Chase Ink Business Preferred vs. Amex Business Platinum: Practicality vs. luxury

Editor’s note: This is a recurring post, regularly updated with new information and offers. Though the Ink Business Preferred® Credit Card (see rates and fees) and The Business Platinum Card® from American Express are both TPG favorites for small businesses, they are very different. The Amex Business Platinum is more of a membership card for …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Though the Ink Business Preferred® Credit Card (see rates and fees) and The Business Platinum Card® from American Express are both TPG favorites for small businesses, they are very different.

The Amex Business Platinum is more of a membership card for business travelers who can take advantage of its perks and benefits. The Ink Business Preferred, on the other hand, is geared toward those looking to maximize earnings on a wider range of business expenses.

There’s value to be had from adding both cards to your wallet. However, those looking for just one card should prioritize applying for the one better suited to their specific spending habits and preferences.

Let’s look at the details and benefits of each to see which you should add to your wallet.

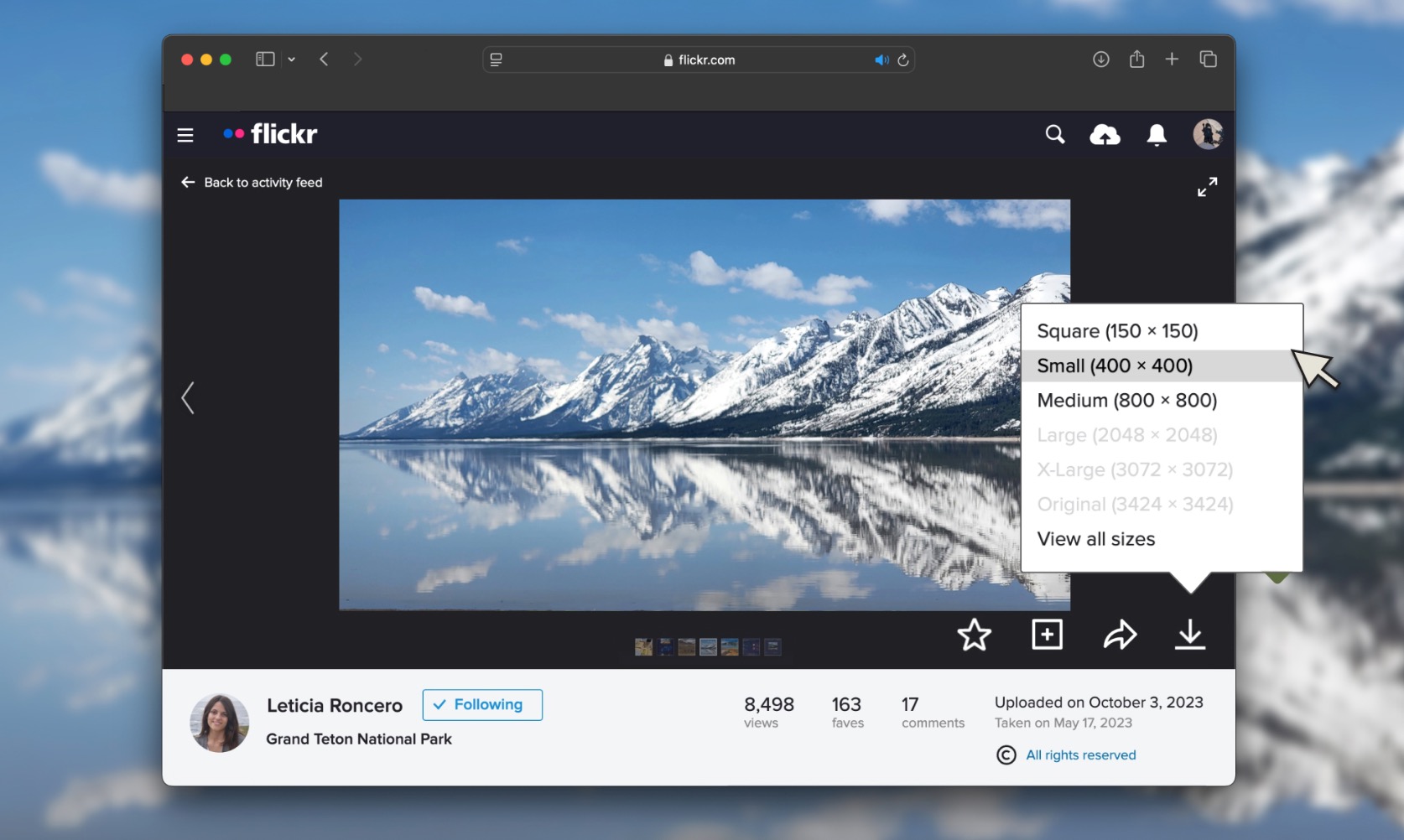

Ink Business Preferred vs. Amex Business Platinum comparison

| Ink Business Preferred | Amex Business Platinum Card | |

| Annual fee | $95 | $695 (see rates and fees) |

| Welcome offer | Earn 90,000 bonus points after spending $8,000 in the first three months of account opening. | Earn 150,000 bonus points after spending $20,000 on eligible purchases in the first three months of card membership. Plus, earn a $500 statement credit after spending $2,500 on qualifying flights booked directly with airlines or through American Express Travel within the first three months of card membership. You can earn one or both of these offers, which end June 30. |

| Earning rates |

|

|

| Statement credits | None |

*Enrollment is required for select benefits; terms apply. ^These benefits are set to change July 1. |

| Lounge access | No | Yes |

| Elite hotel status | None |

Enrollment is required; terms apply. |

| Other benefits |

|

|

Ink Business Preferred vs. Amex Business Platinum welcome offer

With the Ink Business Preferred, you’ll earn 90,000 bonus points after spending $8,000 on eligible purchases in the first three months from account opening.

Meanwhile, with the Amex Business Platinum, you’ll earn 150,000 bonus points after spending $20,000 on eligible purchases in the first three months of card membership. Plus, you’ll earn a $500 statement credit after spending $2,500 on qualifying flights booked directly with airlines or through American Express Travel in the first three months of card membership. You can earn one or both of these offers, which end June 30.

