The best balance transfer credit cards to add to your wallet

When my now-husband and I bought our home, we anticipated making a few updates — new flooring, a fresh coat of paint, redoing our primary bathroom and adding some new light fixtures. But if you’ve ever renovated a house, you know how quickly one project turns into five. In our case, our small list became …

When my now-husband and I bought our home, we anticipated making a few updates — new flooring, a fresh coat of paint, redoing our primary bathroom and adding some new light fixtures.

But if you’ve ever renovated a house, you know how quickly one project turns into five. In our case, our small list became a nearly full remodel once we uncovered hidden issues: leaky windows, tile layered on top of more tile and a dangerous jumble of electrical wires.

At present, I actually love being a homeowner, but if you had asked me about it during the remodel, I may have had a different answer.

In truth, renovating and upgrading our home meant our savings were dwindling rapidly, so we turned to credit cards to keep projects moving along. This way, we could ensure the home we were already paying a mortgage on was move-in ready.

That’s where balance transfer credit cards saved us.

We consolidated all of our miscellaneous purchases and split the balances between two credit cards to focus on paying them off within the designated introductory annual percentage rate, or APR, periods.

It wasn’t always easy, but this kept us from paying a cent of interest (more on that in a bit).

So, if you’re staring down a high-interest balance or trying to catch your breath after a big unexpected expense, a balance transfer card can give you the breathing room you need.

The best balance transfer credit cards

- Citi® Diamond Preferred® Card (see rates and fees)

- Wells Fargo Reflect® Card (see rates and fees)

- Citi Double Cash® Card (see rates and fees)

- Blue Cash Preferred® Card from American Express

- Bank of America® Customized Cash Rewards credit card

- Blue Cash Everyday® Card from American Express

- Discover it® Cash Back

The information for the Discover it Cash Back card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Comparing the best balance transfer credit cards

Here are TPG’s top recommendations for the best balance transfer credit cards.

| Card | Best for | Welcome offer | Earning rates | Annual fee |

| Citi Diamond Preferred Card | Balance transfers | Introductory 0% APR offer on purchases for 12 months from the date or account opening and 21 months for balance transfers from the date of the first transfer (must transfer within four months of account opening, $5 or 5% balance transfer fee). After the introductory period, a variable APR of 17.24%-27.99% will apply, based on your creditworthiness. |

|

$0 |

| Wells Fargo Reflect Card | Financing credit card debt | 0% introductory APR on purchases and qualifying balance transfers for 21 months from account opening. After the introductory period, a variable APR of 17.24%, 23.74% or 28.99% will apply, based on your creditworthiness. Balance transfers made within 120 days qualify for the introductory rate and a 5% or $5 minimum fee. |

|

$0 |

| Citi Double Cash Card | Balance transfers with ongoing simple cash back | 0% introductory APR for 18 months on balance transfers, followed by a variable APR of 18.24% to 28.24% will apply, based on creditworthiness. An introductory balance transfer fee of 3% of each transfer (minimum $5) completed within the first four months of account opening; after that the fee is 5% of each transfer (minimum $5).

The Citi Double Cash Card is also offering $200 cash back after you spend $1,500 on purchases within the first six months from account opening. |

|

$0 |

| Blue Cash Preferred Card from American Express | Balance transfers and rewards on gas and U.S. supermarket purchases | 0% introductory APR on purchases and balance transfers for 12 months from the date of account opening, followed by a variable APR of 20.24% to 29.24% (see rates and fees).

New cardholders can also earn a $250 statement credit after spending $3,000 on eligible purchases within the first six months of card membership. |

Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout. |

$0 introductory annual fee, then $95 (see rates and fees) |

| Bank of America Customized Cash Rewards credit card | Preferred Rewards members | 0% introductory APR for your first 15 billing cycles for purchases and any balance transfers made within the first 60 days from account opening. After the introductory APR offer ends, a variable APR of 18.24% to 28.24% will apply based on your creditworthiness. A balance transfer fee of 3% will apply for 60 days from account opening, then 4% will apply.

New cardholders can also earn a $200 cash rewards bonus after spending $1,000 on purchases within the first 90 days from account opening. |

|

$0 |

| Blue Cash Everyday Card from American Express | Beginner cash back and 0% APR on purchases and balance transfers | 0% introductory APR on purchases and balance transfers for 15 months, then a 20.24% to 29.24% variable APR (see rates and fees).

