Bilt 2.0: Bilt Surveys Credit Card Changes, $550 Annual Fee Product

In December 2024, Bilt hinted at plans to make changes to its credit card, and to start awarding points for mortgages. The Bilt Mastercard is an incredibly lucrative no annual fee card that lets you earn points for paying rent, though the sustainability of the business model is questionable, given how rewarding it is, with minimal effort.

In December 2024, Bilt hinted at plans to make changes to its credit card, and to start awarding points for mortgages. The Bilt Mastercard is an incredibly lucrative no annual fee card that lets you earn points for paying rent, though the sustainability of the business model is questionable, given how rewarding it is, with minimal effort.

Along those lines, today Bilt is sending out a survey to all cardholders, to get feedback on potential changes.

Bilt surveys major credit card changes

Bilt is asking members for their feedback on three different Bilt Card 2.0 constructs. The company claims that these potential options have been designed based on member feedback. The company wants members to share which option is favored at each price point, and also what members would like to see that isn’t included.

The company emphasizes that these are not locked in options, and aren’t finalized or rigid. Quite to the contrary, the company expects there will be many more changes over the next several months. The idea seems to be to have a no annual fee card, a $95 annual fee card, and a $550 annual fee card.

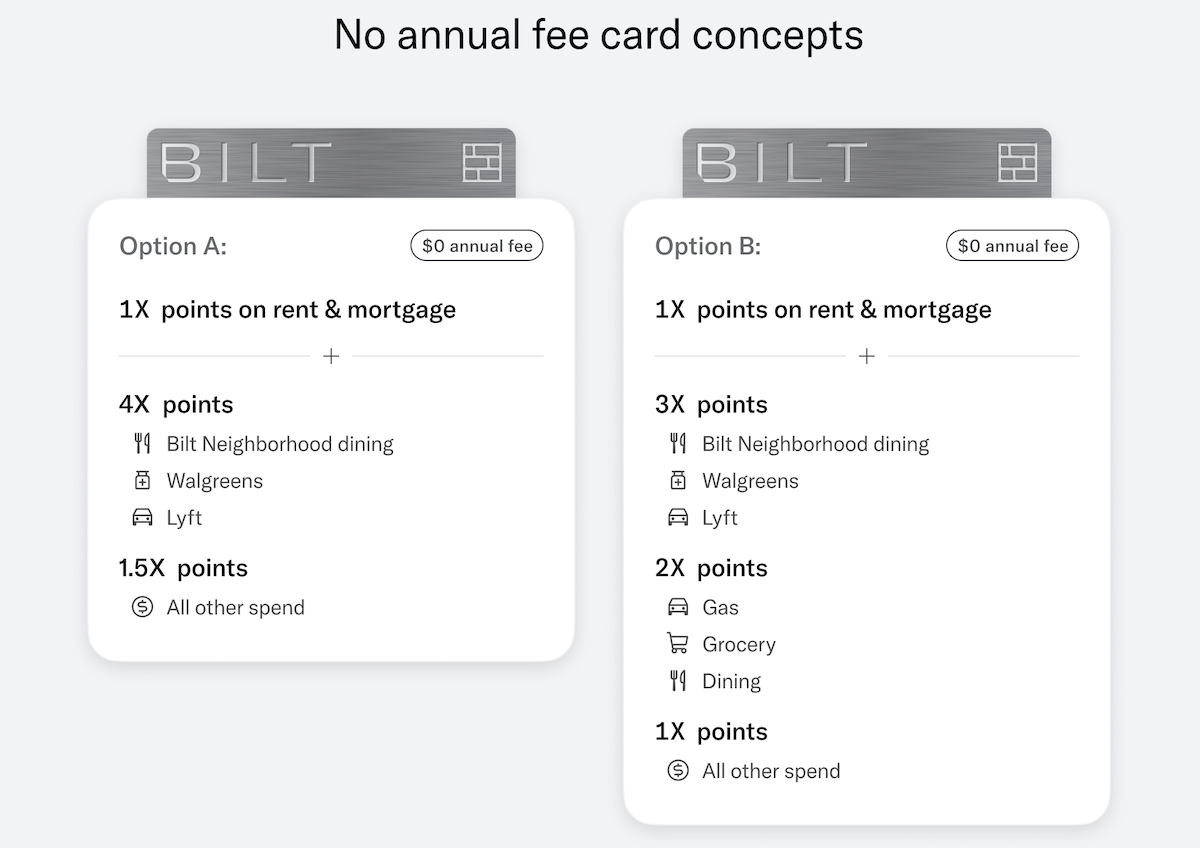

With that in mind, the company presents two versions of a no annual fee card:

- Both cards would earn 1x points on rent and mortgages

- One version of the card would earn 4x points on Bilt Neighborhood Dining, Walgreens, and Lyft, and 1.5x points on all other purchases

- The other version of the card would earn 3x points on Bilt Neighborhood Dining, Walgreens, and Lyft, 2x points on gas, groceries, and dining, and 1x points on all other purchases

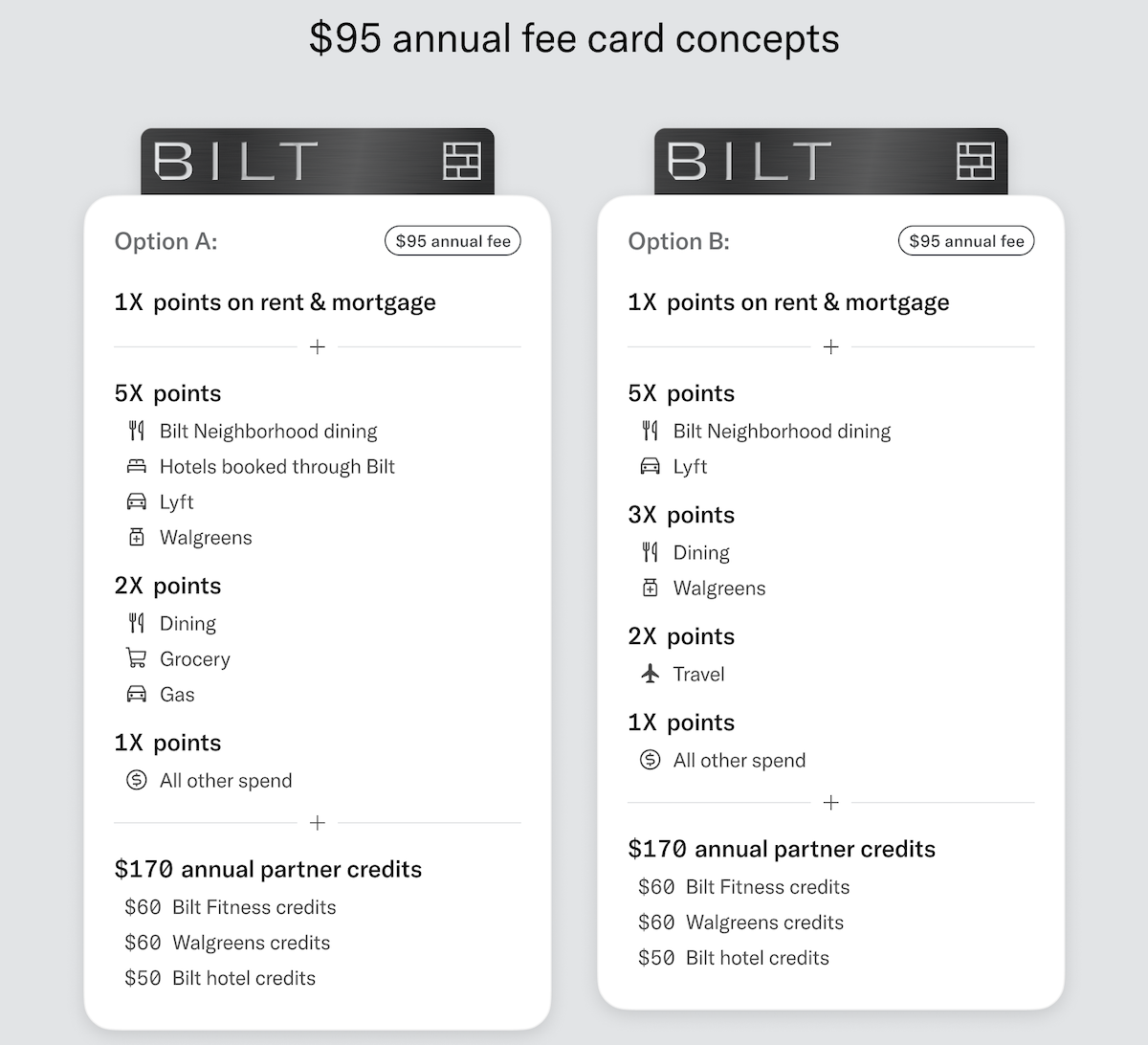

The company also presents concepts for two $95 annual fee cards:

