Flight delayed? Remember these 4 things if you want trip delay reimbursement from your credit card

Editor’s note: This is a recurring post, regularly updated with new information and offers. We talk a lot about using your credit card’s benefits for things like trip delays. The peace of mind these perks can add to your trip when something goes awry is fantastic. However, before you get lulled into a false sense …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

We talk a lot about using your credit card’s benefits for things like trip delays. The peace of mind these perks can add to your trip when something goes awry is fantastic.

However, before you get lulled into a false sense of security, remember these perks are not automatic. You must take specific steps to get reimbursed for reasonable expenses after a lengthy (or overnight) delay.

Here are four things you need to do if you want your credit card’s trip delay reimbursement to actually work for you.

Pay for the trip with a credit card that provides trip delay reimbursement

Trip delay reimbursement is a benefit that compensates you for expenses that aren’t reimbursed by your transportation carrier. Cards reference “common carriers” for this coverage, which typically means forms of public transportation with published schedules on which you bought tickets — not a road trip in your friend’s car, for instance.

While airlines may provide hotel rooms and food vouchers for overnight delays that are under their control, such as maintenance issues, they typically won’t provide coverage for things like weather delays. Moreover, what an airline provides may not cover all of your expenses. This is where trip delay reimbursement can help you.

However, in order to be eligible, you must pay for your trip with a card that offers this coverage.

Here are some cards that are among the best for trip delay reimbursement:

| Card | Required length of delay | Maximum coverage amount | Annual fee |

| Capital One Venture X Rewards Credit Card | 6 hours | $500 per ticket | $395 |

| Chase Sapphire Reserve® | 6 hours or overnight | $500 per ticket | $550 |

| Chase Sapphire Preferred® Card | 12 hours or overnight | $500 per ticket | $95 |

| The Platinum Card® from American Express* | 6 hours | $500 per covered trip, 2 claims per card per 12 months | $695 (see rates and fees) |

| Delta SkyMiles® Reserve American Express Card* | 6 hours | $500 per covered trip, 2 claims per card per 12 months | $650 (see rates and fees) |

| Marriott Bonvoy Brilliant® American Express Card®* | 6 hours | $500 per covered trip, 2 claims per card per 12 months | $650 (see rates and fees) |

| World of Hyatt Credit Card | 12 hours or overnight | $500 per ticket | $95 |

| Marriott Bonvoy Boundless® Credit Card | 12 hours or overnight |

$500 per ticket | $95 |

| Marriott Bonvoy Bold® Credit Card | 12 hours or overnight | $500 per ticket | $0 |

| United Club℠ Infinite Card | 12 hours or overnight | $500 per ticket | $525 |

| United℠ Explorer Card | 12 hours or overnight | $500 per ticket. | $0 intro annual fee for the first year, then $95 |

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

It’s important to note that the specific terms can vary from card to card (or issuer to issuer).

For example, here are the terms from Chase Sapphire Preferred Card (according to the card’s benefits page):

“This benefit applies to reasonable expenses incurred during Your delay not otherwise covered by Your Common Carrier, another party, or Your primary personal insurance policy. You will be refunded the excess amount (up to the maximum) once all other reimbursement has been exhausted up to the limit of liability.”

The card covers “reasonable expenses” from the delay. This means that items like a new toothbrush are likely covered, but three pairs of new shoes probably aren’t.

Also, coverage is secondary, meaning that it kicks in after any other insurance or coverage you may have (benefits from the transportation carrier, your own insurance protections, laws, etc.).

Lastly, find out if your card’s specific benefit requires you to pay for the full amount of the trip or just a part of it to invoke trip delay reimbursement coverage. On the Chase Sapphire Reserve, you can “charge all or a portion of a common carrier fare to your credit card account and/or rewards programs associated with your account.” Capital One cards have similar terminology. Thus, an award booking where you paid for the taxes and fees with your card would be sufficient.

However, many American Express cards would not cover your trip delay in that situation because its terms require you to pay the “full amount” of the trip on the card to receive the benefit.

Related: Flight delayed or canceled? Here are the best credit cards with trip delay reimbursement

Get a statement from the carrier confirming the delay

Once your delay passes the required amount of time mentioned above, it’s time to get it in writing. If it’s not in writing, it doesn’t exist.

The simplest way to do this is to ask a staff member at the customer service desk, at your flight gate or at some other airline facility. Most importantly, try to do this while you’re still at the airport.

If you leave the airport without getting a delay confirmation, it’s possible to request one after the fact. Delta, for example, has a landing page to request this form, while other airlines handle this through their respective customer service contacts. However you get this information, be sure it includes: your name(s), the confirmation or ticket numbers, the flight details (date, flight number, etc.) and the specific reason for the delay.

Confirming a flight was delayed vs. proving that the delay was due to a covered reason are two different things. Be sure you get a form that actually supports the claim you will make for reimbursement with your credit card’s trip delay coverage.

The same concept applies whether your travel was with an airline, bus company or cruise.

