Chase Sapphire Preferred 10% anniversary points bonus: How it works

Editor’s note: This is a recurring post, regularly updated with new information and offers. TPG staffers are huge fans of the Chase Sapphire Preferred® Card (see rates and fees). We happily pay its annual fee each year and list it as one of the cards we suggest for many travelers. We love that this card earns …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

TPG staffers are huge fans of the Chase Sapphire Preferred® Card (see rates and fees). We happily pay its annual fee each year and list it as one of the cards we suggest for many travelers. We love that this card earns bonus points on travel and dining and allows us to transfer our points to valuable transfer partners.

A great benefit is the 10% anniversary points bonus, giving cardholders a 10% bonus based on their total spend during the account anniversary year at a rate of 1 point for each dollar spent. So, for example, if you spent $100,000 on your Sapphire Preferred during your cardmember year, you would get 10,000 bonus points at the end of the year.

Since TPG’s April 2025 valuations place Chase Ultimate Rewards points as worth 2.05 cents each, earning 10,000 bonus points would be like getting $205 in value. The more you spend, the more you’ll earn, and this one perk alone could help make up for some (or all) of the card’s $95 annual fee.

Let’s dive into the specifics of this benefit and how you can track your progress on the Chase Sapphire Preferred’s 10% anniversary bonus.

About the Chase Sapphire Preferred 10% anniversary bonus

Without reading the fine print, this perk can initially sound slightly misleading. Here are the details:

10% anniversary points bonus: Each account anniversary year, you’ll earn bonus points that equal 10% of your total spend in points from purchases made with your credit card during the previous account anniversary year at a rate of 1 point for each $1 spent. “Account anniversary year” means the year beginning with your account open date through the anniversary of your account open date, and each 12 months after that.

You shouldn’t mistake this as earning back 10% of the points you earned in a given year. Instead, you’re earning 10% more points based solely on the dollars you spend during your given account anniversary year.

You can think of this as simply adding 0.1% to the existing bonus categories on the Chase Sapphire Preferred. As a reminder, here’s the earning rate on the card:

- 5 points per dollar spent on travel purchased through Chase Travel℠ (excluding the $50 hotel credit)

- 5 points per dollar spent on Lyft purchases (through Dec. 2027)

- 5 points per dollar spent on Peloton equipment and accessory purchases of $150 or more (through Dec. 2027, with a limit of 25,000 bonus points)

- 3 points per dollar spent on dining

- 3 points per dollar spent on online groceries (excluding Walmart, Target and wholesale clubs)

- 3 points per dollar spent on select streaming services

- 2 points per dollar spent on all other travel purchases

- 1 point per dollar spent on all other eligible purchases

In other words, you’re earning 5.1 points per dollar spent on Lyft purchases (through Dec. 2027), 3.1 points per dollar spent on dining, 2.1 points per dollar spent on other travel purchases — the list goes on.

While not a huge difference, it can certainly add up to a significant number of bonus points at the end of your cardmember year.

Related: Chase Sapphire Preferred benefits you might not know about

How to track your progress for the 10% anniversary bonus

If you don’t know your account anniversary date already, visit the Ultimate Rewards portal to find this date as well as your progress toward your 10% bonus.

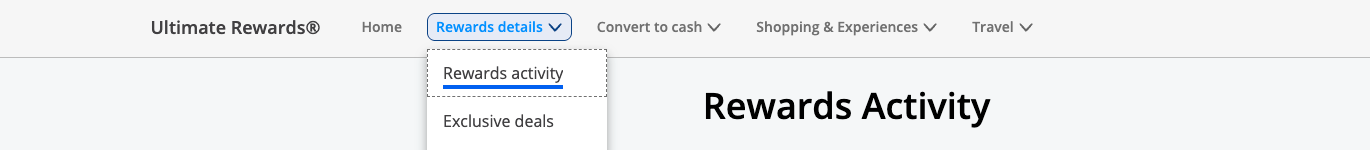

Hover to “Rewards activity” under “Rewards details.”

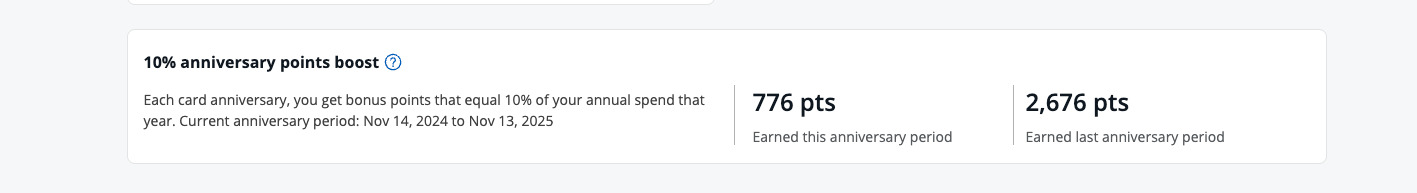

Then, you’ll find a summary of your spending, points earned and progress under “10% anniversary points boost.”

The number will continue to increase as you spend more over the coming year.

Another important thing to note here is that you won’t receive your bonus points until 60 to 90 days after your anniversary period is over. This is likely because Chase wants you to pay your annual fee for the next year before awarding you these bonus points.

Regardless, there’s no extra work involved for you to activate this benefit. The points will automatically accrue and deposit to your account once your anniversary resets. If you want to track your progress, you can do so under the “Rewards activity” tab of the Ultimate Rewards portal. Otherwise, let the points fly in.

Related: How to use the $50 hotel credit on the Chase Sapphire Preferred

Bottom line

If you don’t put a huge amount of spending on your card, this 10% anniversary points bonus isn’t necessarily monumental. Still, it’s another benefit that makes the Chase Sapphire Preferred a card worth getting and keeping.

For more details, check out our full review of the Chase Sapphire Preferred.

Apply here: Chase Sapphire Preferred Card — Earn 100,000 Ultimate Rewards bonus points after spending $5,000 on purchases in the first three months of account opening.