8 biggest factors that impact your credit score

Editor’s note: This is a recurring post, regularly updated with new information and offers. Earning points and miles through lucrative credit card bonuses can open up some amazing travel options. But to really work this hobby to your advantage, you need to have a solid credit score. Let’s take a look at eight factors that …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Earning points and miles through lucrative credit card bonuses can open up some amazing travel options. But to really work this hobby to your advantage, you need to have a solid credit score.

Let’s take a look at eight factors that you may not even realize can influence your credit score.

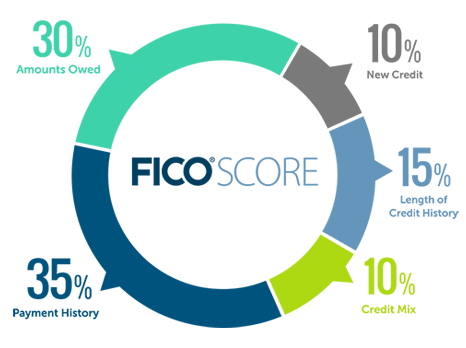

Payment history

Payment history is more important than any other information on your credit report when your credit score is calculated. It’s worth 35% of your FICO score. With VantageScore, your payment history matters even more, accounting for 41% of your credit score under the VantageScore 4.0 model.

The fact that your payment history matters so much isn’t surprising when you take a moment to consider the purpose of a credit score. Credit scores help lenders predict the likelihood that you’ll become at least 90 days late on a payment during the next 24 months.

If your reports show that you’ve done a good job keeping up with your credit obligations in the past, your credit score will almost certainly reflect your hard work.

Related: The complete history of credit cards, from antiquity to today

Missing payments

Because payment history is the number one factor in your credit score, it’s critical to make all of your payments on time every month. Even one 30-day-late payment has the potential to hurt your score. If you frequently make late payments or fall more than 30 days behind on a payment, the credit score drop could be severe.

Credit scoring models evaluate:

- Whether any late payments appear on your report

- How late those payments were (30 days, 60 days, 90 days, etc.)

- When the late payments took place (the more recent, the worse the score impact)

- How many late payments appear on your report

Where credit cards are concerned, it’s best to pay your full statement balance every month. In fact, this is one of the ten commandments of travel rewards cards. But if you make a mistake and overspend, it’s still critical to pay at least your monthly minimum.

Automated payments can be a great backup system to save you from oversights. Most credit card issuers will let you schedule automatic payments either for the minimum amount due or your full statement balance. You can choose the option you prefer.

I’m a big fan of automatic payments on credit cards and other bills. However, I set an alarm on my smartphone to tell me to log into my accounts on the day my auto drafts are scheduled to verify that the payments were, indeed, successful.

Related: What to do if your credit card is delinquent — and how to prevent it from happening

Credit utilization

Your credit utilization ratio is nearly as influential as your payment history in terms of credit score importance. In fact, the relationship between your credit card limits and balances is responsible for 30% of your FICO score.

Say your credit report shows a credit card with a $10,000 limit and a $5,000 balance. In this example, your credit utilization ratio is 50%.

Why do credit scoring models care about credit utilization? It has to do with risk prediction. Statistics show that people who use bigger portions of their credit card limits are more likely to pay bills late.

The lower your utilization ratio, the lower your credit risk. So, lower credit utilization ratios generally lead to better credit scores. If you want a good credit score, you should pay your full statement balance each month (preferably before your account’s statement closing date).

Related: How credit scores work

Using too much available credit

As mentioned, your utilization ratio is equal to your credit card balance divided by your credit limit, converted to a percentage. When you use more of your available credit limit, your utilization rate starts to climb.

Building on the example above, imagine you charge an additional $2,500 on your credit card. However, you don’t pay down your balance (aside from the minimum payment). That move won’t be good for your credit score or your bank account.

The extra spending would cause your utilization ratio to jump from 50% up to 75% when your card issuer sends your updated account information to the credit bureaus — Equifax, TransUnion and Experian.

Under FICO’s credit scoring models, you should aim for a utilization ratio of less than 10%. People with the highest FICO scores have an average utilization ratio of 5% or less. VantageScore, on the other hand, recommends that you maintain less than 30% utilization on your credit card accounts.

A good way to keep your utilization levels low is by paying off your credit card before your statement closing date. Sometimes, banks will do you a favor by raising your credit limit. A higher limit may have the benefit of automatically lowering your utilization ratio.

Related: When is it time to ask for a credit limit increase?

Length of credit history

Your age does not have an impact on your credit score. The age of your accounts, on the other hand, is relevant. FICO bases 15% of your score on your length of credit history.

