JetBlue Plus Card review: A rewarding credit card for JetBlue fans

Editor’s note: This is a recurring post, regularly updated with new information and offers. JetBlue Plus Card overview The JetBlue Plus Card offers a terrific return on airfare spending and comes with multiple perks. Benefits such as an anniversary points bonus, free checked baggage allowance, 10% of your points back on award redemptions and annual …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

JetBlue Plus Card overview

The JetBlue Plus Card offers a terrific return on airfare spending and comes with multiple perks. Benefits such as an anniversary points bonus, free checked baggage allowance, 10% of your points back on award redemptions and annual JetBlue Vacations statement credit make this card worthwhile, even for occasional travelers. Card rating*: ⭐⭐⭐⭐

*Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

JetBlue’s loyalty program, TrueBlue, has flown under the radar over the years, as redemptions were largely restricted to flights operated by JetBlue and Hawaiian Airlines. However, this has changed in recent years, with Icelandair, TAP Air Portugal and Qatar Airways redemptions being added to TrueBlue. Plus, JetBlue is known for its excellent Mint business-class product and extensive East Coast and Caribbean route network.

If you are a JetBlue flyer and want to boost your TrueBlue balance or elevate your flying experience with the airline, you should consider the JetBlue Plus Card. The card offers several valuable perks that help justify its $99 annual fee.

First, note that you’ll want to have a “good” credit score (670 or above) for the best chances of approval. Now, let’s dig into the card specifics.

The information for the JetBlue Plus Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

JetBlue Plus Card pros and cons

| Pros | Cons |

|

|

JetBlue Plus Card welcome offer

New JetBlue Plus cardholders can earn 60,000 points after spending $1,000 on purchases and paying the annual fee in full within the first 90 days.

Based on our June 2025 valuation of JetBlue TrueBlue points at 1.35 cents per point, that’s a value of $810.

This is not the best offer we’ve seen on this card, but it’s a solid value for the annual fee, especially if you’re a JetBlue loyalist.

Related: Complete guide to the best airline credit cards

JetBlue Plus Card benefits

In addition to a high return on JetBlue spending, there’s a ton of value in the benefits offered by the JetBlue Plus Card. The perks mostly revolve around JetBlue, but even occasional flyers should be able to take full advantage of them:

- Annual JetBlue Vacations statement credit: Get a $100 statement credit every year with your purchase of a JetBlue Vacations package of $100 or more with your card.

- Fast-track Mosaic status: Get automatic Mosaic status after spending $50,000 on the card in a calendar year.

- Free first checked bag: When you purchase a ticket on a JetBlue-operated flight with your card, you and up to three companions on the same reservation can check your first bag for free.

- No foreign transaction fees

- Points Payback: You can redeem points for a statement credit of up to $1,000 annually.

- 10% back on award flights: When you redeem TrueBlue points for a JetBlue flight, you’ll earn 10% of those points back after you take the flight.

- 50% inflight savings: Get 50% back on eligible inflight purchases on JetBlue-operated flights, including alcoholic drinks and food. This discount is applied automatically, generally on the day the charge is posted to your card account.

- 5,000-point anniversary bonus: These points are worth about $68 according to our June 2025 valuations, so without setting foot on a JetBlue plane, you’re covering more than two-thirds of the card’s $99 annual fee.

Aside from the JetBlue-specific perks, cardholders will receive travel and purchase protections, as well as other everyday perks via this card being a World Elite Mastercard. Here are a few that stand out:

- Trip cancellation and interruption coverage: Get up to $5,000 back in nonrefundable expenses per trip ($10,000 maximum per 12-month period) if you need to cancel or interrupt a trip for a covered reason.

- Trip delay protection: Get up to $300 per trip if your flight is delayed more than six hours (maximum of twice in a 12-month period)

Related: JetBlue’s anti-Delta lounge: ‘The best JetBlue we can be’

Earning points on the JetBlue Plus Card

On the earning side, this card outdoes many cobranded cards from airlines and even some cards that earn transferable points.

With this card, you’ll earn 6 points per dollar spent on eligible purchases with JetBlue and Paisly (JetBlue’s travel booking platform), 2 points per dollar spent at restaurants and eligible grocery stores, and 1 point per dollar spent on all other purchases.

By comparison, the no-annual-fee version of this card offers half as many points on JetBlue purchases.

It’s also worth noting that as a TrueBlue member, you’ll earn at least 2 base points per dollar spent on JetBlue flights booked directly on top of the 6 points per dollar you’ll earn through the card.

Related: How to earn JetBlue TrueBlue points

Redeeming JetBlue TrueBlue points

The TrueBlue loyalty program is revenue-based for JetBlue-operated flights, so redemptions are very straightforward. You can redeem points for any seat, including Mint seats, on any JetBlue flight across its entire route network and get a fairly consistent value from your points.

The more a flight costs in cash, the more it costs in points, and vice versa.

JetBlue holds somewhat frequent flash sales. Often, flights start at $20 one-way and can be booked for a measly 400 points. The positive is that you won’t have to worry about scouring for saver award availability.

However, it also means there aren’t any major sweet spots for long-haul international first class.

Related: JetBlue now allows Blue Basic award redemptions — and tickets are as low as 700 points

Redeeming TrueBlue points on partner airlines

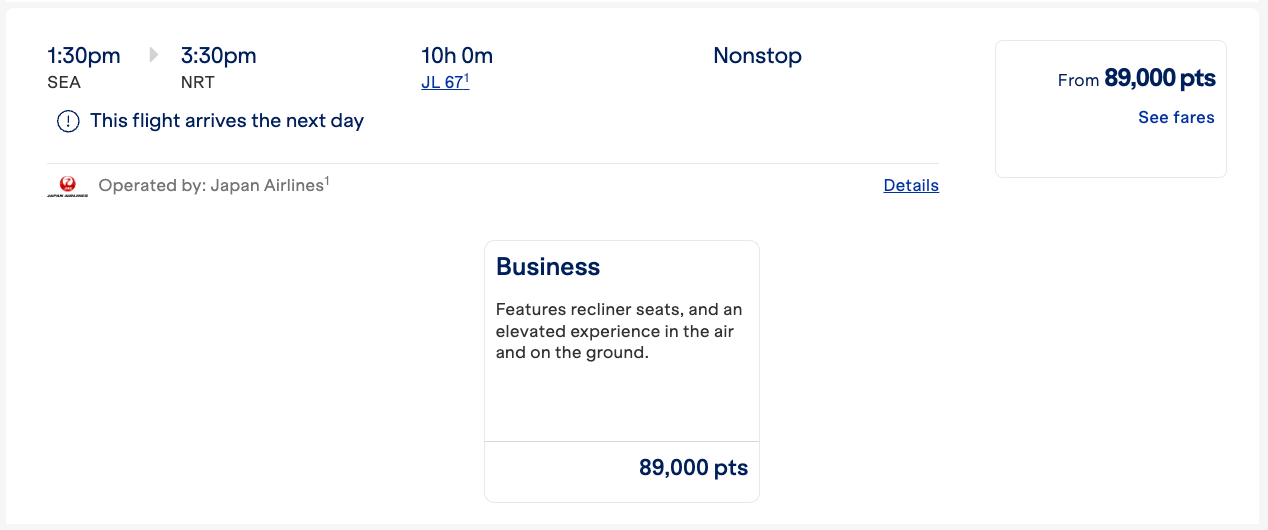

JetBlue partners with a handful of other carriers. You can redeem TrueBlue points with Cape Air, Etihad Airways, Hawaiian Airlines, Icelandair, Japan Airlines, Qatar Airways and TAP Air Portugal. Redeeming TrueBlue points with these partners, especially Qatar and Icelandair, can often yield solid redemption value.

For example, you can redeem 89,000 TrueBlue points for a business-class flight from Seattle-Tacoma International Airport (SEA) to Tokyo’s Narita International Airport (NRT) on many dates. Similar prices exist for Qatar Airways and Icelandair international business-class award tickets.

Plus, JetBlue announced in May 2025 that it’s launching a partnership between TrueBlue and United Airlines MileagePlus called Blue Sky. This collaboration will allow members to earn and redeem miles between the two loyalty programs.

It’s important to note that JetBlue partners with more airlines than those mentioned above, but you can’t redeem TrueBlue points with every partner airline.

Related: JetBlue Mosaic elite status: What it is and how to earn it

Which cards compete with the JetBlue Plus Card?

Here’s a side-by-side look at three of the card’s mid-tier travel competitors:

- If you prefer no annual fee: The JetBlue Card earns 3 points per dollar spent on eligible JetBlue and Paisly purchases, 2 points per dollar spent at restaurants and eligible grocery stores, and 1 point per dollar spent on everything else. It offers a 50% discount on inflight purchases on JetBlue-operated flights and has no annual fee. To learn more, read our full review of the JetBlue Card.

- If you prefer Capital One: The Capital One Venture Rewards Credit Card provides 5 miles per dollar spent on hotels, vacation rentals and rental cars booked through Capital One Travel, and 2 miles per dollar spent on all other purchases for a reasonable $95 annual fee. To learn more, read our full review of the Capital One Venture Rewards Credit Card.

- If you prefer Chase: For a $95 annual fee on the Chase Sapphire Preferred® Card (see rates and fees), you’ll earn 5 points per dollar spent on travel booked through Chase Travel℠, 3 points per dollar spent on dining (including eligible delivery services and takeout) and 2 points per dollar spent on all travel not booked through Chase Travel, and 1 point on all other purchases. To learn more, read our full review of the Sapphire Preferred.

The information for the JetBlue Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

For additional options, check out our full list of the top travel rewards cards.

Related: The complete guide to the JetBlue TrueBlue program

Is the JetBlue Plus Card worth it?

No other mid-tier cards come close to the JetBlue Plus Card when it comes to a return on JetBlue spending or benefits. However, those who aren’t able to fly JetBlue regularly may not get enough value from this card to justify the annual fee.

Related: The best credit cards with annual fees under $100

Bottom line

Even if you only fly JetBlue occasionally, you’ll make up for more than two-thirds of the JetBlue Plus Card’s annual fee by taking advantage of the 5,000-point anniversary bonus alone. With the additional JetBlue perks like the free checked bag and savings on inflight purchases, JetBlue flyers will almost certainly benefit from this card.

However, if you don’t think you would benefit from the higher earning rates or perks, you might want to stick to the no-annual-fee JetBlue Card.

Related: JetBlue’s new premium credit card has launched — should you jump on board?

.jpg)

.jpg)