Tamron is shifting its where its lenses are made because of US Tariffs

Tamron recently built a second factory in Vietnam. Photo: Tamron Quarterly financial results for brands are trickling out, and a common theme so far is the impact of the US tariffs on production and pricing. Last week, Canon publicly discussed that it would be raising prices, likely only in the US, because of the tariffs. Now, Tamron has released its Q1 financial results, with the release detailing changes to production in response to the tariffs. While Tamron's materials for its Q1 financial results don't share as much as Canon's, they do provide some insight into what the brand is doing in response to the US tariffs that went into effect at the beginning of April. In the materials, Tamron calls out that it is looking to "strengthen the global tripolar (Japan, China, Vietnam) production system." As part of that, the company began production at its new factory in Vietnam in February, citing "geopolitical risks, along with rising tariffs on Chinese imports" as reasons for building the second factory in the country. Production at its second Vietnam factory began in February this year. Photo: Tamron According to Tamron's financials, it currently produces approximately 25% of its products in Vietnam, 65% in China and 10% in Japan. However, it is aiming to adjust that by 2028, reducing the amount produced in China to 45% while increasing the amount produced in Vietnam to 45%. Additionally, Tamron says it will reduce its parts procurement from China to 20% this year, down 10% from the current amount. Tamron didn't specify any plans for shifting production specifically for its Photographic Products category. However, roughly 15% of that segment is produced in China, with approximately 60% coming from Vietnam and 25% from Japan. That could be good news for US consumers, since most of its lenses come from countries with lower tariffs for US imports than China. However, it isn't clear how many parts for those lenses come from China. Tamron thinks that further cost reductions could help absorb the impact of tariffs Even with the uncertainty surrounding the tariffs, Tamron hasn't changed its initial forecast for the year in light of its progress in Q1, saying that it exceeded its plan. That's despite a slump in sales in the US market as well as a "reactionary decline in China market," since it says gross profit increased as a result of "cost reductions and productivity improvements." Tamron thinks that further cost reductions could help absorb the impact of tariffs, but added that the tariff situation is fluid and it will "consider possible measures to minimize the impact." It didn't specify if some of those measures could mean increased prices in the US. Tamron added, "From the 2nd quarter, uncertainty and economic slowdown are expected to increase further due to the expanding impact of US tariffs, rekindling of trade friction, and the continuing weakening of the USD and strengthening of the JPY." The US tariff situation continues to be a constantly evolving situation, so only time will tell what the actual impact will be. The company has already announced one lens this year – the 18-300mm F3.5-6.3 Di III-A VC VXD lens to RF mount and Z mount – and says five more are coming. Image: Tamron The financial results presentation also contained some more exciting news: Tamron plans to release six new models in 2025, up from the company's typical five lenses per year. That includes the already announced Tamron 18-300mm f/3.5-6.3 Di III-A VC VXD, which is Tamron's seventh model for Nikon Z-mount and the second model for Canon RF mount.

|

|

Tamron recently built a second factory in Vietnam. Photo: Tamron |

Quarterly financial results for brands are trickling out, and a common theme so far is the impact of the US tariffs on production and pricing. Last week, Canon publicly discussed that it would be raising prices, likely only in the US, because of the tariffs. Now, Tamron has released its Q1 financial results, with the release detailing changes to production in response to the tariffs.

While Tamron's materials for its Q1 financial results don't share as much as Canon's, they do provide some insight into what the brand is doing in response to the US tariffs that went into effect at the beginning of April. In the materials, Tamron calls out that it is looking to "strengthen the global tripolar (Japan, China, Vietnam) production system." As part of that, the company began production at its new factory in Vietnam in February, citing "geopolitical risks, along with rising tariffs on Chinese imports" as reasons for building the second factory in the country.

|

|

Production at its second Vietnam factory began in February this year. Photo: Tamron |

According to Tamron's financials, it currently produces approximately 25% of its products in Vietnam, 65% in China and 10% in Japan. However, it is aiming to adjust that by 2028, reducing the amount produced in China to 45% while increasing the amount produced in Vietnam to 45%. Additionally, Tamron says it will reduce its parts procurement from China to 20% this year, down 10% from the current amount.

