The best credit cards, according to Brian Kelly

Since starting The Points Guy in 2010, one of my favorite things is hearing from readers who share incredible stories of how they’ve maximized points over the years. It really reminds me of just how valuable the information we share is and that it truly unlocks amazing experiences. A huge part of that involves leveraging …

Since starting The Points Guy in 2010, one of my favorite things is hearing from readers who share incredible stories of how they’ve maximized points over the years. It really reminds me of just how valuable the information we share is and that it truly unlocks amazing experiences.

A huge part of that involves leveraging top travel rewards credit cards.

Maybe you’re looking to get a jump-start on your earning strategy ahead of a big trip, or maybe there are some new perks you want to leverage for your summer travels. Perhaps you’re just in the market for a juicy sign-up bonus.

Whatever you’re looking to do, check out my picks for the best credit cards you can add to your wallet to help you do it.

The best credit cards

- Chase Sapphire Preferred® Card (see rates and fees)

- Capital One Venture X Rewards Credit Card

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

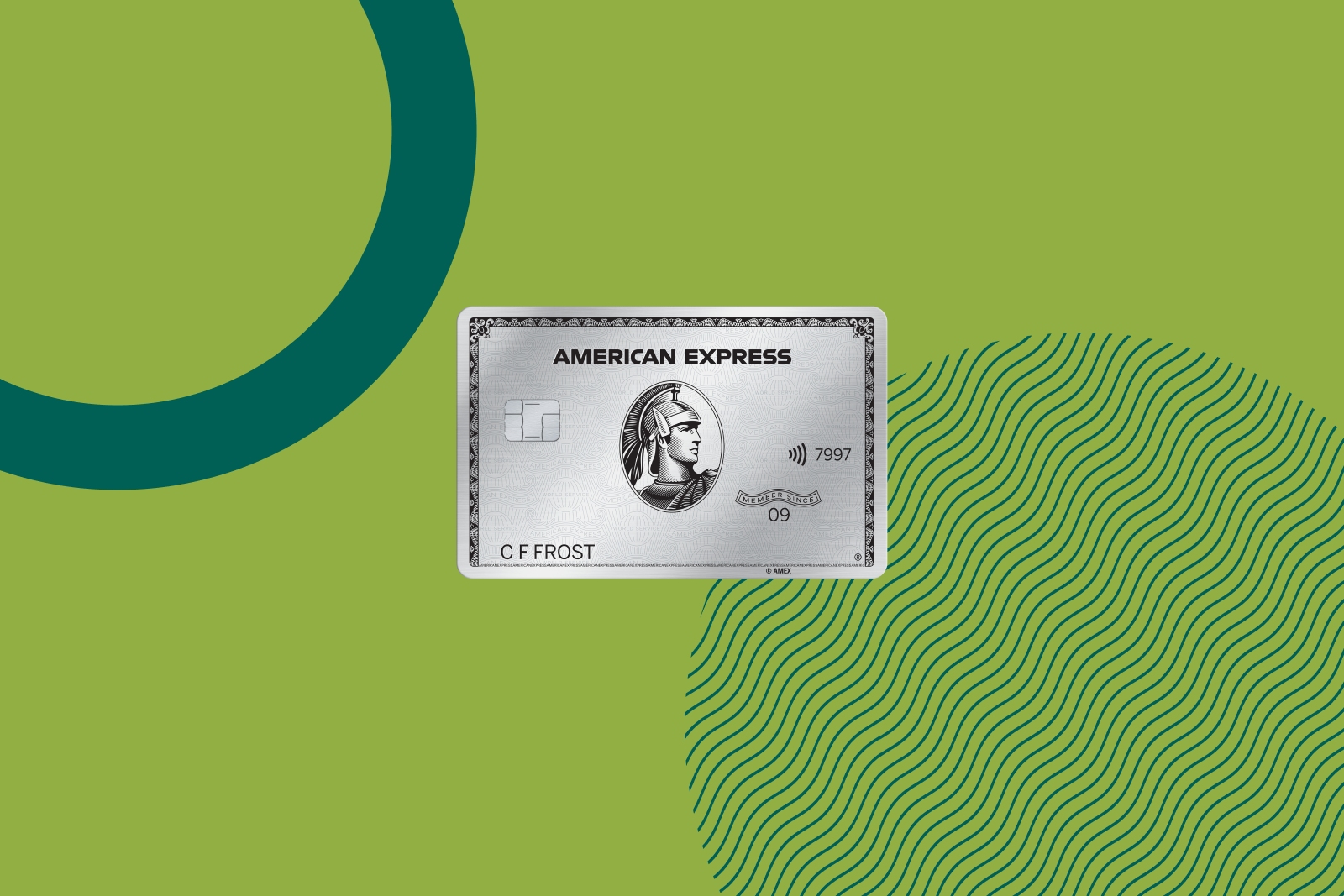

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Ink Business Preferred® Credit Card (see rates and fees)

- Bilt Mastercard® (see rates and fees)*

*I am a Bilt adviser and investor.

Comparing the best credit cards

Here are my top recommendations for the best credit cards.

| Card | Best for | Welcome offer | Earning rates | Annual fee |

| Chase Sapphire Preferred Card | Beginner travelers | Earn 60,000 points after spending $5,000 on purchases within the first three months from account opening. |

|

$95 |

| Capital One Venture X Rewards Credit Card | Premium travel | Earn 75,000 miles after spending $4,000 on purchases within the first three months from account opening. |

|

$395 |

| American Express Gold Card | Groceries and dining at restaurants | Earn 60,000 points after spending $6,000 on purchases within the first six months of card membership. |

|

$325 (see rates and fees) |

| Capital One Venture Rewards Credit Card | Nonbonus spending | Earn 75,000 miles after spending $4,000 on purchases within the first three months from account opening. |

|

$95 |

| The Platinum Card from American Express | Luxury benefits | Earn 80,000 points after spending $8,000 on purchases within the first six months of card membership. |

