EA stock up 5% after strong Q4 2025 earnings: Will it rise further?

TL;DR Electronic Arts’ stock price gained 5% in post-market trading after fourth-quarter results were announced. EA’s full year 2025 net income came in at $1.12 billion, which was near the top end of the company’s guidance. The American Football franchise was a major winner, achieving more than $1 billion in net bookings during the year. … Continued The post EA stock up 5% after strong Q4 2025 earnings: Will it rise further? appeared first on Esports Insider.

TL;DR

- Electronic Arts’ stock price gained 5% in post-market trading after fourth-quarter results were announced.

- EA’s full year 2025 net income came in at $1.12 billion, which was near the top end of the company’s guidance.

- The American Football franchise was a major winner, achieving more than $1 billion in net bookings during the year.

- A quarterly cash dividend of $0.19 per share was declared. It will be paid on June 18, 2025, to stockholders, as of May 28, 2025.

- EA is investing in AI because it’s viewed as a “powerful accelerator” of creativity, innovation and player connection.

Electronic Arts saw its stock price rise 5% in extended trading after publishing decent quarterly results and an upbeat outlook.

The esports game maker highlighted strong performances from key franchises in the fourth quarter and the “highly successful” launch of Split Fiction.

It also confirmed a reveal of Battlefield would take place this summer and emphasized the growing importance of artificial intelligence.

Here, we examine the EA revenue figures for the past year, reveal the views of stock market analysts, and round up the latest Electronic Arts news.

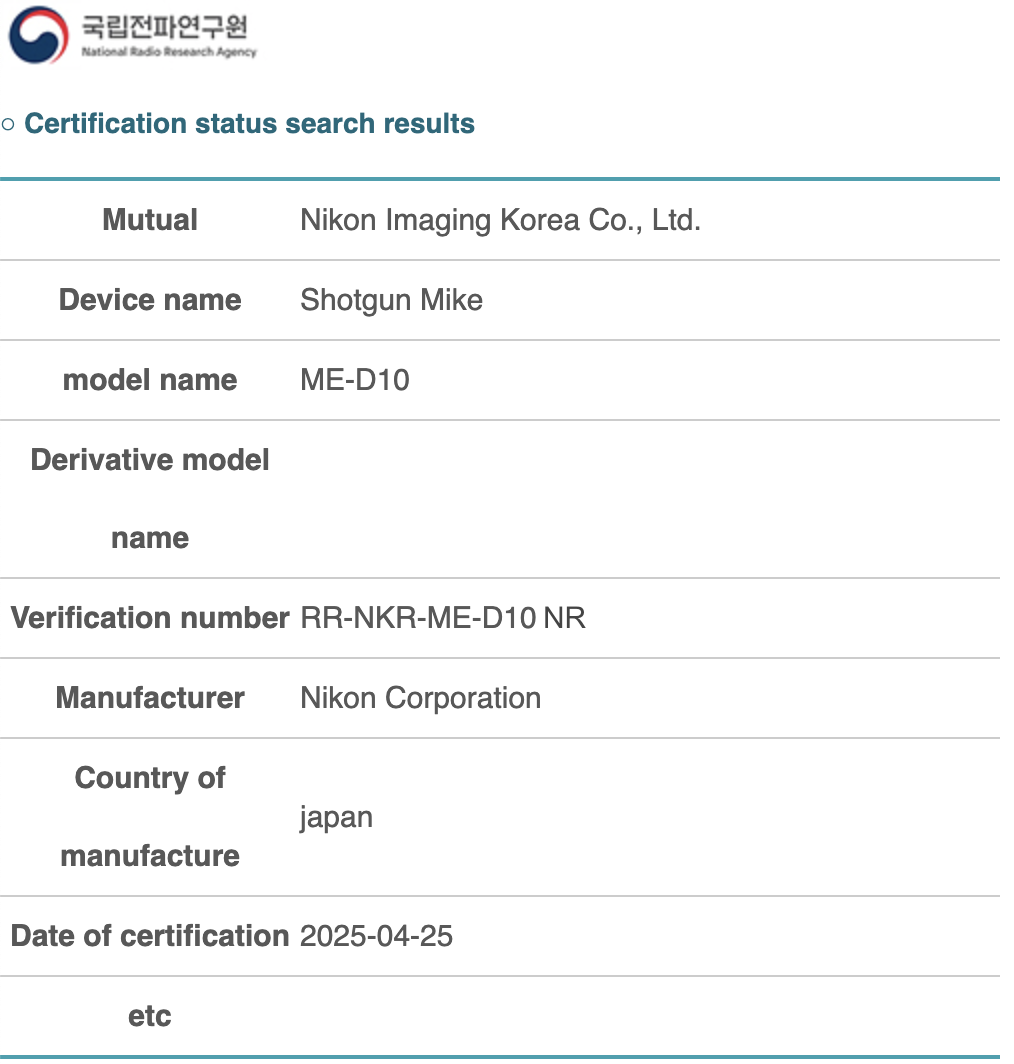

EA headline figures

| Metric | Q4 FY25 | FY25 (12 Months) |

|---|---|---|

| Net Revenue | $1.895 billion | $7.463 billion |

| Net Bookings | $1.799 billion | $7.355 billion |

| Net Income | $254 million | $1.121 billion |

| Diluted EPS | $0.98 | $4.25 |

| Operating cash flow | $549 million | $2.079 billion |

| Cash dividend paid | $48 million | $199 million |

| Full game revenue | $437 million | $2.002 billion |

Source: Electronic Arts

The latest EA earnings were released after the New York Stock Exchange closed on May 6, 2025, and contained plenty of positive news.