- Both cards would earn 1x points on rent and mortgages, and would offer up to $170 in annual partner credits, including $60 Bilt Fitness credits, $60 Walgreens credits, and $50 Bilt hotel credits

- One version of the card would earn 5x points on Bilt Neighborhood Dining, hotels booked through Bilt, Lyft, and Walgreens, 2x points on dining, groceries, and gas, and 1x points on all other purchases

- The other version of the card would earn 5x points on Bilt Neighborhood Dining and Lyft, 3x points on dining and Walgreens, 2x points on travel, and 1x points on all other purchases

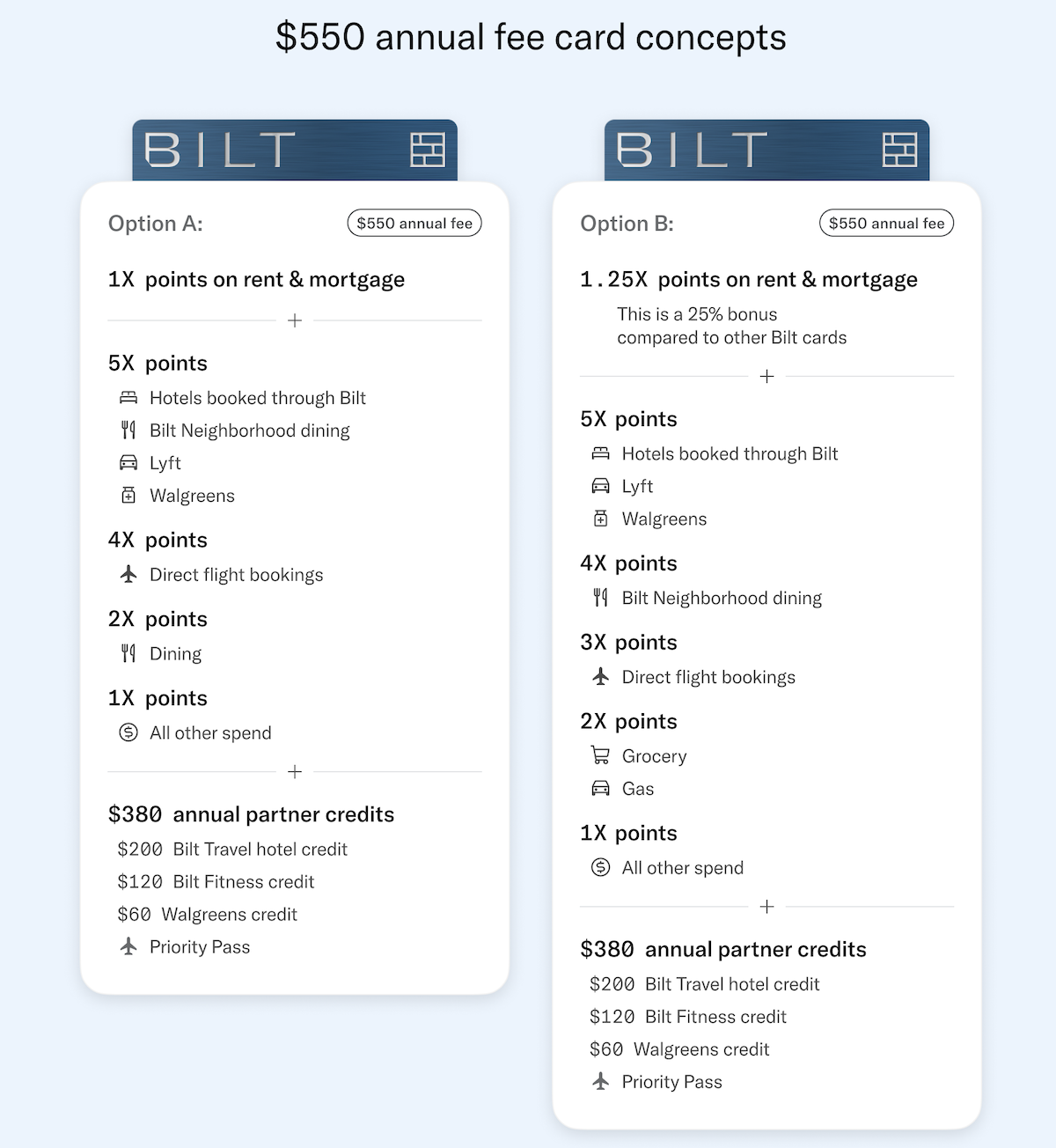

Lastly, the company presents concepts for two $550 annual fee cards:

- Both cards would offer up to $380 in annual partner credits, including $200 in Bilt Travel hotel credits, $120 in Bilt Fitness credits, $60 in Walgreens credits, and a Priority Pass membership

- One version of the card would earn 5x points on hotels booked through Bilt, Bilt Neighborhood Dining, Lyft, and Walgreens, 4x points on direct flight bookings, 2x points on dining, and 1x points on all other purchases, including rent and mortgages

- The other version of the card would earn 5x points on hotels booked through Bilt, Lyft, and Walgreens, 4x points on Bilt Neighborhood Dining, 3x points on direct flight bookings, 2x points on gas and groceries, 1.25x points on rent and mortgages, and 1x points on all other purchases

My take on these proposed Bilt card changes

I don’t necessarily have strong opinions on the above proposed concepts, and which of them is better.

My first reaction is that I’m happy to see that Bilt is committed to keeping around awarding points for paying rent, even on the no annual fee product, and even expanding points earning to mortgages. Now, we could see more restrictions in the future — currently you can earn points on rent as long as you make at least five transactions per billing cycle, and those could be purchases for a dollar each.

I’m more concerned about what the restrictions are for earning points on rent, rather than the exact rewards structure of the cards. But that also gets at the general issue with Bilt in the miles & points space. Bilt is incredibly rewarding and is loved by savvy consumers. Those of us into miles & points enjoy maximizing. Speaking only for myself, and not consumers at large:

- I’m not really interested in more cards with credits that are potentially difficult to use, as I have enough of those already

- None of the card rewards structures are really industry leading, for those of us who use a strategy where we have multiple cards; I earn 2x points on everyday spending, and 5x points on all dining and flights, while some of these bonus categories are very specific

The problem is, Bilt also needs to make money. Wells Fargo is reportedly losing large amounts of money on its agreement with Bilt, because a majority of the spending on the card is rent payments, with the rewards being subsidized by Wells Fargo.

Bilt promised free points for paying rent, as long as five transactions are made per billing cycle. Many people do exactly that, and make five transactions. But that’s also not a great long term business model.

With Wells Fargo reportedly not happy with its Bilt partnership, Bilt will eventually need a new partner to issue the card. I’m curious what that will look like, since I have to imagine any new card wouldn’t be issued with Wells Fargo, unless the company had a reason to believe that economics would be very different.

Yes, Bilt’s business model goes beyond credit card processing fees. I suppose annual fees could help a bit. The company also makes money through its partnerships with landlords, restaurants, etc. But is all of that enough? I don’t know, we don’t have access to that data…

Bottom line

Bilt is surveying some concepts for a Bilt Card 2.0, including cards at three different pricing tiers — one no annual fee card, one $95 annual fee card, and one $550 annual fee card. I don’t think there’s anything revolutionary with these concepts, and if anything, they look like a lot of other products in the market.

Ultimately there’s only so much that can be innovated, so I think any of these products would be fine. The question is how Bilt can actually get people to greatly increase spending on the card in a profitable way, to offset the cost of processing rent payments. I suppose charging an annual fee is a good start, though I’m also not sure the proposed cards are compelling enough, compared to what else is available in the market.

What do you make of these proposed Bilt Card 2.0 concepts?

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)