|

$695 (see rates and fees) |

| The Business Platinum Card from American Express | Luxury perks for small-business owners | Earn 150,000 points after spending $20,000 on eligible purchases within the first three months of card membership. Plus, earn a $500 statement credit after spending $2,500 on qualifying flights booked directly with airlines or through American Express Travel within the first three months of card membership. You can earn one or both of these offers, which end June 30. |

|

$695 (see rates and fees) |

| Ink Business Preferred Credit Card | Bonus-earning | Earn 90,000 points after spending $8,000 on purchases within the first three months from account opening. |

|

$95 |

| Bilt Mastercard | Renters | N/A |

You must use your Bilt card five times each statement period to earn points on rent and qualifying net purchases. |

$0 (see rates and fees) |

Chase Sapphire Preferred Card

Welcome offer: Earn 60,000 points after spending $5,000 on purchases within the first three months from account opening.

Annual fee: $95.

Standout benefits: The Sapphire Preferred offers lucrative earning rates and valuable perks like 3 points per dollar spent on dining and a $50 annual hotel credit, just to name a few, making it one of the best travel cards, according to TPG experts. It’s also a go-to card for both beginners and experts.

I almost exclusively use my Chase Ultimate Rewards points to transfer to more than a dozen of Chase’s transfer partners and book award tickets, which allows me to realize even higher value when redeeming my points.

But I know that not everyone wants to learn how to leverage transfer partners. If that’s you, then the easiest and most straightforward way to use this bonus is through Chase Travel. The 60,000 bonus points are worth $750 when used to book hotels, rental cars and more.

I also love this card for its travel protections and insurance, even if you use it to book an award ticket. Just pay the taxes and fees with the Sapphire Preferred Card, and your trip is covered.

Overall, my Chase points are super valuable as part of my overall points and miles strategy, so if you are looking for a card with a low annual fee, a solid bonus offer and great perks, the Sapphire Preferred is a no-brainer.

For more information, check out our review of the Chase Sapphire Preferred.

Apply here: Chase Sapphire Preferred Card

Capital One Venture X Rewards Credit Card

Welcome offer: Earn 75,000 miles after spending $4,000 on purchases within the first three months from account opening.

