EA stock forecast 2025–2030: Will esports growth boost the share price?

TL;DR Electronic Arts’ roster of popular games includes EA SPORTS FC, Madden NFL, and Need for Speed. EA stock hit its all-time high closing price of $167.53 in late November 2024 but has since been more turbulent. Wall Street analysts believe the stock could rise 5.65% to $154.22 over the coming year, as of April … Continued The post EA stock forecast 2025–2030: Will esports growth boost the share price? appeared first on Esports Insider.

TL;DR

- Electronic Arts’ roster of popular games includes EA SPORTS FC, Madden NFL, and Need for Speed.

- EA stock hit its all-time high closing price of $167.53 in late November 2024 but has since been more turbulent.

- Wall Street analysts believe the stock could rise 5.65% to $154.22 over the coming year, as of April 30, 2025.

- EA missed its third-quarter financial expectations, partly due to a slowdown suffered by its global football franchise.

- The company is expected to report net income of between $1.038 billion and $1.130 billion for the full year 2025.

Electronic Arts is a hugely successful name within the growing esports arena, but its stock price has had a rocky ride over the past few months.

The US-based gaming operator missed financial expectations for the third quarter of 2024 due to a slowdown within some of its most popular franchises.

But what does this mean for the company? How is the EA stock price likely to move over the coming year, and what are the main drivers?

In our EA stock forecast 2025 and beyond, we look at the latest Electronic Arts news, analyse its recent results, and reveal the views of stock market analysts.

EA stock forecast 2025–2026: 1-year EA projection

As of April 30, 2025, EA stock is rated as a ‘hold,’ according to the views of 23 Wall Street analysts compiled by MarketBeat.

They have an average target price of $154.22, which represents a potential 5.65% upside over the coming year. However, the highest projection was $183 and the lowest $125.

However, it’s worth noting that this only represents the views of one Wall Street analyst. The following chart shows the EA outlook of both analysts and algorithmic forecasters.

