Just got the Chase Sapphire Preferred? Do these 7 things next

Editor’s note: This is a recurring post, regularly updated with new information and offers. The Chase Sapphire Preferred® Card (see rates and fees) was one of the first rewards cards I ever got, and it remains a staple in my wallet. For years, I’ve used it to earn valuable transferable points on travel, dining and …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

The Chase Sapphire Preferred® Card (see rates and fees) was one of the first rewards cards I ever got, and it remains a staple in my wallet. For years, I’ve used it to earn valuable transferable points on travel, dining and groceries.

If you haven’t applied for the Sapphire Preferred yet, now is a great time to do so. This card is offering one of the most lucrative welcome bonuses we’ve seen in years: 100,000 Ultimate Rewards points after spending $5,000 on purchases in the first three months from account opening. That’s worth a whopping $2,050 based on our April 2025 valuations.

If you just got your Chase Sapphire Preferred, make sure you take these steps to get the most out of this fantastic card from day one.

Add an authorized user

Having an authorized user on your Sapphire Preferred account lets you earn points faster — and thus reach the welcome bonus sooner. Your authorized user’s purchases will count toward your welcome bonus, but being an authorized user won’t preclude them from earning a welcome bonus on their own Sapphire Preferred in the future.

This also enables you to transfer your Ultimate Rewards points to one of Chase’s airline or hotel partner programs in the name of one household member who is also an authorized user on your card. Plus, authorized users can benefit from the Sapphire Preferred’s travel protection benefits when they book travel with their card.

The process to add an authorized user online is simple and free and takes less than a minute. Sign into your Chase account, click on “More” next to your card, then click “Account services” and “Authorized users.”

Spouses and partners are obvious candidates for authorized users, but they’re not the only ones to consider. TPG staffers have added parents and trusted friends as authorized users to reach welcome bonuses faster, and adding your child as an authorized user is a great way to help them build credit.

Just remember that when you add an authorized user, you’re responsible for paying off any purchases they make on their card.

Related: The credit cards with the greatest value for authorized users

Set it as your default card for travel

The Chase Sapphire Preferred is a card to use for travel purchases for two main reasons:

- It earns at least 2 points per dollar spent on all travel purchases.

- It comes with built-in travel protections, such as trip cancellation insurance and lost luggage reimbursement.

Chase defines travel very broadly, so it covers everything from airlines, hotels and timeshares to car rentals, cruises, travel agencies and campgrounds. It also includes more day-to-day transportation like buses, tolls and parking.

If you have any subscriptions that fall into this category, like a toll pass or monthly parking fees, set your new Sapphire Preferred as your default payment method.

The same goes for your rental car accounts, allowing you to take advantage of the card’s primary rental car coverage.

Plus, Lyft extends special benefits (through September 30, 2027) to Sapphire Preferred Card holders, so be sure to add your card to your Lyft account.

Book a hotel stay

Your new card also gives you access to Chase Travel℠, the issuer’s online travel portal.

You’ll earn 5 Ultimate Rewards points per dollar spent on things like hotels and car rentals booked through the portal — a return of over 10% based on TPG’s valuations.

Additionally, your first hotel booking after each account anniversary will trigger the card’s annual $50 hotel credit.

I’ve found this credit very handy for short stays at boutique and independent hotels; I’m using this year’s credit for a weekend trip to a friend’s wedding.

Add your card to delivery apps and dining programs

While the Chase Sapphire Preferred may be billed as a travel card, it’s also a standout card for dining. It earns 3 Ultimate Rewards points per dollar spent on dining, including eligible delivery services, takeout and dining out, as well as online grocery orders.

Plus, thanks to Chase’s partnership with DoorDash, Sapphire Preferred Card holders can enroll to receive a complimentary DashPass membership for at least a year (activate by December 31, 2027). I love this perk because I can save money on every order with DashPass — without paying the $96 annual DashPass fee.

As soon as you have your Sapphire Preferred Card in hand (or get a virtual card number), set it as the default payment method on your DoorDash account and activate your complimentary DashPass membership. You should also add it to other takeout and delivery services, as well as your online grocery accounts, to maximize rewards on these purchases.

And if you participate in any dining rewards programs, be sure to add your Sapphire Preferred to these accounts. I love double-dipping on rewards this way — I can stack earning Chase points and airline or hotel points at the same time.

Related: Best dining credit cards

Set it to pay for your streaming services

A lesser-known perk of the Chase Sapphire Preferred is that it earns 3 Ultimate Rewards points per dollar spent on select streaming services.

As a result, you’ll want to set your new card as your default payment method for subscriptions with services such as Disney+, Hulu, Netflix, Peacock and Spotify. You can see which merchants qualify for bonus points at Chase’s rewards category page.