Additionally, earn a $200 statement credit after you spend $2,000 on eligible purchases in the first six months of card membership. |

Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout. |

$0 (see rates and fees) |

| Discover it Cash Back | Balance transfers with bonus year-one rewards | 0% introductory APR for 15 months from the date of account opening for new purchases or balance transfers that post to your account by July 10, 2025. After the introductory APR expires, your APR will be 18.24% to 27.24% based on your creditworthiness.

This card will also match all the cash back earned during the new account’s first 12 consecutive billing periods. |

|

$0 |

Citi Diamond Preferred Card

Welcome offer: New applicants can receive an introductory 0% APR offer on balance transfers for 21 months from the date of the first transfer. Transfers must be completed within four months from account opening. After the introductory period, a variable APR of 17.24%-27.99% will apply, based on your creditworthiness.

Annual fee: $0.

Standout benefits: The 21-month 0% APR on balance transfers on the Citi Diamond Preferred gives you a long runway to pay off debt without interest snowballing. It’s one of the longest offers available, making it a great option if you have a larger sum to pay off. It also comes with no annual fee.

Keep in mind that there is a $5 or 5% balance transfer fee for each transfer, but if you use the full introductory period wisely, the interest savings can far outweigh the upfront cost. You’ll have four months from account opening to complete a balance transfer.

The Citi Diamond Preferred also gives you access to your FICO credit score and to Citi Entertainment for early ticket sales and special events.

Bottom line? If your goal is to get back on track financially, this card keeps things simple and stress-free.

For more details, read our full review of the Citi Diamond Preferred Card.

Apply here: Citi Diamond Preferred Card

Wells Fargo Reflect Card

Welcome offer: New applicants can receive a 0% introductory APR on purchases and qualifying balance transfers for 21 months from account opening. After the introductory period, a variable APR of 17.24%, 23.74% or 28.99% will apply, based on your creditworthiness. Balance transfers made within 120 days from account opening qualify for the introductory rate.

Annual fee: $0.

Standout benefits: The Wells Fargo Reflect Card is about simplicity and value, with one of the longest 0% introductory APR periods on the market. You’ll get 21 months of 0% APR on new purchases and balance transfers if you make the transfer within 120 days (four months) of account opening. A 5% or $5 balance transfer fee will apply.

This card is a great option for paying off existing debt and financing a major expense without interest. While the card doesn’t earn rewards or a welcome bonus, it does offer cellphone protection against damage or theft for up to $600 when you pay your monthly bill on the card (subject to $25 deductible). You’ll also have access to My Wells Fargo Deals for cash-back offers.

Bonus: The Wells Fargo Reflect Card has no annual fee.

For more details, read our full review of the Wells Fargo Reflect Card.

