The 8 best no-annual-fee cash-back credit cards

Editor’s note: This is a recurring post, regularly updated with new information and offers. Points and miles enthusiasts love to maximize their travel redemptions and relish in their cardholder benefits that help offset high annual fees. Others prefer a simpler approach, utilizing one card that gives them cash back on their purchases without annual fees. …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Points and miles enthusiasts love to maximize their travel redemptions and relish in their cardholder benefits that help offset high annual fees. Others prefer a simpler approach, utilizing one card that gives them cash back on their purchases without annual fees.

If you’re one for the solo-card approach, one of your main considerations should be whether you’re going to use the card at home, abroad or a mix of both. Chances are, if you don’t like annual fees, you’re not going to like incurring foreign transaction fees either.

Although high annual fee cards can be worth it if you can maximize benefits and redemptions, there are good ways to earn cash back instead of points and miles on your spending.

Let’s take a look at the best no annual fee cash back cards.

Best cash-back cards with no annual fee

- Bank of America® Customized Cash Rewards credit card: Best for elevated cash back in the category of your choice

- Capital One Quicksilver Cash Rewards Credit Card: Best for fixed-rate cash back on all purchases with no foreign transaction fees

- Capital One Savor Cash Rewards Credit Card: Best for elevated cash back on dining and entertainment with no foreign transaction fees

- Chase Freedom Unlimited®: Best for fixed-rate cash back on all purchases and elevated cash back on Lyft

- Chase Freedom Flex®: Best for elevated cash back on rotating categories and Lyft

- Citi Custom Cash® Card: Best for a wider range of elevated cash back in the category of your choice

- Citi Double Cash® Card (see rates and fees): Best for fixed-rate cash back on purchases when you buy and when you pay

- Discover it® Cash Back Credit Card: Best for elevated cash back on rotating categories, both in your first year and with no foreign transaction fees

The information for the Citi Custom Cash and Discover it Cash Back cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bank of America Customized Cash Rewards credit card

Welcome bonus: $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening.

With the Bank of America Customized Cash Rewards credit card, you can earn 3% cash rewards in one category of your choice: gas and EV charging stations, online shopping/cable/internet/phone plans/streaming, dining, travel, drugstores/pharmacies or home improvement/furnishings. You can also earn 2% cash rewards at grocery stores and wholesale clubs — but your 3% and 2% earnings are only on the first $2,500 of spending in these categories each quarter. These categories can be changed once a month. All other purchases earn 1% cash rewards.

If you spend $2,500 each quarter in a chosen 3% category (and don’t do any spending in 2% categories), you’ll get $300 per year in cash rewards from this spending. Additionally, Bank of America’s Preferred Rewards® members can earn between 25% and 75% more cash rewards.

This card also offers extended warranty protection when you pay expenses with it. The downside is that it charges a 3% foreign transaction fee.

For more information, read our full review of the Bank of America Customized Cash card.

Apply here: Bank of America Customized Cash Rewards credit card

Capital One Quicksilver Cash Rewards Credit Card

Welcome bonus: $200 cash bonus once you spend $500 on purchases within three months from account opening.

The Capital One Quicksilver Cash Rewards Credit Card earns unlimited 1.5% cash back on every purchase, with no foreign transaction fees and no annual fee. This makes it a good card for general spending while abroad. Plus, when you pay with this card, it provides extended warranty protection and travel accident insurance.

For more information, read our full review of the Capital One Quicksilver Cash Rewards card.

Learn more: Capital One Quicksilver Cash Rewards Credit Card

Related: Best Capital One cards

Capital One Savor Cash Rewards Credit Card

Welcome bonus: $200 cash bonus once you spend $500 on purchases within the first three months from account opening.

The Capital One Savor Cash Rewards Credit Card offers 3% cash back on dining and entertainment, popular streaming services, at grocery stores (excluding superstores like Walmart® and Target®) and 1% on all other purchases. There are no foreign transaction fees and the card offers extended warranty protection as well as travel accident insurance and an auto rental collision damage waiver. So, this card is a good choice if you tend to spend a lot on dining and entertainment, both at home and abroad.

For more information, read our full review of the Capital One Savor credit card.

Learn more: Capital One Savor Cash Rewards Credit Card

Related: Credit card showdown: Capital One Savor vs. Capital One Quicksilver

Chase Freedom Unlimited

Welcome bonus: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back.

The Chase Freedom Unlimited earns 5% cash back on Lyft rides through March 2025 and 5% back on travel booked through Chase Travel℠, 3% back on dining (including takeout and eligible delivery services), 3% back at drugstores and 1.5% back on everything else.

However, the card charges a 3% foreign transaction fee, so you won’t want to use it for purchases abroad. When you pay for related expenses with your card, the card offers purchase protection, extended warranty protection, trip cancellation/interruption insurance and auto rental collision damage waiver.

