No Annual Fee Mesa Homeowners Card: Too Good To Be True?

We recently saw the introduction of the Mesa Homeowners Card. Okay, that’s not exactly the sexiest card name, and the card’s lack of obvious affiliation with a major bank might make some people skeptical. However, the card offers some really good benefits, all with no annual fee.

Link: Apply now for the Mesa Homeowners Card

We recently saw the introduction of the Mesa Homeowners Card. Okay, that’s not exactly the sexiest card name, and the card’s lack of obvious affiliation with a major bank might make some people skeptical. However, the card offers some really good benefits, all with no annual fee.

I’m trying to decide whether to apply for this myself, so let me cover all the details, because (dare I say) this almost sounds too good to be true. Thanks to Frequent Miler for flagging this.

Basics of the Mesa Homeowners Card

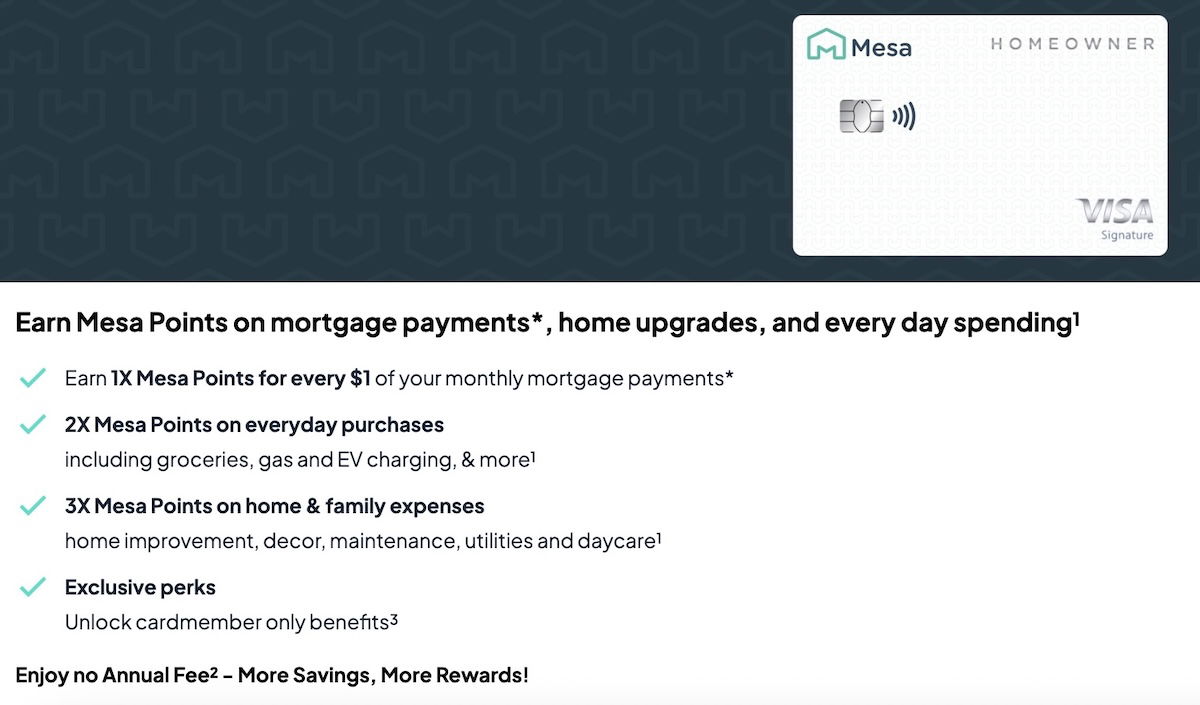

The Mesa Homeowners Card is a Visa Signature product issued by Celtic. It has no annual fee, gives you points for paying your mortgage (without even using the card!), and even offers some credits that can help you come out ahead.

On the surface, I’m almost suspicious of this concept, because I don’t understand how exactly Mesa is supposed to make money. Then again, I largely had the same skepticism when Bilt first launched, yet Bilt is still chugging along, and at least has a very high valuation. Think of Mesa as being to mortgages as Bilt is to paying rent (even though we know that Bilt also plans to get into the mortgage space).