Tamron didn't specify any plans for shifting production specifically for its Photographic Products category. However, roughly 15% of that segment is produced in China, with approximately 60% coming from Vietnam and 25% from Japan. That could be good news for US consumers, since most of its lenses come from countries with lower tariffs for US imports than China. However, it isn't clear how many parts for those lenses come from China.

Tamron thinks that further cost reductions could help absorb the impact of tariffs

Even with the uncertainty surrounding the tariffs, Tamron hasn't changed its initial forecast for the year in light of its progress in Q1, saying that it exceeded its plan. That's despite a slump in sales in the US market as well as a "reactionary decline in China market," since it says gross profit increased as a result of "cost reductions and productivity improvements." Tamron thinks that further cost reductions could help absorb the impact of tariffs, but added that the tariff situation is fluid and it will "consider possible measures to minimize the impact." It didn't specify if some of those measures could mean increased prices in the US.

Tamron added, "From the 2nd quarter, uncertainty and economic slowdown are expected to increase further due to the expanding impact of US tariffs, rekindling of trade friction, and the continuing weakening of the USD and strengthening of the JPY." The US tariff situation continues to be a constantly evolving situation, so only time will tell what the actual impact will be.

|

|

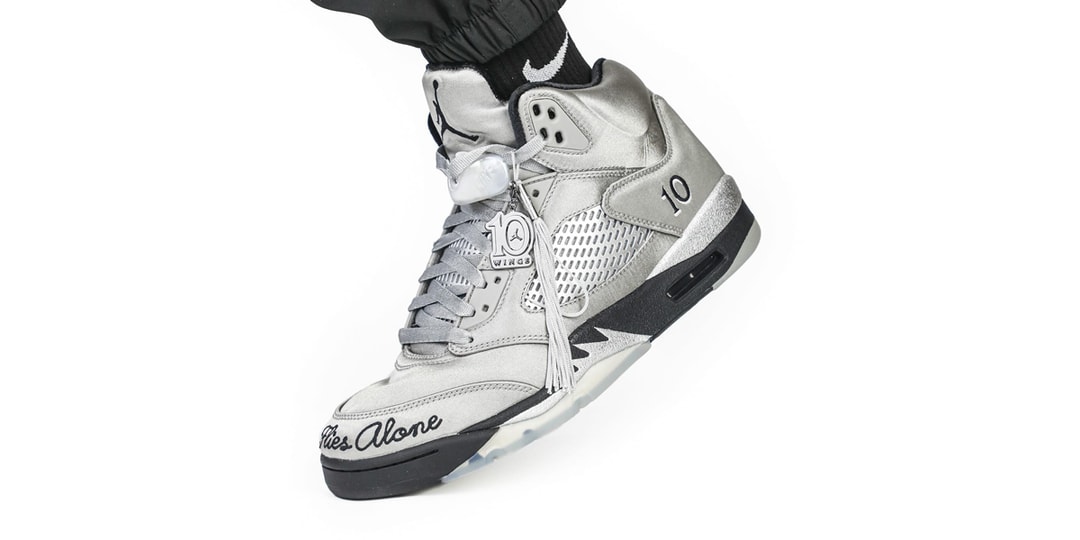

The company has already announced one lens this year – the 18-300mm F3.5-6.3 Di III-A VC VXD lens to RF mount and Z mount – and says five more are coming. Image: Tamron |

The financial results presentation also contained some more exciting news: Tamron plans to release six new models in 2025, up from the company's typical five lenses per year. That includes the already announced Tamron 18-300mm f/3.5-6.3 Di III-A VC VXD, which is Tamron's seventh model for Nikon Z-mount and the second model for Canon RF mount.