Who are the Chase Ultimate Rewards transfer partners? Redeem your points with airlines and hotels

Editor’s note: This is a recurring post, regularly updated with new information and offers. Chase Ultimate Rewards points are the currency of most Chase-branded credit cards. You can earn Chase Ultimate Rewards points for everyday spending and then redeem them for a wide range of rewards. Despite increasing competition from American Express Membership Rewards points, …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Chase Ultimate Rewards points are the currency of most Chase-branded credit cards. You can earn Chase Ultimate Rewards points for everyday spending and then redeem them for a wide range of rewards.

Despite increasing competition from American Express Membership Rewards points, Citi ThankYou Rewards points, Bilt Rewards points, Wells Fargo Rewards points and Capital One miles, Chase points have maintained their place as one of the most valuable and useful rewards currencies — especially with valuable rewards cards like the [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred® Card”] (see [termsConditions pid=”22125056″ overridetext=”rates and fees”]) and the recently refreshed [applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve®”] (see [termsConditions pid=”221211836″ overridetext=”rates and fees”]).

Transferring Ultimate Rewards points to travel partners is often the most valuable way to redeem your hard-earned rewards. With 14 different transfer partners, you have plenty of options.

Here is everything to know about Chase Ultimate Rewards’ transfer partners.

Chase Sapphire Reserve® — Earn 100,000 bonus points plus a $500 Chase Travel℠ credit after spending $5,000 on purchases in the first three months from account opening (see [termsConditions pid=”221211836″ overridetext=”rates and fees”]).

Who are the Chase Ultimate Rewards transfer partners?

You can transfer Ultimate Rewards points to 11 airline programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Club (formerly British Airways Executive Club)

- Emirates Skywards

- Club Iberia Plus (formerly Iberia Plus)

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

Chase also partners with three hotel programs:

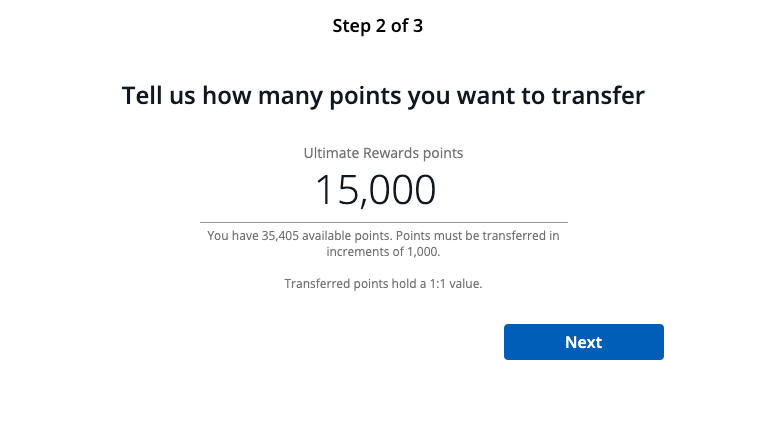

All transfer ratios are 1:1 — though there are occasional transfer bonuses — and you must transfer points in 1,000-point increments.

How long do Chase Ultimate Rewards transfers take?

Most transfers from Chase Ultimate Rewards to its partner programs are instantaneous. However, in our most recent testing, transfers to Singapore Airlines KrisFlyer took about 48 hours.

Note that transfer bonuses can also be inconsistent. For example, when TPG’s senior editorial director Nick Ewen transferred points to Aeroplan to take advantage of a 20% bonus (at the time), the base points arrived immediately, but the bonus points took three days to post to his account.

While most transfers through the Chase portal should be instantaneous, delays can happen when transferring your points. In the past eight months, TPG credit card writer Danyal Ahmed has had varying transfer times for Aeroplan, ranging from instant to two hours.

To help with the transfer process, make sure that the name on your Ultimate Rewards account matches that on your loyalty program account. Additionally, make sure you have signed up with a loyalty program in advance, as a new account may also cause a delay.

How do I transfer Chase Ultimate Rewards points to partners?

You can easily transfer Chase points online. First, log in to your Chase account and navigate to the Ultimate Rewards portal. Under the “Travel” drop-down, select “Transfer points to partners” to access the main transfer page.

You will then see the list of transfer partners and any current transfer bonuses. Select your desired transfer partner, link your external account if you have not already done so, select the number of Ultimate Rewards points you wish to transfer and then submit the transfer.

Remember, Ultimate Rewards transfers cannot be reversed, so it’s best to wait until you have a specific redemption you want to make before transferring them.

Related: Quick Points: Credit card points transfers to airline and hotel partner programs cannot be reversed

What are the best Chase Ultimate Rewards transfer partners?

If you prefer to transfer your points to one of the 11 different airline program partners, the best redemption options for you can vary, depending on factors such as which airlines fly to and from the destinations you wish to visit and which airlines you like to travel aboard.

However, there are notable sweet spots with certain airline transfer options, especially those programs that have retained award charts.

Here are some of our favorite flights to book using Chase points.

Book a round-trip flight to Madrid using Club Iberia Plus

Flying from the U.S. to Spain doesn’t have to set you back thousands of dollars. In fact, a notable redemption option is using Club Iberia Plus to fly round-trip to Madrid for as little as 32,000 points.

Round-trip, off-peak flights from New York’s John F. Kennedy International Airport (JFK) and Boston Logan International Airport (BOS) to Spain’s capital will only set you back 50,000 Avios in economy, 59,000 in premium economy or 81,000 in business class when you transfer your Chase points to Club Iberia Plus.

Considering that most airlines charge at least 60,000 miles for a one-way business-class award to Europe, you’re essentially getting a 50% discount.

Book flights to Hawaii with British Airways

Did you know that you can book American Airlines and Alaska Airlines flights with Chase points? Though the carriers are not direct transfer partners of Chase, you can book flights on these carriers by transferring your Ultimate Rewards points to British Airways. You can then book awards with fellow Oneworld partners American Airlines and Alaska Airlines.

As long as your nonstop flight distance is under 3,000 miles each way (and saver-level award space is available), you can leverage British Airways’ distance-based award chart to fly from any West Coast gateway to Hawaii for 40,000 Avios round-trip.

Fly first-class to Japan by booking ANA flights through Virgin Atlantic

Is a trip to Japan on your bucket list? Well, for 145,000 Virgin Atlantic Flying Club points, you can fly round-trip in first class on All Nippon Airways between the West Coast and Tokyo. Flights from the East Coast to Tokyo will cost 170,000 points round-trip.

Business-class redemptions are an even better deal, costing just 105,000 to 120,000 points round-trip, depending on your U.S. departure airport. If possible, you’ll want to route through JFK and fly ANA’s industry-leading “The Room” business class, which is only available on select routes.

However, note that availability can be difficult to come by.

Book lie-flat business-class seats to London with Virgin Atlantic

Is London calling? Though Virgin Atlantic Flying Club prices its award seats dynamically, the loyalty program offers Saver fares for low-demand travel dates. Therefore, if you’re flexible and come across availability, you could score lie-flat business-class seats from JFK to London’s Heathrow Airport (LHR) for as little as 29,000 points.

If you’re looking to be more thrifty with your hard-earned reward points, you can fly the exact same route in economy for as little as 6,000 points. Be sure to use Virgin’s reward seat checker to find Saver fares or an award booking platform like Seats.aero to help you search dates and prices.

Related: Virgin Atlantic Flying Club dynamic pricing is now live: Major takeaways from the program changes

Stay at a top-tier Hyatt hotel

Aside from transferring your Chase points to airline partners to maximize their value, I also recommend booking stays with World of Hyatt. The hotel loyalty program offers a very attractive award chart, which is broken up into different “categories” and peak, off-peak and standard dates.

By transferring your Chase points to Hyatt, you can book some of the fanciest Park Hyatt properties in the entire portfolio, including the Park Hyatt London River Thames, starting at 25,000 points per night during off-peak dates.

TPG values Hyatt points at 1.7 cents each (per our June 2025 valuations), so 25,000 points are worth $425. That’s a great deal for hotel rooms that typically sell for close to $800 per night, even when demand is low.

There’s also great value at the lower end of the Hyatt award chart. Category 1 hotels range from 3,500 to 6,500 points per night.

If looking to maximize your Chase points, I recommend utilizing transfer partners. However, you should always compare the cash price to the number of points required to book. Additionally, before transferring your points, make sure there is availability — transfers are irreversible.

Related: The best Chase Ultimate Rewards sweet spots

What are Chase Ultimate Rewards points worth?

TPG values Ultimate Rewards points at 2.05 cents apiece, per our June 2025 valuations, and I believe you will receive the best value by transferring points to airline and hotel partners.

