How my Chase Sapphire Preferred saved me nearly $250 on a canceled trip

When I was first approved for the Chase Sapphire Preferred® Card (see rates and fees), the lucrative welcome bonus and valuable transfer partners were what excited me most about the card. The Sapphire Preferred features a host of useful benefits beyond accumulating Chase Ultimate Rewards points at a great earning rate. But, if you’re like …

When I was first approved for the Chase Sapphire Preferred® Card (see rates and fees), the lucrative welcome bonus and valuable transfer partners were what excited me most about the card.

The Sapphire Preferred features a host of useful benefits beyond accumulating Chase Ultimate Rewards points at a great earning rate. But, if you’re like me, you’re probably spending less time researching trip cancellation and interruption insurance and more time daydreaming about how you’re going to redeem 100,000 Ultimate Rewards points.

For a limited time, the Sapphire Preferred is offering 100,000 bonus points after spending $5,000 on purchases within the first three months of account opening. This is the highest offer we’ve ever seen on this card, making now a solid time to apply.

But that doesn’t mean you should overlook the Sapphire Preferred’s travel insurance perks. I’m certainly glad I remembered trip cancellation insurance when I unexpectedly missed a New Year’s Eve celebration.

I made a mistake that almost cost me $250, but I used travel insurance on my Sapphire Preferred to get reimbursed for a hotel I never visited. Here’s what I did so you know exactly what to do if you’re ever in a similar situation.

How I used Chase Sapphire Preferred trip cancellation insurance

In December, I booked a two-night stay at a Hyatt Place in Charlotte to visit some friends for New Year’s Eve. The total cost was $245, which I prepaid online.

Three days before I was ready to hit the road, I caught a terrible bout of the flu. So instead of toasting Champagne and enjoying hors d’oeuvres, I took ibuprofen and napped away my illness.

That $245 Hyatt charge hit my Sapphire Preferred account the day I was supposed to check in. Instead of getting ready for New Year’s celebrations, I was lying on the couch.

When I felt better about a week later, I remembered that I had booked the hotel stay with my Sapphire Preferred, which provides travel insurance. Since I could file a claim, I attempted to get my money back. Here’s how that went down for me.

Related: Your guide to Chase’s trip insurance coverage

How I filed a claim

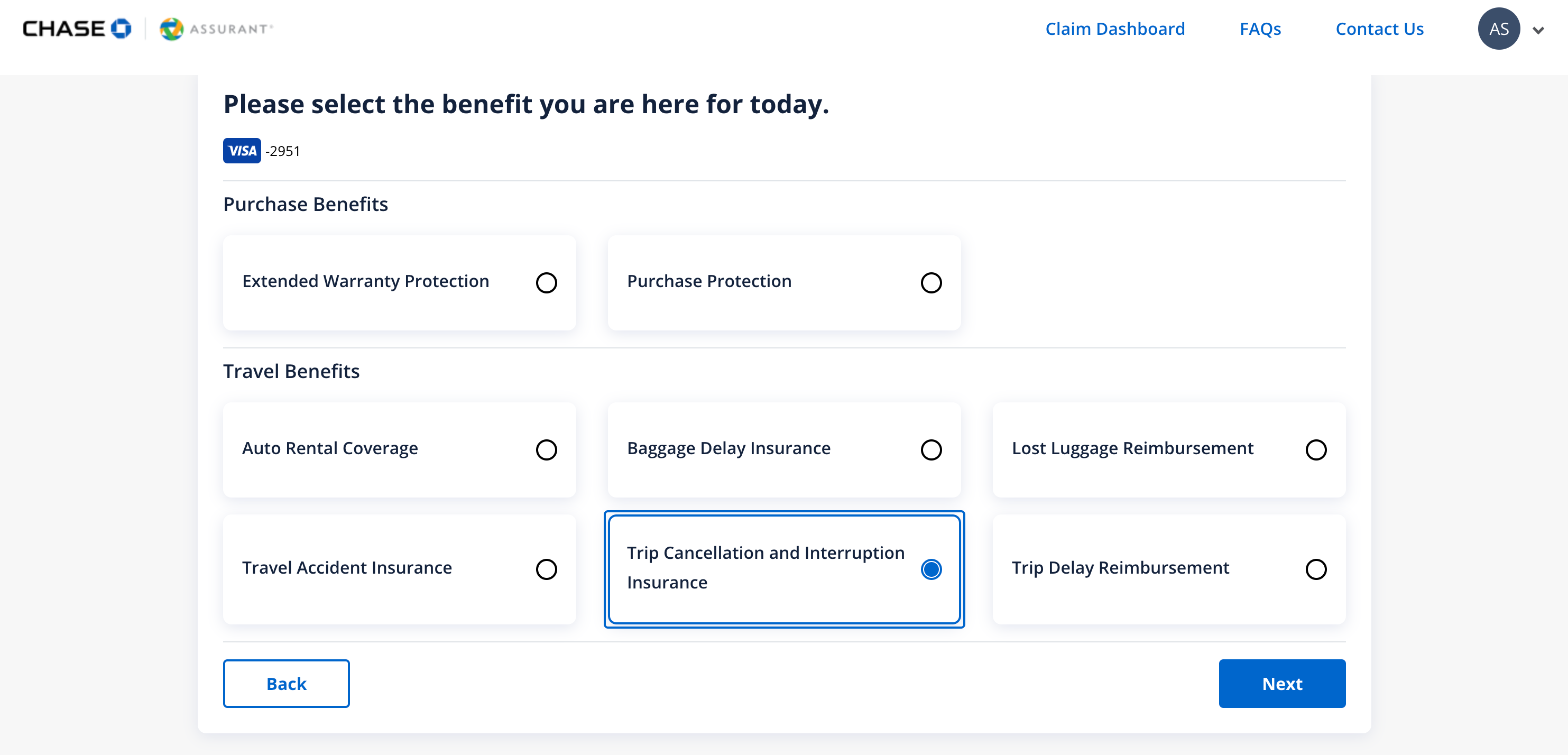

I went to chasecardbenefits.com and registered with my card information. Then, I was taken to my claim dashboard, where I selected “File a Claim.”

