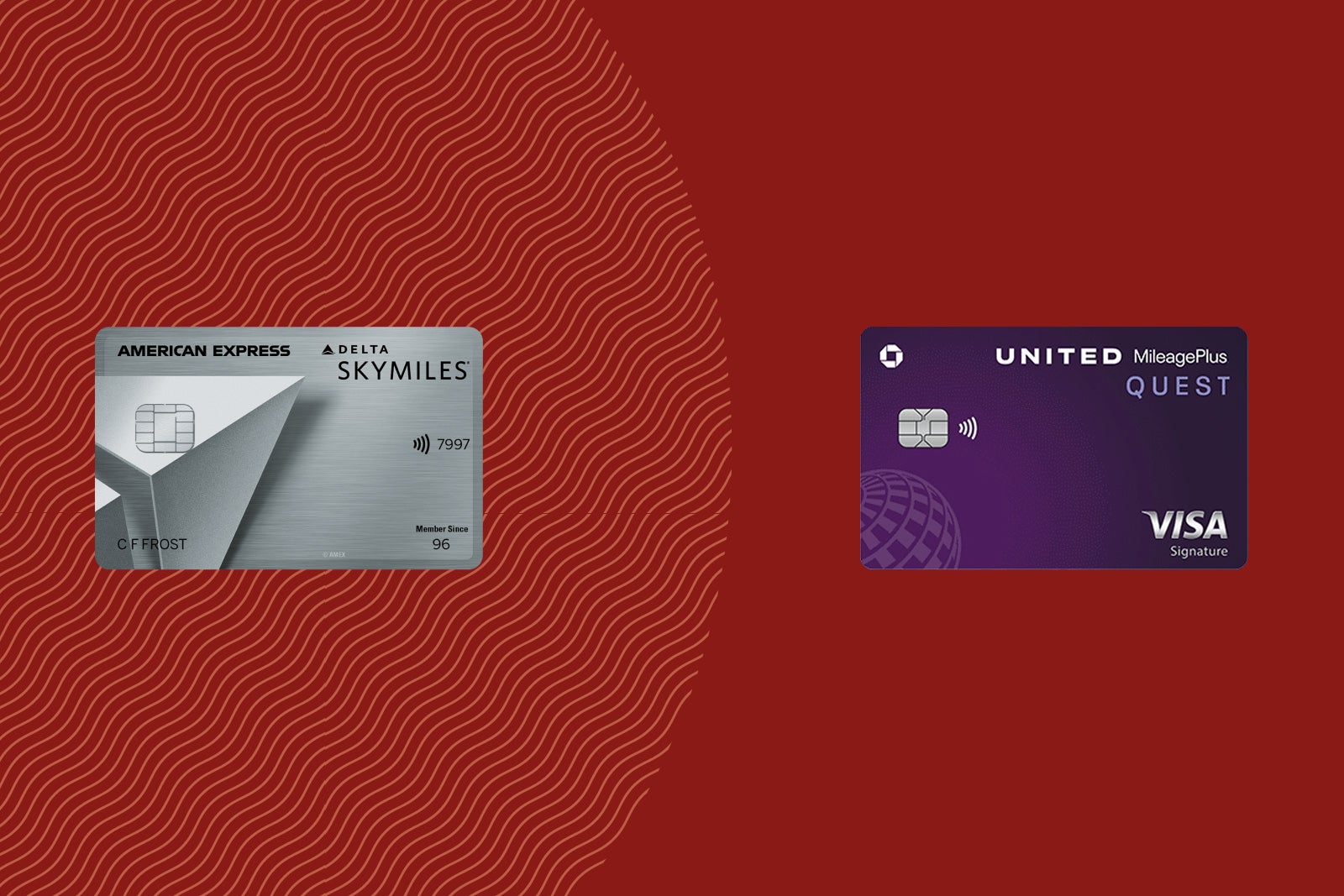

United Quest vs. Delta SkyMiles Platinum Amex: Battle of the mid-tier airline cards

Editor’s note: This is a recurring post, regularly updated with new information and offers. Mid-tier credit cards strike a balance between affordability and robust perks, with annual fees typically ranging from $100 to $350. In the world of airline credit cards, the most head-to-head competitor to the United Quest℠ Card (see rates and fees) — with …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Mid-tier credit cards strike a balance between affordability and robust perks, with annual fees typically ranging from $100 to $350.

In the world of airline credit cards, the most head-to-head competitor to the United Quest℠ Card (see rates and fees) — with a $350 annual fee — at this mid-tier level is likely the Delta SkyMiles® Platinum American Express Card, which comes with a $350 annual fee (see rates and fees).

These two cards are issued by different banks and provide miles and perks for different airlines, but they also share many similarities.

Let’s see how these two cards stack up in a head-to-head competition.

