Chase Sapphire welcome bonus eligibility checklist

One of the primary factors in applying for a new credit card is to earn the sizable welcome bonus offered. Whatever the bonus offer is (and the card’s other perks), it’s typically worth the hard inquiry on your credit report. Chase offers some of the best travel rewards credit cards, with the top two being …

One of the primary factors in applying for a new credit card is to earn the sizable welcome bonus offered. Whatever the bonus offer is (and the card’s other perks), it’s typically worth the hard inquiry on your credit report.

Chase offers some of the best travel rewards credit cards, with the top two being the Chase Sapphire Preferred® Card (see rates and fees) and the Chase Sapphire Reserve® (see rates and fees).

Currently, the Sapphire Preferred is offering its highest-ever welcome offer of 100,000 bonus points after spending $5,000 on purchases within the first three months of account opening.

However, imagine the following scenario: You apply for a new credit card with an amazing welcome offer, and your application is denied, or you are approved but ineligible for the welcome offer.

Let’s go through some scenarios to determine if you’re eligible for a Sapphire card welcome bonus and how to overcome any barriers that may come up.

Chase’s 5/24 restrictions

The first obstacle to getting approved for a Chase Sapphire card is the infamous 5/24 rule. In an attempt to reduce risky lending and tackle credit card churning, Chase enforces this on all applicants.

The rule states that your application will be automatically rejected if you’ve opened five or more cards within the last 24 months. Business credit cards do not count toward this rule; however, being an authorized user on someone else’s account will count toward 5/24.

If you are over the 5/24 rule, do not apply for either the Sapphire Preferred or the Sapphire Reserve because you likely won’t qualify and you’ll still receive a hard inquiry on your credit report.

Solution

You’ll have to do some digging to determine if you’re within 5/24. Luckily, it’s not too difficult. Calculate your 5/24 standing by looking at your credit report.

You can create a free account with Experian and, under “open accounts and closed accounts,” see which accounts are open and when they started reporting to the credit bureau. You can also request a free full credit report from each of the three credit bureaus every 12 months.

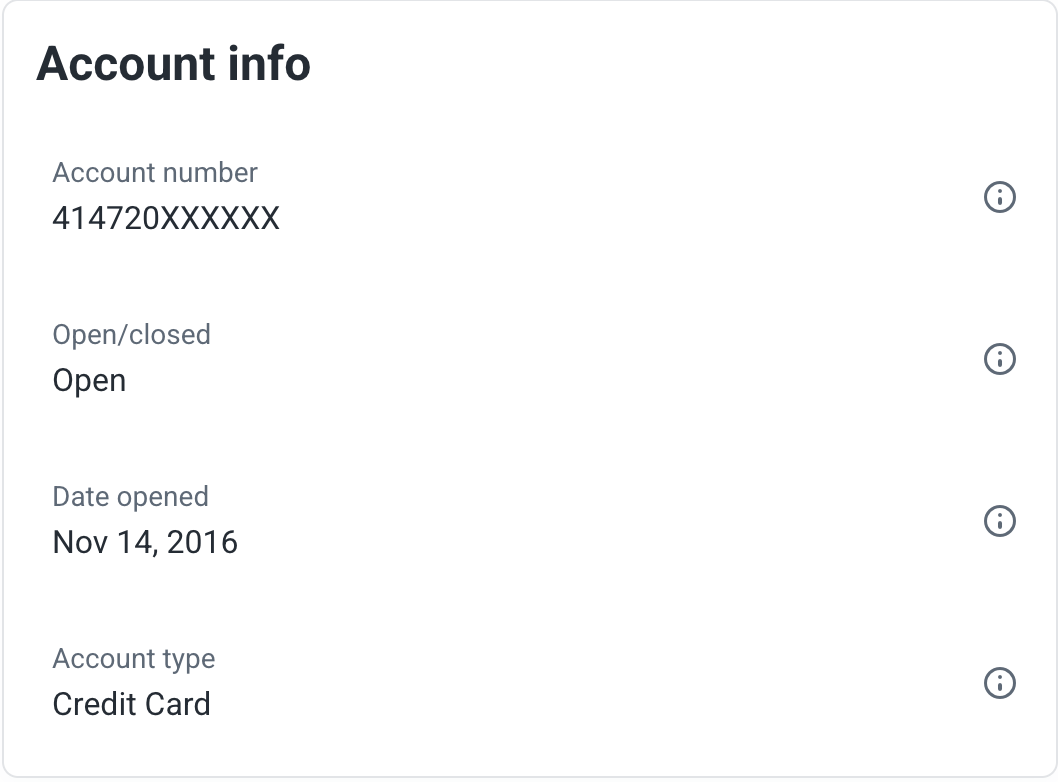

For example, when looking up individual credit cards on Experian, you can see your current account status and the exact date the credit card was opened.