Mesa Homeowners Card points for mortgage payments

The Mesa Homeowners Card offers offers 1x points on your mortgage payments, up to a maximum of 100,000 points per year. You don’t even have to use your Mesa Homeowners Card to pay your mortgage, but instead, you just need to make $1,000 in qualifying purchases on the account per billing cycle to unlock that.

The way it works is that you connect your bank account from which your mortgage is debited to the Mesa app, and then Mesa will give you points for that amount. It’s my understanding that there’s typically little verification and validation when it comes to this. Yes, you’re literally getting points without using the card for those purchases, though you do have to make $1,000 in purchases per billing cycle.

Mesa Homeowners Card 1-3x points rewards structure

Beyond the ability to earn points simply for paying your mortgage, the Mesa Homeowners Card has the following rewards structure, all with no foreign transaction fees:

- 3x points on home & family expenses, including home decor, home improvement, general contractors, cable and streaming services, home insurance, property taxes, maintenance, telecommunications, utilities, and daycare

- 2x points on groceries, gas, and EV charging

- 1x points on other eligible purchases

Those 3x points categories seem super lucrative to me. For example, 3x points on general contractors, property taxes, and daycare, all seem like unique bonus categories that you won’t find on other cards.

Anecdotally, I’ve heard that paying income taxes and HOA fees with the card also triggers the 3x points, but I can’t guarantee that will continue to be the case, and don’t have any firsthand experience.

Mesa Homeowners Card welcome bonus of 5,000 points

Here’s the bad news — the Mesa Homeowners Card doesn’t have a substantial sign-up bonus. There’s no publicly available bonus, though if you sign-up through a refer a friend link, both the person referring and person being referred can get 5,000 points. You can find my refer a friend link here, and others are free to leave their links in the comments section.

In the interest of transparency, let me mention that there was briefly a welcome bonus of 50,000 points on the card, but it was pulled very quickly, which suggests to me that the company doesn’t have plans to offer a generous public bonus, as a standard. Of course some people may still choose to wait for one, which is fair.

