How I earn and redeem points at hotels — even when they don’t belong to a loyalty program

Everyone says a daily puzzle regimen will keep your mind sharp, but in my honest opinion, you can forget about Sudoku, the Rubik’s Cube and Wordle. The most challenging — and satisfying — brainteaser in the world is discovering a way to either earn or use points to book a hotel that is not actually …

Everyone says a daily puzzle regimen will keep your mind sharp, but in my honest opinion, you can forget about Sudoku, the Rubik’s Cube and Wordle. The most challenging — and satisfying — brainteaser in the world is discovering a way to either earn or use points to book a hotel that is not actually part of a traditional loyalty program.

I grapple with this conundrum a lot. As a dual citizen of the U.S. and Italy, I travel to “the old country” fairly often. The regions I visit, my ancestral villages in Frosinone and Catanzaro, largely lack traditional hotel brands participating in loyalty programs, such as World of Hyatt, Hilton Honors, IHG One Rewards and Marriott Bonvoy.

Those programs are near and dear to my heart and are my usual go-tos. It pains me when I have to stay in a hotel where I’m either not earning qualifying elite nights, redeeming points or earning points.

I’ll share how I maximize my points — both earning and burning — in circumstances like this. While some methods are a no-brainer, even I have to remind myself of the more unusual methods.

First things first: How to search for hotels

If you’re new to the world of points and miles, give yourself some grace. There’s no way you could possibly know, off the top of your head, all the hotels that participate in any given loyalty program. You’ll need to do some digging, but don’t just search Google for “Hilton hotel Bangkok,” for example.

Instead, go directly to the major programs’ websites (Hilton, IHG, Marriott, Hyatt, etc.) to search for your destination.

These brands have wide portfolios. Think about World of Hyatt’s relationship with Mr & Mrs Smith properties, Hilton Honors’ relationship with Small Luxury Hotels of the World and Marriott’s relationship with The Luxury Collection. The hotel’s name won’t always signal that it participates in a particular loyalty program.

For example, Fuji Speedway Hotel, with sweeping views of Mount Fuji in one direction and the raceway in the other, is part of Hyatt’s Unbound Collection, so you can book with World of Hyatt points or earn them on your stay.

With that advice out of the way, let’s talk about a few ways to earn or use points at hotels that aren’t part of a loyalty program.

Earn: Apply for a credit card to receive a welcome bonus

If you’re traveling anyway and know you’ll spend a certain amount, consider putting that money toward a secondary purpose: Apply for a new credit card to earn valuable points from a welcome bonus by meeting the spending requirements. It’s the easiest way to earn a lot of points from a stay at a non-points hotel.

Pick the right card, such as the Chase Sapphire Preferred® Card (see rates and fees), which, for a limited time, is offering 100,000 Ultimate Rewards points after spending $5,000 in the first three months of account opening. Note that this highest-ever Chase offer in years; the offer ends May 15.

TPG’s May 2025 valuations peg Chase Ultimate Rewards points at 2.05 cents each, making this welcome offer worth up to $2,050, depending on how you use the points. (You can get outsize value from these points by transferring them to one of Chase’s partners, such as Aeroplan or World of Hyatt.)

To decide if the Chase Sapphire Preferred is the right card for you, check out the following articles:

- How I got a 20X return on my Chase Sapphire Preferred last year

- Is the 100,000-point Chase Sapphire Preferred offer that is ending soon really one of the best deals ever?

- How to maximize your rewards earning with the Chase Sapphire Preferred

- Is the Chase Sapphire Preferred worth it?

Burn: Use flexible points to pay for the hotel

I’ve had good luck using flexible points from several card programs — such as Chase Ultimate Rewards, Capital One miles and American Express Membership Rewards — to pay for hotels outside of traditional loyalty programs. Just be sure to do some calculations to make sure using your points instead of cash is the best value.

You can use these points to pay for accommodations through the issuer’s respective booking portals (i.e., Chase Travel℠, Capital One portal or American Express Travel).

