Credit cards that offer instant card numbers upon approval

Editor’s note: This is a recurring post, regularly updated with new information and offers. Some credit card applications offer instant approval, which is great. But what’s even better than that is getting instant access to your new credit card. Instant access to your new card number lets you start working on spending requirements to earn that …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Some credit card applications offer instant approval, which is great. But what’s even better than that is getting instant access to your new credit card.

Instant access to your new card number lets you start working on spending requirements to earn that card’s welcome bonus. After all, the clock on welcome bonuses starts the day your account is approved, not when you receive your card in the mail and activate it.

It’s also a great feature if you’re applying for a card with an introductory 0% annual percentage rate offer, which you might need if you’re financing a large purchase in the near future.

This means that getting instant access to your new credit card may provide one to two weeks of additional time to work toward its bonus.

Let’s look at various credit card issuers to see which ones offer instant card numbers upon approval.

Our top picks for cards with instant card numbers

An instant card number allows you to start using your new card immediately. This provides extra time to work on earning the card’s welcome bonus.

In the case of store-brand credit cards, you also may receive a discount on your purchases, beginning as soon as you start using the card. It’s important to note that some issuers, like Chase, will allow you to add your card to a digital wallet but not give an instant card number.

While there are too many cards to list that offer instant card numbers or access, here are seven of our top picks.

| Card | Welcome offer | Annual fee | Earnings rate | Best for | Level of instant card access |

| The Platinum Card® from American Express | Earn 80,000 bonus points after spending $8,000 on purchases within the first six months of card membership.

However, you may be targeted for a higher welcome offer via the CardMatch tool. Offers are subject to change at any time and are not necessarily available to everyone.

|

$695 (see rates and fees) |

|

Premium lounge access and lifestyle benefits (enrollment required for select benefits) | It provides access to the full card number and the ability to add to digital wallets. |

| American Express® Gold Card | Earn 60,000 bonus points after spending $6,000 on purchases within the first six months of card membership.

However, you may be targeted for a higher welcome offer via the CardMatch tool. Offers are subject to change at any time and are not necessarily available to everyone.

|

$325 (see rates and fees) |

|

Dining at restaurants worldwide and shopping at U.S. supermarkets | It provides access to the full card number and the ability to add to digital wallets. |

| Capital One Venture X Credit Card | Earn 75,000 bonus miles after spending $4,000 on purchases in the first three months from account opening. | $395 |

|

Simple miles earning and lounge access | Eligible approved cardholders can receive instant access via the Capital One app and add their card to a digital wallet. |

| Capital One Venture Rewards Credit Card | Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months from account opening.

Additionally, you’ll receive a $250 Capital One Travel credit to use during your first cardholder year upon account opening. |

$95 |

|

Travel rewards for a modest annual fee | Eligible approved cardholders can receive instant access via the Capital One app and add their card to a digital wallet. |

| Chase Sapphire Preferred® Card (see rates and fees) | Earn 100,000 bonus points after spending $5,000 on purchases in the first three months from account opening. | $95 |

|

Travel rewards with a variety of bonus categories | It provides the ability to add your card to digital wallets with Spend Instantly. |

| Chase Sapphire Reserve® (see rates and fees) | Earn 60,000 bonus points after spending $5,000 on purchases in the first three months from account opening. | $595 |

Points for travel purchases are earned after using the $300 annual travel credit |

Premium travel rewards | It provides the ability to add your card to digital wallets with Spend Instantly. |

| Bilt Mastercard®* | None | $0 (see rates and fees) |

|

Earning points on rent | It gives instant access to the card number and the ability to add to digital wallets. |

*TPG founder Brian Kelly is a Bilt adviser and investor.

