Iberia: 6 new transatlantic routes, dozens more planes and new lounges

Spanish airline Iberia wants to become a bigger player in the Americas, so it’s planning to add dozens of new planes and more routes to the region. The expansion will see the Oneworld alliance carrier and American Airlines partner add at least six new transatlantic routes — including its first-ever route to Orlando and Philadelphia. …

Spanish airline Iberia wants to become a bigger player in the Americas, so it’s planning to add dozens of new planes and more routes to the region.

The expansion will see the Oneworld alliance carrier and American Airlines partner add at least six new transatlantic routes — including its first-ever route to Orlando and Philadelphia. It’ll expand its long-haul fleet by about two-thirds to 70 total planes in the next few years under its new “Flight Plan 2030.”

The aim is to expand Iberia’s Adolfo Suárez Madrid-Barajas Airport (MAD) hub into “a leading European hub,” Marco Sansavini, CEO of Iberia, said at an event in Madrid on June 18.

“Madrid is the new Miami,” is how Raymond James aviation analyst Savanthi Syth put it in a report on Iberia’s plan.

Flight Plan 2030 is the first strategy for Iberia since the collapse of a plan to turn Madrid into a “360-degree hub” that would compete with the likes of KLM’s hub at Amsterdam Airport Schiphol (AMS) and Lufthansa’s hub at Frankfurt Airport (FRA). International Airlines Group’s (the owner of Iberia) plan to merge the airline with competing Spanish carrier Air Europa collapsed in 2024 after it was blocked by European regulators.