Related: 3 things to do if your flight is delayed

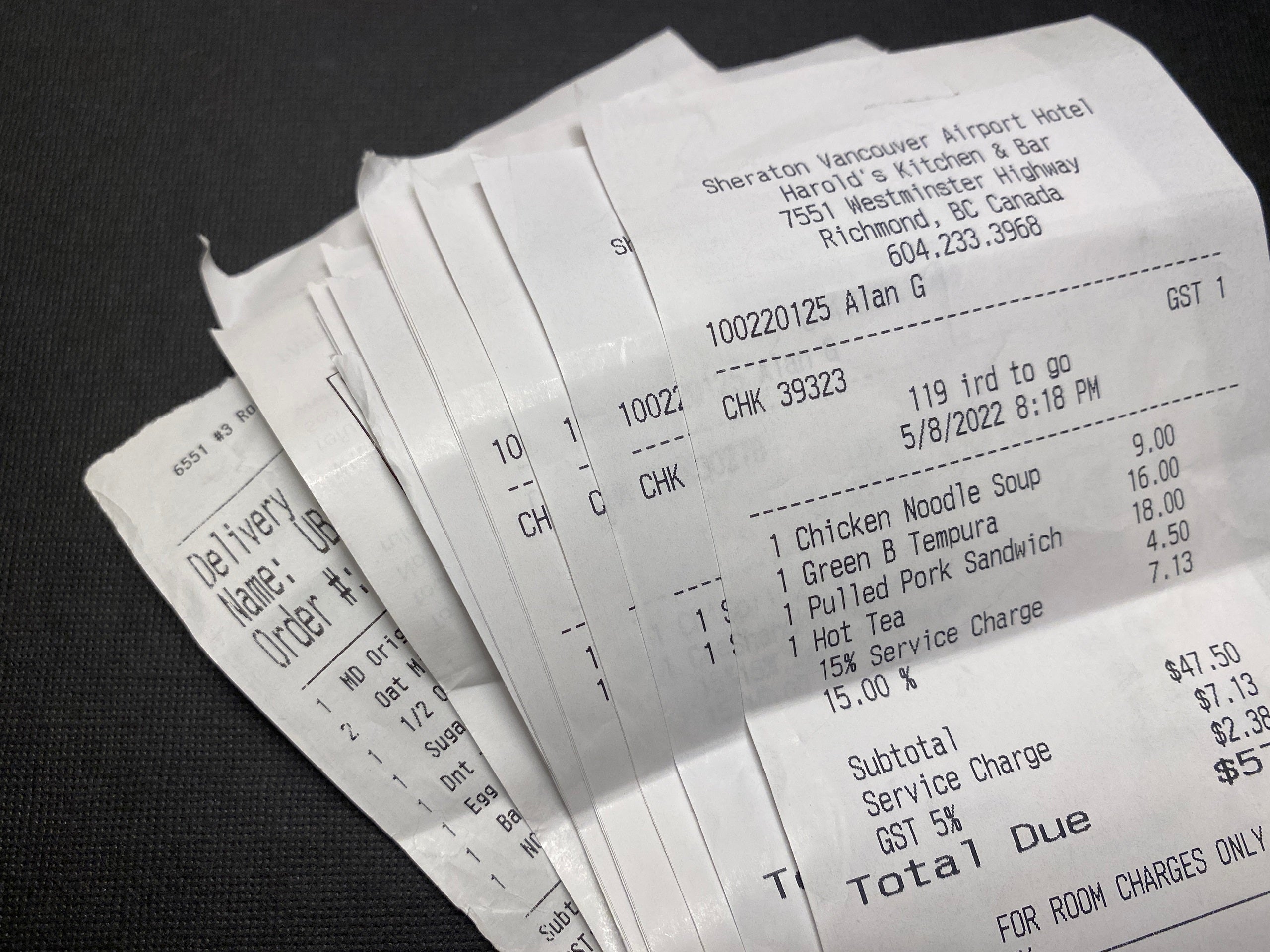

Save the receipts

Get printed receipts for any expenses you incur, and make sure you save them. In fact, you should probably take a picture with your phone as soon as you receive them — that way, you have a record of the purchases, even if the physical copies get lost. If you don’t get a receipt, you can’t submit for reimbursement with your credit card issuer.

This doesn’t just apply to receipts for your purchases during the delay, as you need to save the confirmation emails associated with the trip. You’ll need that documentation to prove that you paid for this trip with a credit card that offers trip delay reimbursement. You may even be asked for the monthly statement with the transaction — which is what TPG senior editorial director Nick Ewen had to provide when he had an unexpected overnight layover in Lima, Peru on his way back from Chile in 2019.

During your delay, you may want to start gathering those documents. Make sure you know which credit card you used to pay for the trip, and start organizing these things for the claim you will make later. Doing this will also help to avoid surprises later.

Why? You’ll verify what coverage you have based on the card you used — like how long the delay must be before coverage kicks in.

Related: Is travel insurance worth it?

If this is part of a longer trip, save the paper trail

In January 2021, I submitted a claim for expenses related to a delay on a flight departing Tanzania. Prior to the flight, my wife and I had been on the road for several weeks, visiting multiple other countries. The insurance adjuster asked for a paper trail showing how we got from our home address to Tanzania prior to the delay and our request for expense reimbursement.

Luckily, I keep those documents organized in my email and on my computer and was able to provide the tickets and confirmation numbers showing where we had been between leaving home and getting to the incident in question.

Experiences will vary, but the point is that you should keep a paper trail. Unfortunately, based on my experience, most insurance companies don’t make it easy for you to be reimbursed. Saving receipts for your expenses and all of the transportation you took after leaving home can help you support a claim when the flight is part of a longer trip that’s not necessarily to or from your home airport.

Related: What to do when an airline loses your luggage

Bottom line

Knowing that you are covered by trip delay reimbursement on your credit card can reduce headaches during your trip. This benefit provides peace of mind during delays, since you know you will be reimbursed for any expenses you incur.

However, you’ll only get that reimbursement check if you follow the proper steps. Make sure you know exactly how your card’s coverage works and when it kicks in. Then make sure you have the necessary documents when submitting your claim. You’ll need your tickets and receipts from the purchase, plus a confirmation of the delay reason from the common carrier and the receipts for your expenses.

Related: Should you get travel insurance if you have credit card protection?

For rates and fees of the Amex Platinum card, click here.

For rates and fees of the Amex Bonvoy Brilliant card, click here.

For rates and fees of the Delta SkyMiles Reserve Amex, click here.

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)