Walmart Cash rewards program: How to earn ‘cash,’ save on your bill and enjoy perks

Editor’s note: Citi is a TPG advertising partner. Nowadays, there are fewer painful activities in life than grocery shopping, as money doesn’t go as far as it used to. If your order total makes you recoil at checkout, there are some things you can do to soften the blow — namely, making sure you’re swiping …

Editor’s note: Citi is a TPG advertising partner.

Nowadays, there are fewer painful activities in life than grocery shopping, as money doesn’t go as far as it used to. If your order total makes you recoil at checkout, there are some things you can do to soften the blow — namely, making sure you’re swiping one of the best grocery credit cards to get a valuable return for your spending.

But here’s the problem: Many credit card issuers don’t consider Walmart, one of the most popular stores on Earth, to be a grocery store. In most cases, you’ll earn a measly 1% cash back. In other words, Walmart is a bit tougher to squeeze value from than many other supermarkets.

That’s where Walmart Cash (formerly called Walmart Rewards) and Walmart+ can make a difference. Here’s everything you need to know about how to maximize this program.

Related: 6 foolproof ways to maximize rewards on grocery spending

What is the difference between Walmart+, Walmart Cash, Walmart Rewards and OneWalmart?

Walmart has a handful of programs that sound very similar. It’s worth knowing what each of them is, as they serve very different purposes:

- Walmart Cash: This is Walmart’s general loyalty program. It’s free to join and earns rewards currency that can be used for Walmart expenses.

- Walmart Rewards: This program no longer exists; it is the discontinued name for the new(ish) Walmart Cash program.

- Walmart+: This paid subscription option offers enhanced savings opportunities and handy benefits that others don’t.

- OneWalmart: Walmart employees can view their work schedules, pay stubs and other information on this site.

Overall, Walmart Cash is the only program with absolutely no strings attached.

What is the Walmart Cash rewards program?

Walmart Cash is Walmart’s proprietary rewards currency. Anyone with a free Walmart account can earn it. By making specific purchases with Walmart, you will earn credit that can be used exclusively with Walmart, though there’s a way to make it more flexible.

Earning

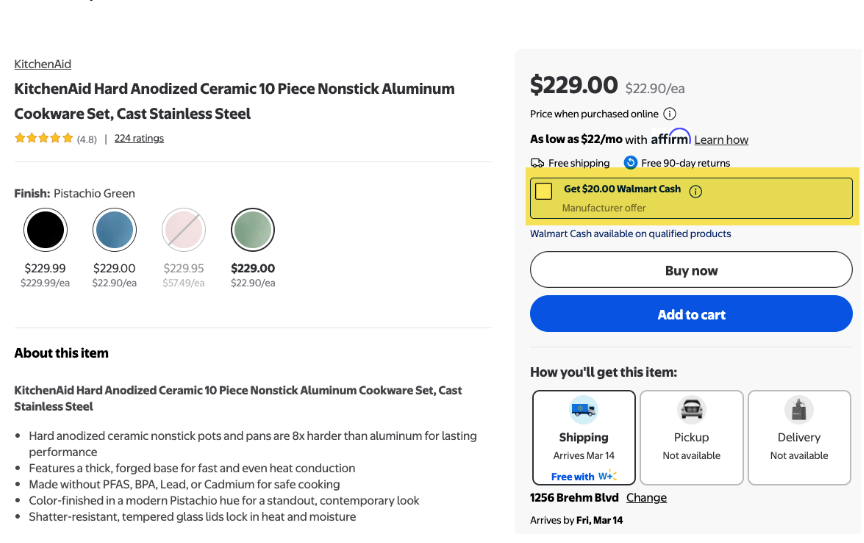

You won’t earn Walmart Cash for every purchase. Instead, you’ll see a “manufacturer’s offer” next to qualifying items. It’ll tell you exactly how much you will earn for your purchase.

To earn rewards, tick the box under each item and earn your rewards after purchasing. If you choose not to buy the item immediately, all manufacturer offers you select will be saved to your account dashboard.

Manufacturer offers expire and change frequently, so if you see an offer you like, be sure to check the expiration date.

It’s also worth noting that members of Walmart+ (Walmart’s premium membership discussed below) will also receive Walmart Cash when purchasing through Walmart+ Travel. You’ll earn 2% cash back on airfare and 5% cash back on other purchases.

Related: Best travel credit cards

Spending

Think of Walmart Cash as more of a rebate than a discount. That is, Walmart Cash is something you earn after you’ve paid for your cart. You accrue a Walmart e-gift card with a balance that rises when you earn and falls when you spend. To redeem Walmart Cash, you have two options.

First, you can use it to offset your Walmart bill. When shopping online, apply your rewards balance to your cart. When shopping in a store, scan a QR code at the register. You can then tap “Use Walmart Cash,” which will redeem as many rewards as necessary to pay for your stuff (you can then choose how you want to pay for any remaining balance).

Alternatively, you can liquidate your rewards by cashing them out in-store. Go to walmart.com or the Walmart app, and click “Cash out in-store.” You will be taken to a page that’ll generate a special barcode for your rewards. Scan it at a Walmart MoneyCenter, show your ID to a customer service associate and receive that sweet cash.

What are the benefits and perks of joining Walmart+?

