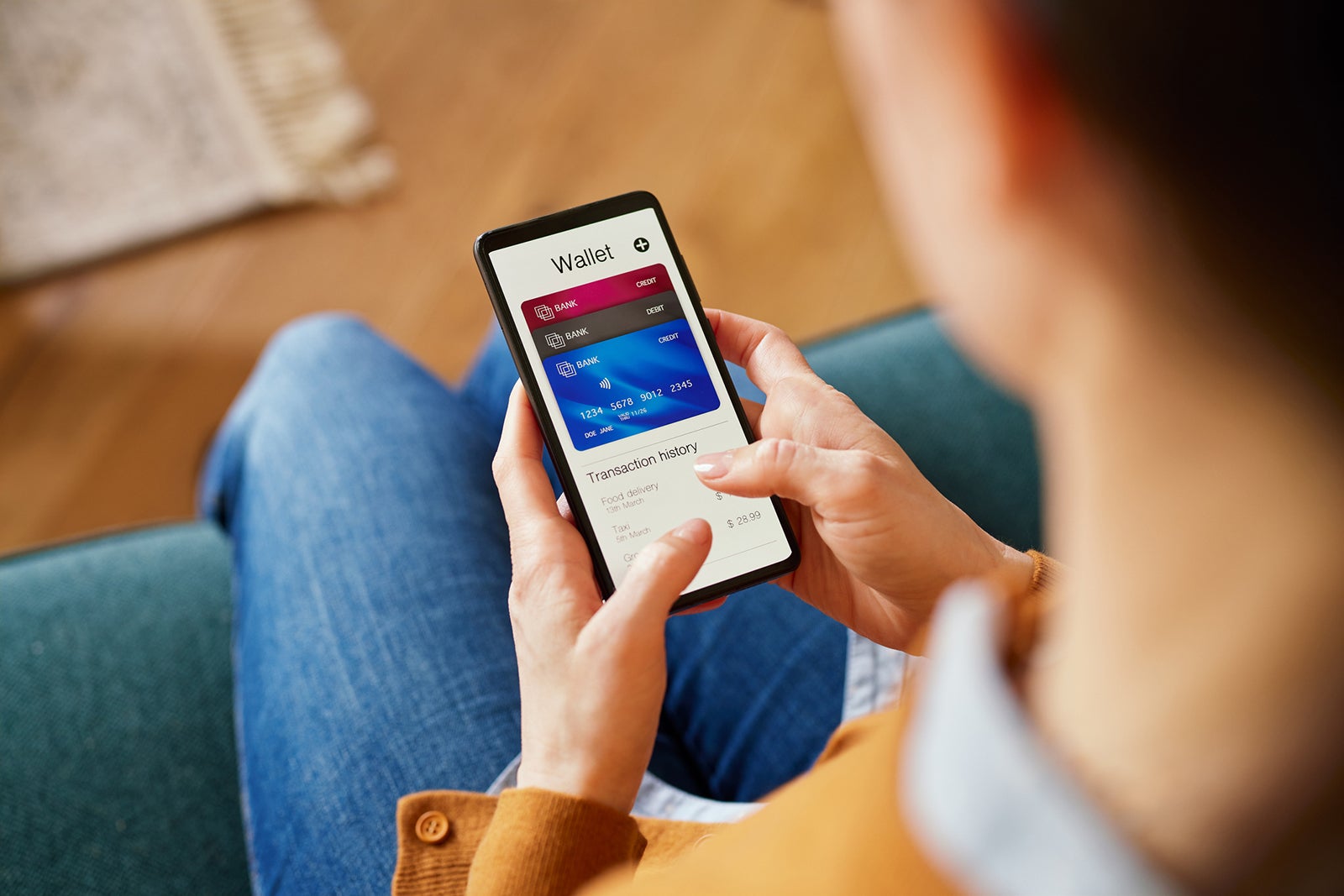

4 ways to recession-proof your credit score

Editor’s note: This post has been updated with additional information. With our economic future unknown and the ever-looming possibility of a recession, it’s more important than ever for you to have a solid financial footing. This includes ensuring your credit score is in tip-top shape. Having a solid credit score gives you a better chance …

Editor’s note: This post has been updated with additional information.

With our economic future unknown and the ever-looming possibility of a recession, it’s more important than ever for you to have a solid financial footing.

This includes ensuring your credit score is in tip-top shape. Having a solid credit score gives you a better chance of approval for credit cards as issuers get stricter with approvals. Plus, with a good credit profile, you can take advantage of welcome offers, including those that offer cash back to put extra money directly back into your pocket.

Let’s look at four ways to recession-proof and protect your credit in the long term.

Keep your accounts active

The easiest thing you can do to protect your credit is to make sure that you are keeping your credit card accounts active, especially your no-annual-fee cards. This demonstrates to issuers that you are utilizing your full lineup of cards to prevent them from closing any of your accounts.

We recommend:

- Using all of your cards at least a few times a year, even if you just make a small purchase, such as a coffee or a pack of gum

- Putting small recurring charges like streaming services on cards you don’t use often to ensure they remain active

- Following our No. 1 commandment of credit cards: Pay your balance in full on these cards after you make these purchases

Ensuring your credit card accounts remain active is a simple way to maintain a good credit score. That’s because closing a card can reduce the length of your credit history and your overall total credit, which lowers your overall credit score.