Here’s what Chase Ultimate Rewards points are worth when redeeming them through the Chase Travel portal:

- Chase Freedom Unlimited® (see rates and fees) and Chase Freedom Flex® (see rates and fees): Each point is worth 1 cent apiece.

- Chase Sapphire Preferred and Ink Business Preferred® Credit Card (see rates and fees): Each point is worth 1.25 cents apiece.

- Chase Sapphire Reserve® (see rates and fees): Each point is worth 1.5 cents apiece.

That means 100,000 points redeemed in the portal are worth:

- $1,000 for holders of standard Chase cards

- $1,250 for Chase Sapphire Preferred and Ink Business Preferred customers

- $1,500 for Chase Sapphire Reserve customers

When redeeming Membership Rewards points through the Amex Travel portal, the number of points you’ll need to redeem for a hotel stay is tied to the cash rate, which is 1 cent per point. Capital One uses the same 1 cent per point redemption rate for its hotel bookings.

Here’s more advice on using travel portals and how to redeem your flexible points:

- Best ways to redeem Chase Ultimate Rewards points for hotel stays

- Capital One Travel portal: Earn and redeem miles on flights, hotels and more

- Everything you need to know about Amex Travel

Earn: Use the right credit card

The easiest way to boost your points and miles balance is to book your hotel with a credit card that rewards you for your spend. You could pick a card like the Capital One Venture Rewards Credit Card, which simplifies life by offering 2 miles per $1 spent on any type of purchase.

Or, opt for a card that rewards you for travel-specific spending. For example, the Chase Sapphire Preferred card offers 2 Ultimate Rewards points per dollar spent in that category, while the premium version of the card, the Chase Sapphire Reserve, rewards 3 Ultimate Rewards points per dollar spent on travel purchases.

However, if you’re chasing status with an airline or hotel loyalty program, you may want to use a branded credit card to pay for your hotel stay. That way, you earn points and miles in those programs, and you can sometimes also earn qualifying elite nights or points. For me, that would include the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) or the World of Hyatt Credit Card (see rates and fees).

Earn: Use AAdvantage Hotels to snag elite status

Whenever I find a destination with few or no points hotels, I immediately log in to AAdvantage Hotels to see what options are available. That’s because I value my American Airlines Executive Platinum elite status. This hotel booking platform not only rewards travelers with American Airlines bonus miles to book award flights, but also Loyalty Points (which count toward annual status).

Related: American AAdvantage miles vs. Loyalty Points: What’s the difference?

You won’t earn elite night credit or hotel points for stays at properties that do participate in a loyalty program. However, what you can earn will sometimes be even more lucrative: AAdvantage Loyalty Points.

AAdvantage status members or AAdvantage credit card holders earn up to five times more base miles on hotel bookings. If you have both AAdvantage status and an AAdvantage credit card, you earn up to 10 times more base miles