Some of the details FICO considers in this category include:

- The age of your oldest account

- The average age of accounts on your credit report

- How long it’s been since you have used the accounts on your credit report

Having older accounts works in your favor in this credit score category. But if you don’t want to sit back and wait for time to do its magic, you can ask a loved one to help you out.

Becoming an authorized user on a friend’s or relative’s credit card might increase your length of credit history and, by extension, your credit score. Just be sure that your loved one adds you to a credit card with a perfect payment history and a low credit utilization rate. Otherwise, being an authorized user might move your credit score in the wrong direction.

Related: Best first credit cards

New credit

When a financial institution pulls your credit score, a record known as an “inquiry” is added to your credit report. Most inquiries stay on your report for 24 months. Certain inquiries, known as “hard” inquiries, have the potential to damage your credit score for 12 months. (Tip: Checking your credit score and report will never hurt you.)

Studies show that people who apply for a lot of credit in a short period of time are riskier borrowers. In other words, they’re more likely to pay a credit obligation 90 days late in the following 24 months.

The logic is as follows: The more credit you apply for, the more it appears that you need money. If you apply for a lot of credit at once, it can make you look desperate for cash. This may raise a red flag with credit card issuers and other lenders.

Some people apply for numerous credit cards at once to accumulate a lot of points in a short period of time. This strategy can have negative implications for your credit score.

Sure, in the short term, you might accumulate a boatload of points. But is putting your credit score at risk really worth it? In my opinion, no. The benefits don’t outweigh the potential cost of a damaged credit score.

Credit card issuers have also begun to crack down on churners in recent years. Cards that were once easily attainable are now being denied because of too many applications in the 18-24 months prior to application. Chase’s 5/24 policy denies credit card applications if you’ve opened five or more credit cards in the previous 24 months. Other card issuers have rules that restrict sign-up bonuses.

The lesson: Be picky about which cards you open and use a smart credit card strategy.

Related: What is the difference between a hard and soft pull on your credit report?

Having multiple open accounts with balances

You might not realize that the number of accounts with balances on your credit report can impact your credit score. Limiting your number of outstanding balances is best from a scoring perspective.

For this reason, it can be helpful to start with your smallest balances and work your way upward when you’re trying to pay down debts (credit cards or otherwise). Consolidating multiple high-interest debts with a personal loan or a balance transfer credit card could help you in this area as well — not to mention it might save you money.

The number of accounts with balances isn’t a huge credit score factor. Still, it’s smart to pay attention to any steps you can take that might push your score in a positive direction.

Related: How to choose a balance transfer credit card

Credit errors

Credit reporting errors happen all too often. Consumer Reports recently released a study on credit report accuracy and found that nearly 50% of consumers had an error on at least one of their credit reports.

You can’t always prevent credit reporting errors from fraud or identity theft. You can’t control whether creditors report bad information to the credit bureaus. Some credit reporting errors, like mixed files, are even caused by the credit bureaus themselves. However, you can take steps to protect your credit and fix problems when they occur.

First, check all three of your credit reports — from Equifax, TransUnion and Experian — often. You’re entitled to a free report from each bureau every 12 months via AnnualCreditReport.com. When you download your reports, go through them line by line. Make a list of any mistakes. Even errors that seem minor might be relevant.

If you find errors, you can dispute them with the credit bureaus. According to the Fair Credit Reporting Act, the credit bureau has 30 days to investigate your dispute (45 days in certain cases). At the end of the investigation, the credit bureau must either verify that the item on your credit report is accurate or delete it. The Consumer Financial Protection Bureau provides a helpful guide to walk you through the dispute process.

Additionally, if you want to lower the chance of someone opening a fraudulent account in your name, consider freezing your three credit reports. You can freeze your credit for free and it will block future lenders from accessing your credit information. When you want to apply for legitimate credit in the future, you’ll need to “thaw” your credit reports first. Although thawing your credit before new applications requires an extra step, it’s well worth it for the added protection against this type of fraud.

Related: How to check your credit score for free

Bottom line

Your credit score matters. Good credit can save you thousands of dollars throughout your life. Good credit may also help you to qualify for attractive offers from lenders, such as premium travel rewards credit cards.

If you currently have less-than-stellar credit, don’t despair. There are still some travel rewards cards that you might qualify for with low credit scores. In the meantime, keep a close eye on your credit reports, avoid the mistakes outlined above and study additional ways to improve your credit for the future. Staying on top of your payments can bring an excellent credit score within reach.

Related reading

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)