Applying for a new credit card after closing on your mortgage

Editor’s note: This is a recurring post, regularly updated with new information and offers. Congratulations! You’ve just bought (or refinanced) a house! Or, maybe you’re considering the possibility. What does this mean if you’re an avid traveler who applies for travel rewards credit cards regularly? Typically, buying or refinancing a house means temporarily putting off …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

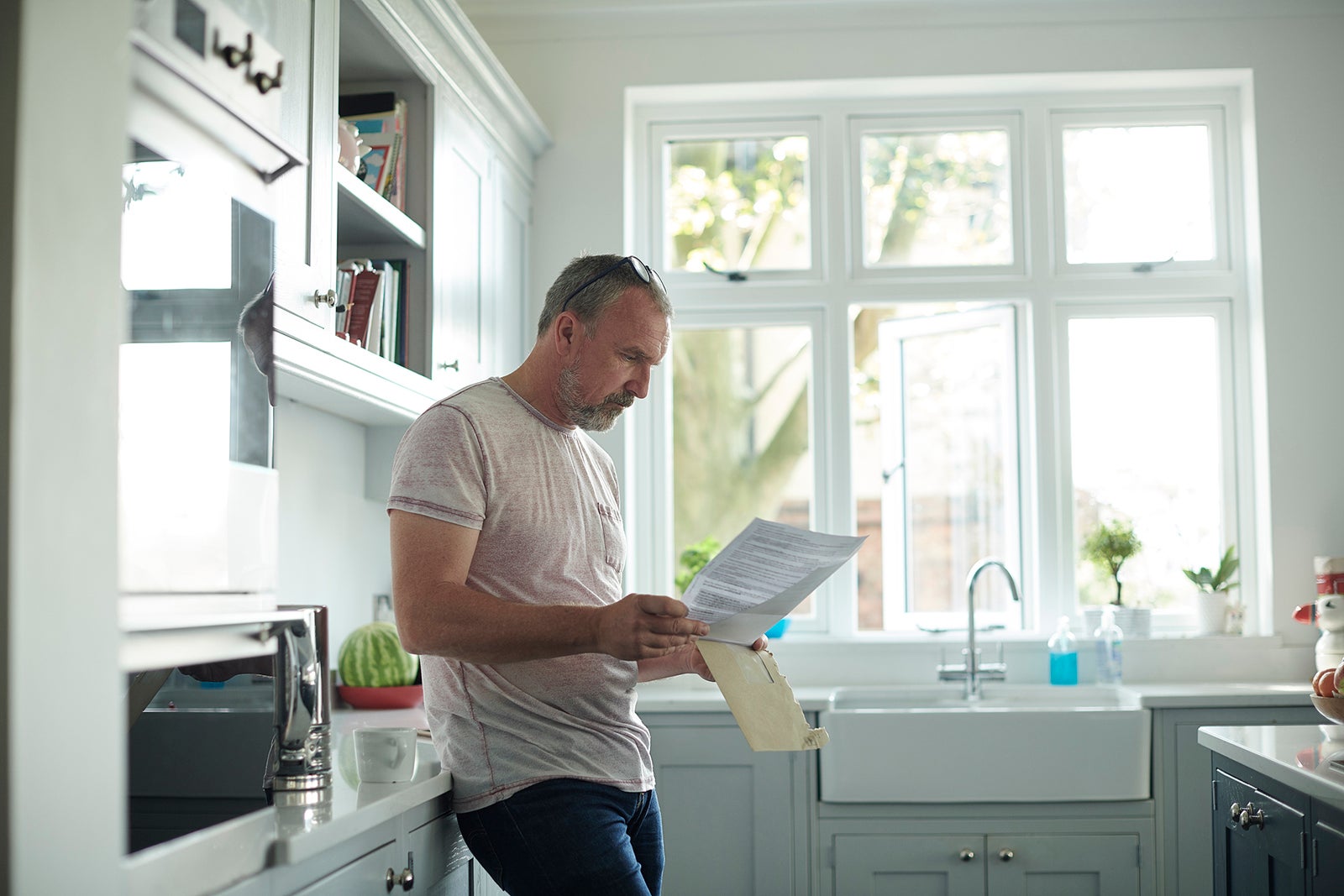

Congratulations! You’ve just bought (or refinanced) a house! Or, maybe you’re considering the possibility.

What does this mean if you’re an avid traveler who applies for travel rewards credit cards regularly? Typically, buying or refinancing a house means temporarily putting off getting the latest and greatest cards.

