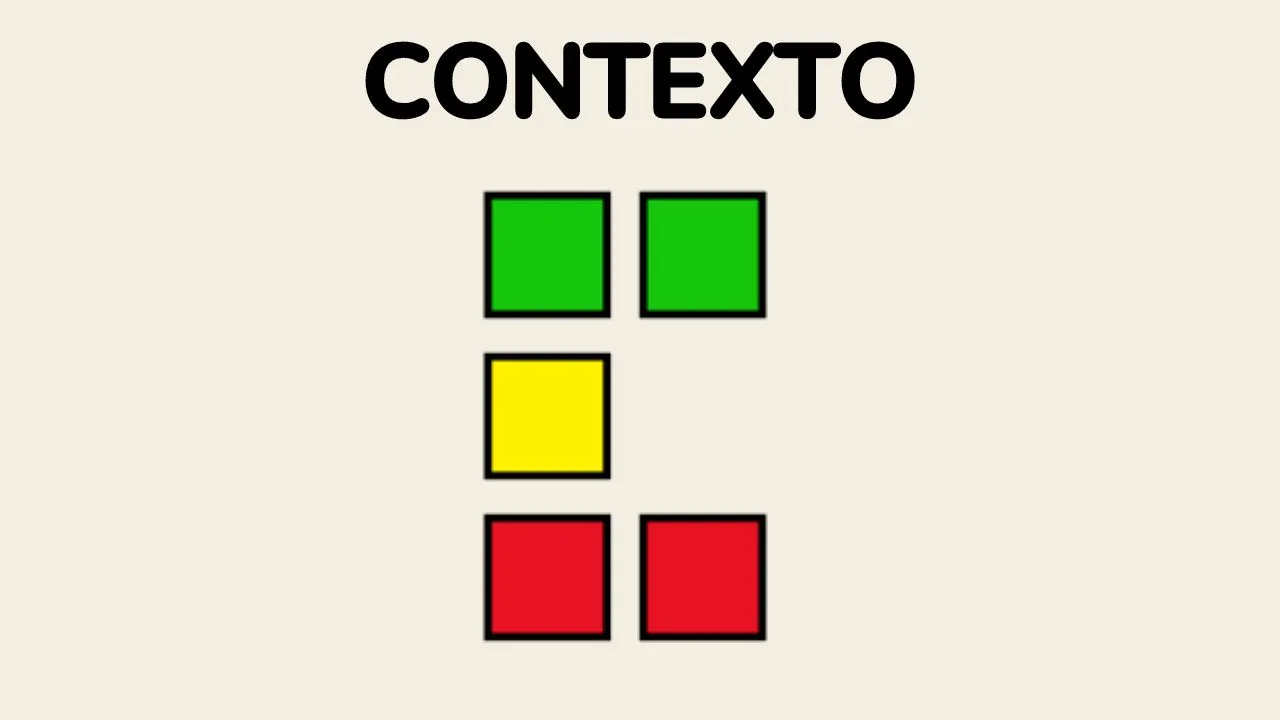

Roughly 178,000 fewer Western Europeans arrived in the U.S. by air in March compared to last year, new data from the U.S. International Trade Administration shows. That represents a 17.4% drop to 846,577 travelers.

Visitors to the U.S. from France, Germany and the U.K. — the three largest European origin countries for U.S.-bound travelers — fell 5%, 29% and 15%, respectively.

Bargain hunting: When is the best time to book flights for the cheapest airfare?

The data is the latest indication that President Trump’s trade war and hard-line immigration approach, including with longtime allies, is having a tangible effect on travel to the U.S. Reports of French and German nationals either being held at the border or denied entry have also eroded travel sentiment.

Already, bookings by Canadians for flights to the U.S. have fallen by double digits since Trump placed tariffs on goods from the country and repeatedly threatened to annex it as America’s “51st” state.

“It’s concerning for us,” Ben Smith, the CEO of Air France and KLM, said at an industry event at the end of March. “We are studying it, looking at it, watching it — as we do all markets — very, very closely.”

The group’s namesake airlines, Air France and KLM, are scheduled to increase seats to the U.S. by 8% and 11.5% year over year, respectively, from April through September, the latest data from aviation analytics firm Cirium shows.

Despite the drop in European travel to the U.S. in March, the industry still plans to grow this summer. Overall seats between the U.S. and Western Europe are up 4.2% from April through September compared to last year and unchanged from a week earlier, schedule data from aviation analytics firm Cirium shows.

United Airlines, Delta Air Lines and American Airlines remain the three largest transatlantic carriers by seats, and plans to add new routes to places like Nuuk, Greenland (United), Sicily, Italy (Delta), and Edinburgh, Scotland (American) remain unchanged.

There are several potential reasons for the lack of change. For one, airlines are likely hesitant to cut schedules this summer when transatlantic travel peaks in case the drop in European travel to the U.S. proves transitory. Another possible scenario is that westbound travel by Americans to Europe counteracts the drop in eastbound travelers.

Savanthi Syth, an airline analyst at Raymond James, wrote April 2 that outbound travel from the U.S. “remains resilient,” even as inbound travel was weakening. She was writing about international trends broadly and not specific to any one geography.

Lufthansa Group CEO Carsten Spohr, also speaking at the end of March, was reported saying the transatlantic “relationship has never been healthier” in terms of demand for international vacations and to visit friends and relatives on either side of the Atlantic.

The Lufthansa Group — including its namesake Lufthansa airline, plus Austrian Airlines, Brussels Airlines and Swiss — plan to grow U.S. seats by 3.4% in the April-through-September period, Cirium data shows.

Lufthansa CEO Jens Ritter on March 19 said the carrier did not “see any impact on the booking situation right now.”

A Swiss spokesperson, however, said the airline had seen a decline in leisure bookings even as business demand remained unchanged.

Still, any significant drop in foreign visitors to the U.S. could be costly. For example, the U.S. Travel Association in February estimated that a 10% drop in just Canadian visitors could cost American businesses $2.1 billion in lost revenue.

Delta will release its first-quarter results Wednesday, April 9, and is expected to update its outlook for summer travel.

Related reading: