Chase Pay Yourself Back Q2 categories — is it a good use of your rewards?

Editor’s note: This is a recurring post, regularly updated with new information and offers. If Chase’s Pay Yourself Back hasn’t been on your radar in a while, it may be worth brushing up on this redemption option. Not only has the option continued to expand to a broader list of Chase cards, but some redemption …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

If Chase’s Pay Yourself Back hasn’t been on your radar in a while, it may be worth brushing up on this redemption option.

Not only has the option continued to expand to a broader list of Chase cards, but some redemption rates aren’t anything to sneeze at.

Chase offers its Pay Yourself Back benefit on some cobranded credit cards, including Southwest Airlines cards, United Airlines cards, the Chase Aeroplan® Credit Card (see rates and fees) and the Marriott Bonvoy Bold® Credit Card (see rates and fees).

Many of these current offers are valid now through June 30.

Here’s everything you need to know about using Chase Pay Yourself Back.

What is Chase Pay Yourself Back?

In 2020, when most of the world wasn’t traveling, Chase introduced Pay Yourself Back as an ongoing redemption option within its Ultimate Rewards program to give cardmembers an alternative to redeeming points for travel. The categories have evolved over time, removing options such as grocery and home improvement stores and adding others.

In short, the Pay Yourself Back option allows cardholders of many Chase cards to use points at a redemption value similar to booking travel. This won’t typically give you the same maximum value for your Ultimate Rewards points you can get with strategic use of transfer partners.

However, it could be a good choice if you’re looking for a simple redemption or are sitting on a pile of points without immediate use.

With some airline cards now eligible for Pay Yourself Back, the rate at which you can redeem for some categories is over the average return you’ll likely get when using the miles to book travel.

Related: The best Chase credit cards

What purchases are eligible for Pay Yourself Back?

Here are the current categories eligible for Pay Yourself Back:

| Card | Redemption value | Current end date |

| Chase Sapphire Reserve® (see rates and fees) and J.P. Morgan Reserve Card | Select charities: 1.5 cents per point

Gas stations, groceries, pet supply stores, veterinary services and cardholder annual fees: 1.25 cents per point |

June 30 |

| Chase Sapphire Preferred® Card (see rates and fees) | Select charities: 1.25 cents per point | June 30 |

| Chase Freedom Flex® (see rates and fees), Chase Freedom Unlimited® (see rates and fees) and Chase Freedom | Select charities: 1.25 cents per point | June 30 |

| Ink Business Preferred® Credit Card (see rates and fees), Ink Business Premier® Credit Card (see rates and fees), Ink Business Cash® Credit Card (see rates and fees) and Ink Business Unlimited® Credit Card (see rates and fees) | Select charities: 1.25 cents per point | June 30 |

| Aeroplan Credit Card | Travel purchases (up to 200,000 points or $2,500 annually) and cardholder annual fee (only purchases made at select merchants within 90 days before the redemption request date are eligible): 1.25 cents per point

Dining at restaurants, grocery stores (excluding Target, Walmart and wholesale clubs), home improvement stores and gas stations: 0.8 cents per point |

Dec. 31 for home improvement stores and gas (dining at restaurants and grocery stores are ongoing categories) |

| United Airlines personal and business credit cards | Cardholder annual fees: 1.35-1.5 cents per mile (based upon United product)

United airfare purchases made directly with the airline of at least $50: 1 cent per mile |

Dec. 31 |

| Southwest Airlines personal and business credit cards | Cardholder annual fees within 90 days of transaction date: 1 cent per point | June 30 |

| Marriott Bonvoy Bold Credit Card | Travel purchases made directly with airlines or Marriott Bonvoy hotels (up to $750 total per year): 1 cent per point | June 30 |

| Disney credit cards | Purchases made at select U.S. Disney locations in Disney Parks and Resorts, Disney store and outlet locations in the U.S., shopDisney.com, DisneyPlus.com, Hulu.com and ESPNPlus.com in the past 90 days: 1 Disney Rewards Dollar per dollar

Those with a Disney® Premier Visa® Card (see rates and fees) can redeem Disney Rewards Dollars toward airline purchases with any airline at the rate of 1 Disney Rewards Dollar per dollar |

Ongoing; no specific end date |

The information for the Chase Freedom card and J.P. Morgan Reserve Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The list of charities for Pay Yourself Back includes:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- GLSEN

- Habitat for Humanity

- International Medical Corps

- International Rescue Committee, Inc.

- Leadership Conference Education Fund

- Make-A-Wish America

- NAACP Legal Defense and Education Fund

- National Urban League

- Out & Equal Workplace Advocates

- SAGE

- Thurgood Marshall College Fund

- United Negro College Fund

- UNICEF USA

- United Way

- World Central Kitchen

Let’s say you wanted to redeem 10,000 points on your Chase Sapphire Reserve. For most purchases, you’ll get a $100 statement credit when redeeming 10,000 points.

But for those same 10,000 points, you’ll get a credit of $150 when you redeem them for an eligible charity donation. You could get an even higher value by transferring your points to travel partners, but this redemption rate matches the rate offered on Chase Travel℠ redemptions for this card.

Related: How much are Chase Ultimate Rewards points worth?

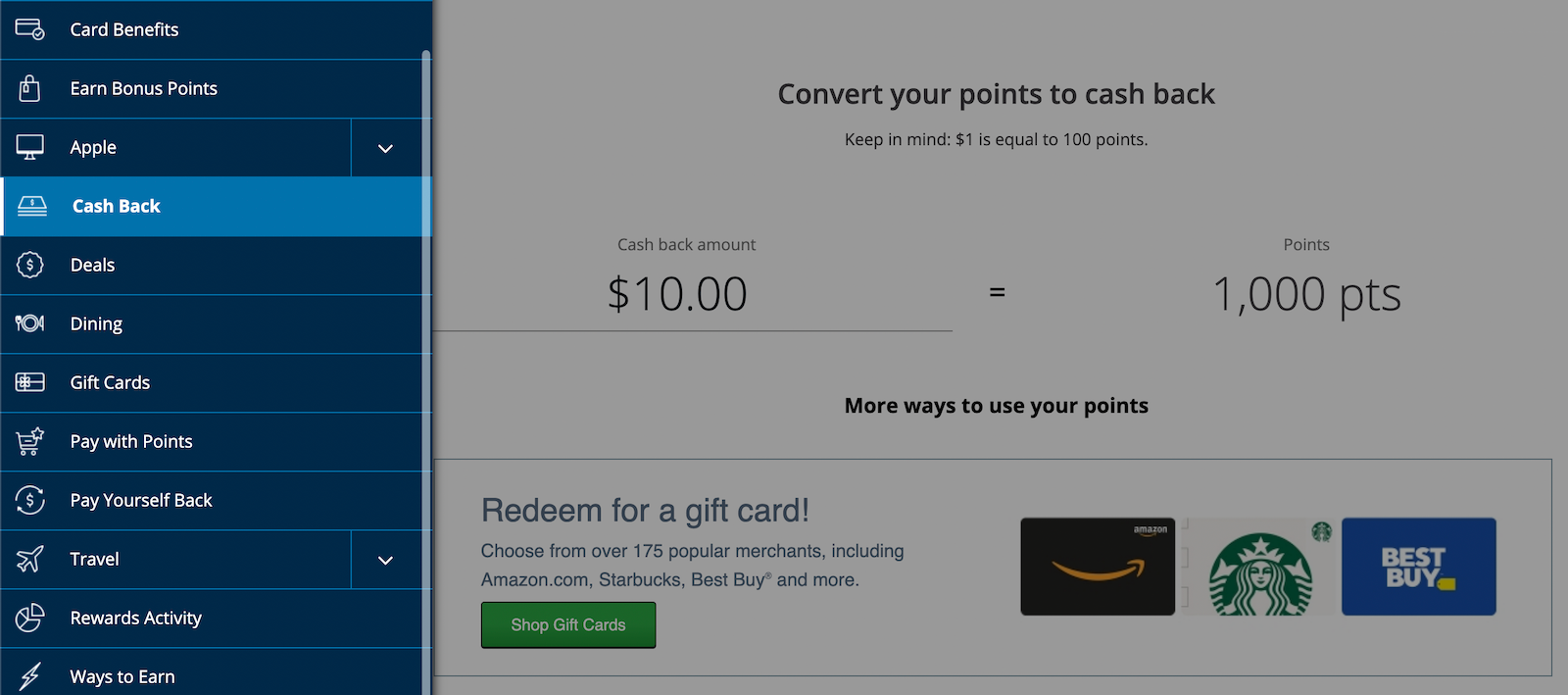

Requesting a credit

Requesting a credit through Chase’s Pay Yourself Back program is relatively straightforward. Log in to your eligible Chase account via the mobile app or desktop and select the “Pay Yourself Back” option in the redemption menu.

Next, you’ll see a list of eligible purchases for which you can redeem points. Points can be redeemed for purchases as far back as 90 days.

You can offset the full purchase amount, assuming you have enough points to cover it.

From there, you can confirm the redemption value and amount of points required and then choose to complete the transaction. Your statement credit should post within three business days.

Related: How to use Shop Through Chase to earn more points

Statement credit options on other purchases

Chase has long offered the option to redeem points for a statement credit — that’s not new. To do this, log into your Ultimate Rewards account, hit the drop-down menu and select “Cash Back.”

You’ll be given an option to enter the amount you’d like to redeem and where you’d like your rewards deposited. All cash-back redemptions are fixed at 1 cent per point, a little less than half of TPG’s March 2025 valuation of Ultimate Rewards at 2.05 cents per point.

That redemption value is also lower than many of the above Pay Yourself Back options.

Even so, Chase’s traditional cash-back option is more generous than what you can expect from some other issuers. You’ll get the same value when redeeming Citi ThankYou points for cash back, but Amex only offers 0.6 cents per point for this option. Capital One comes in last place, with cardholders netting just 0.5 cents per mile when redeeming for cash back.

Related: If I cash out my points and miles, do I have to claim it on my taxes?

Bottom line

Chase’s Pay Yourself Back feature provides valuable flexibility for many cardholders. Ultimately, whether you should redeem your balance in this way depends on how you plan to use your points, how many you currently have and whether or not you’d benefit significantly from the statement credits.

Related: Supercharge your Chase Ultimate Rewards balance with these top 5 cards

![Spirit CEO: "[m0NESY] is an incredible player and I’d love to work with him, but right now we have someone just as good"](https://img-cdn.hltv.org/gallerypicture/wMemh1NUMeyhdnS2OiK0MQ.jpg?auto=compress&ixlib=java-2.1.0&m=/m.png&mw=107&mx=20&my=473&q=75&w=800&s=8cac8af50bb8fc83d0314e59a6cb6f2f#)