Last chance: Capital One Venture Rewards offer worth over $1,000

Editor’s note: This is a recurring post, regularly updated with new information and offers. The Capital One Venture Rewards Credit Card is a great choice for beginners and experts who want an easy way to earn miles without much effort, all with an affordable annual fee. The Venture Rewards has a great welcome offer, and now …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

The Capital One Venture Rewards Credit Card is a great choice for beginners and experts who want an easy way to earn miles without much effort, all with an affordable annual fee.

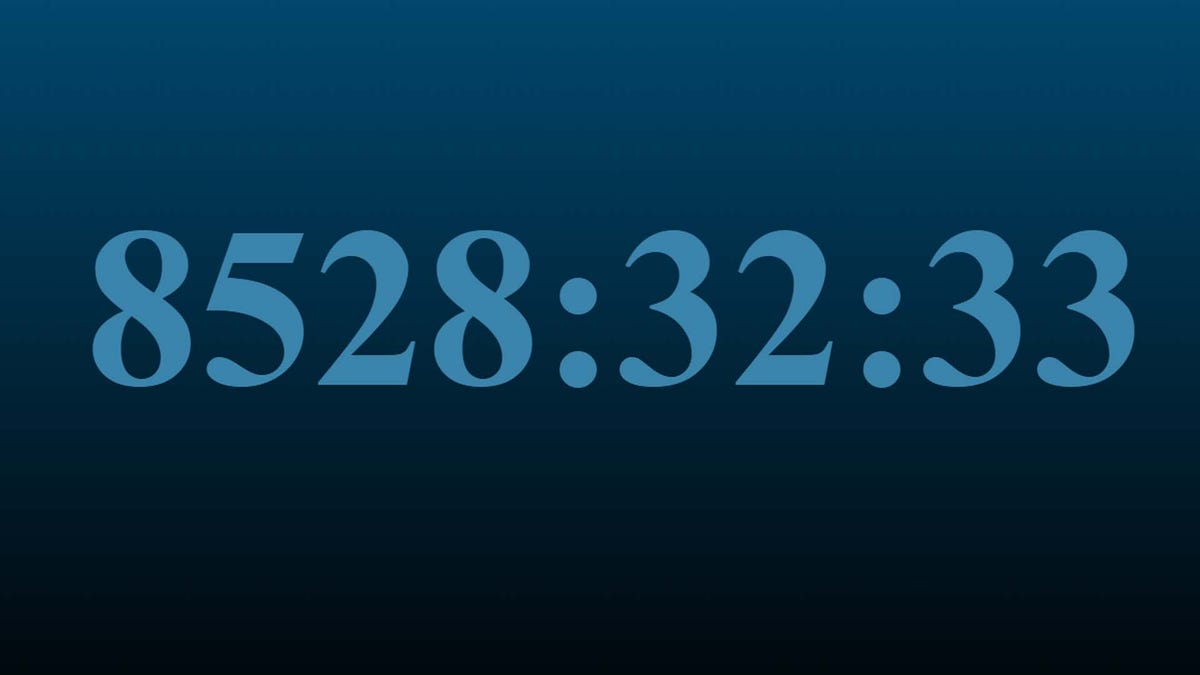

The Venture Rewards has a great welcome offer, and now is your last chance to take advantage of it, as the offer ends May 12. This is tied with the best public welcome offer this card has offered in the past couple of years, so it’s a good time to consider it.

Ending soon: Capital One Venture Rewards Card — Earn 75,000 bonus miles after spending $4,000 in the first three months. Plus, receive a $250 Capital One Travel credit to use in the first year.

Here’s what you need to know about the current Capital One Venture Rewards offer.

Capital One Venture Rewards welcome offer

New Capital One Venture Rewards cardholders can earn 75,000 bonus miles after spending $4,000 on purchases within the first three months of account opening. Plus, they can receive a $250 Capital One Travel credit in the first year. This offer ends May 12, and if you’ve been on the fence about a new travel credit card, this opportunity should not be missed.

After hitting a very manageable spending requirement, this offer will net you $1,388 in value from the bonus miles, according to TPG’s May 2025 valuations. When adding the value of the Capital One Travel credit, you can receive up to $1,638 in total value.

This is tied with the best public welcome offer we have seen on this card in the past couple of years, so now is a great time to apply. Previously, we’ve seen offers as high as 100,000 miles after meeting the minimum spend requirements (no longer available), but this offer is still solid.

It’s possible to squeeze significantly more value from that bonus if you redeem Capital One miles for maximum value, thanks to their impressive roster of 15-plus transfer partners.

Related: The best Capital One credit cards

Earning Capital One miles

This card earns a flat 2 miles per dollar spent on most purchases. So, by spending $4,000 on it to earn the welcome bonus, you’d earn at least 83,000 miles in the first few months, including the welcome bonus.

If you earned 83,000 miles, that bumps the total value of your miles after earning the bonus and the travel credit up to $1,786, based on TPG’s May 2025 valuations.

And since the Venture Rewards earns 5 miles per dollar spent on car rentals, vacation rentals and hotels booked through Capital One Travel, it’s possible to earn even more miles while working toward earning your welcome bonus.

While some travel credit cards may earn slightly higher rates on select categories such as groceries or dining, the draw here is the simplicity — and guarantee — of earning 2 miles per dollar spent on almost anything you buy without memorizing multiple bonus spending categories.

Related: Why I keep the Capital One Venture Rewards card in my wallet

What can Capital One Miles get you?

Your total value from this welcome bonus depends on how you redeem your miles. There are two ideal options:

- Redeem for 1 cent apiece toward travel

- Redeem by transferring to Capital One’s 15-plus partner airlines and hotels

When converting your miles to hotel points or airline miles, most partners offer a 1:1 transfer ratio, though a couple of partners have different ratios. You can get great sweet spot redemptions by transferring miles to programs like Air Canada Aeroplan and Air France-KLM Flying Blue.

For example, Nick Ewen, a senior editorial director at TPG, transferred 117,000 Capital One miles to Emirates Skywards to upgrade himself and two family members to Emirates first class. This broke down to 39,000 miles per person, a reasonable upgrade cost.

If you don’t want to transfer your miles, you can redeem them by booking a trip through Capital One Travel. These redemptions can be very handy in a world where you may be renting recreational vehicles, booking vacation home rentals or securing a cabin close to home more often than hopping on a flight to the other side of the world.

Related: Cashing in Capital One miles? How to get the maximum value when redeeming miles

Other Venture Rewards perks

The Capital One Venture Rewards doesn’t offer the same benefits as more premium travel rewards cards, including its upscale sibling, the Capital One Venture X Rewards Credit Card. But for its modest $95 annual fee, the Venture Rewards provides some useful benefits:

- Up to a $120 statement credit for Global Entry or TSA PreCheck application fees

- Extended warranty protection

- Complimentary concierge service

- MasterRental insurance

- No foreign transaction fees

Related: Chase Sapphire Preferred Card vs. Capital One Venture Rewards

Bottom line

With the ability to transfer miles to travel partners or use miles to cover the cost of whatever travel charges you wish, the Venture Rewards can be a valuable addition to your wallet. Plus, with the limited-time $250 Capital One travel credit ending soon, the card’s value proposition is even stronger.

If you’ve been thinking about applying for the Venture Rewards, now is a great time to do so and take advantage of this great welcome offer before it’s gone. This offer ends May 12.

To learn more, read our full review of the Capital One Venture Rewards card.

Learn more: Capital One Venture Rewards Credit Card

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

/f871ef26-7798-46a2-9db3-fe949a2f050b--2016-0719_okra-couscous-salad_james-ransom-417.jpg?#)