Unique: Chase Sapphire Preferred 10% Anniversary Bonus Points

There’s a lot to love about the $95 annual fee Chase Sapphire Preferred Card (review). The card offers a great return on spending, some valuable perks, and excellent travel protection. This is an especially good time to apply, in light of the bonus that’s currently available, as lots of people should be eligible for the card.

There’s a lot to love about the $95 annual fee Chase Sapphire Preferred® Card (review). The card offers a great return on spending, some valuable perks, and excellent travel protection. This is an especially good time to apply, in light of the bonus that’s currently available, as lots of people should be eligible for the card.

In this post, I want to focus on one unique perk of this card, which is the 10% anniversary points bonus. How does this benefit work, how can you track it, and to what extent should it factor into your math with using this card?

How does the 10% Sapphire Preferred bonus work?

The Chase Sapphire Preferred has an excellent return on spending, as the card offers:

- 5x points on airfare, hotels, car rentals, vacation rentals, and cruises, booked through Chase Travel

- 3x points on dining, select streaming services, and online grocery stores

- 2x points on travel

- 1x points on all other purchases

In addition to that rewards structure, the card has an additional feature, which is that you receive a 10% anniversary points bonus. There are often questions about the exact details of how that works, so let me explain:

- Each account anniversary year, cardmembers receive bonus points equal to 10% of the total spending in points from purchases made with the card during the previous account anniversary year

- The 10% bonus doesn’t apply to the sign-up bonus or any bonus categories, but rather just to base spending

- There’s no registration required to take advantage of this, so you’ll automatically see the 10% bonus post shortly after your account anniversary

Just to be crystal clear, you earn this reward based on the rate of one point per dollar spent, meaning that if you spend $50,000, you earn 5,000 bonus points (even if all that spending is on dining, meaning you initially earned 150,000 points).

How can you track the Sapphire Preferred 10% points bonus?

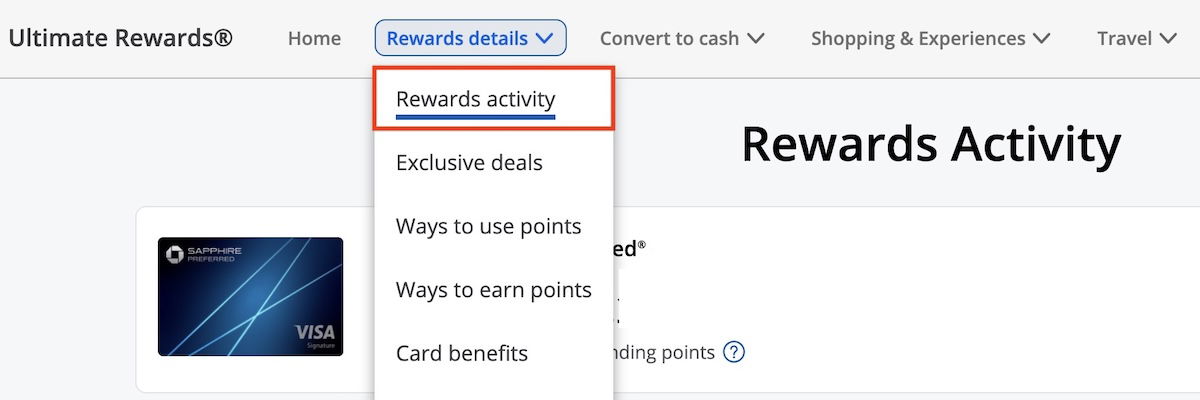

If you have the Chase Sapphire Preferred, how can you figure out when your 10% anniversary bonus post will post, and just how many points you’ll earn? Just log into your account, and go to the Ultimate Rewards section. Once there, click on “Reward details,” and then select “Rewards activity” in the dropdown.

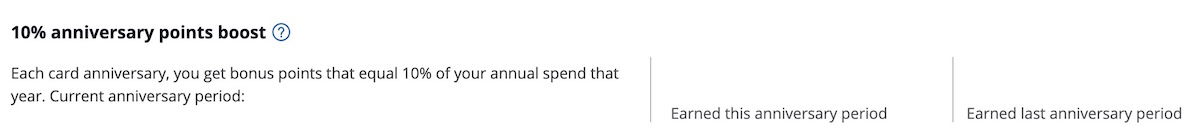

Once you’re on the next page, just scroll down, and you’ll see a section that reads “10% anniversary points boost.” This will display your current anniversary period, so that you have a sense of when you’ll next earn points with this perk. On top of that, it also shows the earned anniversary bonus points both for the current period, and for the last period.

So there’s not much guesswork here, but instead, Chase makes it pretty straightforward (which is nice, because all too often that’s not the case with card perks).

How much does the Sapphire Preferred 10% bonus matter?

To what extent should people care about the Chase Sapphire Preferred 10% anniversary bonus points, or factor it into their overall math when deciding whether to use the card? To state the obvious, with the 10% bonus, this card offers 3.1x points on dining, 2.1x points on travel, and 1.1x points on everyday spending (though of course those 0.1x points are earned after the fact).

I know that many people try to decide between this product and the Chase Sapphire Reserve® Card (review), which is the more premium version of the card. While there are many differences between the cards, the 10% anniversary bonus is exclusive to the less premium version of the card.

Interestingly, the 10% bonus means that the Sapphire Preferred is actually more rewarding than the Sapphire Reserve for dining and non-bonused spending (in addition to having the exclusive bonus categories on streaming and online groceries).

So while I’d consider that to be a mild advantage, I don’t think that will change the math for many people when deciding between cards. A few thoughts:

- There are other great cards with bigger bonus categories for dining or a better return on everyday spending, so it’s not like that 10% bonus puts this card into some incomparable league

- You should get the Chase Sapphire Reserve if you value airport lounge access (including a Priority Pass membership and Chase Sapphire Lounge access), and if you value the 3x points on dining, and then the $300 travel credit will help justify the annual fee

- Ultimately you get the Chase Sapphire Preferred because it’s one of the most well-rounded travel rewards cards, given its reasonable annual fee, good rewards structure, great redemption options, and valuable travel and rental car protection

To keep things simple, personally I’d view the 10% bonus points as a nice treat, but wouldn’t put too much thought into it beyond that.

Bottom line

The Chase Sapphire Preferred is one of the most lucrative travel rewards cards out there. The card has a great rewards structure, and one of the often overlooked aspects of that is the 10% anniversary bonus points. Each cardmember anniversary, you receive 10% bonus points, based on your spending over the past year, at the rate of one point per dollar spent.

If you have the Chase Sapphire Preferred, what’s your take on the 10% anniversary bonus, and how do you factor it into your math?