American Express vs. Chase cash-back: Which is best?

Editor’s note: This is a recurring post, regularly updated with new information and offers. People turn to cash-back cards for simple rewards that can maximize — and sometimes even offset — their everyday spending. Both American Express and Chase offer an impressive lineup of cash-back credit cards. However, they’re very different and provide unique benefits …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

People turn to cash-back cards for simple rewards that can maximize — and sometimes even offset — their everyday spending. Both American Express and Chase offer an impressive lineup of cash-back credit cards. However, they’re very different and provide unique benefits that may make choosing “the best” challenging.

We’ll take a deep dive into Amex and Chase cash-back cards and see how they stack up against each other.

American Express cash-back cards

- Blue Cash Preferred® Card from American Express: Best for maximizing cash back

- Blue Cash Everyday® Card from American Express: Best for cash back beginners

- The American Express Blue Business Cash™ Card: Best for flat-rate rewards

Chase cash-back cards

- Chase Freedom Unlimited®: Best for personal flat-rate rewards

- Chase Freedom Flex®: Best for comprehensive category bonuses

- Ink Business Unlimited® Credit Card: Best for flat-rate rewards for those spending over $50,000

Related: Why there’s no such thing as the ‘best’ credit card

Comparing Amex vs. Chase cash-back personal cards

| Blue Cash Preferred Card from American Express | Blue Cash Everyday Card from American Express | Chase Freedom Unlimited | Chase Freedom Flex | |

| Welcome offer | Earn a $250 statement credit after spending $3,000 within the first six months of cardmembership. | Earn a $200 statement credit after spending $2,000 within the first six months of cardmembership. | Earn $250 cash back after spending $500 in the first three months of account opening. | Earn $200 cash back after spending $500 in the first three months of account opening. |

| Annual fee | $0 introductory annual fee, then $95 (see rates and fees) | $0 (see rates and fees) | $0 | $0 |

| Bonus categories |

|

|

|

|

| All other eligible purchases |

|

|

|

|

Comparing Amex and Chase cash-back business cards

| American Express Blue Business Cash Card | Ink Business Unlimited Credit Card | |

| Welcome offer | Earn a $250 statement credit after spending $3,000 within the first three months of cardmembership. | Earn $750 cash back after spending $6,000 on purchases in the first three months of account opening. |

| Annual fee | $0 (see rates and fees) | $0 |

| Earning rate |

|

|

Which Amex or Chase cash-back card is best for personal cards?

The best Amex or Chase card for personal use depends entirely on how you utilize the card’s bonus categories and benefits. You should also keep a close eye on welcome offers, as this is your best chance to rack up quite a bit of cash back from the start.

Best welcome offer for personal cards

At a quick glance, the Chase Freedom Unlimited appears to have the best welcome offer. While you’ll earn the same amount as you would with the Amex Blue Cash Preferred ($250), you only need to spend $500 in three months. That’s very doable, even for low spenders.

New Blue Cash Preferred cardmembers can earn a $250 statement credit after spending $3,000 within the first six months of cardmembership. That should still be realistic for most spenders, but it’s a significantly higher spending requirement.

The other downside? The card has a $95 annual fee after the first year, while the other personal cash back cards we’ve highlighted have none.

The Freedom Unlimited is the clear winner as far as welcome offers go.

Most rewarding personal cash-back card for spending

Once you’ve earned a welcome bonus, it’s important to get recurring earning potential to justify keeping the card. Both Amex and Chase’s cash back cards offer generous category bonuses. Choosing the “most rewarding card” is highly subjective, depending solely on your spending habits and preferences.

The Chase Freedom Flex offers the most comprehensive suite of category bonuses. With this card, you’ll earn 5% back on travel booked through Chase Travel, 3% cash back on dining (including eligible delivery services) and 3% at drugstores. Plus, you’ll earn 5% back on a rotating selection of categories each quarter you activate (on the first $1,500 spent, then 1% back). All other purchases earn 1% cash back.

As a bonus, these rewards can be converted to transferable Ultimate Rewards points if you have another credit card that earns these points.

While the Amex Blue Cash Preferred Card earns 6% cash back on the first $6,000 spent at U.S. supermarkets per calendar year (1% after that) and select U.S. streaming subscriptions, it carries a $95 annual fee after the first year. Cash back is received in the form of Reward Dollars that can be redeemed for a statement credit or at Amazon.com checkout.

To offset that annual fee, you’ll need to spend at least $1,600 on these categories each year.

If you’re searching for a cash-back card that earns more than 1% back on all purchases, the Chase Freedom Unlimited is your best bet. This card earns 1.5% back on all non-bonused spending. That doesn’t stack up against a lot of other cards that earn more than 1% on every purchase, but it’s good for a cash-back card.