United Quest vs. Delta SkyMiles Platinum comparison

| Card | United Quest | Delta SkyMiles Platinum Amex |

| Welcome offer | Earn 90,000 bonus miles and 500 Premier qualifying points after spending $4,000 on purchases in the first three months from account opening. This offer ends May 7. | Earn 60,000 bonus miles after spending $3,000 on eligible purchases in the first six months of card membership. |

| Annual fee | $350 | $350 |

| Earning rates |

|

|

| Benefits |

|

|

| Credits |

|

(Enrollment is required for select benefits) |

| Lounge benefits | None | None |

| Elite status benefits |

|

|

United Quest vs. Delta SkyMiles Platinum welcome bonus

The United Quest offers 90,000 bonus United miles and 500 PQPs after spending $4,000 on purchases in the first three months. This offer ends May 7.

TPG’s April 2025 valuations peg United miles at 1.35 cents a piece, making these bonus miles worth $1,215.

The Delta SkyMiles Platinum is currently offering 60,000 bonus miles after spending $3,000 on eligible purchases in the first six months of card membership. TPG’s April 2025 valuations peg Delta SkyMiles at 1.2 cents a piece, making this bonus worth $720.

Winner: United Quest. Its welcome offer is worth almost double the bonus available with the Delta Platinum.

Related: The ultimate guide to credit card application restrictions

United Quest vs. Delta SkyMiles Platinum benefits

Both cards offer elitelike benefits, such as free checked bags when flying that airline, priority boarding, an inflight discount and shortcuts to elite status.

Additionally, both cards offer an up to $120 Global Entry or TSA PreCheck credit, statement credits, and rental car and trip protection coverage.

Of note is that the United Quest offers two free checked bags for you and up to one companion on the same reservation. The Delta Platinum only offers one free bag, but it’s for you and up to eight companions on the same reservation. So, you’ll get more value from the Delta card if you travel with a large group and check bags.

The Delta Platinum’s marquee benefit is the anniversary companion ticket awarded each year you renew the card. This ticket is valid in Main Cabin (economy) and can be used to fly you and a companion round-trip within all 50 U.S. states, as well as to and from Mexico, the Caribbean and Central America. You pay for the first ticket and then cover just the taxes and fees on the second.

While the Delta Platinum’s statement credits are arguably easier to use, the United Quest offers more value in statement credits. The Quest also requires additional spending to unlock some benefits, whereas none of the Delta Platinum’s benefits require additional spending.

Winner: Delta Platinum. Both cards offer similar airline-specific benefits and credits, but the Delta Platinum’s companion certificate gives it a slight edge.

Related: United Airlines MileagePlus: Guide to earning and redeeming miles, elite status and more

Earning miles on the United Quest vs. Delta SkyMiles Platinum

The United Quest wins in most categories, offering a higher return on flights, most travel (except hotels), dining and select streaming services.

The only categories that the Delta Platinum wins in are hotels, restaurants worldwide and U.S. supermarkets.

Winner: United Quest. It has more bonus-earning categories, and United miles are worth more than Delta’s.

Related: United MileagePlus program: How to redeem miles for flights, hotels and more

Redeeming miles on the United Quest vs. Delta SkyMiles Platinum

Both cards can redeem the miles earned on their respective airlines.

With the United Quest, you can redeem flights for United, partner and Star Alliance flights. With the Delta Platinum, you can redeem your SkyMiles for Delta, partner and SkyTeam flights.

Where the United Quest one-ups the Delta Platinum is in offering expanded availability for discounted and saver awards. I tend to take advantage of these discounted fares, especially when going on round-trip itineraries to Europe and tacking on an essentially free (just the cost of taxes and fees) stopover in another city using United’s Excursionist Perk.

However, I also like to redeem SkyMiles whenever Delta runs award flash sales and stack this with the 15% award discount perk on eligible Delta-operated award tickets. Recently, I booked a one-way ticket from Seattle to Cancun, Mexico, for just 3,400 SkyMiles in economy class.

Winner: United Quest. It edges out the Delta Platinum, as United miles are worth slightly more. Plus, it offers expanded discounted award availability for cardholders.

Related: Delta Medallion status: What it is and how to earn it

Should you get the United Quest or Delta SkyMiles Platinum?

Put simply: If you fly Delta more frequently, you should opt for the Delta Platinum; if you fly United more, then the Quest Card is for you.

If you’re split between the two, consider each card’s benefits and how they’d best fit into your lifestyle. For example, the Delta Platinum offers a companion certificate (a major perk), while the Quest provides more valuable statement credits, but they’re harder to maximize.

Related: Best Delta credit cards

How to switch from the United Quest to the Delta SkyMiles Platinum

You can’t product-change between these two cards, as the United Quest is issued by Chase and the Delta Platinum is issued by American Express. You would have to apply for whichever card you don’t have.

Related: Best United Airlines credit cards

Bottom line

These mid-tier cards both make compelling cases to join your credit card lineup. If you only want to choose one, the best one for you will likely be the one that aligns with the airline you fly most frequently.

Even if you only fly each airline a couple of times per year, both cards are worth considering. It’s entirely possible that both the United Quest and the Delta SkyMiles Platinum cards deserve a spot in your wallet.

No matter which card you choose, know that the right mid-tier airline card can unlock real value and elevate your travel experience.

To learn more, read our full reviews of the United Quest and the Delta SkyMiles Platinum.

Apply here: United Quest Card

Apply here: Delta SkyMiles Platinum American Express Card

For rates and fees of the Delta SkyMiles Platinum Amex Card, please click here.

.jpg)