The 6 best Visa cards for Costco purchases — plus a Mastercard ideal for Costco.com shopping

Editor’s note: This is a recurring post, regularly updated with new information and offers. Many people love Costco because of its wide variety of products (and the free sample stations you can pick from while you shop!) However, some don’t like the retailer’s restrictions on payment options. For most purchases, Costco only accepts Visa credit …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Many people love Costco because of its wide variety of products (and the free sample stations you can pick from while you shop!) However, some don’t like the retailer’s restrictions on payment options.

For most purchases, Costco only accepts Visa credit cards — meaning you can’t use a Mastercard or Amex to pay. An exception to this rule is Costco.com purchases, which allow for Mastercard to be used.

Let’s review which Visa cards are the most rewarding ones to use the next time you check out at Costco.

Costco Anywhere Visa Card by Citi

Annual fee: $0 (with paid Costco membership)

Welcome bonus: None

The first pick is the most obvious one, the cobranded Costco Anywhere Visa® Card by Citi (see rates and fees). This card earns cash back at the following rates:

- 5% cash back on gas purchased at Costco warehouse locations worldwide and 4% cash back on other eligible gas and EV charging purchases (on the first $7,000 in combined purchases per year and then 1% cash back thereafter)

- 3% cash back on restaurant and eligible travel purchases worldwide

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

The sweet spot for this card is gas purchases, although note the cap of $7,000 applies to gas purchases made at both Costco warehouses and other gas vendors.

Unfortunately, the card doesn’t offer a welcome bonus, but because it doesn’t charge an annual fee (with a paid Costco membership), you can rack up cash rewards with no out-of-pocket cost.

The cash back earned on the card is redeemed once a year as a reward certificate that comes after your February billing statement closes. Once you have the reward certificate, you can redeem it for merchandise or cash.

Read our full review of the Costco Anywhere Visa Card

Apply here: Costo Anywhere Visa Card

Chase Freedom Unlimited

Annual fee: $0

Welcome bonus: Earn an additional 1.5% cash back on everything purchased (on up to $20,000 spent in the first year) – worth up to $300 cash back.

Since most cards don’t offer bonus categories specific to warehouse clubs like Costco, your best bet is often to use a card that offers a strong return on everyday spending. Among all the Visa cards, none is better in this category than the Chase Freedom Unlimited®. This no-annual-fee card offers 1.5% cash back on purchases with no cap.

If you also hold a premium Ultimate Rewards-earning card such as the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® or the Ink Business Preferred® Credit Card, you can redeem cash back rewards as Ultimate Rewards points, effectively increasing your return on all purchases from 1.5% to 3%.

This could definitely be worth considering, especially if you’re interested in redeeming for awards rather than only receiving straight cash back. With this card (provided you also have another Ultimate Rewards-earning card in your wallet), you have the option to transfer rewards to a variety of travel partners.

Read our full review of the Chase Freedom Unlimited

Apply here: Chase Freedom Unlimited

Chase Freedom

Annual fee: $0

Welcome bonus: None

Although this card is no longer open to new applicants, it’s sometimes confused with the Freedom Unlimited or Chase Freedom Flex®. Where the Chase Freedom® differs from other cards in the same family is its earning structure — otherwise, it has the same welcome bonus, redemption options and no annual fee.

With the Chase Freedom, you’ll earn 5% back on your first $1,500 spent on rotating quarterly bonus categories (activation required), and 1% on all other purchases. Wholesale clubs like Costco normally appear on the bonus calendar at least once a year, giving you the opportunity to earn up to 5% back during this time frame.

The information for the Chase Freedom has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Chase Sapphire Preferred Card

Annual fee: $95

Welcome bonus: Earn 60,000 bonus points after spending $4,000 on purchases in the first three months from account opening.

Due to its wholesale prices, Costco is a go-to for many shoppers looking to buy big-ticket items such as TVs and jewelry. If you plan to make a large purchase at this retailer, you might want to consider using this card due to its purchase protection policy.

With the Chase Sapphire Preferred, you’re covered for theft, damage or “involuntary and accidental parting” on eligible items for up to 120 days after you made the purchase (charging it to this card, of course). The policy will replace, repair or reimburse you for up to $500 per claim, with a maximum of $50,000 per account.

Even if you don’t need this coverage, the Chase Sapphire Preferred Card could be worth using on Costco purchases since it earns valuable Ultimate Rewards points. However, you’ll only get 1 point per dollar spent at this retailer.

Read our full review of the Chase Sapphire Preferred

Apply here: Chase Sapphire Preferred

Alaska Airlines Visa Signature credit card

Annual fee: $95

Welcome bonus: Earn 70,000 bonus miles plus Alaska’s Famous Companion Fare™ ($99 fare plus taxes and fees from $23) after making $3,000 or more in purchases within the first 90 days of account opening.

This pick may be surprising to some, since it doesn’t offer any bonuses on spending at Costco. Still, the Alaska Airlines Visa Signature® credit card earns solid rates in specific categories including:

- Unlimited 3 miles per dollar spent on eligible Alaska Airlines purchases

- Unlimited 2 miles per dollar spent on eligible gas, EV charging station, cable, streaming and local transit purchases

- Unlimited 1 mile per dollar spent on all other purchases

According to TPG’s February 2025 valuation, TPG values these miles at 1.45 cents apiece.

Further Reading: Maximizing redemptions with Alaska Airlines Mileage Plan

From free stopovers on one-way awards to competitive premium cabin flights on Cathay Pacific and Starlux, Mileage Plan is an incredibly valuable program, and shopping at Costco can help you rack up miles quickly.

Read our full review of the Alaska Airlines Visa Signature card.