Annual fee: $395.

Standout benefits: If you want to maximize points and miles when it comes to credit cards, your goal should be to earn more than 1 point per dollar spent on all purchases. This can be hard when most cards only offer bonus rewards in key categories like dining, groceries and gas.

Thankfully, the base earning rate on the Capital One Venture X is 2 miles per dollar spent, so a huge portion of my personal spending goes on this card. When I’m shopping for clothing, baby supplies, paying for insurance — all categories where I can’t earn 3, 4 or 5 miles per dollar — I put those on my Venture X.

While it has a $395 annual fee, don’t let that scare you. It’s easy to offset that annual fee with benefits like the $300 annual Capital One Travel credit and the 10,000 bonus miles earned each account anniversary. The latter becomes even more valuable when you transfer to airline loyalty programs, which I do often.

For more information, check out our review of the Capital One Venture X.

Learn more: Capital One Venture X Rewards Credit Card

American Express Gold Card

Welcome offer: Earn 60,000 points after spending $6,000 on purchases within the first six months of card membership.

Annual fee: $325.

Standout benefits: If there’s one thing I do almost every day, it’s dine out or order in — so maximizing my points earnings from dining and groceries is huge. Since becoming a dad, my grocery bill has gone up dramatically, so this is where the Amex Gold is a no-brainer.

For starters, you’ll earn 4 points per dollar spent at U.S. supermarkets (up to $25,000 each calendar year, then 1 point per dollar) and 4 points per dollar spent at restaurants worldwide (up to $50,000 each calendar year, then 1 point per dollar). This is a great way to ramp up your earnings on two huge spending categories, whether you’re dining out or entertaining at home.

You also get various statement credits, which almost completely offset the card’s annual fee. This includes up to $120 in Uber Cash ($10 per month, valid for rides and Uber Eats orders in the U.S. after using any Amex card when adding the Amex Gold to your Uber account) and up to $120 in dining statement credits with eligible dining partners (up to $10 per month). Enrollment is required.

I load my Amex Gold Card into all my delivery apps: Caviar, Seamless and Uber Eats. Those points really add up quickly. Then, to make those points even more valuable, I watch for transfer bonuses that Amex runs with travel partners so I can turn my points into miles and book airfare.

For more information, check out our review of the Amex Gold Card.

Apply here: American Express Gold Card

Capital One Venture Rewards Credit Card

Welcome offer: Earn 75,000 miles after spending $4,000 on purchases within the first three months from account opening.

Annual fee: $95.

Standout benefits: This is a great card no matter what your goals are — whether you’re newer to points and miles, prefer a straightforward earning structure or use it as part of a wider earning strategy, like me.

Similar to the Venture X, it allows you to earn 2 miles per dollar spent on all purchases, making it a great card for transactions that don’t fit into common bonus categories.

But it’s especially valuable because of the flexibility it offers to cover all sorts of travel with these miles.

For example, you can redeem these miles at 1 cent apiece against any travel charges you put on the card. Alternatively, you can book flights, rental cars or hotels through Capital One Travel with your miles — also at a value of 1 cent apiece.

But if, like me, you want to stretch the value of those miles even further, you can transfer those miles to any of the 15-plus hotel and airline programs that partner with Capital One.

For example, you could transfer the miles to Air France-KLM Flying Blue and book bougie business-class seats from the U.S. to Europe starting at 60,000 miles plus taxes and fees each way. Or, transfer to Virgin Atlantic Flying Club, where you can find lie-flat Upper Class seats to the U.K. for as little as 29,000 points plus taxes and fees each way.

For more information, check out our review of the Capital One Venture Rewards.

Learn more: Capital One Venture Rewards Credit Card

The Platinum Card from American Express

Welcome offer: Earn 80,000 points after spending $8,000 on purchases within the first six months of card membership.

Annual fee: $695.

Standout benefits: Despite its high cost, the Amex Platinum remains a favorite of mine — and many TPG staffers as well.