If you’re a regular Walmart customer (and even if you’re not, in some cases), a Walmart+ subscription could far outweigh its annual cost.

There are two tiers of Walmart+. Here’s what you need to know about each.

Walmart+

The standard Walmart+ membership costs $98 annually (or $12.95 per month). However, those with The Platinum Card® from American Express can get it complimentary. The card comes with up to $12.95 in monthly statement credits toward a Walmart+ membership (enrollment required).

The perks for Walmart+ are:

- Free shipping from walmart.com (no order minimum)

- Free grocery delivery on orders of $35 and up (you must have a Walmart within a reasonable distance)

- Free pharmacy delivery (no order minimum)

- Free 24-hour online support from veterinary experts

- Save on fuel, up to 10 cents off per gallon, at participating gas stations (Exxon, Mobil, Sam’s Club, Murphy and Walmart)

- Auto care benefits, including free flat tire repair and free road hazard warranty after you purchase new tires with installation

- 25% off Burger King purchases — and a free Whopper every three months

- Free returns from home (no printing or repackaging necessary)

- Free Paramount+ Essential subscription (and 50% off Paramount+ with Showtime)

- Select ad-free Pluto TV shows

- Up to 5% in Walmart Cash when booking travel through Walmart+ Travel

Related: A guide to the Amex Platinum Walmart+ benefit: The membership that pays for itself

InHome Plus Up

You can upgrade your Walmart+ subscription to a membership called InHome Plus Up. It costs an additional $40 per year (or $7 every month). That means you’ll pay $138 annually or $19.95 monthly (the Amex Platinum Card statement credit isn’t valid for Plus Up membership).

InHome Plus Up is a white-glove version of Walmart+. It allows you to receive store deliveries from a trusted Walmart associate to your garage or kitchen. To qualify, you need a smart lock, home/garage keypad or similar device.

Key things to know about the Walmart Cash rewards program

Walmart Cash is pretty straightforward, but there are a few eccentricities to be aware of.

You must cash out your rewards to buy certain items

You can’t redeem Walmart Cash for everything. Specific items can’t be discounted with your rewards, including:

- Alcohol

- Tobacco

- Firearms

- Lottery tickets

- Financial services like money transfers and bill payments

- Gift cards

- Many prescription-related items

You also can’t offset the price of your Walmart+ Travel purchases.

That said, you can still cash out your rewards and do whatever you want with that money. It’s just an extra (slightly inconvenient) step.

There are rules for cashing out your rewards in-store

You must have at least $25 in Walmart Cash to cash out your rewards in a store. You can only cash out once daily at a maximum of $500. You’re also capped at $1,000 in weekly withdrawals and $2,000 in monthly withdrawals.

Unless you’re an absolute Walmart Cash-earning monster, these restrictions shouldn’t be a big deal.

Paper coupons supersede Walmart Cash

You can’t use paper coupons while you earn Walmart Cash. It’s one or the other — and paper coupons override Walmart Cash. Just make sure you keep this in mind as you crunch the numbers to figure out how to save the most money.

Walmart Pay

Walmart Pay is Walmart’s digital wallet, similar to Apple Pay and Samsung Pay. In short, you can store your credit, debit and Walmart gift cards to scan your phone at checkout.

You won’t earn bonus rewards for using Walmart Pay — it’s simply convenient.

What about the Capital One Walmart Rewards Mastercard?

The Capital One Walmart Rewards® Mastercard® was a cobranded credit card that earned bonus rewards for specific Walmart purchases. The card was discontinued in late 2024. This means the best credit cards for Walmart shopping are now:

- The Platinum Card from American Express: Its aforementioned Walmart+ credits make it a great deal.

- Chase Freedom Unlimited® (see rates and fees): Earn a fixed 1.5% cash back on all purchases.

- Capital One Venture Rewards Credit Card and Capital One Venture X Rewards Credit Card: Both earn 2 miles per dollar spent on all purchases.

- Citi Double Cash® Card (see rates and fees): You’ll get 1% back when you make a Walmart purchase and 1% back when you pay off that purchase (effectively 2%).

The information for the Capital One Walmart Rewards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

FAQs about the Walmart Cash rewards program

Does Walmart Cash expire?

Walmart Cash never expires.

Does Walmart Cash have a minimum redemption amount?

Walmart Cash does not require you to accrue a specific amount of cash before you can redeem it for Walmart purchases. However, you’ll need at least $25 in Walmart Cash to cash out your rewards in-store.

Why is Walmart+ worth it?

Walmart+ can quickly justify itself by waiving fees and offering discounts on everyday purchases. For example, if you routinely request home deliveries or fill up at qualifying gas stations, it may be wise to subscribe to Walmart+.

Bottom line

If you are even an occasional Walmart shopper, it’s recommended that you sign up for Walmart Cash. It’s free to join and earns rewards you can use for Walmart expenses.

For frequent shoppers, the paid Walmart+ service comes with plenty of benefits like free shipping, grocery and pharmacy delivery, fuel discounts and up to 10 cents per gallon on fuel at participating gas stations.

Remember to pay with the right credit card to maximize your rewards and even wipe off the cost of the Walmart+ monthly membership fee.

-Mafia-The-Old-Country---The-Initiation-Trailer-00-00-54.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)