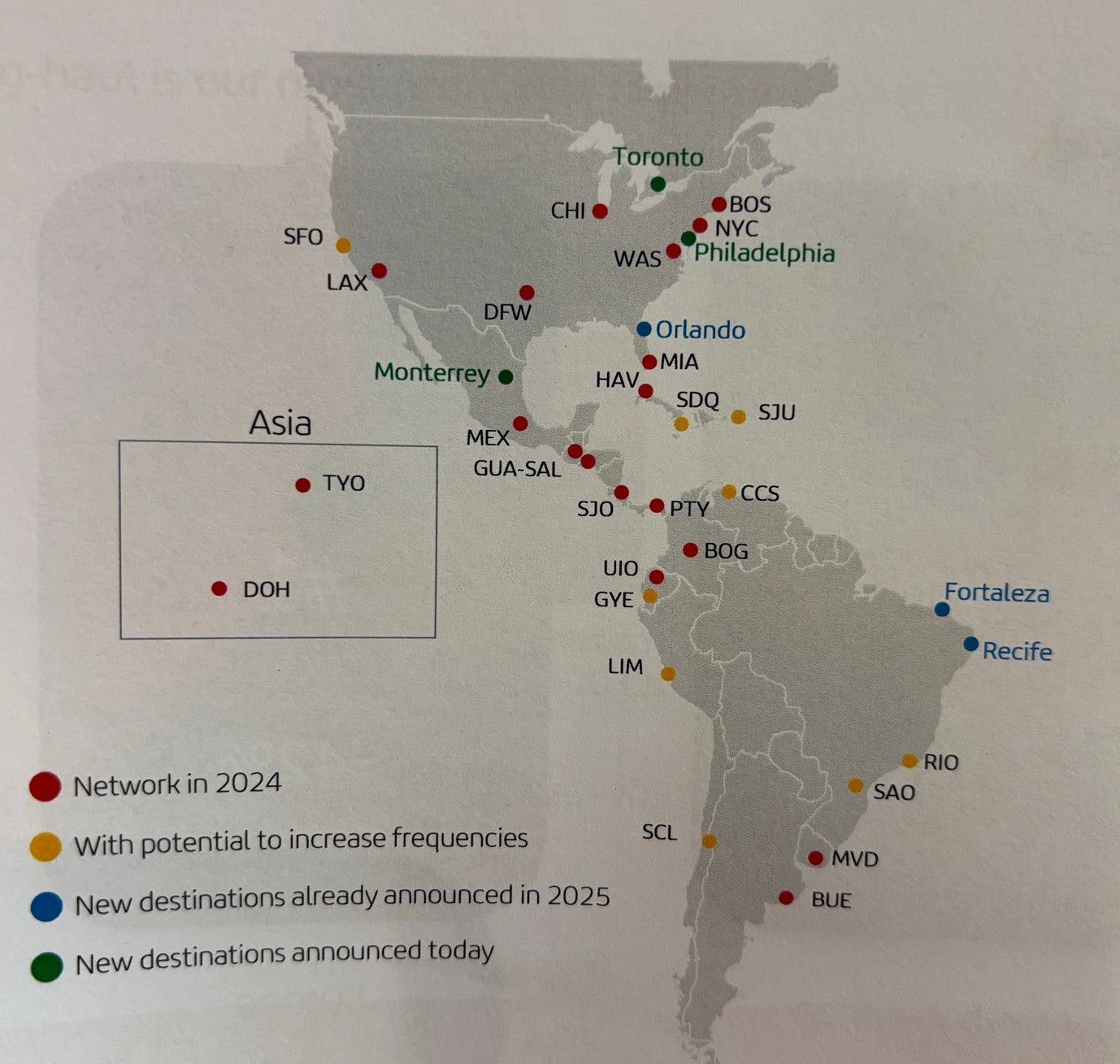

The new plan is somewhat less ambitious. Rather than a 360-degree hub, Iberia will leverage the geographic position of Madrid in the southwestern corner of Europe to become one of the continent’s main gateways to the Americas. Service to Africa and Asia will be left to partners, including Japan Airlines and Qatar Airways, as well as other IAG airlines, like British Airways.

“It is very clear to us that the American continent is an opportunity,” Maria Jesús López Solás, chief commercial officer of Iberia, said at the event in Madrid.

But even a less ambitious plan has big competitive ramifications for Iberia. Schedule data from aviation analytics firm Cirium shows that the airline was the eighth largest by seats between Europe and the Americas in the second quarter. A two-thirds expansion of its long-haul fleet could bump it up a few notches, potentially surpassing airlines like Air Canada and Lufthansa.

New Orlando, Philadelphia flights are just the beginning

Iberia on Wednesday unveiled plans for three new destinations in the Americas: Monterrey International Airport (MTY) in Mexico, Philadelphia International Airport (PHL) — a major hub and the main European gateway for American — and Toronto Pearson Airport (YYZ).

The Monterrey route will operate with either an Airbus A330 or A350; the Philadelphia and Toronto routes “could be” flown by one of Iberia’s new Airbus A321XLRs, a longer-range variant of the popular Airbus A321neo, Solás said.

With the additions, Iberia has six new transatlantic routes on deck and more on the way. The airline will begin flights from MAD to Orlando International Airport (MCO) on Oct. 26, 2025, and to the Brazilian destinations of Recife/Guararapes-Gilberto Freyre International Airport (REC) in December and Pinto Martins-Fortaleza International Airport (FOR) in January 2026.

Iberia’s new routes are only the start. The airline is evaluating more U.S. destinations on the East Coast within range of the A321XLR, Solás said. She reiterated that all of Iberia’s XLRs will fly to the Americas.

One possible addition is Newark Liberty International Airport (EWR) or a “second New York airport,” as Solás put it.

A separate investor presentation on June 17 also shows Charlotte-Douglas International Airport and Seattle-Tacoma International Airport — both Oneworld alliance hubs — as future potential destinations, as well as dozens of additional cities in Canada and Latin America.

Iberia will also expand to Latin America, where it has long held a dominant position among European airlines. This will include new destinations and additional flights to major cities — “super core” markets, as Sansavini put it — like Buenos Aires, Mexico City and Santiago, Chile.

“No one has the coverage that we have,” he said.

Iberia plans to grow its schedule, or capacity, by 3% to 5% annually through 2030.

More A321XLRs, A330s and A350s

Key to Iberia’s plan are 25 new long-haul planes. These include five A321XLRs and nine A350-900s already committed to the airline by IAG, as well as 11 of the 21 A330-900s in IAG’s order book. Deliveries will stretch into the early 2030s.

Iberia currently flies 45 long-haul planes: three A321XLRs, 20 A330s and 22 A350s, its fleet plan shows.

All of the new planes will feature Iberia’s latest onboard product. This includes lie-flat, business-class suites on the A330s and A350s, an updated premium economy seat, and inflight connectivity across all aircraft. Older A330s will be retrofitted with the new offerings.

The new aircraft are contingent on Iberia achieving its financial targets of operating profit margins of 13.5% to 15% annually, Sansavini said. If it fails to meet those targets, growth could slow.

Upgrades to Iberia’s Madrid hub

Iberia plans to upgrade its facilities in Madrid to match its growth. The first piece is a new premium lounge for, as Solás described it, Oneworld Emerald (the alliance’s highest loyalty tier) travelers at MAD. The new lounge, Iberia’s third at MAD, is expected to open around the end of the year.

The airline already has two lounges in the Madrid airport: one for travelers within Europe’s Schengen Area and one for those going to destinations outside of Europe.

Sansavini did not comment on bottlenecks at customs in Terminal 4 at MAD, where non-European Union passport holders can face waits of more than an hour. Long waits increase minimum connection times and make a hub less efficient by forcing an airline to schedule more time between flights.

This reporter’s flight from Madrid to Washington, D.C., was delayed by 20 minutes awaiting travelers stuck in customs.

MAD operator Aena is in the midst of a multibillion-dollar expansion of Terminal 4 by 2030 to accommodate future passenger growth.

“We’re working closely with Aena,” Sansavini said. “We believe this is coherent with [our] development plan.”