Apply here: Wells Fargo Reflect Card

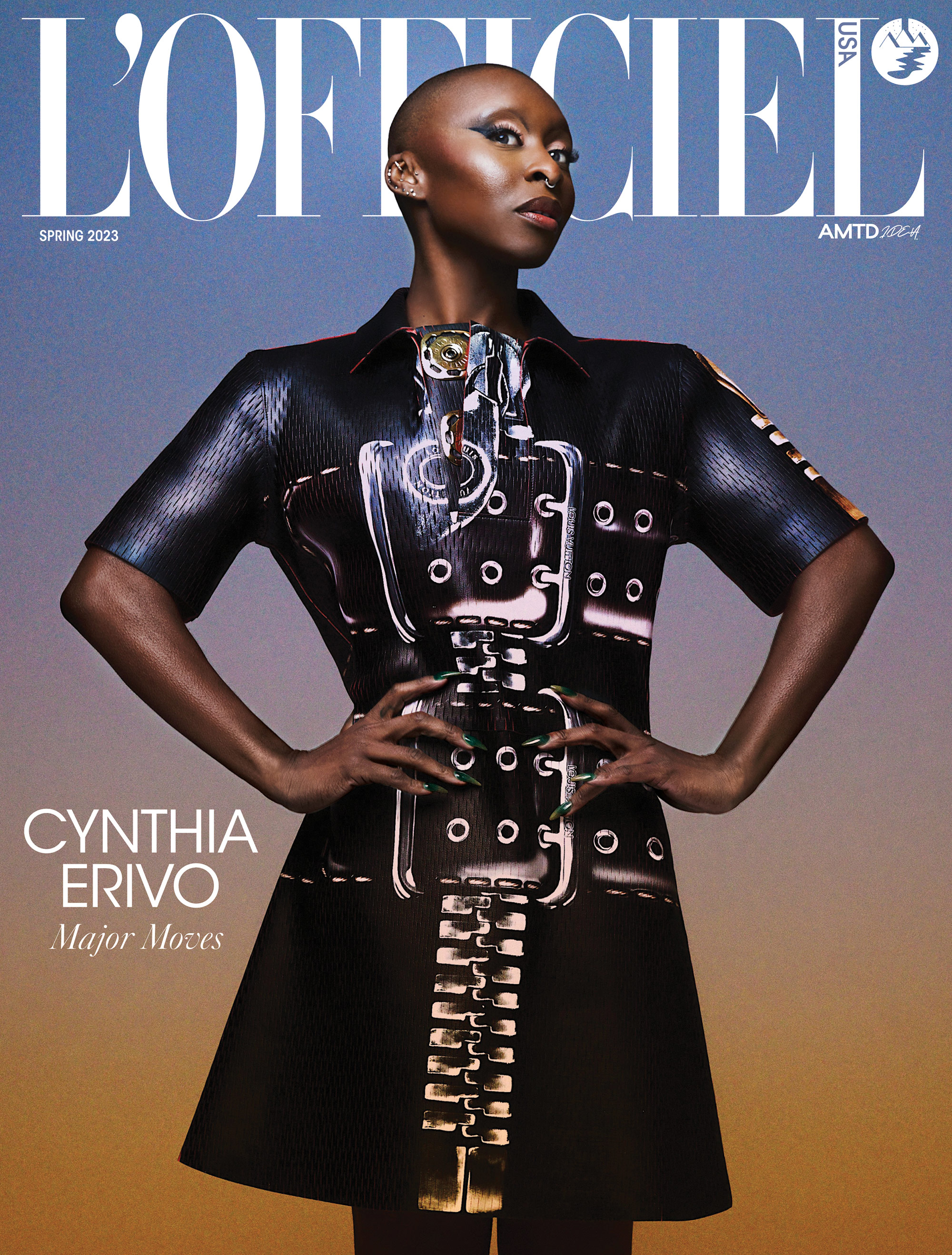

Citi Double Cash Card

Welcome offer: New applicants can receive a 0% introductory APR for 18 months on balance transfers, as long as the transfer is completed within four months from account opening. After the introductory period, a variable APR of 18.24% to 28.24% will apply, based on your creditworthiness. The Citi Double Cash Card is also offering $200 cash back after you spend $1,500 on purchases in the first six months from account opening. This bonus offer will be fulfilled as 20,000 ThankYou points, which can be redeemed for $200 cash back.

Annual fee: $0.

Standout benefits: The Citi Double Cash Card is one of the rare balance transfer cards that also delivers rewards. It offers 18 months of 0% introductory APR on balance transfers, and you’ll earn 2% cash back on every purchase — 1% when you buy and 1% when you pay. Remember that you won’t earn rewards on any balance transfer amounts; instead, it’ll count on new purchases when you use the card.

This card also allows you to convert your cash back into Citi ThankYou points, which opens the door to more flexible travel redemptions when paired with an eligible Citi card like the Citi Strata Premier℠ Card (see rates and fees).

The Citi Double Cash is a solid pick for those who want to consolidate debt and earn simple rewards long after their balance is paid off.

For the 0% introductory rate to apply, you’ll need to complete your balance transfer within four months. The balance transfer fee is only 3% for the first four months — after that, your fee will be 5% of each transfer ($5 minimum).

For more details, read our full review of the Citi Double Cash Card.

Apply here: Citi Double Cash Card

Blue Cash Preferred Card from American Express

Welcome offer: Earn a $250 statement credit after you spend $3,000 on eligible purchases within the first six months of account opening. This card also offers a 0% introductory APR on purchases and balance transfers for 12 months from the date of account opening, followed by a variable APR of 20.24% to 29.24%.

Annual fee: $0 introductory annual fee for the first year, then $95 (see rates and fees).

Standout benefits: The Blue Cash Preferred is a powerhouse for everyday spending, offering 12 months of 0% introductory APR on new purchases and balance transfers (then a variable rate of 20.24%-29.24%). A 3% balance transfer fee will apply.

It shines with standout cash-back rates: 6% at U.S. supermarkets (on up to $6,000 per year, then 1%), 6% on streaming services and 3% at U.S. gas stations.

Cardholders can also earn up to $7 back each month as a statement credit (up to $84 in a calendar year) after spending $9.99 or more on eligible subscriptions to a Disney Bundle. Enrollment is required; terms apply.

If you plan to earn the welcome bonus, aim to spend $3,000 early and complete your balance transfer within 60 days to lock in the introductory APR. But don’t spend for the sake of spending. Make sure your spending is strategic and necessary.