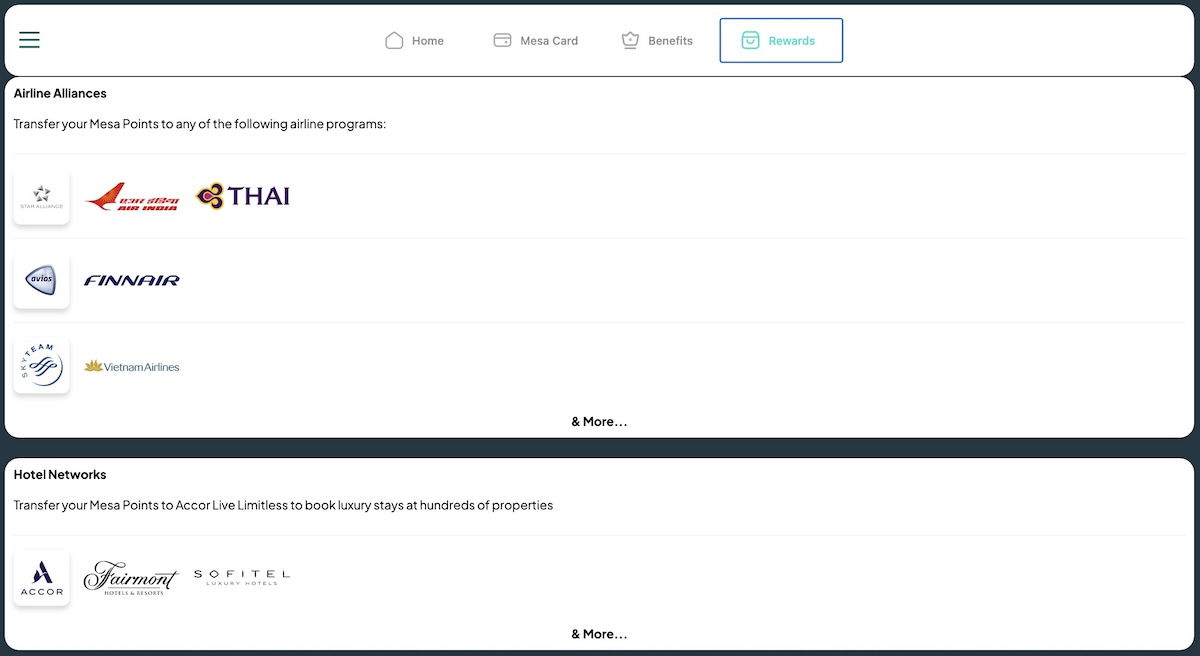

Mesa Homeowners Card points redemption options

Mesa points can be redeemed in a variety of ways. You can redeem them toward gift cards at the rate of 0.8 cents per point, or toward statement credits at the rate of 0.6 cents per point. That’s not terribly exciting, though fortunately it’s also possible to transfer points to travel partners.

Mesa points can be transfered to the following travel partners (all at a 1:1 ratio, except Accor, which is at a 1.5:1 ratio):

