Why I’m keeping my Chase Sapphire Preferred Card forever

Editor’s note: This is a recurring post, regularly updated with new information and offers. Over the years, I’ve thought of giving up my Chase Sapphire Preferred® Card (see rates and fees) a few times, mostly because I am intrigued by the Chase Sapphire Reserve® (see rates and fees), but I’ve realized you can’t really beat …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Over the years, I’ve thought of giving up my Chase Sapphire Preferred® Card (see rates and fees) a few times, mostly because I am intrigued by the Chase Sapphire Reserve® (see rates and fees), but I’ve realized you can’t really beat the benefits … especially for a card with such a low annual fee.

The card earns a solid 2 Chase Ultimate Rewards points per dollar spent on travel and 3 points per dollar spent on dining while delivering exceptional travel protection benefits — rarely seen in a credit card with an annual fee under $100.

And right now, the card is offering a welcome bonus of 100,000 Ultimate Rewards points after you spend $5,000 on purchases in the first three months from account opening. TPG values this offer at $2,050.

Apply now: Earn 100,000 bonus points with the Chase Sapphire Preferred for a limited time.

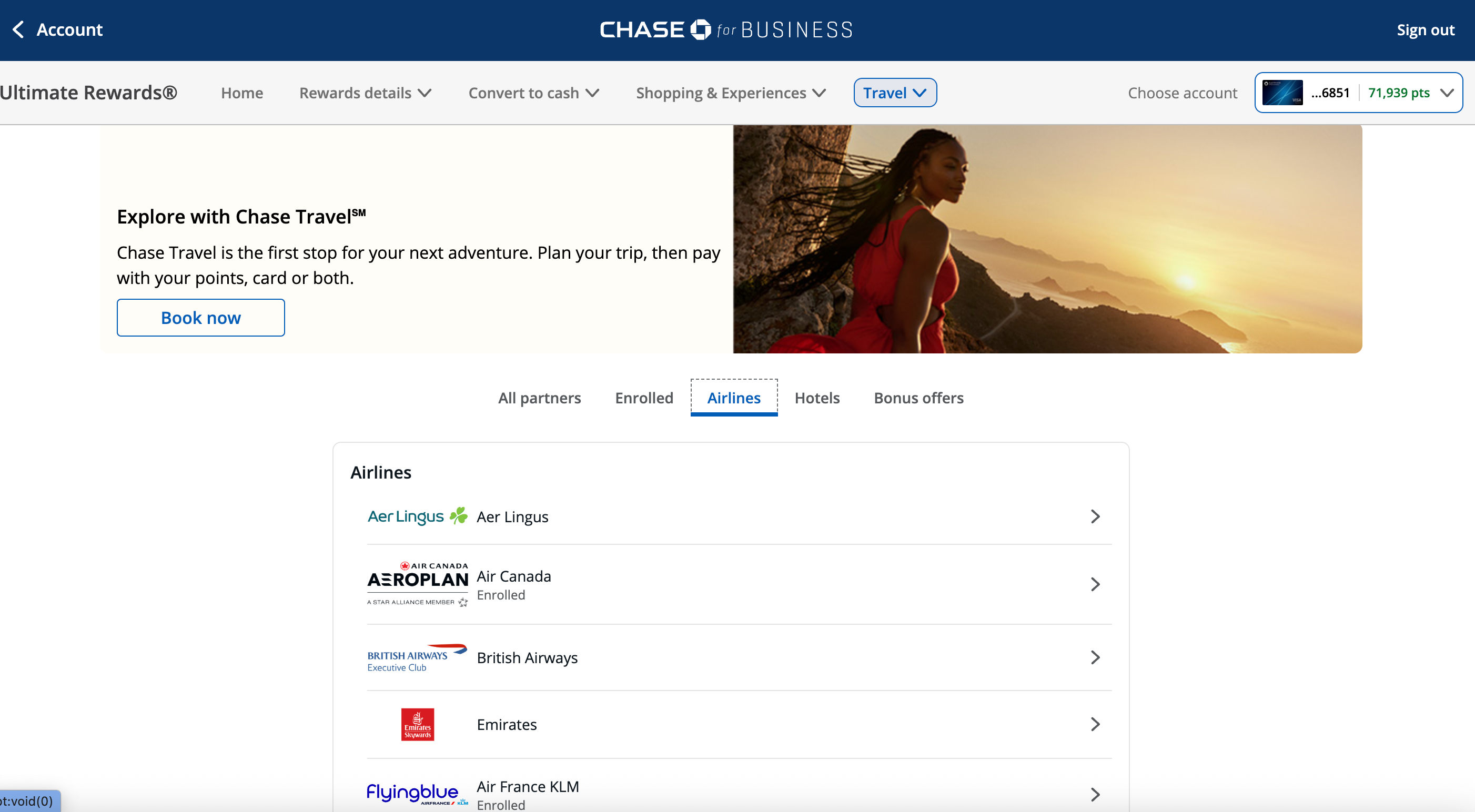

As if that wasn’t reason enough to open the card, it also provides outstanding travel redemption possibilities when transferring points to one of Chase’s valuable transfer partners, such as United Airlines, Hyatt and British Airways.