The balance transfer must be requested within 60 days of account opening for the 0% introductory APR.

I’d recommend this card if you’re looking for a solid cash-back card for supermarket and gas purchases once you’ve paid down your debt.

For more details, read our full review of the Blue Cash Preferred Card from American Express.

Apply here: Blue Cash Preferred Card from American Express

Bank of America Customized Cash Rewards credit card

Welcome offer: The Customized Cash Rewards card currently offers a $200 cash rewards bonus after you spend $1,000 on purchases within the first 90 days from account opening. This card also offers a 0% introductory APR for your first 15 billing cycles for purchases and any balance transfers made within the first 60 days from account opening. After the introductory APR offer ends, a variable APR of 18.24% to 28.24% will apply based on your creditworthiness.

Annual fee: $0.

Standout benefits: The Bank of America Customized Cash Rewards card offers a 0% introductory APR for 15 billing cycles on purchases and balance transfers made within the first 60 days. Because of this, I signed up for this card during our remodel.

I liked the idea of no annual fee and flexible rewards in a category of my choice. Options include gas, dining, online shopping and travel. Cardholders also earn 2% at grocery stores and wholesale clubs, and 1% on everything else, capped at $2,500 per quarter in combined bonus category spending.

What sets this card apart is the Bank of America Preferred Rewards program — members can boost their earnings by 25% to 75%, turning that 3% into as much as 5.25% cash back.

Because the period for earning the welcome bonus and making an eligible balance transfer is pretty short, I ended up forgoing the welcome offer to get the most out of the 15 months of my balance transfer. I also liked the 3% balance transfer fee, versus the 5% that other cards offered.

Now that I’ve paid off my balance transfer, I rotate my custom cash-back categories depending on what I’m using my other credit cards for and take advantage of BankAmeriDeals cash-back offers.

For more details, read our full review of the Bank of America Customized Cash Rewards credit card.

Apply here: Bank of America Customized Cash Rewards credit card

Blue Cash Everyday Card from American Express

Welcome offer: The Blue Cash Everyday Card currently offers a $200 statement credit after you spend $2,000 on eligible purchases in the first six months of card membership and a 0% introductory APR on purchases and balance transfers for 15 months (then a variable APR of 20.24% to 29.24%).

Annual fee: $0 (see rates and fees).

Standout benefits: I usually recommend this card to friends who are just getting into the credit card rewards game or who want a no-fuss card with solid perks. The 3% cash back at U.S. supermarkets and U.S. gas stations and on U.S. online retail purchases (on up to $6,000 per category annually, then 1%) adds up fast, especially if you’re like me and always order something from Target or Publix (my local grocery store).

Although I didn’t use this card for a balance transfer, I enjoy having it in my wallet for simple cash back with no annual fee. With a 0% introductory APR for 15 months on purchases and balance transfers, it doubles as a good short-term financing tool. A 3% balance transfer fee will apply.

Add in benefits like access to Amex Offers, a Disney Bundle statement credit, Home Chef statement credit and travel protections, and this card packs surprising value for no annual fee. Select benefits require enrollment.

For more details, read our full review of the Blue Cash Everyday Card from American Express.

Apply here: Blue Cash Everyday Card from American Express

Discover it Cash Back Credit Card

Welcome offer: Instead of a traditional welcome offer, the Discover it Cash Back Credit Card will match all the cash back earned during the first 12 consecutive billing periods that the new account is open. This card also offers a 0% introductory APR for 15 months from the date of account opening for new purchases or balance transfers that post to your account by August 10, 2025. After the introductory APR expires, your APR will be 18.24%- 27.24% based on your creditworthiness.

Annual fee: $0.

Standout benefits: The rotating 5% categories are actually pretty useful, especially since I can earn bonus rewards in categories where I would normally earn just 1% (like PayPal and Amazon).

When I was looking for a balance transfer, I already had this card in my wallet, and noticed I had an existing offer for 12 months at 0%. Knowing I would eventually open a new credit card when we were done paying down our debt, selecting this existing offer made sense for me. Which reminds me: Be sure to check your existing cards to see if you have any offers already available.

For new cardholders, the 15-month 0% APR window to reduce an older balance is a solid amount of time. A 3% balance transfer fee will apply.

Long-term, this card is great for earning 5% on bonus categories every quarter. The only catch? You have to activate the 5% categories before earning, but Discover makes it easy with reminders.

For more details, read our full review of the Discover it Cash Back Credit Card.