The rewards the Freedom Unlimited earns can be converted to transferable Ultimate Rewards points with the right card, like the Freedom Flex.

Again, the best option comes down to your spending habits, but Chase cash back cards take the lead when it comes to category bonuses.

Which Amex or Chase cash-back card is best for business cards?

When comparing cash-back business cards, you’ll want to consider similar factors as with personal cash-back cards. As a business owner, your spending can vary based on the size of your business and where your business spends money. It’s best to choose a card where you’ll be earning bonus rewards on your most frequent spending categories.

Best welcome offer for business cards

The Ink Business Unlimited Credit Card stands out. The Ink Business Unlimited allows new cardholders to earn $750 cash back after spending $6,000 on purchases in the first three months from account opening.

The welcome offer from the American Express Blue Business Cash Card, on the other hand, is smaller. With it, new cardmembers earn a $250 statement credit after spending $3,000 on purchases within the first three months. Although this is $500 less than the Ink Business Unlimited’s welcome offer, smaller businesses may have an easier time with the spending requirement.

If your business can naturally spend $6,000 in three months, go with the Ink Business Unlimited. Otherwise, the Amex Blue Business Cash may be a better fit.

Most rewarding business cash-back card for spending

The American Express Blue Business Cash Card offers a simple reward structure. Blue Business Cash cardmembers earn a flat 2% cash back on the first $50,000 spent on eligible purchases each calendar year (then 1%). It’s ideal for those who don’t want multiple cards in their wallets or to keep track of bonus categories.

Cash back earned on this card is automatically credited to your account as a statement credit. That’s a great feature for anyone who wants to take the complication out of redeeming rewards.

The Ink Business Unlimited earns cash back at a lower rate than the Amex Blue Business Cash but lacks a spending cap. With this card, you’ll earn 1.5% back on all eligible purchases.

If your business spends more than $50,000 annually, it makes sense to go with the Ink Business Unlimited. Otherwise, you’ll get more bang for your buck with the Blue Business Cash.

Amex and Chase cater to different customers with their respective cash-back cards. Consider your spending habits and determine which option is best for you.

Best recurring card perks

Cash-back cards aren’t renowned for their travel perks — however, both Amex and Chase offer unique recurring benefits.

