Are Delta & Amex Planning New Super Premium Credit Card?

There’s no denying that premium credit cards are all the rage nowadays, and annual fees are reaching new heights. The Chase Sapphire Reserve is undergoing a refresh, a new Chase Sapphire Business is launching, and the Amex Platinum is undergoing some updates later this year.

There’s no denying that premium credit cards are all the rage nowadays, and annual fees are reaching new heights. The Chase Sapphire Reserve is undergoing a refresh, a new Chase Sapphire Business is launching, and the Amex Platinum is undergoing some updates later this year.

So here’s another fun credit card topic. Could Delta soon issue (by far) the highest annual fee co-branded credit card in the United States? It would appear so.

New premium Delta credit card on the way?

View from the Wing flags how a Reddit user shares that there’s a new Delta Amex card in the works, above the current Delta Reserve Card (which is Delta’s most premium credit card). The user shares no other details, but points out how they also shared the Medallion program overhaul days before the official announcement, and before details leaked anywhere else. So there’s definitely some credibility there.

For what it’s worth, this isn’t the first time that we’ve heard of this general concept. During Delta’s November 2024 Investor Day presentation, Delta President Glenn Hauenstein hinted at the possibility of a more premium card. He acknowledged that “we’ve got the Reserve Card out there,” but asked “is there even a better card?” He finished by saying “we’ll put on our thinking caps on that.”

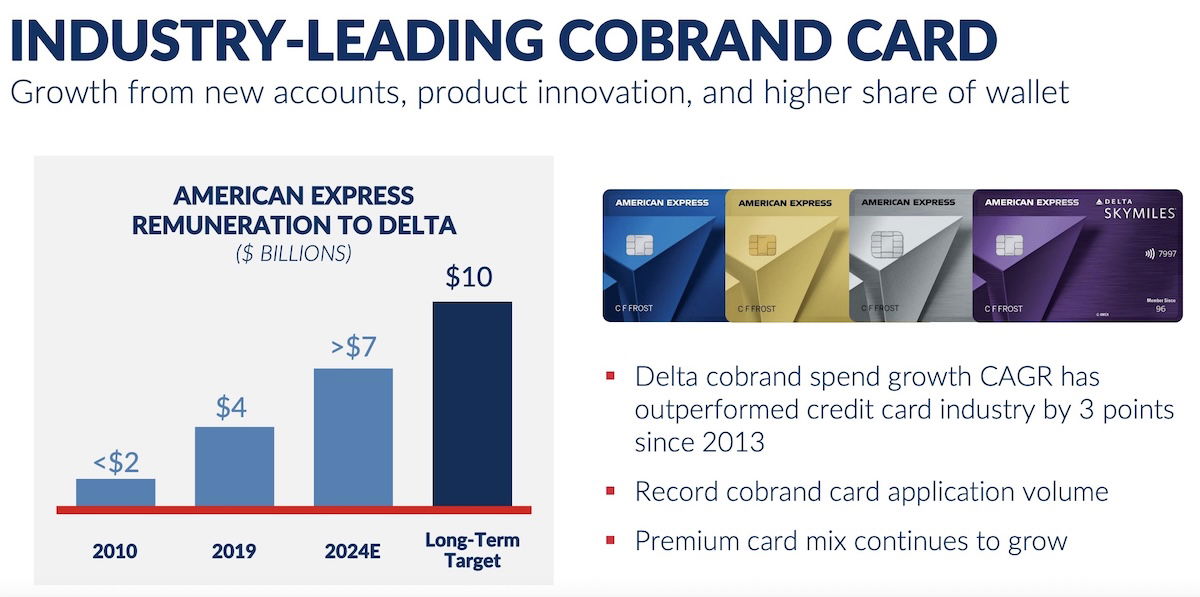

We know that for US airlines, loyalty programs, and in particular co-brand credit cards, are one of the biggest sources of profit. Delta’s renumeration from its co-brand Amex portfolio is currently around $7 billion annually, though the airline is hoping to increase that to $10 billion.

However, the timeline with which that happens keeping being pushed back. Given how competitive the credit card space has become, including the increased popularity of transferable points cards, I imagine that poses a challenge for Delta. So I suppose a super premium card might be part of that strategy.

Is there a limit to how “premium” cards can get?

The popularity of premium credit cards has exploded in recent years. I’d say this largely comes down to several factors, including the following:

- The cards largely actually have good value propositions, and are easy to justify, at least for savvy consumers

- Demand for premium travel continues to be through the roof, and it’s clear younger generations are happy spending their disposable income on travel experiences more than ever before

- We live in an era where people feel the need to “keep up” (made worse by social media), and I think the travel experience is a large part of that

We’ve gotten to the point where $600-800 annual fees are normalized. So could we see annual fees of $1,000+? What about $5,000+? In theory, I can see how this could be a very appealing segment to card issuers — not only could those annual fees generate significant revenue, but people spending that much on an annual fee are also likely to spend a lot on their cards, which is another way card issuers make money.

The issue is, what kind of a value proposition could Delta come up with that would make the card worthwhile? Elite status isn’t worth as much as it used to be. Lounge crowding is a major issue. First class upgrades are rare. So would a premium card just be about giving people even more priority beyond existing card members? After all, so many “benefits” nowadays are just about rearranging priority for experiences. Or could we see something else like, Delta One Lounge access, automatic elite status, etc.?

It’s anyone’s guess how this plays out, but I’m inclined to believe that something is in the works here. Delta already has four tiers of credit cards, so what’s a fifth tier, I suppose?

Bottom line

Delta is reportedly working on a new premium card, a tier above the current premium card. While we don’t have any additional details as of now, I’d expect this card might have a four-figure annual fee. The question is what kind of perks would be lucrative enough for someone to consider the card.

What do you make of the concept of an even more premium Delta credit card?