Learn more: Discover it Cash Back Credit Card

What to consider when choosing a balance transfer credit card

There are several factors to consider when picking a balance transfer card.

I wanted to consolidate small balances on several cards into one or two main accounts. I also wanted a low balance transfer fee and at least 12 months to pay my balances off completely. I didn’t want to pay an annual fee, but I did want a card that would serve me long-term in some capacity, so ongoing perks mattered.

I also wanted to be cognizant of how many new cards I’d open, as my now-husband and I weren’t married at the time. I knew a wedding and honeymoon were on the horizon, and that these events would be great opportunities to cash in on cards with high welcome bonuses, so I also considered these factors.

Fees and timing

When picking a balance transfer card, consider the introductory APR (you should aim for 0%), the balance transfer fee (which tends to vary between 3% and 5%) and the length of time you’ll have to pay off the balance transfer.

If you need to transfer a higher balance, looking for a lower fee and longer time may be beneficial. All the cards on our list offer a 0% APR for an introductory period of 12-21 months.

Remember that if you pay the minimum payment each month, you will likely not pay off your balance transfer in time. Instead, you’ll want to take your total, including the balance transfer fee, and divide it by the number of months you have to pay it off.

For example, if your total is $5,525 and you have 12 months to pay it off, you’ll want to pay $460.42 monthly. Otherwise, interest will accrue on the remaining balance at the variable APR.

Preferred rewards

Another factor to consider is how you’ll use the card after paying off your balance transfer. If the priority is more time, I’d suggest foregoing thinking about rewards.

If you’re more flexible in how long you need to pay off your balance, consider a rewards or cash-back program that aligns with your spending habits.

While these may not be the primary focus if you’re looking to transfer debt, some cards provide perks ranging from 1%-6% back on everyday purchases, which could add value if you use the card after transferring your balance.

Welcome bonus

Some balance transfer cards offer welcome bonuses to sweeten the deal, but these bonuses typically have a minimum spending requirement within the first few months of opening the card.

If you anticipate spending money on necessities (like groceries and utility bills) and can afford to hit the minimum spending requirement for the bonus before making the balance transfer, it can help offset the cost of the balance transfer fees or provide future rewards.

That said, if chasing a bonus will push you further into debt, skip it. When initiating the transfer, you’ll want your card to have a $0 balance to maximize the 0% APR window.

Annual fee

Most balance transfer cards — like the ones on our list — don’t charge an annual fee. The exception is the Amex Blue Cash Preferred, which waives its fee the first year and charges $95 after that. If you’re choosing a card with a fee, make sure its long-term rewards and benefits justify the cost.

However, if your only goal is to pay off a balance, stick to a no-fee option to keep things simple and affordable.

How we chose the best balance transfer credit cards

We rated the best cards based on introductory APR period, repayment length, transfer fees, and added value like rewards or long-term perks.

To learn about how TPG evaluates and chooses cards for our roundups, check out our methodology page.

Redemption options for balance transfer credit cards

Balance transfer credit cards aren’t typically known for flashy redemption perks. After all, their biggest value is helping you save on interest.

In my case, using a balance transfer card helped my now-husband and me pay off our remodel in 15 months while paying almost no interest. We chose credit cards with a 3% balance transfer fee, helping reduce costs where we could. Had it not been for those two balance transfers, we would have likely paid hundreds of dollars in interest.

Now, I still use those same cards—my Bank of America Customized Cash Rewards card for custom rotating 3% categories, and my Discover it for 5% bonus categories like Amazon and PayPal.

Bottom line

Sometimes, we end up with unexpected costs, whether it be through a home remodel, like me, or an unfortunate emergency.

If you accumulate high-interest debt, the right balance transfer credit card can give you breathing room and help you get back on track.

Pick a card with a 0% introductory APR, know the transfer fee, and track your payoff timeline carefully. The goal, after all, is to get it paid off during the 0% introductory window, so skip making the minimum payment and instead divide your total by the amount of time you’ve been given to take advantage of that low APR offer.

If you can afford to hit a welcome bonus spending requirement while planning your transfer, even better.

Once your balance is paid, some cards can continue delivering value, whether through rewards, perks or category bonuses.

Just remember: The real win is staying debt-free once you’ve paid things off.

For rates and fees of the Amex Blue Cash Preferred, click here.

For rates and fees of the Amex Blue Cash Everyday, click here.

/f871ef26-7798-46a2-9db3-fe949a2f050b--2016-0719_okra-couscous-salad_james-ransom-417.jpg?#)

.jpg)

.jpg)

.jpg)