Statement credits

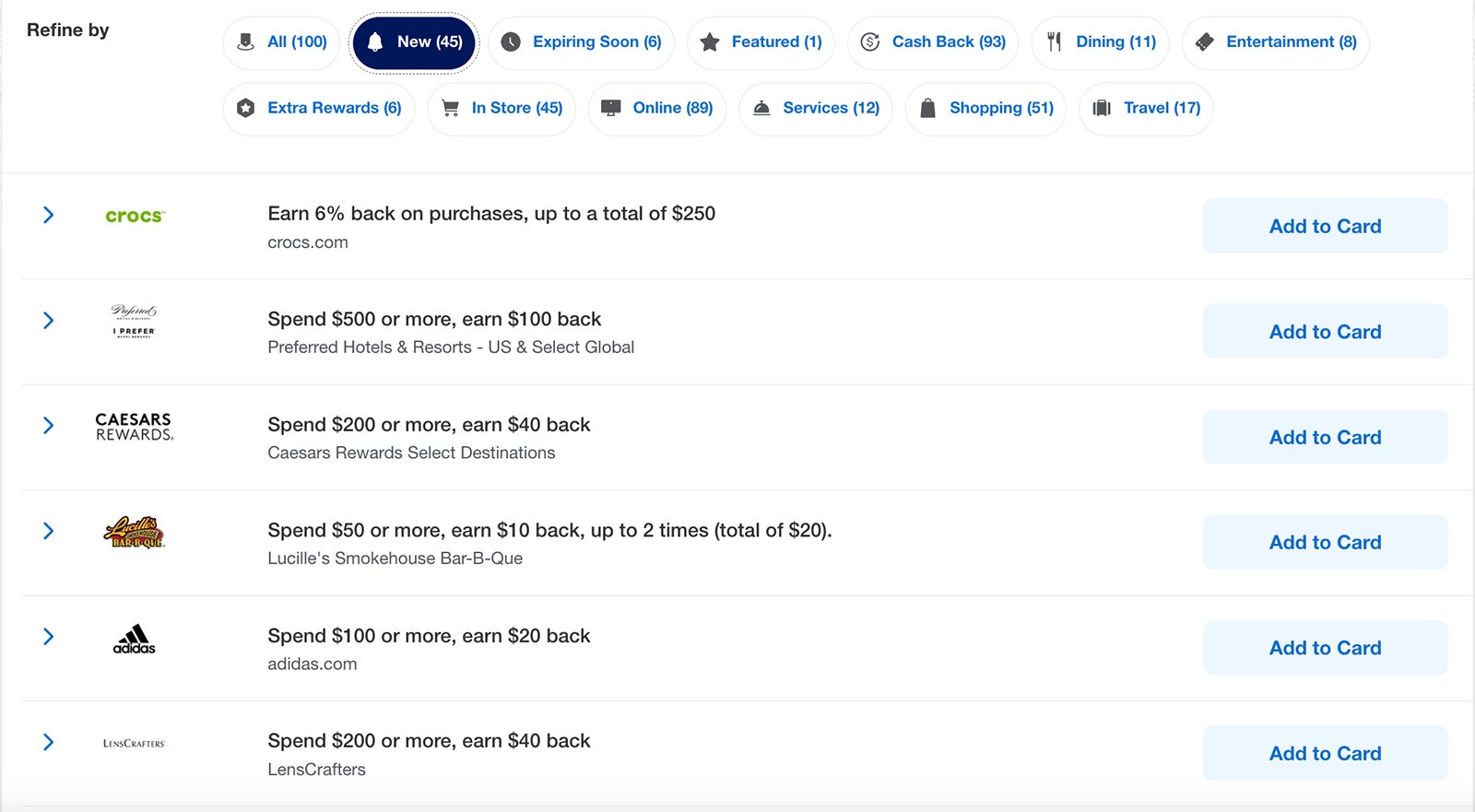

For starters, Amex cash-back cards give you access to Amex Offers, a changing list of deals from popular merchants offering statement credits and bonus points. Enrollment is required; terms apply.

Many other banks now offer sync deals but don’t quite measure up to Amex Offers. For example, Chase regularly offers 10% back at popular brands, but they usually come with a maximum of $20 back or less. Amex’s higher-value offers make its cash-back cards even more valuable.

Amex Blue Cash Preferred and Blue Cash Everyday cardmembers receive up to $84 each calendar year (up to $7 each month) for an eligible Disney Bundle subscription (subject to auto-renewal). While this may not cover the cost of your entire Disney Bundle subscription, it can help a lot if you’re already a subscriber.

Enrollment is required; terms apply.

Shopping

Chase compensates by offering a slew of other perks. Specifically, Chase Freedom Unlimited and Freedom Flex cardholders get three months of complimentary DoorDash DashPass (activate by Dec. 31, 2027). Plus, cardholders get 5% cash back on Lyft rides through March 31, 2025. Ink Business Unlimited cardholders will also enjoy 5% back on Lyft rides through the same date.

Depending on your shopping habits, these Chase perks may far outweigh the offers you’ll get with an Amex card.

Refer-a-friend bonuses

Amex cash-back cards also have an advantage when it comes to refer-a-friend bonuses. Both Amex and Chase banks allow cash-back cardmembers to earn bonus rewards for successful referrals.

When it comes to business cards, I utilize refer-a-friend links as an Ink Business Preferred® Credit Card cardholder. In the past 12 months, I’ve earned 80,000 bonus Chase Ultimate Rewards from successful approvals to various Chase Ink cards from friends and family.

Amex offers referral bonuses, but they’re inconsistent and often limited to certain cards. If you’re planning to earn more rewards by referring friends and family to your card, you’ll want to opt for a Chase card.

Flexibility

One significant advantage that Chase cash-back cards have over Amex is flexibility in redeeming rewards. Cash back doesn’t have to be just cash back if you have another Chase card that earns Ultimate Rewards points.

You can convert your cash back to transferable Ultimate Rewards points if you also have a card such as the Chase Sapphire Preferred® Card. So those 5% rotating category bonuses from the Chase Freedom Flex can be equivalent to earning 5 Ultimate Rewards points per dollar spent.

This is significant because according to TPG’s March 2025 valuation, Ultimate Rewards points are worth 2.05 cents each when transferred to airline and hotel partners. So, by taking advantage of this option, you’re essentially doubling the value of your rewards.

Unfortunately, you can’t convert Amex cash-back rewards to Membership Rewards points, so your Amex cash redemption options are far more limited than what you’ll get with a Chase card.

Bottom line

When comparing Amex versus Chase cash-back cards, it’s important to weigh all the different features based on what’s important to you.

If you’re after more flexible rewards and referral bonuses, Chase is easily your winner. However, Amex will take the lead if you want more valuable merchant offers.

But remember — you don’t have to choose just one. You might decide that a card from each issuer will make the perfect card pairing for your wallet.

Related: How to choose the best credit card for you

For rates and fees of the Blue Cash Preferred card, click here.

For rates and fees of the Blue Cash Everyday card, click here.

For rates and fees of the Amex Blue Business Cash card, click here.