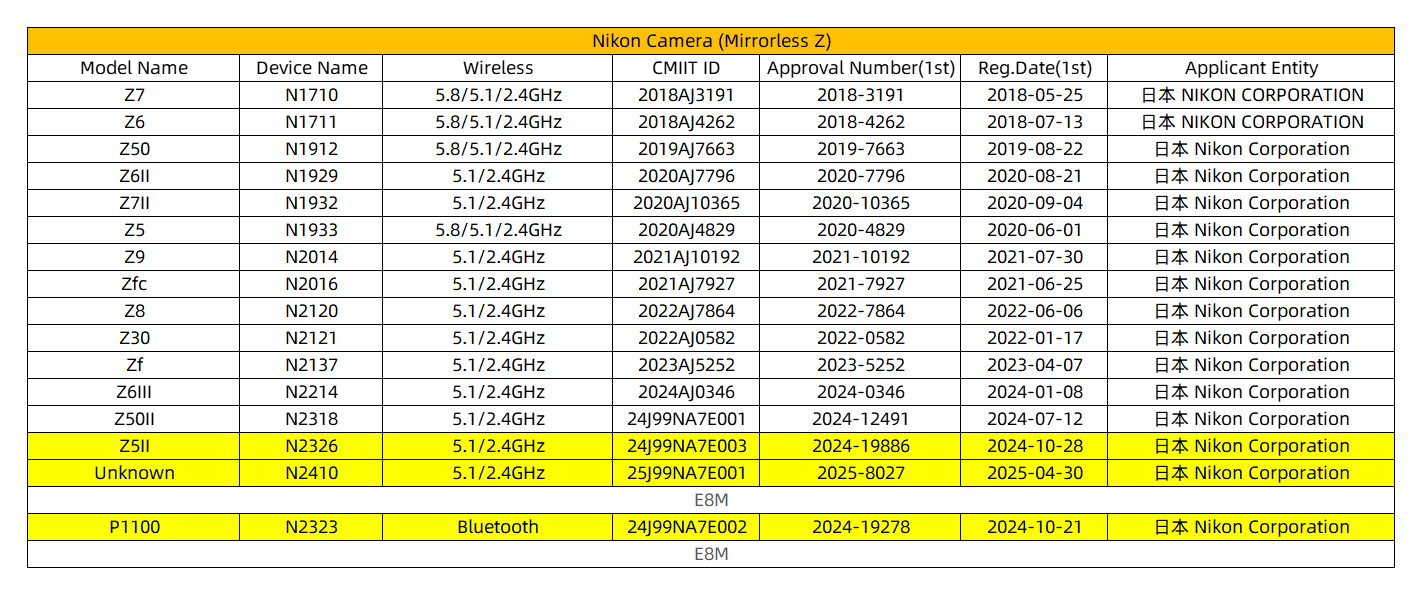

| 1-year Electronic Arts stock forecast (as of April 30, 2025) | |

| MarketBeat | $154.22 |

| WalletInvestor | $148.82 |

| GovCapital | $161.81 |

So, what do analysts think of Electronic Arts’ stock expectations and the company’s potential future?

Analysts’ latest EA stock forecast

According to Danni Hewson, head of financial analysis at AJ Bell, the stock market is anticipating some challenging times ahead.

She told Esports Insider:

“Electronic Arts missed estimates last quarter, and analysts expect it to disappoint in terms of profits this time round.”

However, she believes there is a reason that brokers like the stock and why its share price is up almost 15% over the past year.

“EA has been working on improving its margins, and it is expected to rebound in terms of EPS (earnings per share) over the next financial year.”

Hewson pointed out that its previously announced share buyback shows the business is confident in its future direction, while its roster of games illustrates why it’s attractive.

“People love sports, especially football, whether it’s the American version or soccer, and the immersive game play that EA Sports now provides its fans is leading to more money spent in the game,” she explained.

As an added bonus, investors are seeing it as a resilient investment. Hewson added:

“There’s an expectation that this kind of gaming will broadly escape any economic downturn because it’s an affordable luxury that people can indulge in without breaking the bank, and one that complements a sports fan’s enjoyment.”

EA stock forecast 2027–2030: Longer-term prospects

| Long-term Electronic Arts stock forecasts (as of April 30, 2025) | ||

| Year | April 2027 | April 2030 |

| WalletInvestor | $151.69 | $158.36 |

| GovCapital | $168.46 | $178.27 |

How about the longer-term EA stock price forecast? Are analysts optimistic about the company’s current trajectory, or do they have nagging doubts?

Matthew Dolgin, senior equity analyst at Morningstar, is a fan of the approach taken by the company and is relatively upbeat about the outlook.

In his latest Electronic Arts stock prediction, he said:

“We prefer EA’s business to other video game companies because we think its sports strategy makes results steadier and less risky.”

He highlighted the fact that EA holds the rights to the two most popular sports video games: American football and soccer, with its Madden and FC franchises.

“EA does not disclose how much revenue it derives from individual games, but we believe Madden and FC are typically the firm’s top-selling games in years without major releases from its other franchises,” he explained.

Looking ahead, Dolgin emphasised the importance of EA’s sports games, while also highlighting franchises such as Apex Legends, Battlefield, and The Sims.

“Other games should go through peaks and valleys based on the release of sequels, and we expect EA to continue working to develop new franchises,” he said. “However, we expect sports to carry the company.”

As far as his EA price target is concerned, Dolgin has had a fair value estimate of $145 on the stock since Jan 22, 2025.

EA stock YTD, 1-year & 5-year performance analysis

EA stock year-to-date: -0.23%

It’s certainly been a tough start to 2025. The EA stock price plummeted 18% to $116 in late January after the company issued a disappointing trading update.

The good news is that the shares have since staged a mini-recovery and have risen to $145.97 as the market closed on April 29, 2025.

EA stock 1-year performance: +14.13%

The EA share price performance certainly looks healthier when judged over the past year, with a rise of almost 15%.

However, that headline figure doesn’t tell the full story, as the price hit an all-time high closing price of $167.53 in late November 2024 before the subsequent turbulence.

EA stock 5-year performance: +29.43%

Investors who have stayed loyal to EA stock will have seen the value of their holdings increase by almost 30% over the past five years.