So why have I decided to keep the Chase Sapphire Preferred Card in my wallet indefinitely? Here are just a few reasons.

Valuable transfer partners

For me, the World of Hyatt program is the single most valuable transfer partner of the Chase Ultimate Rewards program. Ultimate Rewards points transfer to Hyatt at a 1:1 ratio and it’s easy to get outsize value at Hyatt properties (like the Park Hyatt London River Thames).

I’ve stayed at Hyatts in Vienna, Maui and Paris using my transferred Chase points over the years. It’s by far my favorite way to use my Chase points.

Ultimate Rewards points can also be transferred at a ratio of 1:1 to another of my favorite transfer partners, Air France-KLM Flying Blue. I’ve transferred my Chase points to Flying Blue for some amazing redemptions.

Just one example? I flew from Newark to Paris in Air France business class for just 50,000 Flying Blue miles (after a devaluation, the lowest rate is now 60,000 miles, but that’s still a great deal).

Chase Ultimate Rewards has other great transfer partners, including British Airways, Air Canada and Singapore Airlines.

Related: Sweet spots that get you more value for your Ultimate Rewards

Good-value redemptions

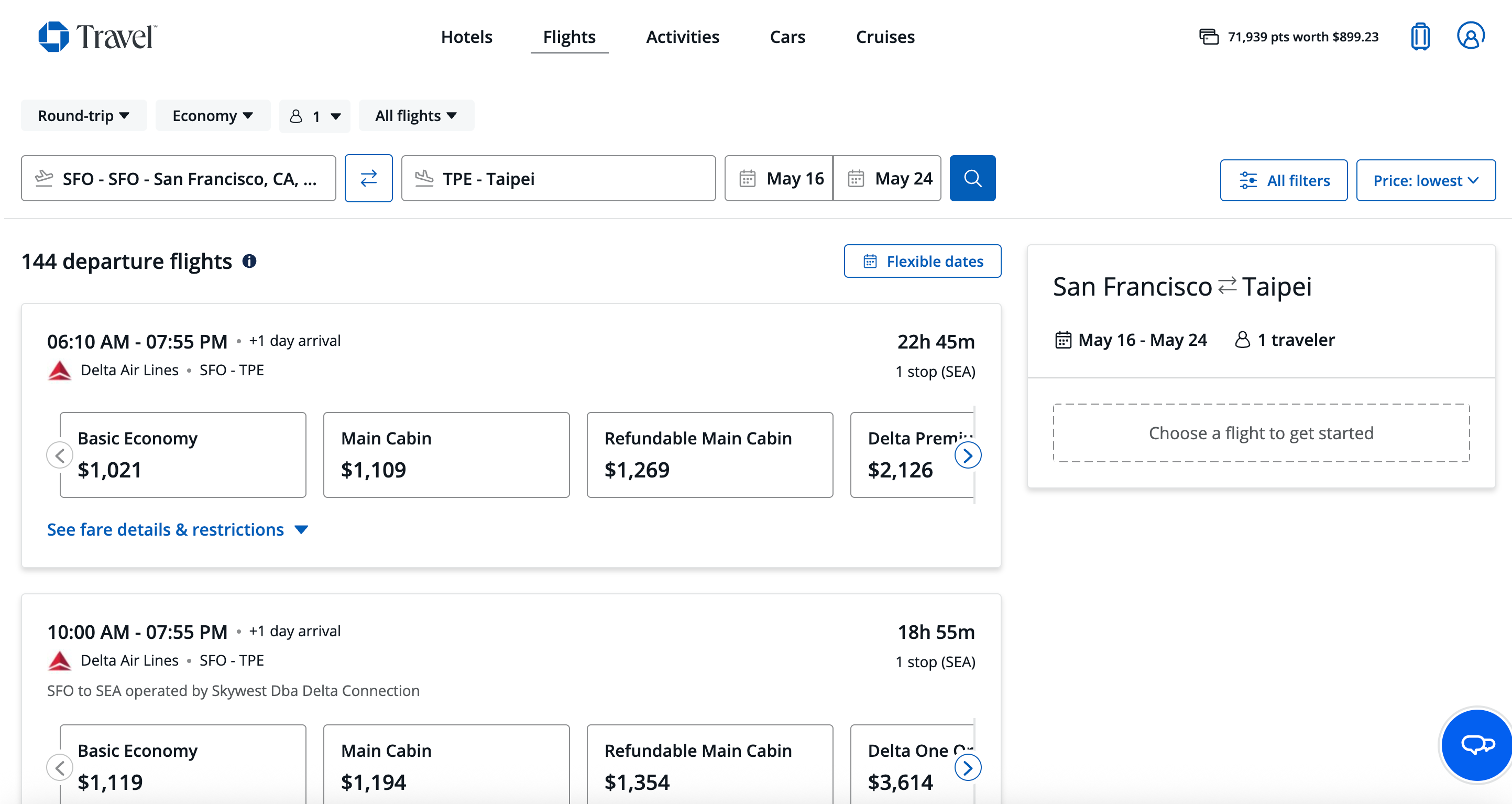

I also like earning points with my Chase Sapphire Preferred Card. It’s a full-fledged Chase Ultimate Rewards points-earning card, just like the Chase Sapphire Reserve or Ink Business Preferred® Credit Card (see rates and fees). That means I can book travel through Chase Travel℠.

Or I can transfer points to one of Chase’s 14 travel partners (11 airlines and three hotel chains).

As a Chase Sapphire Preferred cardholder, I can redeem points via Chase Travel for 1.25 cents apiece. For example, a $200 flight would only cost 16,000 points when booked through Chase Travel. This can be useful when you want to use an airline or book a hotel that isn’t a transfer partner of Chase (or when you want to use your annual $50 hotel credit).

Related: The power of the Chase Trifecta

Statement credits

One of my favorite features of my Sapphire Preferred Card is the once-yearly statement credit on hotels booked via Chase Travel. I’ve been able to use the credit every year to offset one of my hotel stays.

Last year, on my quest to visit all 50 states, I stayed at the fun AC Hotel by Marriott Little Rock Downtown for about $190. After the statement credit, it cost me just $140.

That’s more than half the annual fee right there.