However, you’ll get varying values for Chase points if you pursue other redemption opportunities. For example, Ultimate Rewards points are worth 1.5 cents apiece through Chase Travel℠ for [applyLink pid=”221211836″ overridetext=”Sapphire Reserve”] cardholders or 1.25 cents for those with the [applyLink pid=”22125056″ overridetext=”Sapphire Preferred”] or [applyLink pid=”221211974″ overridetext=”Ink Business Preferred® Credit Card”] (see [termsConditions pid=”221211974″ overridetext=”rates and fees”]).

As a cardholder of any of the above products, you’ll also have access to Chase Pay Yourself Back, and there are occasionally offers to use Chase points for Apple products or gift cards at an enhanced value.

Starting June 23, 2025, existing Sapphire Reserve cardholders will see ‘Points Boost’ in Chase Travel. This accelerator will allow cardholders to redeem their Ultimate Rewards points at a rate of up to 2 cents per point when making reservations with select airlines and hotels — including The Edit properties. Points Boost is replacing the 1.5-cent value on Chase Travel redemptions for those who get the card on (or after) June 23, 2025.

Other important rates and dates to be aware of regarding Points Boost include:

- If you had a Sapphire Reserve prior to June 23, 2025, and earned Ultimate Rewards points before October 26, 2025, those points remain eligible for redemption at the 1.5-cent rate via Chase Travel (until October 26, 2027).

- For points earned before October 26, 2025, you will receive the better offer between Points Boost and the 1.5-cent redemption rate value (when booking via Chase Travel through October 26, 2027).

- After October 26, 2027, points will be redeemable at a rate of 1 cent per point for all purchases not eligible for Points Boost.

Additionally, cards that feature a 1.25-cent rate — like the Sapphire Preferred and the Ink Business Preferred — will see a Points Boost redemption rate of up to 1.5 cents per point on hotels and flights booked via Chase Travel. If you opt for a premium cabin ticket (with select airlines), you’ll see an up to 1.75 cents per point value in the travel portal.

Similar to the Sapphire Reserve rate changes noted above, here’s what to expect if you’re a Sapphire Preferred cardholder:

- If you had a Sapphire Preferred or Ink Business Preferred prior to June 23, 2025, and earned Ultimate Rewards points before October 26, 2025, those points remain eligible for redemption at the 1.25-cent rate via Chase Travel (until October 26, 2027).

- For points earned before October 26, 2025, you will receive the better offer between Points Boost and the 1.25-cent redemption rate value (when booking via Chase Travel through October 26, 2027).

- After October 26, 2027, points will be redeemable at a rate of 1 cent per point for all purchases not eligible for Points Boost.

How do I earn Chase Ultimate Rewards points?

There are many ways to earn Chase points at a rate of 1-8 points per dollar spent, depending on the specific Chase credit card you carry.

The first three cards below — [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred”], [applyLink pid=”221211836″ overridetext=”Sapphire Reserve”]and [applyLink pid=”221211974″ overridetext=”Ink Business Preferred”] — earn fully transferable Ultimate Rewards points by themselves.

The remaining four — [applyLink pid=”7538″ overridetext=”Chase Freedom Flex®”] (see [termsConditions pid=”7538″ overridetext=”rates and fees”]), [applyLink pid=”221211281″ overridetext=”Chase Freedom Unlimited®”] (see [termsConditions pid=”221211281″ overridetext=”rates and fees”]), [applyLink pid=”22125825″ overridetext=”Ink Business Cash® Credit Card”] (see [termsConditions pid=”22125825″ overridetext=”rates and fees”]) and the [applyLink pid=”6218″ overridetext=”Ink Business Unlimited® Credit Card”] (see [termsConditions pid=”6218″ overridetext=”rates and fees”]) — are technically billed as cash-back credit cards.

However, if you have an Ultimate Rewards points-earning card, you can effectively convert your cash-back rewards into Ultimate Rewards points. For this reason, having more than one Chase card can make sense to maximize your earning and redeeming potential.

Here are the cards that allow you to earn Chase Ultimate Rewards points.

Chase Sapphire Preferred Card

Welcome bonus: Earn 75,000 bonus points after spending $5,000 on purchases in the first three months from account opening.

Annual fee: $95.

