Capital One Spark Miles Card: 7 Reasons To Apply

Link:Apply now for the Capital One Spark Miles for Business Card

Link: Apply now for the Capital One Spark Miles for Business Card

The Capital One Spark Miles for Business (review) is one of the more rewarding business credit cards out there. If you’re looking to earn travel rewards and want a card that offers a good bonus, reasonable annual fee, and solid return on everyday spending, this is the card for you.

In this post, I want to share seven reasons you should consider picking up the card. In no particular order…

Bonus of 50K Capital One bonus miles

The Capital One Spark Miles offers a welcome bonus of 50,000 miles after spending $4,500 within the first three months. Personally I value Capital One miles at 1.7 cents each, so to me this bonus is worth $850, which is quite good. I’ll talk more below about the general value of and flexibility provided by Capital One miles.

Annual fee waived for first 12 months

The Capital One Spark Miles has a reasonable $95 annual fee, which is even waived for the first 12 months. The waived annual fee for the first 12 months is a great way to try the card before you have to “buy” it, so to speak.

On top of that, the ongoing annual fee is quite reasonable, and lower than what you’ll find on many other lucrative business cards, like the American Express® Business Gold Card (review) or Capital One Spark Cash Plus (review).

2x Capital One miles on all purchases

The Capital One Spark Miles offers unlimited 2x Capital One miles on all purchases, making this one of the best cards for everyday spending. I value Capital One miles at 1.7 cents each, so to me that’s the equivalent of a 3.4% return on everyday spending, which is tough to beat.