I put all airfare on my Amex Platinum because I earn 5 points per dollar spent on airfare (on up to $500,000 per calendar year, then 1 point per dollar) when I book directly with an airline or via Amex Travel. And while the annual fee is steep, the benefits include an up to $200 annual fee statement credit for airline incidentals and an up to $200 statement credit for prepaid bookings with American Express Fine Hotels + Resorts and The Hotel Collection. (Enrollment is required for select benefits.)

Amex continues to be a leader in the card lounge space, and this premium travel card provides access to its Centurion Lounges, plus Priority Pass lounges and Delta Sky Clubs when flying Delta Air Lines. (Enrollment is required for select benefits.)

For more information, check out our review of the Amex Platinum Card.

Apply here: The Platinum Card from American Express

The Business Platinum Card from American Express

Welcome offer: Earn 150,000 points after spending $20,000 on eligible purchases within the first three months of card membership. Plus, earn a $500 statement credit after spending $2,500 on qualifying flights booked directly with airlines or through Amex Travel within the first three months of card membership. You can earn one or both of these offers, which end June 30.

Annual fee: $695.

Standout benefits: One of my favorite perks on this card is Pay with Points — cardholders receive a 35% bonus when they Pay with Points on first- or business-class tickets through Amex Travel (up to 1 million points per calendar year).

Even though this is a business card, it comes with premium travel perks and business statement credits:

- Centurion Lounge access and Priority Pass membership

- A statement credit of $120 for Global Entry every four years or a statement credit of up to $85 for TSA PreCheck every 4 1/2 years

- An airline credit fee of up to $200 annually

- Gold elite status with Hilton Honors and Marriott Bonvoy

- Access to Amex Fine Hotels + Resorts and The Hotel Collection

Even though the annual fee is $695, the annual statement credits and benefits more than offset that. For example, The Business Platinum card offers:

- An up to $400 Dell statement credit per calendar year (up to $200 semiannually)**

- An up to $360 Indeed statement credit per calendar year (up to $90 per quarter)

- An up to $150 Adobe statement credit per calendar year (subject to auto-renewal)**

- Up to $200 in Hilton credits per calendar year (up to $50 per quarter; Hilton for Business membership required)

- Up to $120 per calendar year for U.S. wireless telephone providers (up to $10 per month)

- An up to $199 Clear Plus membership statement credit per calendar year (subject to auto-renewal)

- The aforementioned up to $200 airline fee credit per calendar year on charges made with an airline of your choosing

- The aforementioned up to $120 Global Entry/TSA PreCheck credit

**The Dell and Adobe credits are set to change July 1

If you maxed out these statement credits, you’d net $1,749 — about two and a half times the annual fee. Even if you didn’t have use for the Dell, Indeed and Adobe credits, but you still maxed out the travel-related credits along with the Hilton and wireless telephone service provider credits, you’d still come out ahead. Enrollment required for select benefits.

For more information, check out our review of the Amex Business Platinum.

Apply here: The Business Platinum Card from American Express

Ink Business Preferred Credit Card

Welcome offer: Earn 90,000 points after spending $8,000 on purchases within the first three months from account opening.

Annual fee: $95.

Standout benefits: I love my Ink Business Preferred card and its bonus categories — especially the online internet advertising category, which earns 3 points per dollar spent on up to $150,000 a year (then 1 point after that). If you max out this annual bonus, those 450,000 points you earn can be used for travel bookings via Chase Travel for 1.25 cents each — but possibly more if you leverage Chase’s network of airline and hotel transfer partners and transfer bonuses (when available).

Chase points are very versatile, and I use mine as quickly as I earn them. If you own a small business or even have a business idea, you can apply using your Social Security number; check out our posts to see who might be eligible for a business credit card (you might be surprised!) and how to apply.

In my opinion, this card is a heavyweight, especially for the low annual fee of $95.

For more information, check out our review of the Ink Business Preferred.

Apply here: Ink Business Preferred Credit Card

Bilt Mastercard

Welcome offer: N/A.

Annual fee: $0 (see rates and fees).

Standout benefits: For so many people, rent is their biggest monthly expense. Yet for years, the only way to pay for rent was to give landlords checks or Venmo payments. If you wanted to pay by credit card, you would incur a fee.