Why you want it: This is a fantastic all-around travel credit card. It earns points at the following rates:

- 5 points per dollar spent on Lyft (through Sept. 30, 2027)

- 5 points per dollar spent on all travel purchased through Chase Travel

- 3 points per dollar spent on dining, including eligible delivery services, takeout and dining out

- 3 points per dollar spent on select streaming services

- 3 points per dollar spent on online grocery purchases (excluding Target, Walmart and wholesale clubs)

- 2 points per dollar spent on all other travel

- 1 point per dollar spent on all other purchases

The Sapphire Preferred has no foreign transaction fees and has many travel perks, including delayed baggage insurance, trip interruption/cancellation insurance and primary car rental insurance.

Apply here: [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred Card”]

Chase Sapphire Reserve

Welcome bonus: Earn 100,000 bonus points and a $500 Chase Travel credit after spending $5,000 on purchases within the first three months from account opening.

Annual fee: $795.

Why you want it: The Sapphire Reserve offers earning power paired with travel perks that can easily cover the annual fee. It earns points at the following rates:

- 8 points per dollar spent on all Chase Travel purchases (flights, hotels, car rentals and more)

- 5 points per dollar spent on eligible Lyft rides (through Sept. 30, 2027)

- 4 points per dollar spent on flights booked directly with an airline

- 4 points per dollar spent on hotels booked directly

- 3 points per dollar spent on dining worldwide

- 1 point per dollar spent on all other eligible purchases

Other perks include an easy-to-use $300 annual travel credit, a fee credit for Global Entry or TSA PreCheck (up to $120 once every four years), and access to Priority Pass Select lounges and the growing list of Sapphire lounges. Cardholders also get primary car rental coverage, trip interruption/cancellation insurance and other protections.

Apply here: [applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve”]

Ink Business Preferred Credit Card

Welcome bonus: Earn 90,000 bonus points after spending $8,000 on purchases in the first three months from account opening.

Annual fee: $95.

Why you want it: This is one of the best credit cards for small-business owners, earning 3 points per dollar on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services and advertising made with social media sites and search engines each account anniversary year. You earn 1 point per dollar spent on all other purchases, and points don’t expire as long as your account is open.

Apply here: [applyLink pid=”221211974″ overridetext=”Ink Business Preferred Credit Card”]

Cash-back Chase credit cards

Four Chase credit cards are technically billed as cash-back products. However, suppose you have one of the three cards noted above. In that case, you can combine your points in a single account, converting these cash-back rewards into fully transferable Ultimate Rewards points.

Even better? None of these cards charges an annual fee.

Here are the four cards that offer this functionality:

- [applyLink pid=”7538″ overridetext=”Chase Freedom Flex”]: Earn $200 after spending $500 on purchases in the first three months from account opening. Earn 5% cash back on select bonus categories, which rotate every quarter to up to $1,500 in combined spending (activation required). Plus, earn 5% cash back on travel purchased through Chase Travel, 3% cash back on dining at restaurants (including takeout and eligible delivery services), 3% cash back on drugstore purchases, and 1% cash back on all other purchases.

- [applyLink pid=”221211281″ overridetext=”Chase Freedom Unlimited”]: Earn $200 after spending $500 on purchases in the first three months from account opening. Plus, earn 5% cash back on travel purchased through Chase Travel, 3% cash back on dining at restaurants (including takeout and eligible delivery services), 3% cash back on drugstore purchases and 1.5% cash back on all other purchases.

- [applyLink pid=”22125825″ overridetext=”Ink Business Cash”]: Earn up to $750: $350 bonus cash back after spending $3,000 on purchases in the first three months, and an additional $400 after spending $6,000 on purchases in the first six months from account opening. Earn 5% cash back on the first $25,000 in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year (then 1% cash back). Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year (then 1% cash back).

- [applyLink pid=”6218″ overridetext=”Ink Business Unlimited”]: Earn $750 cash back after spending $6,000 on purchases in the first three months from account opening. Earn unlimited 1.5% cash-back rewards on every purchase.

Note that Chase also issues the [applyLink pid=”8489″ overridetext=”Ink Business Premier® Credit Card”] (see [termsConditions pid=”8489″ overridetext=”rates and fees”]). However, the earnings on this card can’t be combined with others in the Ultimate Rewards ecosystem.

Bottom line

If you value the flexibility of choosing from 11 airline partners and three hotel partners, Chase Ultimate Rewards is one of our favorite credit card programs at TPG.

In the age of no-notice devaluations by some loyalty programs, it is smart to earn Ultimate Rewards points via credit card welcome offers, category bonuses and everyday spending, and then keep your points until you are ready to transfer and book with an airline or hotel partner.

Related: The power of the Chase Trifecta: Maximize your earnings with 3 cards