But just how long after closing on your mortgage do you need to wait to apply for your next travel rewards credit card? We talked to a mortgage industry professional to find out some of the dos and don’ts during the mortgage process and how long you should wait before applying for new credit cards.

Related: The best travel credit cards

Keep the status quo during the process

Mark Karetskiy, loan officer and branch leader for the Karetskiy Lending Team with Movement Mortgage, sends prospective homebuyers a list of “Ten Mortgage Commandments of Buying a Home.” Among the commandments is “Thou shalt not originate any kinds of inquiries into your credit.”

Related: TPG’s 10 commandments of credit card rewards

“Will applying for a travel rewards credit card before closing on your purchase or refinance disqualify you from obtaining the financing?” he said. “No, not necessarily.”

However, Karetskiy says it could. And it will likely cause more work, time and stress for both you and your loan officer.

“The lender’s job is to make a yes-or-no decision on an applicant’s request for credit based on the applicant’s current and past two-year income, credit and asset history,” he continued. “It is in the best interest of anyone requesting credit to keep the status quo on everything related to their qualifications, most importantly, their credit.”

Although adding a new credit card doesn’t have to mean adding debt if you’re paying your balances in full every month, your loan officer doesn’t know whether you intend to carry a balance on any new credit cards. You’ll need to be prepared to provide more documentation to help the lender fully understand the debt obligations associated with the card as part of your overall financial picture.

Related: Here are 3 reliable ways to pay off credit card debt

The wait is over

For a home purchase, it’s best to wait at least a full business day after closing before applying for new credit cards to ensure your loan has been funded and disbursed.

“Until you have the keys, don’t do anything,” Karetskiy said. “Even if you’ve signed and received confirmation that your lender has funded, the title company still needs to disburse the money. Until they do, you’re not really done.”

The guidance changes slightly for a refinance on a primary residence because the closing date is not the funding date. With refinances, the borrower has a three-day right of rescission, which means you have three business days after closing to rescind or cancel your mortgage loan. Your refinance is not funded until these three days have passed.

“Therefore, on refinances, it is best to wait until you’ve received confirmation from your loan officer or lender that your loan has officially been funded and disbursed prior to resuming regular use of your credit,” Karetskiy explained.

Related: Credit card strategies for mortgage and home loan applicants

Apply after closing

Once you’ve received confirmation that your closing is complete, you may want to apply for a new rewards credit card immediately. Typically, there are lots of expenses involved in moving and setting up a new house, especially for first-time buyers.

Since many credit cards require spending a minimum amount — often between $3,000 and $5,000 within a certain number of months — in order to receive a welcome bonus, it’s fairly easy to earn a valuable welcome bonus with the purchases you’ll need after buying a home.

You may need furniture, lawn equipment and appliances, and you can pay for all of these with your new rewards card.

Related: The best credit cards and strategies for maximizing home improvement spending

Impact on your credit score

While everyone’s situation is different, applying for a new credit card shortly after closing on your mortgage can potentially lower your credit score. Adding a mortgage means you’ve opened new credit, increased your total amount owed, affected your credit mix and decreased the length of your credit history. Additionally, since it’s a new account, you have no payment history associated with it.

“If someone just closed on a mortgage, they are impacting every factor that goes into their FICO score,” Karetskiy said. “So, it’s safe to say that adding a new credit card in addition to a new mortgage in a short time frame is likely going to decrease your scores.”

Related: When you should (and shouldn’t) worry about a credit score drop

If you’ve applied and been denied

Sometimes, a credit card application relatively close to your home purchase may result in a pending and denied application, likely due to an increased number of recent inquiries. Typically, a lender will run your credit several times during the homebuying or refinance process, shopping for mortgage rates.

You may also have inquiries about setting up utility services at your new home since some providers require a credit check before completing any work.

If you experience a pending approval or denial, your best bet for approval is to call the respective issuer’s reconsideration line to discuss your situation and hopefully overturn the denial.

Related: Your guide to calling a credit card reconsideration line

Bottom line

Buying a home is typically the biggest purchase of your life, and it often requires waiting until the process is complete before applying for new credit cards. But after you’ve received the OK from your lender and title company that everything’s funded, you’ll be ready to dive right back into boosting your points and miles balances one can of paint or insurance payment at a time.

Just remember that opening any new lines of credit, whether it be credit cards, personal loans or car loans, can lengthen (or sometimes even jeopardize) the homebuying or refinance process. The rewards credit card landscape is vast, and a few months of patience is all you need to have the best of both worlds.

.jpg)