This rise has been partly driven by net bookings for its global football franchise, which has grown more than 70% over this period. Net bookings refer to the net amount of products and services sold both digitally and physically during the period.

Latest earnings results

The most recent Electronic Arts stock news was the company’s disappointing third-quarter results, which were published in February 2025.

The results had been pre-empted by a gloomy trading update in which EA noted that its initial guidance for fiscal year 2025 had been for mid-single-digit growth in live services net bookings.

“However, the company now projects a mid-single-digit decline, with Global Football accounting for the majority of the change,” it declared.

Despite an initially strong start, momentum for the FC game wasn’t maintained, with some users staying with previous iterations of the game.

More broadly, the company declared a quarterly cash dividend of $0.19 per share and announced plans for a $1 billion accelerated share repurchase.

Is the outlook more positive?

Chief executive Andrew Wilson acknowledged Q3 was “not the financial performance we wanted or expected” but outlined how the company was turning fortunes around.

In a statement, he said:

“We know as a leader in global entertainment, great titles – even when built and delivered with polished execution – can sometimes miss our financial expectations.”

According to Wilson, the company listened to feedback and has already implemented “significant changes” to the gameplay experience in a substantial update.

“Following the gameplay update and our popular Team of the Year event, we have reactivated over two million Ultimate Team players with all acquisition cohorts experiencing positive trends,” he noted.

Looking ahead, the company is expecting to report net income of between $1.038 billion and $1.130 billion for the full year 2025.

What is Electronic Arts?

EA is one of the leading names in the digital entertainment world, with a focus on building games and experiences for global online communities.

As of April 30, 2025, the EA market cap stands at $38.04 billion, making it the world’s third largest Esports player behind Tencent and Take 2 Interactive.

Its roster of popular games includes EA SPORTS FC (formerly FIFA), Madden NFL, Apex Legends, and Need for Speed.

Almost 10 years ago, the company launched the EA Competitive Gaming Division (CGD), with the aim of creating “highly engaging competitive experiences” with its games.

At the time, chief executive Andrew Wilson declared: “As this passion continues to grow, we’re committed to creating even more opportunities for you to connect and compete.”

Conclusion: Should I buy EA stock?

There are always plenty of pros and cons when it comes to investing in individual stocks, and Electronic Arts is no different. That’s why it’s so important to carry out your own research.

The bulls point to the fact that EA has the rights to some hugely popular games, reliable revenue streams, and plenty of experience.

However, the bears counter by pointing out that EA relies on a relative handful of games and depends on the continual renewal of licensing agreements.

Looking to the future, EA will need to continue working on new franchises to diversify its income stream in what has become a fiercely competitive esports environment.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

It’s important to draw your own conclusion as to whether Electronic Arts is a good stock by researching the company and considering the views of stock market analysts. Remember: no investment is guaranteed, so only invest what you can realistically afford to lose.

No one knows for sure. However, the stock is expected to rise 5.65% to $154.22 over the coming year, according to the consensus view of 23 Wall Street analysts compiled by MarketBeat as of April 30, 2025.

Yes, but more than 20 years ago. It has actually undergone four splits, the most recent of which took place on November 18, 2003. One EA share bought prior to March 27, 1992, would be equal to 16 EA shares today, according to Companiesmarketcap.

Net income for the full year ending March 31, 2025, is expected to be between $1.038 billion and $1.130 billion, according to the company’s most recent results.

References

- https://www.marketbeat.com/stocks/NASDAQ/EA/forecast/ (MarketBeat)

- https://www.macrotrends.net/stocks/charts/EA/electronic-arts/stock-price-history (MacroTrends)

- https://s204.q4cdn.com/701424631/files/doc_financials/2025/q3/Q3-FY25-Earnings-Press-Release-FINAL.pdf (Earnings Press Release 2025)

- https://www.ea.com/news/announcing-the-ea-competitive-gaming-division-led-by-peter-moore (ElectronicArts)

- https://companiesmarketcap.com/gbp/electronic-arts/stock-splits/ (CompaniesMarketCap)

The post EA stock forecast 2025–2030: Will esports growth boost the share price? appeared first on Esports Insider.