According to TPG’s May 2025 valuations, Amex and Chase points are worth 2 and 2.05 cents apiece, respectively. This means the Ink Business Preferred offer is worth about $1,845, and the Amex Business Platinum offer is worth up to $3,500 (including the statement credit).

Winner: Amex Business Platinum. Its current bonus is worth almost double the Ink Business Preferred’s.

Ink Business Preferred vs. Amex Business Platinum benefits

Undoubtedly, the Amex Business Platinum offers more value to businesses thanks to its plethora of statement credits, which include:

- Up to $400 in statement credits for Dell purchases per calendar year (until June 30)^

- Up to $360 in statement credits for Indeed purchases per calendar year (up to $90 per quarter)

- Up to $200 in airline statement credits with an eligible selected airline per calendar year

- An up to $199 statement credit as reimbursement for the annual Clear Plus membership fee per calendar year (subject to auto-renewal)

- Up to $150 for eligible Adobe purchases (subject to auto-renewal) per calendar year (until June 30)^

- A $120 statement credit for Global Entry (every four years) or an up to $85 statement credit for TSA PreCheck (every 4 1/2 years)

- Up to $120 in statement credits for spending on wireless plans with U.S. providers per calendar year (up to $10 monthly)

^These benefits are set to change July 1.

Enrollment is required for the aforementioned benefits, and terms apply.

Additionally, Amex Business Card members enjoy valuable travel perks like access to the American Express Global Lounge Collection. This includes Delta Sky Clubs (10 visits per calendar year when flying on a same-day Delta Air Lines flight; excludes basic economy flights) and Centurion, Priority Pass (enrollment required), Airspace, Escape, Plaza Premium and select Lufthansa lounges.

Cardmembers also receive complimentary Gold elite status (after enrolling) with both Hilton Honors and Marriott Bonvoy, plus useful travel protections and purchase protections.

In comparison, the Ink Business Preferred offers no statement credits or lounge access. However, the card does provide travel and purchase protections and has the slight upper hand by offering primary rental car coverage, whereas the Amex Business Platinum only offers secondary coverage.†

†Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

At the end of the day, the Amex Business Platinum takes the cake regarding valuable benefits, especially if you travel a lot for work. While the annual fee is significantly higher, using most of the Amex benefits can offset that cost.

Winner: Amex Business Platinum. The card is hard to beat when it comes to travel perks and benefits.

Earning points on the Ink Business Preferred vs. Amex Business Platinum

The two cards earn at differing rates, and each has its own unique bonus categories.

The Amex Business Platinum has the following earning rates:

- 5 points per dollar spent on flights and prepaid hotels booked through Amex Travel

- 1.5 points per dollar spent on purchases in the U.S. that are $5,000 or more each (up to $2 million in eligible purchases), as well as on purchases in the U.S. with: software and cloud system providers, construction materials and hardware suppliers, electronic goods retailers and shipping providers (then 1 point per dollar)

- 1 point per dollar spent on all other eligible purchases

Meanwhile, the Ink Business Preferred has slightly simpler bonus categories:

- 3 points per dollar spent on advertising, cable, internet, phone, shipping, social media, search engine and travel purchases (up to the first $150,000 in combined purchases per account anniversary year)

- 1 point per dollar spent on all other purchases

While the Amex Business Platinum has a higher multiplier, the Ink Business Preferred has a more attractive rewards structure for most businesses.

The Amex Business Platinum only earns 5 points per dollar spent on travel booked through Amex, so it’s not the card to use for most of your everyday spending.

In contrast, the Ink Business Preferred offers a slightly lower 3 points per dollar spent on a wider range of categories, including travel. Plus, Chase defines travel broadly, so everything from booking directly with airlines and hotels to trips booked through Chase Travel℠ and purchases made with ride-hailing services is covered.

Winner: Ink Business Preferred. The card offers a more valuable rewards structure.

Redeeming points on the Ink Business Preferred vs. Amex Business Platinum

You can redeem your Chase points at a fixed rate of 1.25 cents apiece for travel purchases like flights, hotels and rental cars that you book through Chase Travel. Or, if you have the Chase Sapphire Reserve® (see rates and fees), you could transfer your points to that card and redeem them at a fixed rate of 1.5 cents apiece toward travel.

Amex Business Platinum points can be redeemed for up to 1.54 cents apiece in value when used to cover business- or first-class flights with any airline or a ticket in any class with your preferred airline, thanks to Amex’s Pay with Points perk.

You can also redeem your points for merchant gift cards or to cover charges on your bill. However, these options significantly devalue your rewards to 1 cent per point or less, so we don’t recommend using your points this way.

Winner: Tie. Both cards offer decent redemption options but are much more valuable if you leverage their transfer partners.

Transferring points on the Ink Business Preferred vs. Amex Business Platinum

Both cards are part of valuable rewards programs that offer a lot of redemption flexibility. Both offer an incentive for booking award travel through their portals and have a solid list of transfer partners.

However, I would say that you can get more value out of the Amex Membership Rewards program because of two primary features: a superior transfer partner program and the Pay with Points benefit.

Chase and Amex each have solid lists of transfer partners that include airlines and hotels, but Amex edges Chase out with 21 partners to choose from, including Delta, Emirates, Hilton and Marriott. Amex also frequently runs transfer bonus promotions. Chase, in comparison, has only 14 transfer partners and offers less frequent transfer bonuses.

I recently transferred my Chase Ultimate Rewards points to Virgin Atlantic Flying Club with a 40% transfer bonus. I was able to secure a business-class ticket on Virgin Atlantic from Los Angeles International Airport (LAX) to London’s Heathrow Airport (LHR) for only 35,000 Chase points.

Related: A complete list of transfer bonuses over the past decade — which issuer is the most generous?

Winner: Amex Business Platinum. It can’t be beaten, thanks to its top-notch transfer partner program and Pay with Points benefit.

Should I get the Ink Business Preferred or Amex Business Platinum?

The Ink Business Preferred is geared toward everyday business spending thanks to its easy-to-maximize bonus categories. Conversely, the Amex Business Platinum emphasizes premium perks such as business- and travel-related statement credits. It also offers bonus categories that are suited to businesses that make large purchases and spend a lot on flights and hotels.

Bottom line

The Amex Business Platinum is best for business owners who want to enjoy premium travel perks and earn bonus points on flights and hotels … and can stomach the high $695 annual fee.

However, if you are a business owner who doesn’t travel frequently but wants to earn a high number of points, the Ink Business Preferred is the better choice, as it has a more affordable annual fee of $95.

For many people, it might make sense to hold both cards. That way, you can maximize several opportunities to earn bonus points across a wide range of categories.

Whether you choose one or both cards, you’ll want to ensure you understand the credit card application rules and restrictions before applying.

For more information on these cards, read our full reviews of the Ink Business Preferred and the Amex Business Platinum.

Apply here: Ink Business Preferred Credit Card

Apply here: The Business Platinum Card from American Express

For rates and fees of the Amex Business Platinum Card, click here.