Why you should consider having both the personal and business Amex Platinum cards

Editor’s note: This is a recurring post, regularly updated with new information and offers. The Platinum Card® from American Express and The Business Platinum Card® from American Express have established themselves as the cards to have if you’re interested in luxury travel benefits. With an overlapping rewards structure and similar benefits, it’s logical to question …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

The Platinum Card® from American Express and The Business Platinum Card® from American Express have established themselves as the cards to have if you’re interested in luxury travel benefits. With an overlapping rewards structure and similar benefits, it’s logical to question which of the two is the best for you. Or, if you already have one of the cards, you may be wondering whether you should also go for the other.

It could actually work out in your favor to make room for both cards in your wallet — even with the $695 annual fees on each (see rates and fees for the Amex Platinum and rates and fees for the Amex Business Platinum).

Each card has benefits to complement the other and travelers will have no problem earning back the steep yearly fees, making them a great combination when it comes to getting the most out of your trips.

Here’s why you may want both in your wallet.

Incredible welcome offer value

Both cards come with pretty substantial welcome offers. Right now, new Business Platinum Card cardmembers can earn 150,000 bonus points after spending $20,000 in the first three months of cardmembership.

With the Amex Platinum, new cardmembers can earn 80,000 bonus points after spending $8,000 in the first six months of cardmembership (although you may be targeted for a higher offer via the CardMatch Tool — subject to change at any time and not everyone will be targeted for the same offers).

If you apply for both cards and earn the full welcome bonuses, you’ll get at least 230,000 Membership Rewards points. Based on TPG’s March 2025 valuations, that’s worth $4,600— more than triple the combined cost of the annual fees.

Related: Is the Amex Business Platinum worth the annual fee?

Card credits

Both cards have a number of credits to help cardmembers get value year after year. Enrollment is required for select benefits; terms apply.

Typically, one of the easiest perks to take advantage of with the Platinum cards is the annual airline fee statement credit you’ll receive each calendar year.

Each card has an up-to-$200 annual airline fee statement credit each calendar year (enrollment required). While it isn’t as generous as the $300 annual travel credit you’ll get with the Chase Sapphire Reserve® (which can be applied to any travel purchase), the credit with the Amex Platinum cards is still very useful.

On top of the airline fee credits, the personal Platinum card is loaded with annual offers. Cardmembers enjoy the following (some benefits require enrollment):

- Up to $200 per calendar year in annual Uber statement credits (up to $15 in Uber Cash each month, plus a bonus up to $20 in December; for use in the U.S.). Your Amex Plat must be added to your Uber account and you can redeem with any Amex card.

- Up to $100 per calendar year in Saks statement credits (up to $50 from January to June and another up to $50 from July to December)

- Up to $200 per calendar year in hotel statement credits for prepaid stays booked through American Express Travel at participating properties with Fine Hotels + Resorts or The Hotel Collection (the latter requires a two-night minimum stay).

- Up to $240 per calendar year in digital entertainment statement credits (up to $20 monthly)

- Up to $155 per calendar year in Walmart+ statement credits (up to $12.95 per month toward one Walmart+ membership; Plus Ups are excluded; subject to auto-renewal)

- Up to $300 per calendar year in Equinox fitness statement credits (subject to auto-renewal)

- Up to $199 each calendar year in Clear Plus statement credits (subject to auto-renewal)

- $120 in credits for your Global Entry application every 4 years, or up to $85 in credits for your TSA PreCheck application every 4½ years

When it comes to annual statement credits, the Business Platinum is no slouch, either. It offers up to $400 in Dell statement credits each calendar year (up to $200 semi-annually), up to $360 in statement credits for Indeed per calendar year (up to $90 each quarter), up to $200 per calendar year in Hilton statement credits (up to $50 per quarter), up to $150 each calendar year in Adobe statement credits (subject to auto-renewal) and up to $120 per calendar year in statement credits for purchases with U.S. wireless cellphone providers (up to $10 per month). The Dell and Adobe credits will end on June. 30.

The Business Platinum also matches the personal Platinum in offering statement credits for both Clear Plus and your Global Entry or TSA PreCheck application fee (which you can use to pay for a frequent travel companion’s application). These credits are worth the same as the Amex Platinum’s, and are issued in the same timeframe.

Enrollment is required for select benefits; terms apply.

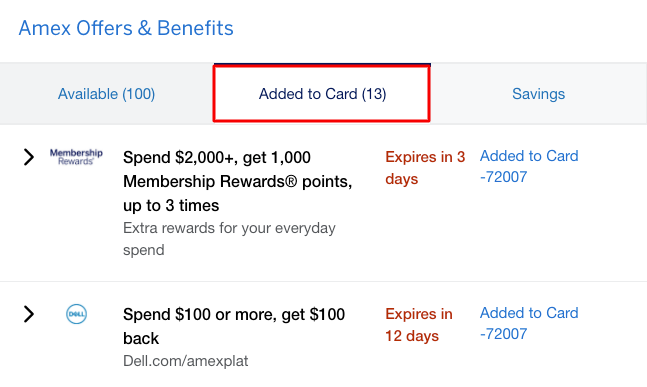

Amex Offers

All American Express cards, including the Platinum and Business Platinum cards, come with access to Amex Offers. You can find your available offers if you scroll down to “Amex Offers & Benefits” on your online account page or click on the “Offers” tab on the Amex app. They are targeted to each cardmember and come from merchants including hotels, travel providers, restaurants and clothing and jewelry stores. These offers are usually either:

- Spend $X, get Y number of bonus points.

- Spend $X, get $Y back.

- Get additional points for each dollar you spend at a select merchant.

While Amex Offers can be a great deal alone, you can do even better when you stack them with online shopping portals to earn extra cash back or bonus points on your purchase.

Be warned: Depending on the terms of the offer, using online portals, promo codes or other savings methods could cause your Amex Offer not to trigger, so always read the fine print in the terms.

That said, the good news is that you can stack the top Amex Offers with other popular Amex perks, including some of the annual statement credits that come with the Platinum and the Business Platinum cards. Eligibility for these offers is limited. Enrollment is required in the Amex Offers section of your account before redeeming.

Related: Your ultimate guide to Amex Offers

Travel benefits

Cardmembers have access to a variety of insurance policies when booking travel and going shopping with their card, including:

- Trip cancellation and interruption insurance*

- Trip delay insurance*

- Cellphone protection*

- Baggage insurance**

- Purchase protection**

- Return protection**

- Extended warranty**

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

**Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Some cards have eliminated these protections over the last few years, so these benefits provide another reason to book your travel with an Amex Platinum.

The Platinum cards not only protect you from several travel disasters but can also enhance your travel experience.

The Platinum cards get you access to The Global Lounge Collection, giving cardmembers free entry into any Amex Centurion Lounge plus access to a number of additional airport lounges as well. Access is limited to eligible cardmembers. Overall, the collection grants access to over 1,400 VIP lounge locations across 140 countries — a very valuable benefit.

Surely to be sought out by frequent flyers, the Platinum cards also provide some supplemental benefits to make travels a bit easier: Platinum Travel Service counselors can help set an itinerary to make the most of your trips, while Global Dining Access by Resy can get you into your most desired restaurants. Preferred Access is even a way to snag exclusive seats at cultural and sporting events.

Enrollment is required for select benefits; terms apply.

Hotel benefits

One area where these two cards overlap is access to an array of hotel benefits. With both the personal and business Amex Platinum, you’ll receive complimentary Gold status at Hilton and Marriott and have access to Amex Fine Hotels + Resorts. Enrollment is required for select benefits; terms apply.

Gold status at Hilton comes with perks like complimentary breakfast, room upgrades when available and an 80% point bonus on paid stays. Marriott Bonvoy Gold status comes with benefits such as priority late checkout, upgrades when available and a 25% point bonus.

Amex Fine Hotels + Resorts is a program that offers elitelike benefits at properties around the world. These perks include guaranteed late checkout, daily breakfast for two, room upgrades when available and a unique property amenity (valued at $100 or more).

Some properties in this program will also offer third, fourth or fifth nights free, which is a valuable benefit when you’re not looking to use your hotel points for a stay.

While you only need one Platinum card to enjoy these benefits, having both ensures you’re taking advantage of benefits while maximizing earning, whether your trip is for business or pleasure.

Maximizing personal and business spending

Perhaps one of the biggest benefits of having both the personal and business versions of the Amex Platinum is that you can effectively earn 7.7% back on every airfare purchase you put on your personal Platinum Card (airfare booked directly with the airline or through American Express Travel earns 5 points per dollar on up to $500,000 spent on these purchases per calendar year; 1 point per dollar thereafter). This earning rate also holds true for prepaid hotels booked through Amex Travel.

This is because, when you have the Business Platinum Card, you have the ability to Pay with Points to book flights with Amex Travel, and doing so will get you 35% of your points back (up to 1 million points per calendar year). This essentially gets you a value of 1.54 cents per point.

If you earn 5 points per dollar on eligible travel purchases and then redeem those points at a value of 1.54 cents, you’re getting a return of 7.7%.

That said, if you maximize American Express’s array of valuable transfer partners, you may be able to get even more value. After all, TPG values Amex Membership Rewards points at 2 cents apiece as of our March 2025 valuations.

Something else to consider is that the Amex Business Platinum earns 1.5 points per dollar on U.S. construction material and hardware purchases, U.S. electronics, cloud system providers and software purchases and U.S. shipping providers. To top it off, the Business Platinum also earns 1.5 points per dollar on purchases of $5,000 or more. Purchases that earn 1.5 points per dollar are limited to the first $2 million every calendar year (1 point per dollar thereafter).

Say, for example, you’re making an $11,500 purchase, and you wouldn’t be eligible for a bonus with another card. In total, you’d earn 17,250 Membership Rewards points on the Business Platinum card — worth about $345 based on TPG’s valuations.

If you were to use another eligible Amex card without a category bonus for what you’re buying, you’d earn 11,500 Membership Rewards points — worth about $230.

Effectively, you’d be getting more than $100 extra in value by using the Business Platinum.

Related: How to maximize your earning with the Amex Business Platinum

Bottom line

Using both the personal Amex Platinum Card and the Business Platinum Card can get you the maximum value on both your rewards-earning and redemptions, in addition to some great cardmember perks.

The combo is perfect for business-owning travelers who have a high budget and want to take advantage of huge savings, generous credits and luxurious travel opportunities.

Although the annual costs are high, the right cardmembers will have no issue getting massive value out of this pairing. Each is a great card on its own, but having both in your wallet can get you even more Membership Rewards points and help you stretch those points further when it comes time to use them for travel.

To learn more, read our full reviews of the Amex Platinum and Amex Business Platinum.

Apply here: Amex Platinum

Apply here: Amex Business Platinum

For rates and fees of the Amex Platinum card, click here.

For rates and fees of the Amex Business Platinum card, click here.

![Everything Patrick Schwarzenegger Cooks in a Day [Exclusive]](https://cdn.apartmenttherapy.info/image/upload/f_auto,q_auto:eco,c_fill,g_auto,w_660/k/Design/2025/03-2025/k-cooking-diaries-patrick-schwarzenegger/cooking-diaries-patrick-schwarzenegger-lead)

.jpg)