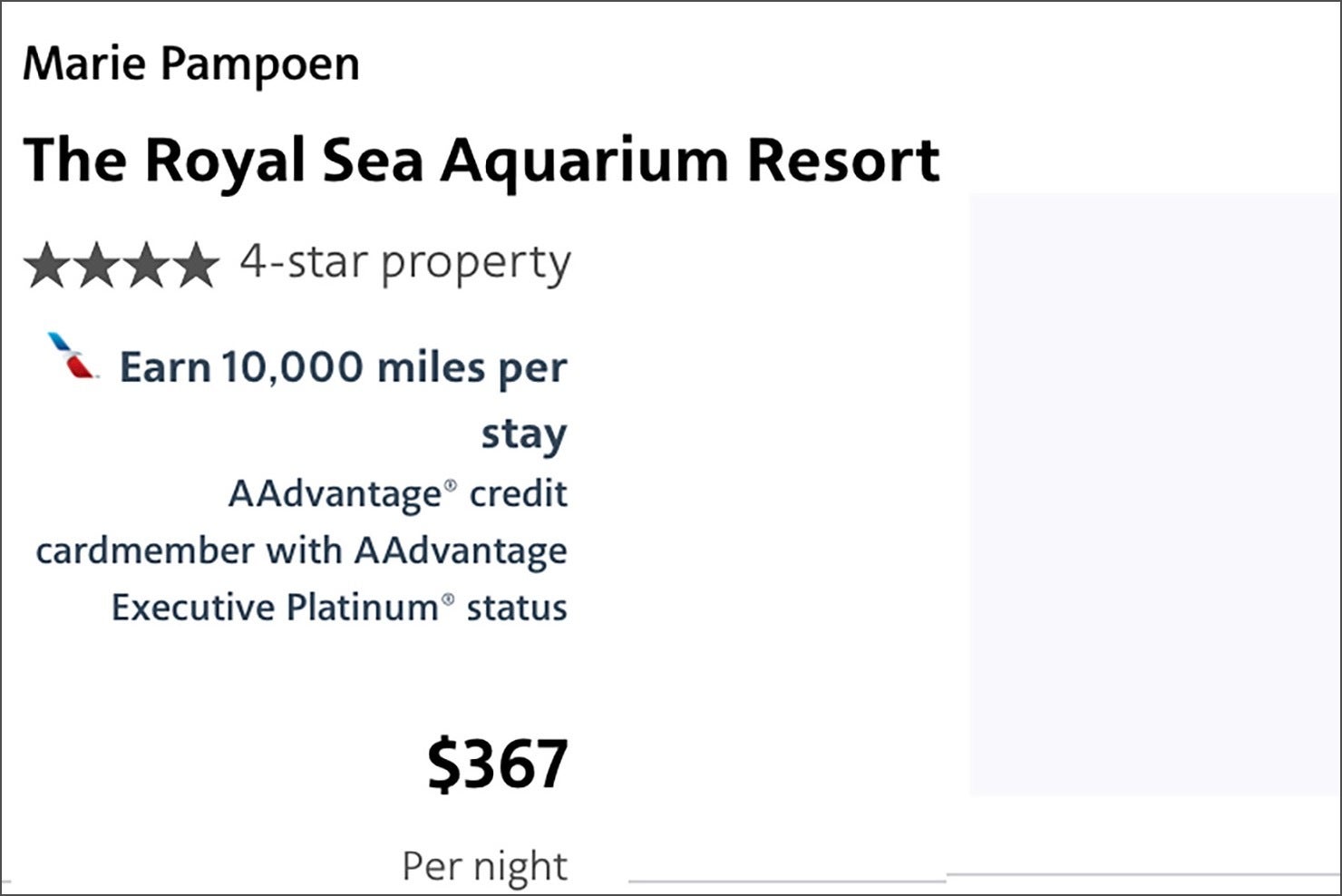

The screenshot below shows a one-night stay in Curacao that earns 10,000 base miles and Loyalty Points for an Executive Platinum member holding the Citi® / AAdvantage® Executive World Elite Mastercard®.

You only need 40,000 Loyalty Points to earn American’s Gold status, so this one-night stay would get you a quarter of the way there.

Burn: Use points to pay off a statement charge

You can also use the right credit card to convert your flexible points to cash to pay off an expense on your statement. You can redeem Capital One miles at 1 cent each when you use them to pay off a statement charge for travel purchases.

Chase Ultimate Rewards points are generally worth 1 cent each when paying off a statement charge, though some cobranded Chase cards may have an elevated redemption through the Pay Yourself Back feature.

Don’t redeem American Express Membership Rewards points for a statement credit. The value is terrible at just $0.6 per point.

Bottom line

With these strategies, you can pay for a stay at San Domenico Palace, Taormina, A Four Seasons Hotel — the featured property in season two of “The White Lotus” — with flexible points through American Express Travel, Chase Travel or Capital One Travel.

Looking for a charming bed-and-breakfast in Southern France? You’ll find options on those portals, too. Is your idea of heaven an all-inclusive resort in Mexico? Pay with the right credit card and then use flexible points or miles to wipe away the charges on your statement. Or, contribute to earning American Airlines elite status by using AAdvantage Hotels for your next getaway.

Trust me: If you find the hotel of your dreams but realize it’s not part of a loyalty program, there are usually still several ways to book that will net you more rewards in your pocket. Or, there’s a way to pay for the stay with your points stash.

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)