I’ve also taken advantage of many Chase Offers over the years for extra savings. I’ve saved $190.49 in statement credits simply by enrolling in offers for stores, restaurants and services I would have shopped at anyway.

Primary car rental insurance

I also like the ability to decline the car rental company’s offer of a “collision damage waiver.”

The Sapphire Preferred (along with some other premium credit cards) provides primary car rental insurance, which allows holders to decline those added fees but still have insurance.

If you are in an accident in your rental vehicle, this coverage reimburses you for the damage or replaces the vehicle.

All that’s required to add the extra layer of protection when renting a car is to pay the rental with your Chase Sapphire Preferred, and you’ll be protected if any unfortunate accident occurs.

There’s also trip cancellation and interruption insurance, so I’m backed up in case things go sideways during my travels.

Related: Credit cards that offer car rental coverage

Ultimate Rewards points really add up

I travel quite a bit, and I love earning 2 points per dollar spent on travel and 3 points per dollar spent on dining with the Sapphire Preferred. I’ve also enjoyed earning 5 points per dollar spent on travel booked via the Chase Travel portal and the 5 points per dollar spent on Lyft rides (through September 2027).

As an added perk, the Sapphire Preferred runs on the Visa payment network, so I am virtually guaranteed acceptance with most merchants I frequent while traveling outside the U.S. That’s not always the case with American Express.

Oh, and no foreign transaction fees.

Bottom line

I’ve been on a bit of a speaking circuit recently, and I’ve been strongly advocating for newbies to sign up for the Chase Sapphire Preferred Card. It’s a great beginner card.

And if you’ve ever considered the card, now is the time. It’s currently offering a great welcome bonus of 100,000 Ultimate Rewards points after you spend $5,000 on purchases in the first three months from account opening.

The Chase Sapphire Preferred stays in my wallet year after year. I easily get more in value than the $95 annual fee. I’m keeping this card for the long haul.

To learn more, read our full review of the Chase Sapphire Preferred.

Apply here: Chase Sapphire Preferred Card with 100,000 Ultimate Rewards points after you spend $5,000 on purchases in the first three months from account opening.

/33901f8b-dab8-4ac5-8d01-7bf897aa6a96--2015-0122_chocolate-dump-it-cake_james-ransom_008.jpg?#)

.jpg)