American Express

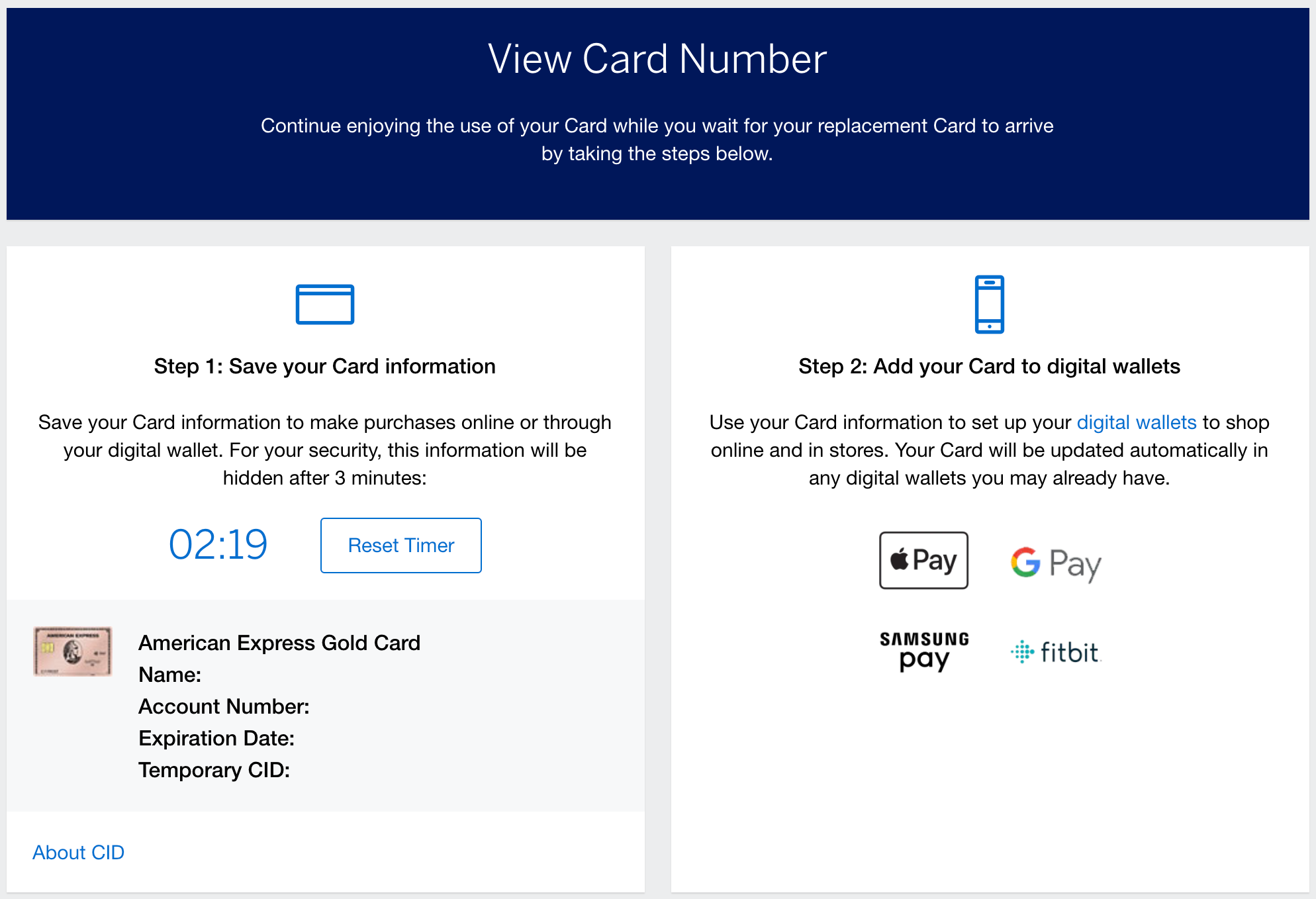

American Express provides your new account number immediately after approval of your online application, assuming your identity can be verified. Previously, you had to take a screenshot or write down your card number since you couldn’t view the number again. However, some readers have received emails from Amex that allowed them to view the instant card number again upon request.

The instant card number will be the same as the physical card you’ll get in the mail, but the four-digit card identification number on the front of the card will be different. Because of that, you might want to avoid using this card for recurring payments.

Note that instant card numbers for some cobranded cards may only be used with the cobranded company (for example, Hilton or Marriott).

In addition to instant numbers for new cardmembers, Amex gives existing cardmembers access to their card information when ordering replacement cards.