On the next page, I chose my Sapphire Preferred. I was brought to a screen where I could select the specific purchase or travel benefit I was looking to utilize.

I clicked on “Trip Cancellation and Interruption Insurance” since this was the benefit that applied to my situation.

Next, I filled in the purchase date of my “ticket/itinerary” and the date of cancellation/interruption.

Afterward, I was given a prompt to choose the type of loss from a list of 16 options:

- Accidental bodily injury

- Burglarized residence

- Damaged residence

- Disease/illness

- Hospitalization

- Jury duty/subpoena

- Loss of life

- Military order

- Named storm

- Quarantine

- Severe weather

- Transportation strike

- Travel warning

- Terrorist incident

- Uninhabitable residence/lodging

- Other

I selected “disease/illness” since I had a medical note proving my diagnosis days before I was supposed to travel.

Documentation I submitted

The next part of the process required an extra lift.

I was asked to provide documentation to substantiate my claim. What you need to submit will vary depending on which type of loss you select.

Chase’s benefits guide notes that, depending on the nature of your claim, you may need to provide more details.

Generally, however, here’s what you’ll need to round up:

- Travel itinerary

- Documents that confirm the reason for trip cancellation or interruption, such as medical records or a death certificate

- Your card statement showing the last four digits of your account number and the payment you made with your eligible card

- Cancellation or refund policies of the provider involved

- Proof of covered travel expenses incurred due to a trip interruption

- Any unused vouchers, tickets or coupons

- Any other document requested to substantiate the claim

In my case of the flu versus a Hyatt reservation, I initially submitted:

- An email confirmation of my Hyatt Place booking with dates

- A doctor’s note confirming my flu diagnosis with a date

- Evidence of the Hyatt transaction from my Chase online portal

Just over a week later, I was sent a follow-up email asking for a few more details.

The email stated that I needed to submit “confirmation that the travel arrangements were canceled with the travel supplier,” plus the “card account statement (showing the last four (4) digits of the account number) demonstrating the payment for the trip was made on your Covered Card and/or with redeemable Rewards [and] any unused vouchers, tickets, or coupons from the common carrier (such as planes, trains and cruise ships).”

Since the initial transaction was a couple of weeks ago at this point, I was able to submit my monthly card statement. I also uploaded a hotel bill I retrieved from Hyatt’s website.

Where I thought I made a mistake

Another week passed, and I received a second email asking for more documentation. This time, the letter repeated a need for “confirmation that the travel arrangements were canceled with the travel supplier.”

At this point, I realized I may have made a mistake.

I didn’t have official confirmation of the cancellation. In my flu-related daze, I’d completely forgotten to officially cancel my reservation. So, instead of this being a “trip cancellation” issue, I was essentially a no-show.

Embarrassed, I left my claim behind. Then, I wrote about it for TPG’s Daily Newsletter, hoping to help others avoid making my mistake by remembering to actually cancel reservations for trips they have to miss.

The result

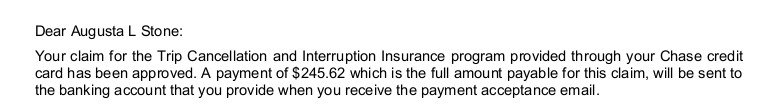

This email exchange occurred in late January, so you can imagine my surprise when I woke up to an email in March that my claim had been approved.

I’ll note that there’s never a guarantee your specific claim will be approved. So, if you don’t actually cancel your reservations, you may not be refunded.

Once I was approved, receiving my refund was easy. I received a same-day email from Virginia Surety Company, which works with Assurant, Chase’s insurance provider. I submitted my bank information through a secure channel, and the money was in my account by the next morning.

My claim was a success — and I didn’t even expect it.

Related: The best cards for trip cancellation and interruption insurance — and what it actually covers

Bottom line

With trip cancellation insurance on the Chase Sapphire Preferred, you’ll generally be reimbursed for nonrefundable, prepaid travel expenses charged by a supplier, including hotel stays like the one I booked.

Each Chase card comes with a Guide to Benefits explaining its insurance benefits. If you hold a card with trip cancellation and interruption coverage, remember to cancel your reservations ahead of time and file a claim in the unfortunate event you miss a trip.

If you’re looking for a card with this coverage, I recommend the Sapphire Preferred. In addition to this surprisingly easy process, the card itself offers valuable Chase Ultimate Rewards points, excellent earning rates and great transfer partners. When you add in the comfort of travel protections, it doesn’t get much sweeter for a $95 annual fee.

Apply here: Chase Sapphire Preferred Card

Related: Is the Chase Sapphire Preferred worth the annual fee? I say yes