The Bilt Mastercard has completely revolutionized this system. As long as you make at least five purchases with the card each statement period, you can earn points on rent payments and other qualifying net purchases. Even if your landlord only takes a check, Bilt can send checks and automated clearing house direct deposits so you can earn points on the transactions (up to 100,000 points per year).

Because you are paying rent via a credit card, you can also help build your credit history with each payment. It’s an absolute no-brainer, especially since there’s no annual fee (see rates and fees).

For more information, check out our review of the Bilt Mastercard.

Apply here: Bilt Mastercard

What to consider when choosing the best card

There isn’t a one-size-fits-all strategy for picking the best credit cards. There are several factors you should analyze before selecting which ones deserve a spot in your wallet.

Preferred rewards

First, consider the type of rewards you want to earn for your purchases. If you want simplicity, a cash-back card may be a great option since you generally have few limitations on how those rewards can be used. On the other hand, if you’re after free travel or want to really maximize your spending, you may be better off with a transferable rewards currency like American Express Membership Rewards or Chase Ultimate Rewards.

Welcome bonus

Earning a big haul of points or miles as a welcome bonus is typically the best way to quickly boost your rewards balance. This is particularly lucrative if one of the cards you’re considering has a limited-time offer. Just be sure to review each issuer’s eligibility requirements, and consider checking your credit score in advance of your application so you have an idea of whether you’ll be approved.

Spending habits

Before opening any credit card (or opening a new one), take some time to analyze your spending habits over the last year, along with how you’re earning rewards on any cards currently in your wallet. Many TPG readers start with a simple, no-annual-fee card that earns 1 point, 1 mile or 1% cash back on all purchases, but, as I’ve said in my weekly newsletter before, “Friends don’t let friends earn only 1 point per dollar.”

If you spend a ton at restaurants, be sure you have a card that rewards you when making dining purchases. If you have a significant commute, pick up a card that rewards you for gas or transit expenses. It’s easy to double or even triple your earning rates for many purchases with the right combination of cards.

Annual fee

Finally, you should consider the out-of-pocket cost of any new card on your radar. While some have no annual fee (or waive the fee for the first year), others have hefty ones, as you saw in the list above.

In the first year, almost every card with a solid welcome offer will pay for itself (and then some), but you should take some time before you apply to make sure you can truly take advantage of that card’s benefits, both now and in the future.

How we chose the best credit cards

Many factors go into our selection of the best credit cards, including earning rates, welcome offers, benefits and perks. The cards I list above have personally allowed me to earn tens of thousands of dollars worth of rewards over the years.

You can learn more about how we analyze cards here at TPG on our methodology page.

Redemption options for the best credit cards

Savvy travelers will recognize that all the cards I list above have something in common: Each one earns transferable points or miles — and that’s no coincidence. These rewards are incredibly valuable because of the flexibility they offer. You’re not locked into one airline and its partners, or one hotel program and its participating brands. You are in the driver’s seat when it comes time to redeem.

For example, let’s say I want to fly Virgin Atlantic to London’s Heathrow Airport (LHR) in the carrier’s Upper Class, and the one-way flight I need is $4,000. I could use 400,000 Amex points to book through American Express Travel, but that same flight could also be 235,000 miles using Delta SkyMiles, which is a 1:1 transfer partner of Amex. However, Virgin Atlantic Flying Club has prices as low as 29,000 points — and it, too, partners with Amex.

Bottom line

Credit cards can play a major role in unlocking rewards for purchases you’re already going to make, but there’s no one perfect card that works for everyone. The above options are just a few choices that’ve worked well for me over the years, but it’s critical for you to analyze which one makes sense for your individual situation.

Of course, if you do get into the world of travel credit cards, be sure you don’t spend beyond your means and pay your balances in full and on time every month.

For rates and fees of the Amex Gold, click here.

For the rates and fees of the Amex Platinum, click here.

For rates and fees of the Amex Business Platinum, click here.

For rates and fees of the Bilt Mastercard, click here.

For rewards and benefits of the Bilt Mastercard, click here.