Related: Choosing the best American Express card for you

Even if you’re not interested in getting your card number immediately, you should still request it when prompted by the system. All Amex personal and business cards offer instant card numbers except for the Amazon Business Card and the Amazon Business Prime Card.

The information for the Amazon Business and Amazon Business Prime cards have been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Some of our top picks include:

- Amex Platinum Card

- Amex Gold Card

- Blue Cash Preferred® Card from American Express

- Hilton Honors Aspire Card

The information for the Hilton Amex Aspire card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The power of the Amex Trifecta

Bank of America

The only Bank of America card that consistently offers an instant card number is the Alaska Airlines Visa Signature® credit card.

Occasionally, those with Bank of America checking accounts may receive a targeted promotion offering an instant card number for cards like the Bank of America® Premium Rewards® credit card; however, this is not standard practice.

The Alaska Airlines Visa Signature card offers a generous welcome bonus and some of the most valuable airline miles around. You’ll also get a free checked bag and priority boarding if you use the card to pay for your flight.

To learn more, read our full review of the Alaska Airlines Visa Signature card.

Related: The best Bank of America credit cards

Barclays

Barclays never offers instant card numbers. However, you may have access to your card’s spending limit (without having access to the card number itself) if you apply for a Barclays-issued card while making a reservation.

Examples include the Frontier Airlines World Mastercard®, Holland America Line Rewards Visa® Card and JetBlue Card. If you apply for and get approved for these cards while making a reservation, you may be able to pay for your trip with the new card; you won’t be able to use the card for purchases elsewhere, though.

The information for the Frontier Mastercard, Holland America Visa and JetBlue cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Capital One

It may be possible to use your Capital One card number instantly, but not everyone will have this opportunity. You must be an existing account holder and use the Capital One mobile app to access an instant account number.

Note that this differs from the virtual card numbers offered by Capital One.

Some of our top picks for Capital One cards offering instant card numbers to eligible applicants are:

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

Related: Capital One Venture vs Venture Rewards

Cardless

Cardless focuses on cobranded credit cards that you can use without needing the physical card, instantly upon account approval and throughout the life of the card. Through the Cardless app, you can access these cobranded cards and can even get a new card number immediately in the app if your card is ever compromised.

Cardless provides cobranded credit cards for brands like Simon Property Group, Avianca and LATAM Airlines.