- Accor Live Limitless

- Air Canada Aeroplan

- Air India Maharaja Club

- Finnair Plus

- Hainan Airlines Fortune Wings Club

- SAS EuroBonus

- Thai Airways Royal Orchid Plus

- Vietnam Airlines LotusMiles

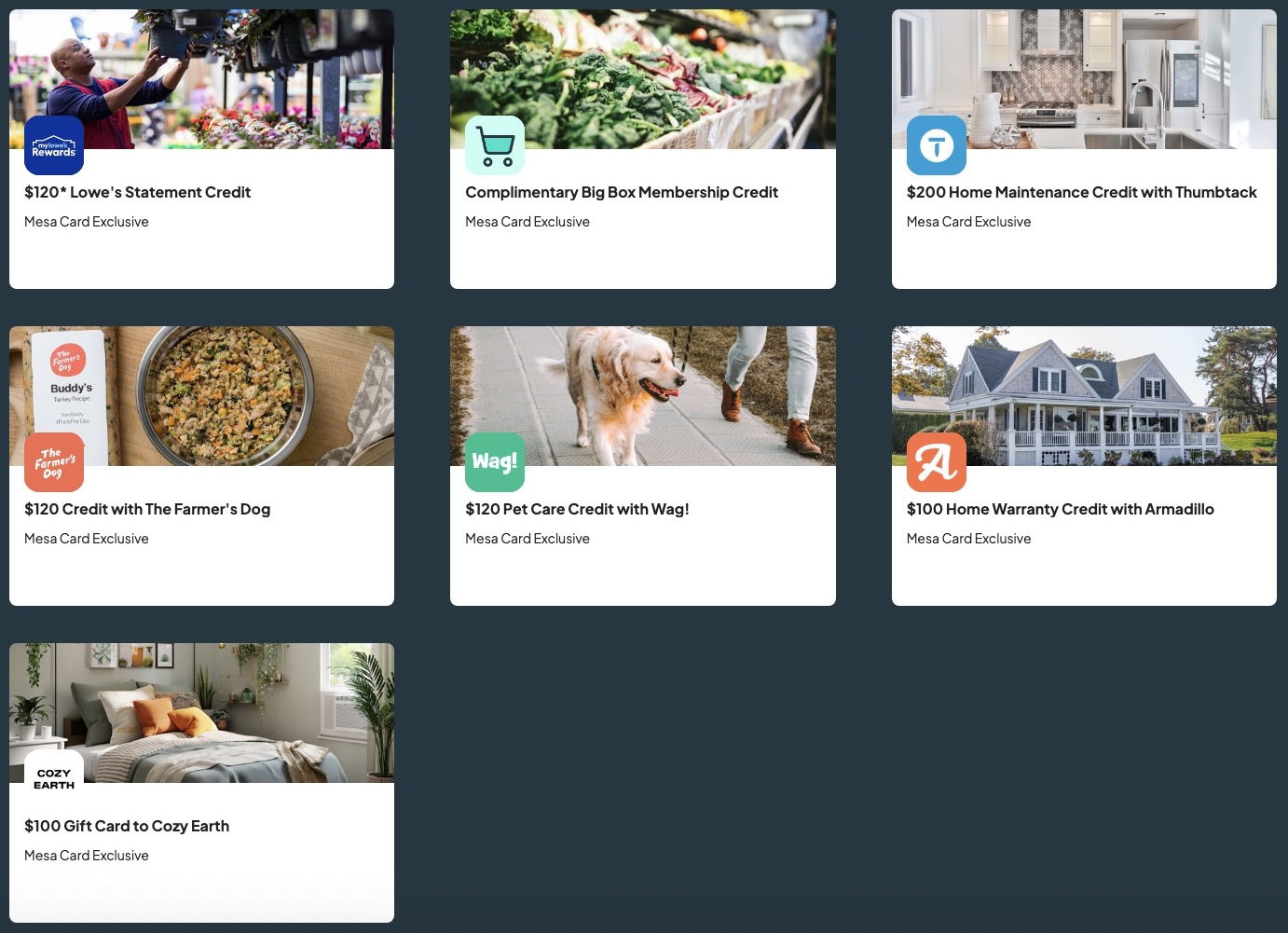

Mesa Homeowners Card credits & benefits

Despite being a no annual fee product, the Mesa Homeowners Card offers a surprising number of credits and benefits, which in and of themselves could make it worthwhile to acquire the card. Here are some of the credits offered, with enrollment generally being required, and some offers only being valid the first year:

- A complimentary big box membership credit of up to $65, toward a membership for Costco, Sam’s Club, and BJ’s

- Up to $200 per year in home maintenance credits with Thumbtack, in the form of a $25 credit per job

- Up to $120 per year in Lowe’s statement credits, in the form of a $30 quarterly statement credit

- Up to $120 per year in credits for The Farmer’s Dog, in the form of a $10 monthly credit

- Up to $120 per year in Wag! credits, in the form of a $10 monthly credit

- Up to $100 in Cozy Earth gift cards, for home essentials & bedding

- Up to $100 in home warranty credits with Armadillo, toward a home warranty deductible

Is the Mesa Homeowners Card worth it?

A no annual fee card that gives you points for paying your mortgage, offers credits, and even has some awesome bonus categories? Sounds pretty great, no? Here’s my take, because I’ll admit, I was a bit skeptical at first.

In fairness, the card doesn’t have a very big welcome offer, so I suppose many people would consider there to be an opportunity cost to this application, compared to the larger welcome bonus they could get on another card. In theory, cards aren’t mutually exclusive, but I know some people try to keep their total number of inquiries down.

With that out of the way, this card really seems like a no brainer for many, if you don’t mind picking up another card:

- If you pay a substantial mortgage, then earning points for that is fantastic, and worth taking advantage of

- Yes, you have to spend $1,000 per billing cycle, but I think that could be worth the effort, especially with the bonus categories, and could be done with minimal (or no) opportunity cost

- Speaking of the bonus categories, there are some really lucrative published ones, like 3x points on property tax payments, which in and of themselves may be a good reason to pick up this card

- The transfer partners aren’t the most exciting on earth, and I don’t think there have been any transfer bonuses yet, but still, given the earnings rates, that’s not a huge issue

- The credits seem like the icing on the cake, especially the membership club fee statement credit

I’ve gotta say, I’m seriously considering applying for this card, but am curious to hear how OMAAT readers feel, and if anyone has firsthand experience.

I guess my one hesitation is that with these new concepts that I don’t know much about, I always wonder how sustainable the business model is, and how long it is until serious changes are made. Then again, I had that same skepticism with Bilt, and it seems to have worked out pretty well for them, so…

Bottom line

The no annual fee Mesa Homeowners Card is an interesting product that’s worth a look, if nothing else. The card offers points for paying your mortgage (without even putting the mortgage cost on the card), as long as you spend at least $1,000 on the card per billing cycle.

Even beyond that, the card offers unique bonus categories, like 3x points on everything ranging from property tax payments to daycare. The icing on the cake is that the card even offers credits, despite not having an annual fee. It sure feels to me like this card borders on being too good to be true, so I’m mighty tempted to apply.

What do you make of the Mesa Homeowners Card?