Looking at cash-back rates and foreign transaction fees, the Chase Freedom Unlimited isn’t the best card for everyday spending; however, if you would consider paying the Chase Sapphire Preferred® Card’s $95 annual fee in the future, you could accumulate rewards from everyday spending on the Chase Freedom Unlimited and then transfer them to your Sapphire Preferred account when you’re ready to redeem.

1% cash back would become one Chase Ultimate Reward point when transferred to your Sapphire Preferred account, and then you could redeem your points for travel through Chase Travel at 1.25 cents per point or transfer your points to airline and hotel partners (which TPG’s February 2025 valuations peg at 2.05 cents per point).

For more details, read our full review of the Chase Freedom Unlimited.

Apply here: Chase Freedom Unlimited

Related: Why Chase Sapphire Preferred and Freedom Unlimited are the perfect beginner combo

Chase Freedom Flex

Welcome bonus: $200 bonus after you spend $500 on purchases in your first three months from account opening.

The Chase Freedom Flex earns 5% cash back on Lyft rides (through March 2025), 5% on up to $1,500 in combined purchases in bonus categories each quarter you activate, 3% cash back on dining and drugstore purchases and 1% cash back on everything else.

For the first quarter of 2025, the 5% categories include select grocery stores (including Instacart and excluding Walmart® and Target®), fitness club and gym memberships, self-care and spa services and Norwegian Cruise Line purchases (must book directly with the cruise line). There is also a special birthday surprise category coming in March.

You won’t want to use the card for purchases abroad because of a 3% foreign transaction fee, but the card offers purchase protection, extended warranty protection, trip cancellation/interruption insurance and auto rental collision damage waiver when you pay for related expenses with your card.

As with the Chase Freedom Unlimited, your rewards can become more valuable if you transfer them to another card that earns Chase Ultimate Rewards, such as the Chase Sapphire Preferred Card, Chase Sapphire Reserve® or the Ink Business Preferred® Credit Card.

For more information, read our full review of the Chase Freedom Flex.

Apply here: Chase Freedom Flex

Related: Chase Freedom vs. Chase Freedom Unlimited: Which card is right for you?

Citi Custom Cash

Welcome bonus: Earn $200 cash back after spending $1,500 on purchases in the first six months of account opening.

The Citi Custom Cash earns 5% cash back in your top eligible spending category each billing cycle, up to the first $500, 1% cash back thereafter and 1% cash back on all other purchases.

The categories include drugstores, fitness clubs, gas stations, grocery stores, home improvement stores, live entertainment, restaurants, select travel, select transit and select streaming services. Additionally, through June 30, 2026, you’ll earn an additional 4% cash back on hotels, car rentals, and attractions booked through the Citi Travel portal.

You will not want to use this card internationally because it imposes a 3% foreign transaction fee. This card also includes access to Citi Entertainment, which can help you score tickets to some of the hottest events in town.

For more details, read our full review of the Citi Custom Cash.