The company reported that net revenue came in at $1.89 billion for the three months ended March 31, 2025. This was up from $1.77 billion in the corresponding quarter last year.

Net income, meanwhile, was up from $182 million to $254 million, while diluted earnings per share came in at $0.98.

As far as full-year 2025 figures were concerned, net revenue was down 1.3% to $7.46 billion, with net income slipping from $1.27 billion to $1.12 billion.

The company revealed net bookings for the full year – the amount of products and services sold both digitally and physically – stood at $7.36 billion, down 1% year-over-year.

EA repurchased 9.8 million shares for $1.37 billion during the quarter, bringing the total for the fiscal year to 17.6 million shares for $2.5 billion.

A quarterly cash dividend of $0.19 per share of the Company’s common stock. This is payable on June 18, 2025, to stockholders, as of the close of business on May 28, 2025.

Upbeat overview

According to Andrew Wilson, EA’s chief executive, a January update helped kickstart the reacceleration of growth in EA Sports FC after a shaky period.

In a statement, he also noted the positive contributions made during the quarter by the company’s American Football franchises. He wrote:

“Players across Madden NFL and College Football across console and PC grew double digits and hours played were up 68%, leading to net bookings of over $1 billion dollars – up over 70% year over year.”

Elsewhere, Wilson noted that The Sims delivered double-digit year-over-year growth in net bookings during the fourth quarter, in what is the franchise’s 25th birthday.

“This growth reflects successful player reengagement and the continued impact of our strategy to expand the global audience and elevate community connection,” he stated.

Meanwhile, the three-month period also saw the launch of Split Fiction. “This incredible title overperformed our expectations, captured global attention, and to date has reached nearly four million units sold,” he added.

EA stock is on the rise

The market responded well to the results announcement, with the EA share price rising 5.07% to $162.55 in extended trading. This was up from $154.70 as the market closed on May 6, 2025.

It’s hoped this positive momentum will continue when the stock market reopens, as the company has endured quite a turbulent 2025.

The stock price was trading around $116 in February 2025 after missing third quarter expectations, but has since been gradually recovering.

EA stock is currently rated as a ‘hold,’ according to the views of 23 Wall Street analysts compiled by MarketBeat.

Their consensus 12-month price target is for the price to be $154.22, although forecasts range from $125 to $183.

What are the analysts’ views?

Matthew Dolgin, senior equity analyst at Morningstar, increased his fair value estimate for EA from $145 to $150 after the announcement. This reverses the change made in January.

In an update, he said:

“EA’s core sports franchises and player engagement with them are key to our narrow moat rating and the stable growth we project.”

Dolgin pointed out that the company’s business had “materially accelerated” after it warned back in January that sales had slowed.

“January’s softness was largely due to weak sales in the FC soccer game, a critical franchise for EA,” he explained. “EA released an FC gameplay update in January and subsequently saw engagement and monetization grow by double digits.”

Dolgin also noted that “most of EA’s largest franchises” were now performing well.

Guidance for 2026

Net bookings for fiscal year 2026 are expected to be approximately $7.6 billion to $8 billion, with growth driven by the EA Sports portfolio, The Sims, and launches such as Battlefield.

It means net revenue is expected to come in between $7.1 billion and $7.5 billion, with net income of approximately $795 million and $974 million.

The first quarter of fiscal year 2026, meanwhile, should see net bookings of $1.17 billion to $1.27 billion, as well as net income of $125 million to $169 million.

As far as the next EA earnings date is concerned, the company has scheduled the first quarter fiscal 2026 earnings call for July 29, 2025.

Company plans & outlook for 2026

How about other EA news? What should investors in the company expect to see over the coming year?

Well, EA Sports F1 25 is expected to be introduced at the end of May 2025, while a batch of new releases are scheduled for the second quarter.

These are:

- EA Sports College Football 26

- EA Sports Madden NFL 26

- EA Sports NHL 26

- EA Sports FC 26

The company also noted the “highly anticipated reveal” of Battlefield this summer, which is branded as a “pivotal step” in delivering the next generation of blockbuster entertainment.

Conclusion: Future driven by AI

Looking to the future, AI is seen as a “powerful accelerator” of creativity, innovation, and player connection, according to EA’s Andrew Wilson.

He declared: “Our developers are using AI to push the boundaries of what’s possible in design, animation, and storytelling, helping us deliver deeper, more immersive gameplay.”

According to Wilson, the focus is on “amplifying the power” of this technology to “unlock new possibilities” for the future of interactive entertainment.

The company is investing in new workflows and capabilities to integrate AI to enhance how they build, scale, and personalize experiences – from dynamic in-game worlds, to “delivering authentic athlete and team likenesses at incredible scale.”

FAQs

EA stock is currently rated a ‘hold,’ based on the views of 23 Wall Street analysts, compiled by MarketBeat, as of May 7, 2025. Remember that trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

No one has recently stated an intention to buy EA, although media reports have previously suggested the company could be attractive to potential suitors.

Yes. The company reported net income of $1.12 billion for the 12 months ended March 31, 2025.

Live Services, which includes in-game purchases and multiplayer events, is where EA generates most of its revenue. It generated revenue of $5.46 billion from this area in the full year 2025.

References

- https://s204.q4cdn.com/701424631/files/doc_financials/2025/q4/Q4-FY25-Earnings-Press-Release-FINAL1.pdf (EA)

- https://www.marketbeat.com/stocks/NASDAQ/EA/forecast/ (MarketBeat)

- https://metro.co.uk/2022/05/23/disney-amazon-and-apple-in-line-to-buy-ea-claim-rumours-16690609/ (Metro)

The post EA stock up 5% after strong Q4 2025 earnings: Will it rise further? appeared first on Esports Insider.