If you calculate your standing as four or fewer cards opened within the last 24 months, you can proceed to the next step of confirming eligibility for the welcome bonus.

Related: The best ways to use your Chase 5/24 slots

Current Sapphire product cardholder

Now that you know your application for a Chase Sapphire card won’t be automatically denied due to 5/24, the next step is to determine if you are eligible based on the cards in your wallet. Essentially, you will not be approved for a Chase Sapphire card if you currently hold another Sapphire credit card.

For example, as a current cardholder of the Chase Sapphire Reserve, I am automatically ineligible to earn the welcome bonus on the Chase Sapphire Preferred.

Solution

To earn the current welcome bonus of 100,000 bonus points on the Sapphire Preferred, you must close any current Sapphire card or downgrade to another Chase credit card.

For example, you can downgrade a current Sapphire card to the Chase Freedom Flex® (see rates and fees) by calling the number on the back of your Sapphire card and requesting a product change with the representative. However, to be eligible for the welcome bonus, you must meet another set of criteria.

Related: When can you downgrade your credit card?

48-month rule

If you’ve never held a Chase Sapphire credit card, proceed to apply and rest assured you won’t be denied for violating any of the previously stated issuer restrictions. If you’ve held a Sapphire credit card and have closed or downgraded it, you’ll need to make sure you have not received a cardmember bonus within the last 48 months.

If you’ve earned a welcome bonus on either Sapphire card within the last 48 months, even if you’ve closed the card and no longer have it, you are still ineligible.

Solution

If I wanted to capitalize on the Sapphire Preferred‘s 100,000 bonus points offer, I would have to either close my Sapphire Reserve or downgrade it to the Chase Freedom Unlimited® (see rates and fees) or the Freedom Flex and wait a few days to make sure it has gone through. Keep in mind, closing your card would impact your credit score, whereas downgrading your card would not.

I would then apply for the Sapphire Preferred. Assuming I get approved, I’d be eligible for the current welcome bonus since I earned the welcome bonus for my Sapphire Reserve in 2016.

Keep in mind that welcome bonuses are usually earned months after opening a Sapphire card, so be sure to calculate accordingly if you’re cutting it close.

This can be done by first verifying when you opened the account (you can use your credit report for this) and then checking your monthly statements online from that point forward to see when the bonus hit. Lastly, do some quick math to make sure you’re past the 48-month mark.

Related: The ultimate guide to credit card application restrictions

Credit score requirements

When going through the checklist, you may ask, “Am I eligible for the Chase Sapphire Preferred bonus?” After making sure you meet the issuer’s requirements for welcome bonus eligibility for Sapphire credit cards, the final step is to make sure your current credit score and history are good enough to land you an approval.

Based on online crowdsourced data, both the Chase Sapphire Preferred and the Chase Sapphire Reserve have high approval standards. As a Visa Infinite product, the Sapphire Reserve will most likely be approved for someone who can meet the financial requirements for a minimum credit limit of $10,000.

Factors that determine this include a credit score of 740 or better for the Sapphire Reserve or 670 or higher for the Sapphire Preferred. This is in addition to having a low debt-to-income ratio, good credit history and low credit utilization.

Solution

If you have no or limited credit history or a low credit score, it’s better to start off with a more entry-level credit card, such as the Chase Freedom Unlimited or the Citi Double Cash® Card (see rates and fees). Wait a year or so and then apply for a Sapphire card, likely the mid-tier Chase Sapphire Preferred due to it being one of the best beginner credit cards, thanks, in part, to its low annual fee of $95.

Within that year, make sure to practice good habits such as paying your balance on time and in full, avoiding late payments and keeping your credit utilization under 30%. This will likely increase your credit score, and although you’ll miss this limited-time welcome offer, chances are your approval odds will be much higher.

Related: 8 biggest factors that impact your credit score

Bottom line

Several roadblocks can exist when trying to earn the welcome bonus on a Chase Sapphire credit card. Issuer-related restrictions, such as Chase’s 5/24 or 48-month rule for previous cardholders, can be avoided by checking your credit report or simply waiting until you fall outside of those restrictions.

Of course, there are also personal limitations, including a low credit score or weak credit history. If you’re interested in opening a Sapphire credit card, use this checklist to confirm your approval eligibility and ability to earn the welcome bonus.

To learn more, read our full review of the Chase Sapphire Preferred.

To learn more, read our full review of the Chase Sapphire Reserve.

Apply here: Chase Sapphire Preferred Card

Apply here: Chase Sapphire Reserve

.jpg)