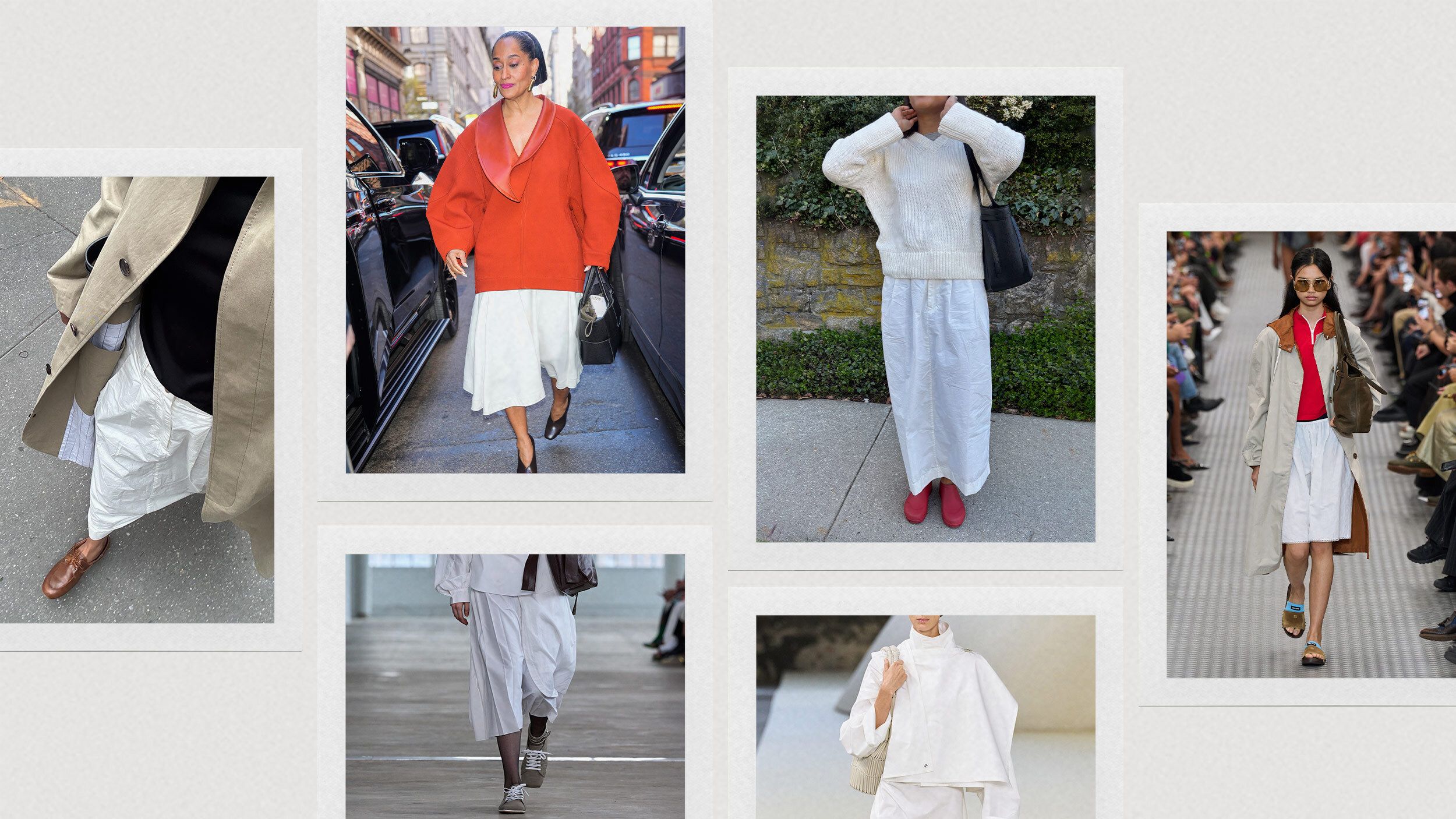

Citi Double Cash Card

Welcome bonus: Earn $200 cash back after spending $1,500 on purchases in the first 6 months of account opening.

The Citi Double Cash card earns 2% cash back on everything (1% when you buy and 1% as you pay).

The Citi Double Cash Card earns up to 2% cash back on all purchases — 1% when you make a purchase and another 1% when you pay your statement — all with no annual fee and no limit on the cash back you can earn. This makes it a good choice for general spending while you’re in the U.S. But you’ll want to store it deep in your luggage when you travel internationally because it charges a 3% foreign transaction fee.

For more information, read our full review of the Citi Double Cash.

Apply here: Citi Double Cash Card

Related: How to get maximum value out of your Citi Double Cash ThankYou points

Discover it Cash Back

Welcome bonus: None.

With Discover it Cash Back, you can earn 5% cash back on up to $1,500 in purchases (per Discover’s Cashback Calendar after enrollment and activation) and 1% cash back on all other purchases.

The card has no annual fee and no foreign transaction fees, so it’s a good choice for spending in the quarterly bonus categories whether you’re in the U.S. or overseas.

Discover matches your total cash back after the first year of card membership, meaning bonus category purchases will effectively earn 10% cash back in your first year. Unfortunately, the card doesn’t offer a welcome bonus.

For more information, read our full review of the Discover It Cash Back.

Related: Your ultimate guide to Discover cards

Should you get one or multiple cards?

If you refuse to pay any annual fees, or if you travel internationally and prefer the simplicity of cash-back rewards, you could sign up for the Capital One Quicksilver Cash Rewards card, which provides 1.5% back on everything.

If most of your credit card spending is on dining, entertainment and groceries, you may be better off with the Capital One Savor Cash Rewards card. Neither of these cards charges an annual fee nor any foreign transaction fees, which makes either card a good choice if you’re looking for one card for all your expenses at home and abroad.

If you don’t travel internationally, you may be better off getting the Citi Double Cash Card if you only want one card. But, depending on what types of expenses you normally put on your credit card, you may be better off getting the Bank of America Customized Cash Rewards card or the Capital One Savor Cash Rewards.

If you’re open to getting a premium Chase Ultimate Rewards card, such as the Chase Sapphire Preferred, the Chase Freedom Unlimited is also a reasonable choice.

If you really want to maximize your cash back earnings, you can opt for getting multiple cards. I would start with the Citi Double Cash as a great card to start with, as it earns 2% cash back on all purchases (1% when you buy, 1% when you pay).

You can pair that with any of the other cards above to cover other bonus categories to maximize your spending.

Related: How many credit cards should I have at once?

Bottom Line

There’s no shortage of good cash back and travel rewards credit cards on the market. While travel rewards can offer outsize value, those looking for more flexibility will enjoy earning cash back. Luckily, there are several great options that don’t charge annual fees, so you can hold onto these cards year after year without needing to pay to keep them in your wallet.

Related: Cash back vs. points and miles credit cards: The pros and cons of each

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.