Chase

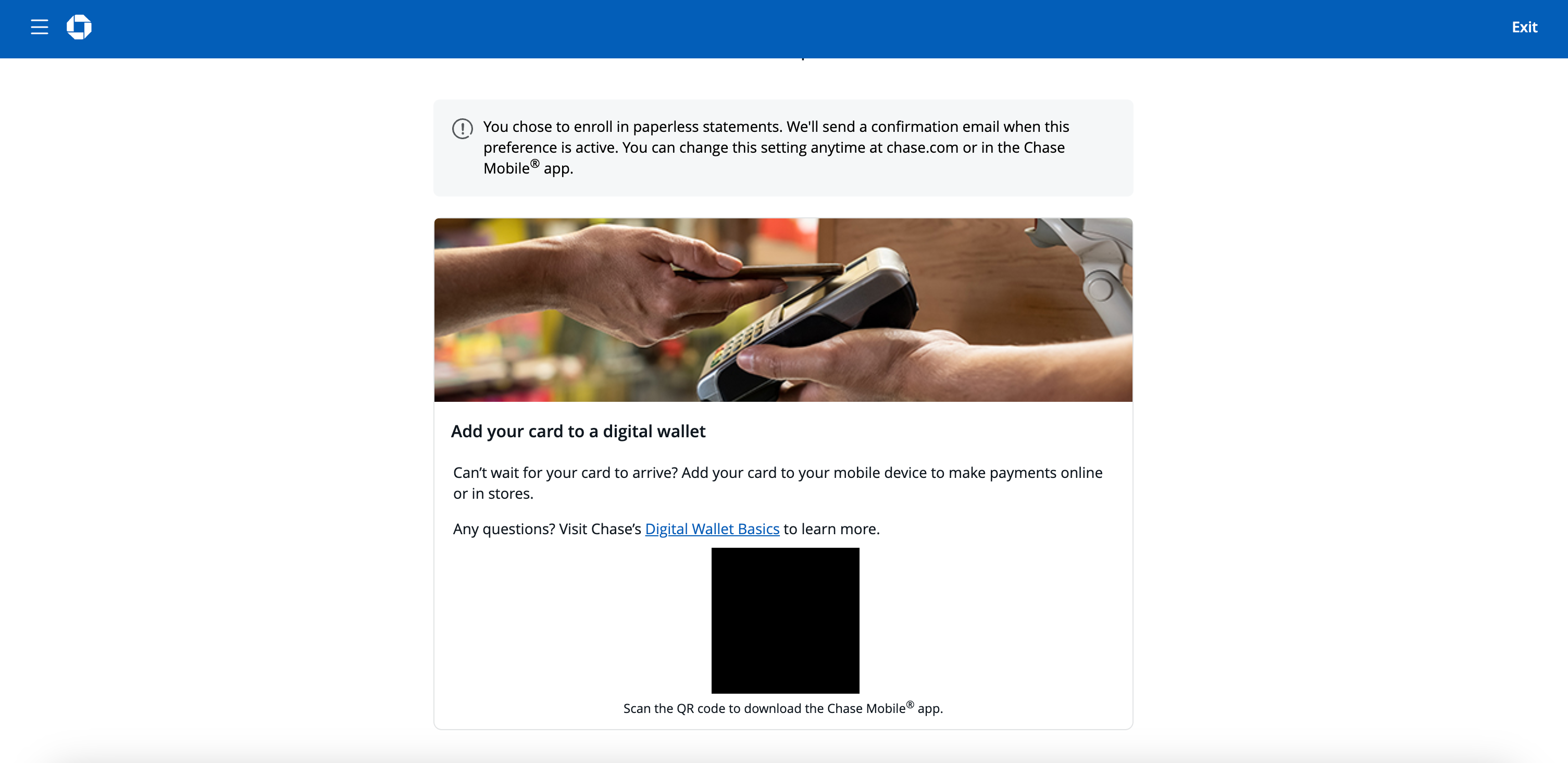

It is possible to use popular Chase cards — like the Chase Sapphire Preferred, United℠ Explorer Card (see rates and fees) and World of Hyatt Credit Card (see rates and fees) — instantly upon account approval by adding these cards to a digital wallet through Spend Instantly.

It’s important to note that this does not include a way to access an instant card number, but a way to instantly add your card to a digital wallet.

Here are the steps to set up Spend Instantly.

- Open the Chase app.

- Go to your card account.

- Navigate to account services, then select digital wallets.

- Then, choose what mobile wallet you want to add your card to. Follow those steps, and you should be good to go to use your card at merchants that accept digital wallets.

However, the issuer notes that there are several cards you cannot use instantly, including Mastercards, Amazon cards and business cards.

Related: The best Chase cards

Citi

Citi offers instant card numbers if your application is approved instantly and your identity is verified. However, note that you’ll have just one opportunity to view this number, so be sure to write it down.

Plus, instant credit card numbers are not available on small-business or American Airlines credit cards, according to a Citi spokesperson. Some readers have reported not having the option to get an instant card number with cards like the Citi Double Cash® Card (see rates and fees)

If your credit card application is approved instantly, you can click on “Get Card Number Today” to access your new card’s virtual number. Verification may be required to access your instant card number.

Once you see a green check mark, click on “See Card Summary” to view your temporary card number and card verification value number. However, you won’t have access to your card’s full spending limit until you receive the physical card.

However, only a few cards typically allow you access to your temporary card number. These include:

- AT&T Points Plus℠ Card

- Citi Custom Cash® Card

- Costco Anywhere Visa® Card by Citi (see rates and fees)

A caveat here is that you can only make purchases via instant access at AT&T and Costco with the AT&T Points Plus and Costco Anywhere Visa, respectively. Instant access purchases are not available at other merchants with those cards.