Related: Credit cards that save you money on streaming subscriptions

Link your loyalty accounts

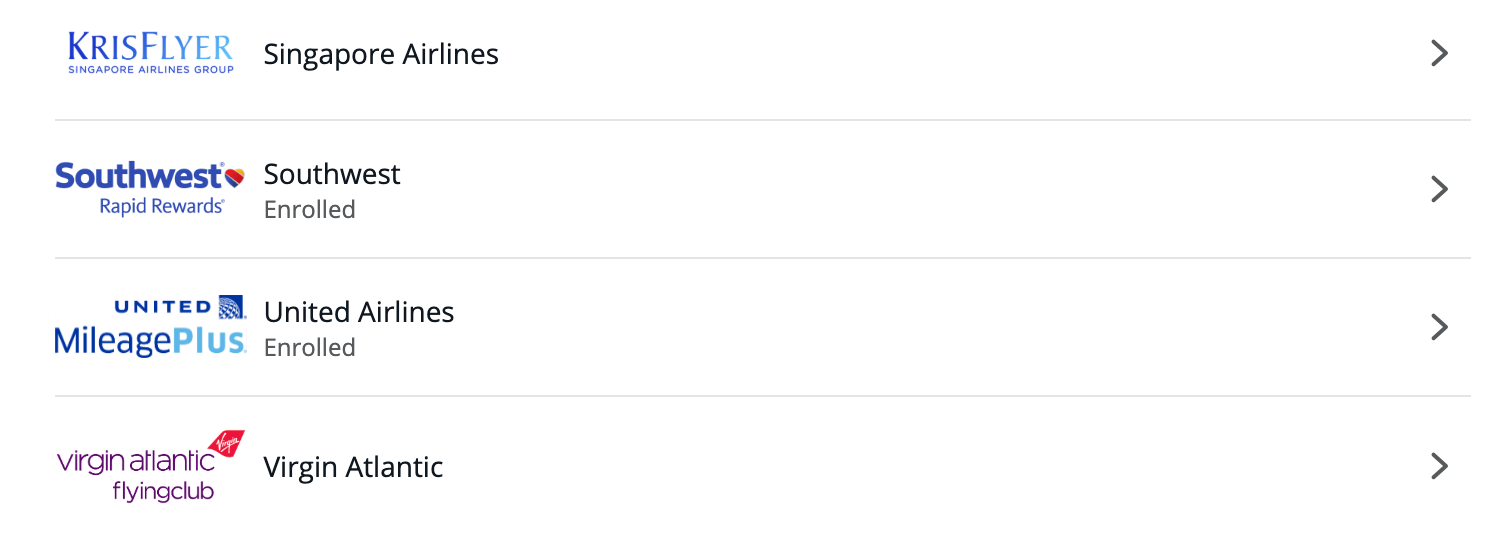

While the Chase Sapphire Preferred lets you redeem your Ultimate Rewards points at a flat rate of 1.25 cents each through Chase Travel, you can often get far more value by redeeming them with one of Chase’s 14 airline and hotel partners.

We generally recommend waiting to transfer your Chase points until you’ve confirmed award availability with the airline or hotel. When you’re ready to transfer, you don’t want anything to slow down the process — otherwise, that luxurious hotel room or first-class seat you have your eye on could be snapped up before the transfer completes.

Most Chase Ultimate Rewards transfers happen almost instantly, but they can take longer if your partner loyalty account is relatively new. That’s why we recommend registering for loyalty accounts with Chase’s partners and linking them to your Chase account now — even if you don’t plan to transfer points anytime soon.

For instance, since my home airport is a United Airlines and Southwest Airlines hub, I knew I would eventually use these transfer partners. I clicked through Chase’s site like I would to transfer points and linked my loyalty account numbers. Now my account says “Enrolled,” meaning I’m ready to transfer to these airlines.

Related: Why transferable points and miles are worth more than other rewards

Complete the Chase quartet

When the time is right for you to get your next card, adding a Chase card that complements your Sapphire Preferred can help you build your Ultimate Rewards balance even faster.

Our favorite cards to pair with the Chase Sapphire Preferred include:

- Chase Freedom Flex® (see rates and fees): To earn bonus points on rotating quarterly categories after activation

- Chase Freedom Unlimited® (see rates and fees): To earn bonus points on everyday purchases

- Ink Business Preferred® Credit Card (see rates and fees): If you own a business

However, when planning your credit card strategy, keep Chase’s 5/24 rule in mind. The issuer won’t approve you for a new card if you’ve opened five or more credit cards (from any bank) in the last two years.

Related: The ultimate guide to the best credit card combinations

Bottom line

There’s a reason why the Chase Sapphire Preferred remains a TPG favorite year after year. In short, it’s an excellent earner with tons of perks and a reasonable annual fee.

Follow the steps above to start maximizing the card right away, and you’ll see your Chase Ultimate Rewards balance take off. To ensure you nab those bonus points as part of the welcome offer, check out our tips for earning a welcome bonus.

Related: Chase Sapphire Preferred benefits you might not know about

-Classic-Nintendo-GameCube-games-are-coming-to-Nintendo-Switch-2!-00-00-13.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)