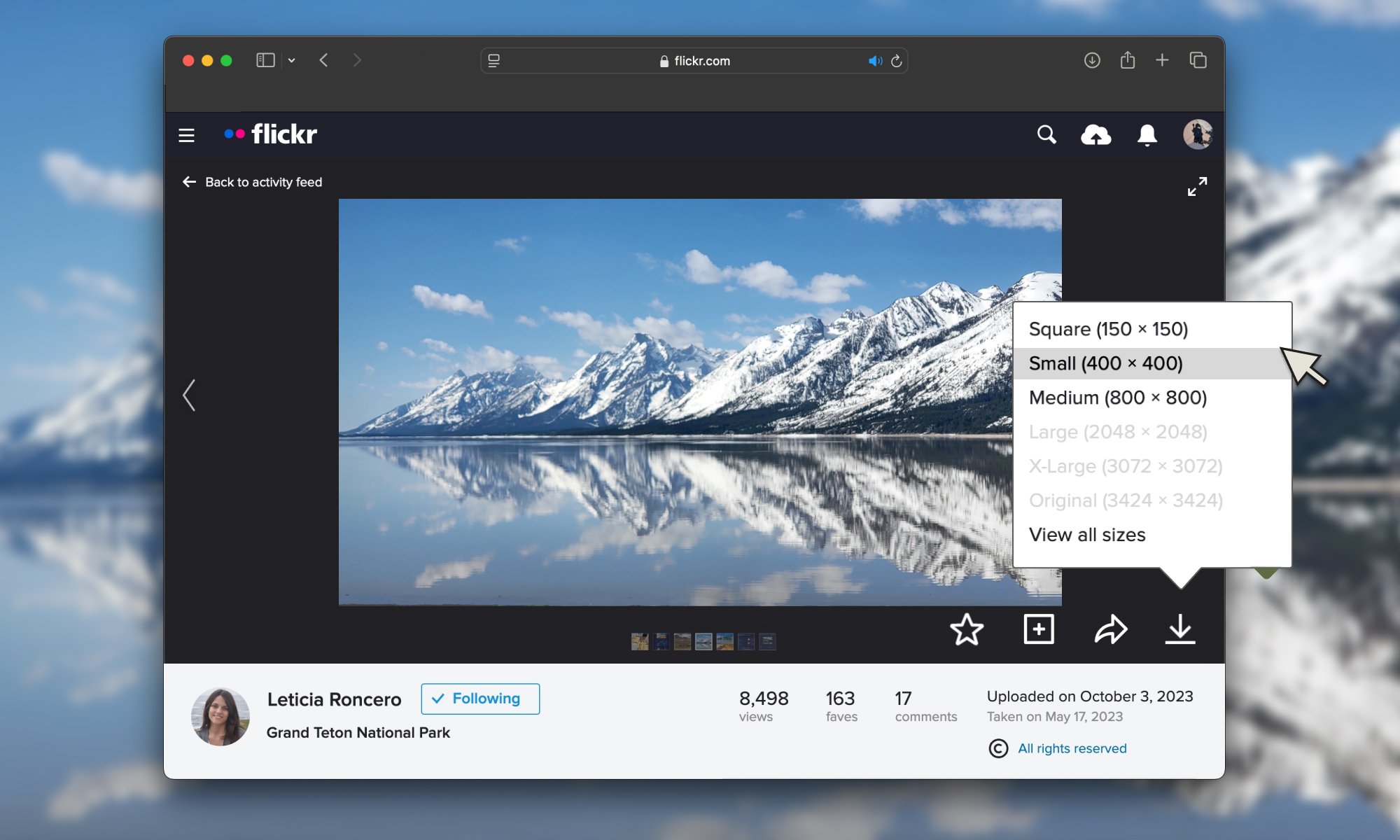

Capital One miles are valuable & flexible

Capital One miles provide lots of flexibility. For one, you can redeem them after the fact for one cent each toward virtually any travel purchase. That’s not my preferred use of these miles, though.

Rather, my preference is to transfer miles to Capital One’s airline & hotel partners, as you can transfer miles at a 1:1 ratio to over a dozen partners. As is the case with all major transferable points currencies, this allows you to get way outsized value, especially when redeeming for first & business class travel.

No foreign transaction fees

The Capital One Spark Miles has no foreign transaction fees, making it a fantastic card for purchases abroad. It’s nice to not only get an industry-leading return on spending, but to get that same rate internationally without it costing you extra.

Many non-Capital One cards that earn 2x points per dollar do have foreign transaction fees, so this is a significant competitive advantage.

Rental car coverage

Rental car coverage is an important perk many people look for in credit cards. Fortunately the Capital One Spark Miles offers collision damage waiver coverage when renting for business reasons.

Just charge the entire rental to your card and decline the rental company’s collision damage waiver coverage, and you’ll be covered for damage due to collision or theft. Of course you’ll want to consult the cardmember agreement for full details.

Global Entry or TSA PreCheck credit

The Capital One Spark Miles offers a Global Entry or TSA PreCheck credit once every four years. This is super handy, as TSA PreCheck can save you lots of time at security, while Global Entry can save you lots of time at immigration. They’re among the two innovations that have most improved the airport experience over the years, in my opinion.

What about the Capital One Venture X Business?

When talking about Capital One business cards, much of the focus nowadays is on the Capital One Venture X Business (review). How do the two cards compare? Both offer 2x Capital One miles on a vast majority of purchases, so I’d view the ongoing value proposition for spending to be quite similar.

The way I view it, the major difference is that the Venture X Business has a $395 annual fee, which also isn’t waived for the first year. However, you get a lot of value in exchange for that:

- The Venture X Business offers a $300 annual travel credit plus 10,000 anniversary bonus miles, which to me more than justifies the annual fee

- The Venture X Business offers a Priority Pass membership, plus unlimited access to Capital One Lounges and Capital One Landings

- The Venture X Business is offering a significantly bigger welcome bonus for big spenders

Personally I think the Venture X Business is the logical choice, assuming you travel with any frequency. The annual travel credit and anniversary bonus miles should more than cover the annual fee on an ongoing basis, and then you get some awesome extra perks, like lounge access.

That being said, understandably some people don’t like paying a big annual fee upfront, and for those people, the Capital One Spark Miles is probably a better option.

Bottom line

The Capital One Spark Miles is a fantastic business credit card, with a big welcome bonus, annual fee waived the first year, great return on everyday spending with no foreign transaction fees, and some surprisingly valuable perks for a card with a reasonable ongoing annual fee.

If you’re looking for a business card with great travel rewards for everyday spending, this product is worth considering. If you don’t yet have the Capital One Spark Miles and are eligible, I’d recommend considering applying.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)