The information for the AT&T Points Plus Card and Citi Custom Cash has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best Citi credit cards

Discover

Discover often gives you an instant decision on whether you’ve been approved for a credit card. After this decision, if eligible, you can receive a virtual card number to use online or add to a digital wallet.

The Discover it® Cash Back Credit Card is our top pick. It is a good card for beginners, offering an unlimited cash back match in the first year and rotating 5% quarterly cash-back categories.

The information for the Discover it Cash Back card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Goldman Sachs

Goldman Sachs lets you use the Apple Card instantly with Apple Pay after account approval. Having a physical card is completely optional.

The Apple Card is a solid option as it has no annual fee and earns at least 2% back on all purchases when paying with Apple Pay. Plus, cash-back rewards are available right after each purchase.

The information for the Apple Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

SoFi

SoFi’s credit cards offer instant access to a digital card, with physical cards arriving in the mail within 10 business days. These cards include:

- SoFi Unlimited Credit Card

- SoFi Everyday Cash Rewards Credit Card

- SoFi Essentials Credit Card

The first two options are great cash back options. The SoFi Unlimited offers unlimited 2% cash back on all purchases. Meanwhile, the SoFi Everyday offers up to 3% bonus cash back in a variety of categories, including dining, grocery stores and online grocery delivery.

The information for the SoFi Unlimited Credit Card, SoFi Everyday Cash Rewards Credit Card and SoFi Essentials Credit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best 2% cash-back credit cards

Synchrony

There are two cards from Synchrony that you can use immediately upon approval. However, you’ll only be able to use them instantly within digital wallets or within their respective apps: PayPal (for the PayPal Cashback Mastercard®) and Venmo (for the Venmo Credit Card).

You’ll need to wait for your card to arrive in the mail for purchases with other merchants.

The information for the PayPal Mastercard and Venmo Credit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

US Bank

U.S. Bank typically only offers instant card numbers to consumer cardholders who have verified identities and a banking history with them. U.S. Bank has some excellent cash-back card offerings.

Some good options to consider are:

The information for the U.S. Bank Altitude Go and U.S. Bank Altitude Connect Visa Signature Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Wells Fargo

While most Wells Fargo-issued cards don’t offer instant card numbers, the Bilt Mastercard is an exception and has no annual fee (see rates and fees). The Bilt Mastercard is in a category of its own due to its unrivaled ability to earn bonus points on rent (up to 100,000 each calendar year; use the card five times each statement period to earn points) without incurring additional transaction fees (see rates and fees).

You’ll also have instant access to your card number in the Bilt Rewards app.

To learn more, read our full review of the Bilt Mastercard.

FAQs

What is a credit card instant approval, and how does it work?

As soon as you apply for a credit card, your application is processed by a computer. You’ll typically receive one of three responses: immediate approval, some form of “pending” status or denial.

Receiving instant approval doesn’t guarantee that you’ll be able to begin using your card immediately. If you receive instant approval, you may be presented with the option to view your card number right away; otherwise, you’ll usually need to wait until your physical card arrives in the mail before you can begin using it.

How long does it take for me to get my new credit card?

It can take five to 10 business days to get a new credit card after approval. However, that time frame can vary depending on the card and issuer. For instance, American Express uses overnight shipping for the Amex Platinum. Some issuers offer expedited shipping on request, but there’s no guarantee. You may need to pay when requesting expedited shipping.

Bottom line

Some issuers offer expedited shipping for your new card. In most cases, though, you’ll have to wait roughly a week for your new card to arrive in the mail. Having instant access to your new card number can make a big difference, especially if you want to start working toward meeting the minimum spend requirement to receive a welcome bonus as soon as possible.

If you’re in immediate need of a new credit card, consider one of the options above.

Related: Want concert presale access? Don’t be loyal to one bank

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For rates and fees of the Amex Platinum card, click here.

For rates and fees of the Amex Gold card, click here.

For rates and fees of the Bilt Mastercard, click here.

For rewards and benefits of the Bilt Mastercard, click here.

/f871ef26-7798-46a2-9db3-fe949a2f050b--2016-0719_okra-couscous-salad_james-ransom-417.jpg?#)

.jpg)

.jpg)

.jpg)