Apply here: Alaska Airlines Visa Signature

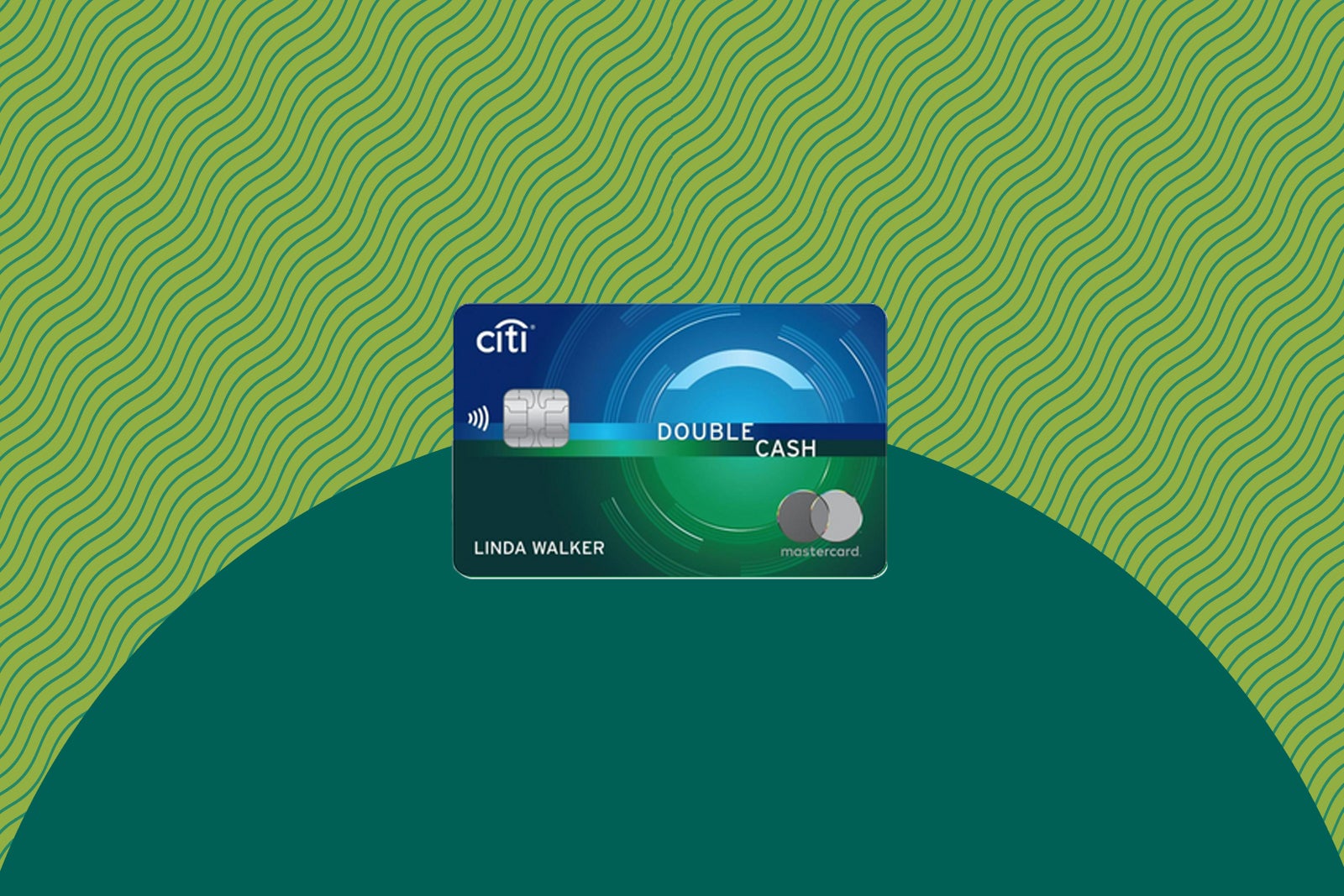

Citi Double Cash Card

Annual fee: $0

Welcome bonus: Earn $200 in cash back after spending $1,500 on purchases in the first six months of account opening.

The Citi Double Cash® Card (see rates and fees) has a straightforward earning structure. Cardholders earn a total of 2% cash back on purchases: 1% when you buy and 1% as you pay for your purchases. There are no bonus categories to worry about or caps on how much cash back you can earn.

Keep in mind that the Double Cash card is a Mastercard and, therefore, will only work when used for purchases at Costco.com. Cash back is earned in the form of Citi ThankYou points, so if you also hold a Citi card that has transfer partners such as the Citi Strata Premier℠ Card (see rates and fees), earning 2% cash back can be a great way to rack up rewards toward travel.

Read our full review of the Citi Double Cash review.

Apply here: Citi Double Cash

Capital One Spark Miles for Business

Annual fee: $0 introductory annual fee the first year, then $95 after.

Welcome bonus: Earn 50,000 bonus miles after spending $4,500 on purchases within the first 3 months of account opening.

For business owners, the Capital One Spark Miles for Business is a great option for Costco.com purchases. The card earns 2 miles per dollar spent on all purchases plus 5 miles per dollar spent on hotels, vacation rentals and rental cars booked through Capital One Travel. For business owners who often shop at Costco, opt for online shopping as this card is a Mastercard and can help you rack up your Capital One Miles.

The card also offers employee cards at no additional cost, so you maximize your earning power via employee spending as well. Best of all, miles earned can be transferred to Capital One’s 15-plus transfer partners.

Read our full review of the Capital One Spark Miles for Business review.

Learn more: Capital One Spark Miles for Business

Bottom line

Picking the right card to use at Costco can be a challenge, between the general lack of bonus categories and the Visa-only policy — with the exception of Costco.com allowing for Mastercard. Still, you can maximize your Costco spending by using the right card to earn cash back, points or miles each time you check out.