It’s pertinent to keep these no-annual-fee cards open as “unused cards that don’t hold an annual fee are particularly susceptible to being closed as issuers mitigate their risk,” says Greg McBride, chief financial analyst at Bankrate.

Using your cards frequently reduces the chances of your credit limits being lowered and accounts being closed, which could negatively affect your credit score.

During a recession, banks and credit card companies will look for any and every way possible to mitigate risks and prevent delinquencies. So, how does that translate to them shutting down unused accounts?

“From the issuer’s perspective, if the card has been sitting in a drawer unused for the last year, what’s the chance the consumer is going to suddenly start using that unless they are in a bind?” said McBride. “That’s the risk issuers are trying to mitigate.”

While issuers encourage spending, they don’t want people to spend more than they will be able to pay off. So, dust off those no-annual-fee cards and use them on a few small purchases. That way, those accounts are more likely to stay open and your credit limits are more likely to stay high, both of which help you maintain a high credit score.

Related: How credit scores work

Pay off debt

It’s important to reduce your debt as much as possible before the next financial downturn. When a recession comes, you will want to have as little debt as possible because:

- Paying off balances now gives additional wiggle room in your budget.

- You’ll have one less monthly payment to make.

- Reducing debt allows you to save more money in your emergency fund.

Our recommended strategy to pay off your debt is to:

- Prioritize paying debt with higher interest rates first (such as credit cards).

- Then look at auto loans, mortgages and personal loans.

- Consider a balance transfer, which moves high-interest credit card debt to a card with a 0% introductory annual percentage rate to save on interest payments.

It’s important to note that paying off nonrevolving credit (such as a mortgage) won’t help your credit score. And these types of credit tend to have lower interest rates, so it may not make sense to prioritize them unless you are close to paying them off.

Reducing your balance across all cards will result in a higher credit score because it will reduce your credit utilization ratio. This is how much of your total available credit you’re using, and it makes up 30% of your credit score. If your credit utilization rate is higher than this percentage, you will likely have a lower credit score.

Save, save and save more

While this doesn’t directly affect your credit score, unexpected expenses may pop up that you can’t fully cover in the event of a recession. Having an adequately funded savings account can prevent you from going into further debt, which can potentially lower your credit score.

Related: How to check your credit score for absolutely free

Be mindful of financial reviews

Financial reviews became prevalent after the 2008 recession and are typically most common with American Express. A financial review is when issuers look at and evaluate your financial information and determine if you can manage your credit and repay debt.

Financial reviews can be triggered by several things, including:

- Making unusually large purchases

- Maxing out your entire credit limit, then paying it off and making more purchases within the same billing cycle

- Opening and closing credit cards frequently (“credit card churning”)

- Rapidly increasing or decreasing your spending

- Using most of your credit limit

The exact process and pattern of behaviors that trigger a review differ from issuer to issuer. Note that even normal behavior can trigger a review.

Generally, American Express will notify you that your ability to charge has been suspended and provide a way for you to reach out for more information. However, if Chase suspects you of risky behavior, it may shut down all of your accounts and only notify you retroactively.

In both scenarios, there are steps you can take to help get your accounts back in good standing, but those processes are an added stress. With reviews likely becoming more frequent during a recession, it’s important to be mindful of your credit behavior.

Related: Understanding the Amex financial review process

Have a plan when applying for new cards

According to Bankrate’s McBride, issuers in a recession get much pickier about who they give credit to and how much they allocate. They want to do business with high-quality borrowers with minimal risk of default.

While those with credit scores of 700 and up are likely to be OK, those hovering below that may have a little more trouble getting approved for new cards. If you don’t have a high credit score, you may get declined for some credit cards, which can temporarily lower your credit score.

It’s also important to note that each time you apply for a new card, you incur a hard inquiry on your credit report. These tend to lower your credit score (usually by less than five points) but generally won’t have an impact on your score after a few months. After two years, they should fall off your credit report.

However, if you are going to apply for new credit cards, make sure you have a clear plan in place before applying.

Prior to going on an application spree, analyze your credit card goals and what cards will be best suited for your wallet. Be especially mindful of issuer-specific rules. For example, Chase’s 5/24 rule means you’ll probably want to apply for Chase cards before non-Chase cards.

If you do apply for new cards, make sure you can pay any balance you rack up. And if the card offers a welcome bonus, make sure you can meet the minimum spending requirement without overextending yourself financially. Be sure to keep an eye out for limited-time welcome bonuses across cards on your wishlist.

Related: 10 ways to meet the spending requirements and earn the bonus on a new card

Bottom line

Regardless of whether we are in an economic boom or bust, building and maintaining good financial habits can help recession-proof your credit score.

You should always aim to practice responsible credit card habits:

- Paying off your bills in full each month

- Never missing a payment

- Avoiding using your credit card as an emergency fund

- Staying on top of your credit score and reports

Related: Best credit cards

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg)

.2%20(1).jpg)